The squirrel is industrious throughout the year, gathering supplies. In winter, i.e. during hard times, it can live well from them. This is exactly what investors can achieve with equities – but they need the suitable kind of equities to do so! In this article, we would like to illustrate why dividend shares should be part of your portfolio.

Companies – some are profitable, some aren’t

Independent of country or sector, countries can roughly be classified into the following categories:

- Companies that are not yet making a profit

- Companies that are making a profit and keep it within the company so as to be able to expand their business (growth shares)

- Companies that are making a profit and pay it out, at least in parts, to their shareholders as dividends

In different market phases, investors prefer different segments of shares. When interest rates are low and the economy is performing well, the focus is usually on growth shares (those that are already making profits or will be making profits in the future), as they promise the highest share price gains.

However, when times become more difficult (e.g. due to lower economic growth, rising inflation or rising interest rates) and prices correct or are moving sideways, dividend shares become more interesting again. And this is exactly the kind of market phase we have been in for a few months now.

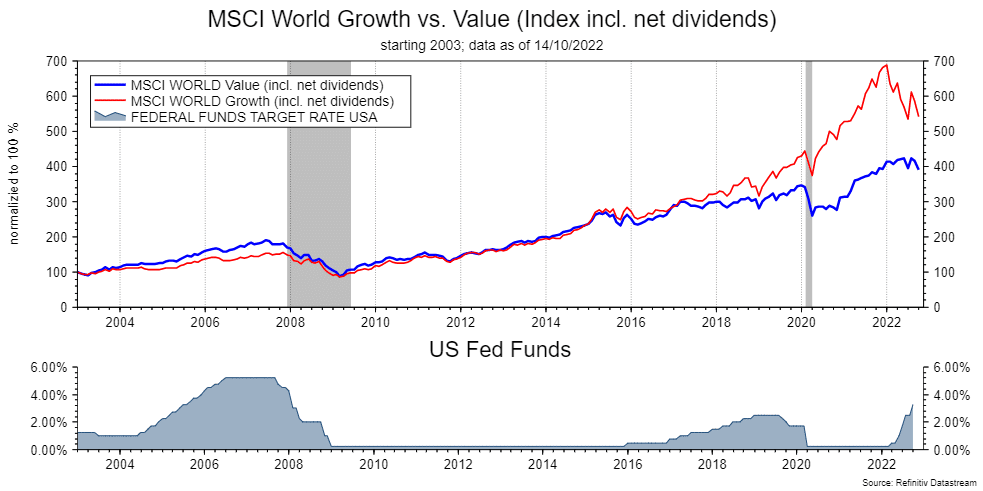

The chart shows the divergence in performance between growth shares and dividend shares (value) from the year 2003 onwards on the basis of the global equity market.

Source: Refinitiv Datastream, Data as of October 14, 2022; Note: Past performance is not a reliable indicator for future performance.

The long-term chart clearly illustrates that growth shares have outperformed dividend shares significantly since 2010, i.e. for the past twelve years. However, they were hit considerably harder by the correction on the equity markets in the past months. The lower part of the chart shows the US Fed funds rate which for years had been close to zero before rising rapidly in recent months. The US Fed has signaled that further interest rate increases are incoming.

The market environment has changed significantly in recent months, and in such times many investors look for the safety of reputable companies with a strong substance. One possible reaction to this is to invest in companies with high dividends. This is not only about possible gains in the share price, but above all about current income.

Dividend shares offer additional income

Due to the significant price increases of growth shares in recent years, dividend shares were simply not en vogue among investors. The performance was correspondingly lower, but – and this is currently an important factor – the valuations are also significantly lower. Dividend shares generate high earnings in relation to their market capitalisation. This means that the price-earnings ratio (P/E ratio) is significantly lower than for growth shares.

When companies generate high profits, they can also pay out attractive dividends. This regular income helps in times of market difficulties.

How to select the right dividend shares

There are many companies that pay dividends. But in which of them should you invest? Some companies currently pay very high dividends, but you need to ask how they are financed.

- Sustainable dividend: Does the company have a business model that facilitates ongoing earnings? Because, only in that case can a regular dividend be paid out. A part of the profit should be ploughed back for hard times of for expansion. Therefore, the question of how much of the profit is sustainably paid out as a dividend is also crucial

An attractive and sustainably paid dividend is therefore an essential criterion for investing in a company. But a second factor should always be taken into account from the investor’s point of view:

- Broad diversification: every industry can be affected by a recession, and every single company can get into trouble. Therefore, investors who want to rely on dividends should always take this into consideration and diversify their capital over several companies (from different sectors and countries).

Choosing assets yourself vs. investing in a dividend equity fund

Investors with sufficient know-how and levels of capital can of course select their assets and diversification strategy on their own. A simpler alternative would be to invest in a dividend equity fund. Here, the shares are selected after a thorough analysis by experts and, if necessary, also switched. This funds automatically gives investors a broad diversification. However, they have no say in the selection or the level of dividend payout.

Dividend equity funds – this is how you do it

Investors deciding to go for a dividend equity fund can choose between two options:

- A-shares with annual dividend distribution

- T-shares without distribution

As is customary with funds, the investment amount is also very flexible. For example, you can start with a one-off investment and make additional purchases later. By means of a fund savings plan, you can invest as little as EUR 50 per month and thus gradually invest in the selected fund.

One fund by Erste Asset Management that is structured on the basis of dividend shares is ERSTE RESPONSIBLE STOCK DIVIDEND. In addition to the aforementioned selection criteria, there is one more:

- All assets in the fund have to comply with sustainable aspects.

For more information about the funds and about your investment options, please visit the fact sheet and the legal documents on the ERSTE RESPONSIBLE STOCK DIVIDEND fund, or talk to an investment advisor at any branch office of Erste Bank and Sparkassen in Austria.

In addition, our specialists will provide exciting insights and information on the ERSTE RESPONSIBLE STOCK DIVIDEND in an online expert discussion on Wednesday, Nov. 16, 2022, at 10:00 am (only in German).

Conclusion

Much like a squirrel that stores provisions for the winter, investors, too, can build provisions for the future.

Equity funds with current income from dividends are one possible way to go. However, the higher earnings opportunities also come with a higher level of investment risk. Broad diversification, which can be achieved by a fund, is therefore particularly important. In addition, one’s own risk profile has to be taken into account when deciding on the allocation size of an investment.

Risk notes on ERSTE RESPONSIBLE STOCK DIVIDEND

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK DIVIDEND as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK DIVIDEND, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK DIVIDEND as described in the Fund Documents.

Legal note:

Prognoses are no reliable indicator for future performance.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.