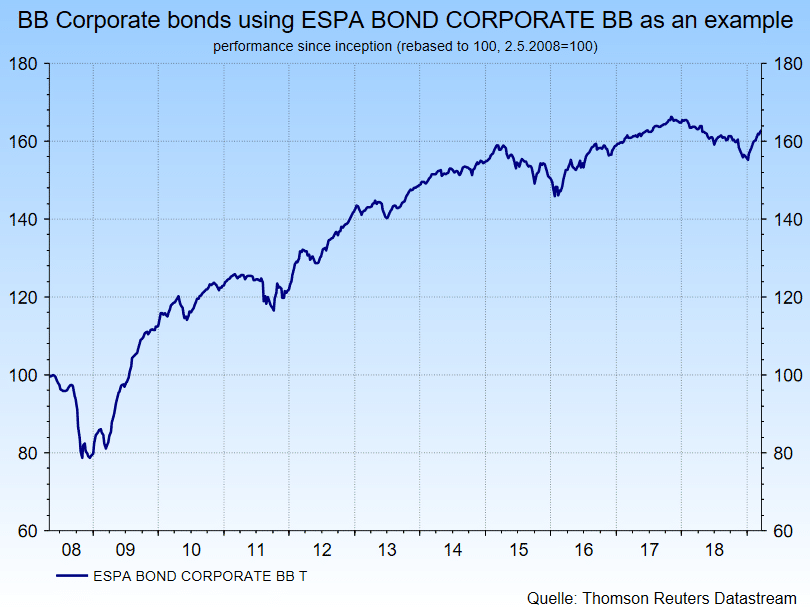

Corporate bond funds have produced above-average rates of return in the past ten years. There was particular interest in companies from the BB rating segment, i.e. issuers at the threshold of high-yield to investment grade bonds. These would often be bonds that for some reason, e.g. an inferior financial report, had been downgraded but were in with a chance of a re-upgrade. The offered yields are therefore higher than those for highly rated issuers. There are relatively few funds that restrict their investments to such companies.

One of them, ESPA BOND CORPORATE BB (ISIN: AT0000A09HC7) by Erste Asset Management, received the award as best fund in its peer group over the past ten years at the Lipper Fund Awards 2019. The fund had recorded an average annual growth rate of 8.14%.*) This award is even more important since the fund won it not only in Austria, but also in Germany and in Europe.

*) Source: FMP, Erste Asset Management as of 31 December 2018. The performance accounts for the management fee and any performance fee. It does not allow for a one-time load of up to 3.50%, if applicable at the time of purchase, nor any other fees reducing return such as individual account or depositary fees. Historical performance data are not indicative of the future development of the fund.

Bernd Stampfl, Senior Fondsmanager ESPA BOND CORPORATE BB

We took this award as opportunity to talk with Fund Manager Bernd Stampfl about the fund, interest rates, and his investment focus.

What sort of developments have been driving this segment lately? What are the yields like?

Last year, the political risks were coming to the forefront again, which led investors to re-assess their positions. Issues like the trade war, the rather risky budget policy of the Italian government, and Brexit were the general drivers of uncertainty. In spite of the correction towards the end of 2018, the BB corporate bond market has retained its stable development. The favourable yield level at the beginning of the year and the outlook on an imminent agreement in the trade conflict has caused investors to search out risk again and to re-take positions in this asset class. We have benefited from this situation and are now back at pre-correction levels.

Why should one invest in this segment at the moment?

Towards the end of last year, the spreads of BB bonds had widened to a level that, relative to the default risk at hand, have now turned these assets into an interesting investment opportunity. And the ECB has recently indicated that no end is foreseeable for the zero interest-rate policy in 2019. This means that the search for yield is ongoing. Another factor that, from our point of view, supports the case for these bonds: in contrast to US companies, European issuers use the proceeds of their bond issues for investments and not so much for share price nursing. As a result, operating profits continued to increase last year in Europe. Also, the companies have improved their balance sheets in the past two years and have further strengthened their operations.

How would you describe the corporate bond segment in general? Who are the typical issuers? Do they come from the financial or the telecoms sector? Or from a different one altogether?

Breaking down corporate bonds by sector and debt outstanding, the typical issuer usually comes from the industrial sector, telecommunication, retail, or the automotive sector. The respective shares of these sectors have remained very stable in recent years. Significant shifts are only facilitated by changes in ratings. For example, after 2017 and 2018 more companies were “have been” upgraded to the investment grade than downgraded to high-yield for the first time ever. The biggest BB issuers in this peer group are Telecom Italia and the Spanish Telefónica. The Israeli pharmaceutical company Teva, the French supermarket chain Casino, and the car manufacturer Fiat are also prominent members of the BB segment. Total volume has remained very stable in view of the robust market environment and the aforementioned aspects.

In summary, BB offer a surplus yield relative to the low interest rates and the interest rate differential on safe (i.e. investment grade) corporate bonds thanks to the increased spreads. In this environment of low interest rates, defaults are unlikely to become a problem.

About Lipper Fund Awards

The annual Lipper Fund Awards from Refinitiv are an event that has already built a certain degree of tradition in the fund industry. Funds are awarded that have achieved above-average, risk-adjusted returns on a continuous basis (categories: 3Y, 5Y, and 10Y) in comparison with other funds. The funds have to be accredited for public distribution in Austria, and the initial approval has to date back at least three years. The cut-off date for this year was 31 December 2018.

About ESPA BOND CORPORATE BB

ESPA BOND CORPORATE BB is a broadly diversified fund that invests in about 170 largely EUR-denominated corporate bonds from countries such as France, the UK, and Italy as well as, to a lesser degree, the USA and emerging economies like Brazil and Mexico. The focus is on telecommunication and the basic materials sector. The foreign exchange risk is fully hedged against the euro.

Benefits for the investor

- Broad diversification in high-yield bonds

- Long-term attractive investment segment

- High annual dividends

- Foreign exchange fluctuations are irrelevant due to currency hedge

Risks to be aware of

- Medium to high level of volatility possible

- Price declines possible especially amid widening spreads (i.e. falling rating)

- Average rating below investment grade, i.e. defaults more likely

- Capital loss is possible

- Fully accumulating shares can only be bought by investors who are not subject to taxation in Austria

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.