In a newsletter article in April this year, I discussed the increased uncertainty on global markets triggered by the aggressive trade policy of the United States and the resulting demand for value-preserving investment strategies, such as our value strategy in the equity sector.

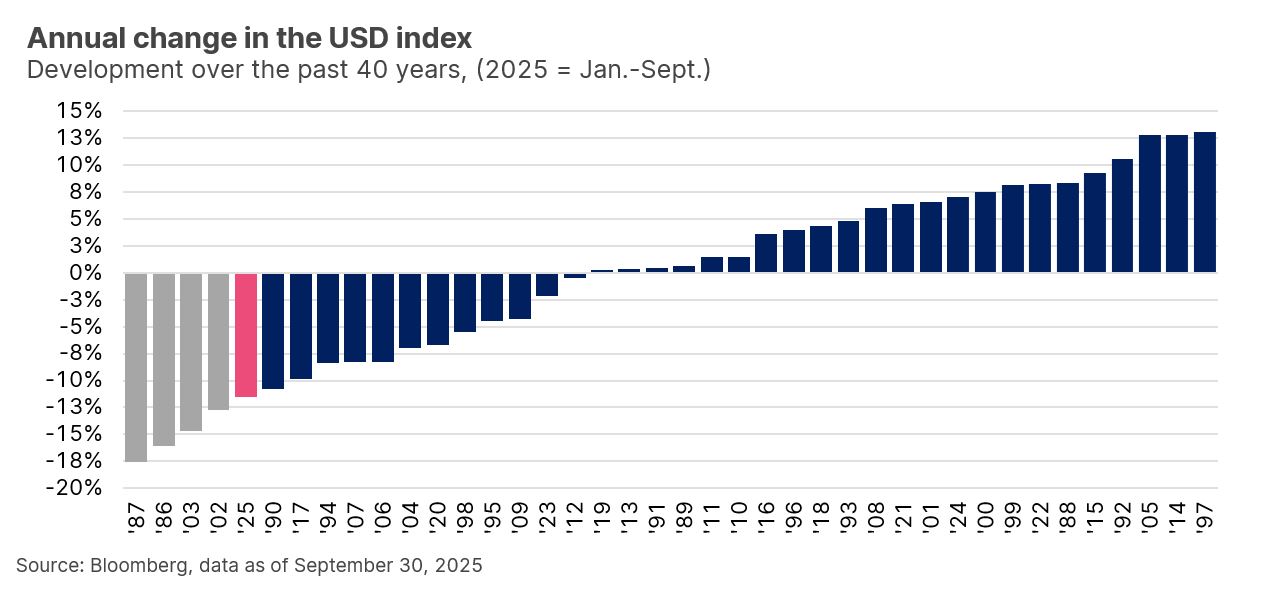

At hindsight, we can see that the performance has confirmed this hypothesis: the “search for stability” that we described recently led to a stronger performance of these investment strategies, driven primarily by the depreciation of the US dollar and demand for equities of relatively secure companies. As a result, our fund, which invests according to this value strategy on a euro basis, achieved a return of almost 5% on top of the broad US equity market in the first three quarters.

Note: Past performance is no reliable indicator of future value developments. Investments in securities entail risks in addition to the opportunities described.

Geo-economic situation remains tense

Today, we have to acknowledge that this uncertainty, shaped by US politics, has not been resolved in the third quarter. This is primarily due to the fact that the Trump administration is eroding confidence in the neutrality of political institutions through its interventions. After all, this neutrality is one of the cornerstones of the US economic system, on which foreign investors have counted for decades.

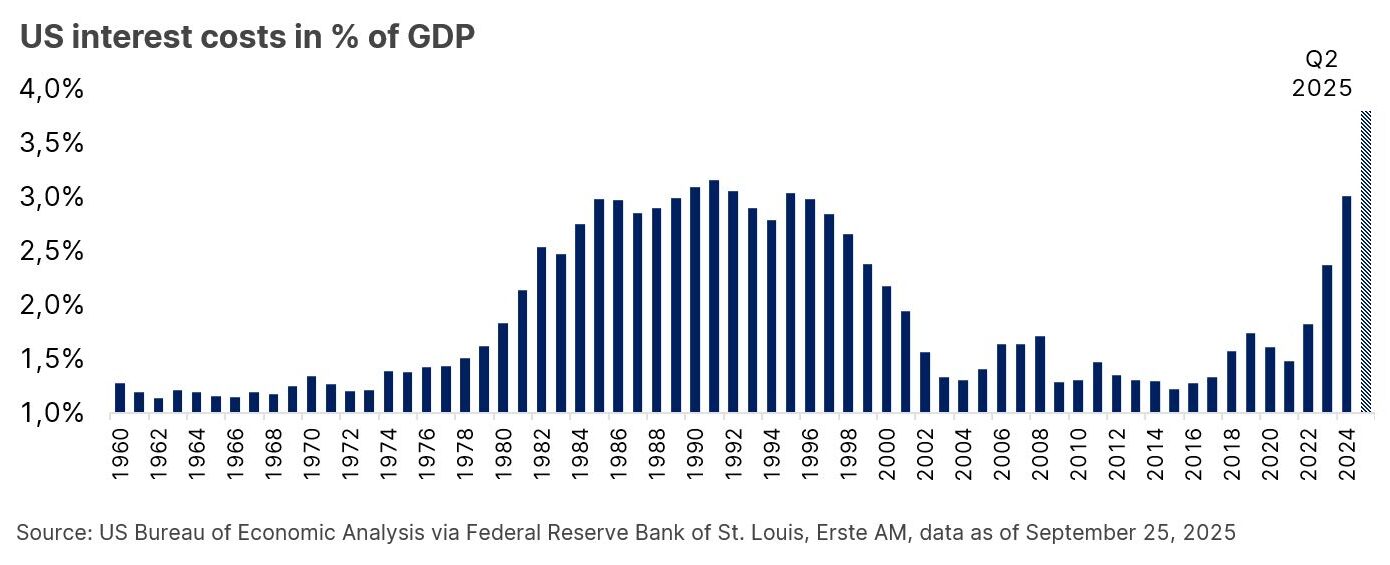

Following a weak labour market report, President Trump ordered the dismissal of Erika McEntarfer, head of the Bureau of Labour Statistics, which is responsible, among other things, for compiling inflation reports. In addition, the government increased pressure on Fed Governor Lisa Cook, who stands in the way of its ambition to cut interest rates further. One reason for this strategy is to artificially suppress interest costs, which have reached a new all-time high this year. On the one hand, this is meant to enable the government to take on new debt, which is needed due to tax cuts. On the other hand, the aim is to support domestic industry (“America First”) and the capital markets. The implementation of the “Big Beautiful Bill” could further exacerbate the situation and push interest costs as a percentage of GDP from the current estimated 3.8% (Q2 2025) to over 5% by the end of the decade.

Note: Prognoses are not a reliable indicator of future performance.

However, this strategy of politically suppressing interest costs, combined with higher volumes of new borrowing, also led to the depreciation of the US dollar, as lower interest rates on US Treasury bonds do not adequately compensate investors for the higher financial risk they take on. This means that, assuming stable future performance of the US dollar, US Treasury bonds have now become cheaper for investors based in Europe, while the USA has lost purchasing power. So even for the United States, there is no such thing as a free lunch!

The relevance of the US dollar in the current geopolitical context

The stability of the US dollar and the attractiveness of US Treasury bonds to foreign investors are extremely critical issues for US financial policy. Thanks to stable economic growth, innovation and, above all, a high level of investor protection, the USA has attracted huge capital flows over decades, providing both the private sector (in the form of shares and bonds) and the government (in the form of Treasury bonds) with enormous financing capacities. This relationship between the exceptionally high demand for US Treasury bonds and the stability of the US dollar has been referred to, among other things, as “exorbitant privilege”, i.e. the privilege of being able to borrow excessively (abroad), as US Treasury bonds and, consequently, the US dollar, are in constant high demand as a safe haven.

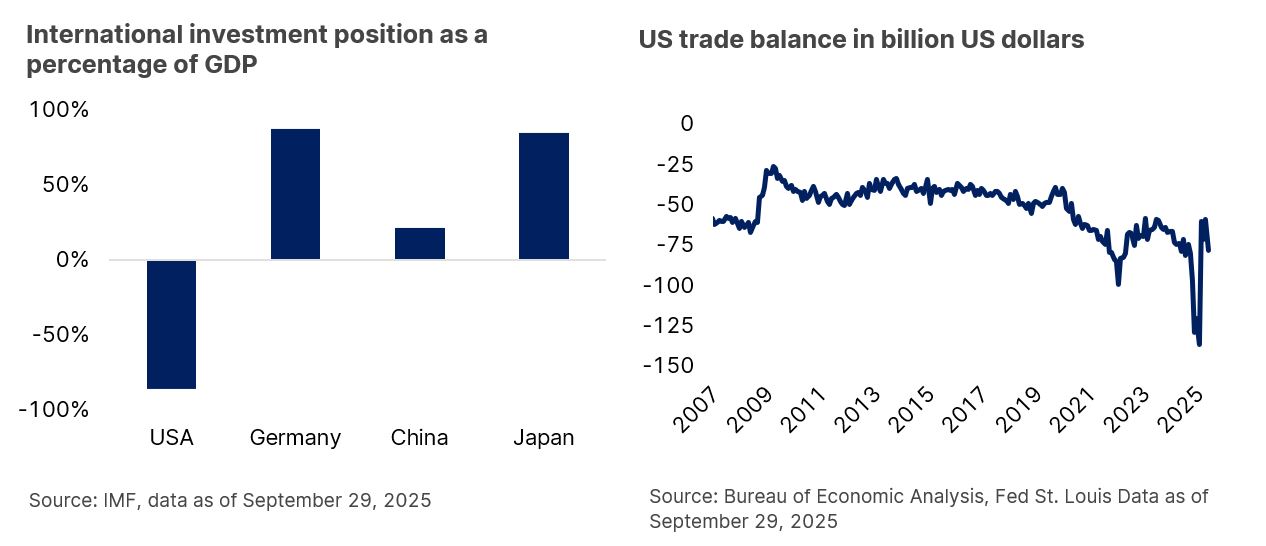

This demand is so (exorbitantly) high that the United States, as the world’s largest debtor, has accumulated liabilities in the form of government securities amounting to approximately USD 60 trillion. After deducting US foreign assets, this results in a net asset position of USD -26 trillion, which corresponds to approximately 80% of US GDP. Consequently, it should be in the United States’ interest not to upset its creditors, as less demand for US Treasury bonds would cause their yields, and thus interest costs, to rise further. The Trump administration is trying to counteract this by putting pressure on the US Federal Reserve to further cut interest rates. However, this can only be partially successful, as only short-term interest rates are determined by the central bank, while longer-term interest rates are driven by growth and inflation expectations as well as market demand for government securities. In exceptional situations, such as the Covid crisis, the central bank can manipulate longer-term interest rates by purchasing bonds, but this crowds out other investors who would only be willing to invest in US debt securities at a lower price (or a cheaper US dollar) or a higher yield.

In addition, the US government is working to reduce its dependence on foreign capital by supporting the domestic industry (“America First”) and exports, thereby bringing money back into the country through trade surpluses. As we know, Donald Trump’s preferred tool for this is the use of trade tariffs. These are meant to strengthen the relative attractiveness of US goods on the international market and, in addition, to increase demand for them through the more favourable US dollar exchange rate. So far, the US economy has continued to grow strongly in the service and technology sectors, but gains in industrial production and exports have been largely absent, except for the new tariff revenues, despite an 11.5% depreciation of the US dollar index.

Note: Past performance is no reliable indicator of future value developments.

Investors seek (new) ‘safe havens’

As the macroeconomic environment has been changing at a historically rapid pace in the year to date, it is extremely challenging to make a reliable currency forecast for the US dollar. That being said, we can conclude that the US trade and financial policy is postulating a weaker currency. On the one hand, this is due to industrial policy in the form of tariffs and prioritisation of domestic production, which is driving inflation, and on the other hand, due to interest rate cuts and higher government debt (“Big Beautiful Bill”). The exorbitantly high demand for US Treasury bonds as the financial industry’s safe haven of choice, which still accounts for about 60% of global currency reserves, is counteracting this. As long as the US dollar does not lose this status, there is strong support that can offset bouts of historical depreciation such as those seen this year in the medium term.

In areas other than the currency markets, however, the search for safe havens for large capital flows has already left its mark. While gold and silver (both at all-time highs) normally absorb part of these capital flows, along with government bonds from other industrialised countries such as Germany and Japan, there is currently increasing demand for short-term corporate bonds, conservative (value) equity strategies, and Asia and emerging markets, which offer diversification effects for global portfolios thanks to their ability to generate growth increasingly isolated from the West. One reason for this is that fiscal discipline is declining not only in the USA, but also in European countries such as France, the UK, and Austria – and this despite falling productivity. Private companies cannot afford this and are therefore becoming relatively safer investments, both in the equity and bond segments.

Investieren in Value-Qualitätsaktien

The ERSTE STOCK QUALITY VALUE is an equity fund which invests in selected companies worldwide. The stock selection is conducted with focus on quality companies attractively valued quality stocks with comparatively low price fluctuations. Note: Investments in securities entail risks in addition to the opportunities described.

👉 You can read more about the fund on our website

Risk notes ERSTE STOCK QUALITY VALUE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE STOCK QUALITY VALUE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK QUALITY VALUE, consideration should be given to any characteristics or objectives of the ERSTE STOCK QUALITY VALUE as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.