The seasons come and go with wondrous regularity, sometimes lasting longer, sometimes shorter, and they are being perceived as more or less pleasant by people.

It is no different in the economy. The economic cycle also moves in stages – upswing, boom, downswing, and recession – sometimes lasting longer, sometimes shorter, being perceived as more or less pleasant by all of us. However, the ups and downs of the economy not only affect each and every one of us for example through income or inflation, but of course they also have an impact on the performance of assets such as equities and bonds. We call this the investment cycle. There are periods when equities do well, and then there are periods when bonds do well. Or there are also phases in which both asset classes perform strongly at the same time or both collapse at the same time.

Please note: Forecasts are no reliable indicator for future developments.

Different factors affect the markets

This situation is never a coincidence, but always has an underlying reason. In most cases, it is the economy that influences the financial markets, both positively and negatively, but occasionally it is the other way around, as for example in the financial crisis of 2008. The economy and the financial markets, or more precisely their oscillating course, which we refer to as the economic and investment cycle, are thus closely linked and mutually influence each other.

The monetary policy of the central bank and the fiscal policy of a country or economic area – as part of general economic policy – usually have the strongest impact on the economic and investment cycle.

A fund manager who invests in equities, bonds, or other asset classes is exposed to the general economic and investment cycle with the performance of his portfolio, just like everyone else. It therefore makes sense to consider what phase the cycle is in, how it will develop and then – in addition to other decision criteria – to align your stock selection and asset class weighting accordingly.

What asset class for what season?

However, accurately determining and forecasting the economic and investment cycle is no mean feat. There is a wide range of economic and financial data available, each with a different significance. In practice, however, two indicators have proven quite useful:

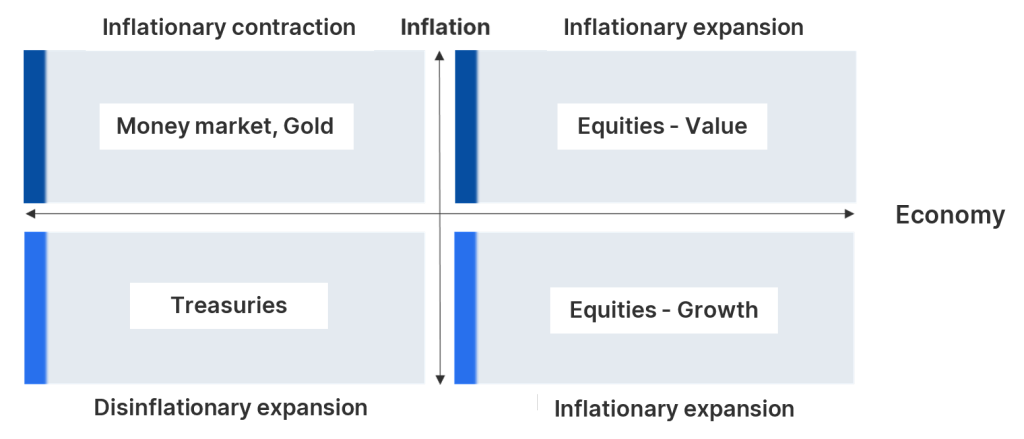

- Inflation (as measured on the basis of the consumer prices) and

- the economy (as measured on the basis of the GDP)

In simplified terms, both indicators can assume the following values:

- Inflation is rising or high (Inflationary)

- Inflation is falling or low (Disinflationary)

- The economy is growing or booming (Expansion)

- The economy is stagnating or shrinking (Contraction)

Depending on the “economic season”, the various asset classes also perform differently. The following chart shows a selection of asset classes that promise the strongest return prospects relative to the other asset classes in the respective phase of the economic cycle. Relative means better than the others, but not necessarily a positive return in absolute terms.

In simple terms, the economic and investment cycle can thus be categorised into the following “four seasons”:

Economic and investment cycle

OK – so, where are we coming from, and where exactly are we at this point in time?

Take the USA as an example. Fund managers and economists always like to look to the United States because it is the largest economy with the largest financial market and always sets the trend, for better or for worse.

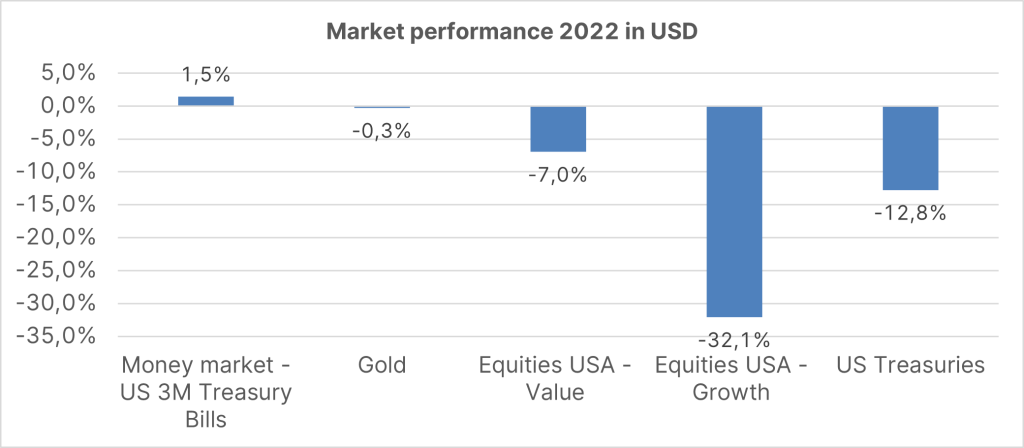

In 2022, we experienced an inflationary contraction in the USA. Inflation was high and continued to accelerate (from 7.5% to as high as 9.1%). In response, the US Federal Reserve raised key-lending rates massively (from 0.25% to 4.5%), which naturally had a severe impact on economic growth prospects.

Please note: Past performance is no reliable indicator for future value development.

Source: LSEG Datastream; please note: equities USA – value = MSCI USA Value index, equities USA – growth = MSCI USA Growth index, money market = ICE Bofa US 3M Treasury Bill index, Treasury bonds = ICE BofA US Treasury & Agency index; indices displayed, no direct investment possible.

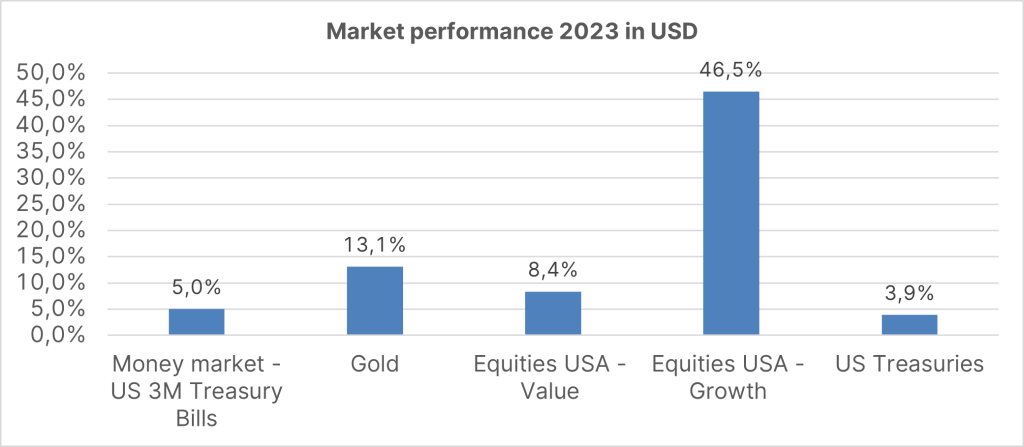

In 2023, the USA entered the phase of disinflationary expansion. The interest rate hikes had an effect. Inflation fell significantly (from 6.4% to 3.4%) and the economy remained surprisingly robust (3.2% in the fourth quarter of 2023), contrary to expectations.

Source: LSEG Datastream; please note: equities USA – value = MSCI USA Value index, equities USA – growth = MSCI USA Growth index, money market = ICE Bofa US 3M Treasury Bill index, Treasury bonds = ICE BofA US Treasury & Agency index; indices displayed, no direct investment possible.

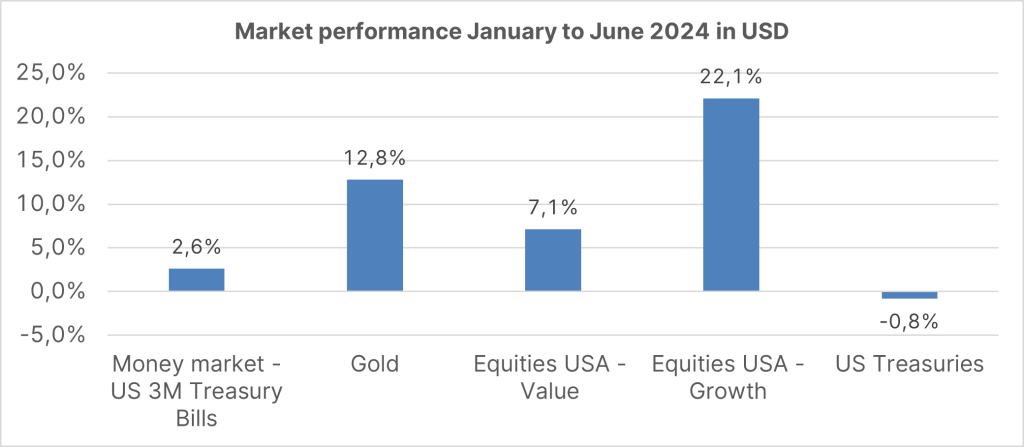

The phase of disinflationary expansion also set the tone until mid-2024.

Please note: Past performance is no reliable indicator for future value development.

Source: LSEG Datastream; please note: equities USA – value = MSCI USA Value index, equities USA – growth = MSCI USA Growth index, money market = ICE Bofa US 3M Treasury Bill index, Treasury bonds = ICE BofA US Treasury & Agency index; indices displayed, no direct investment possible.

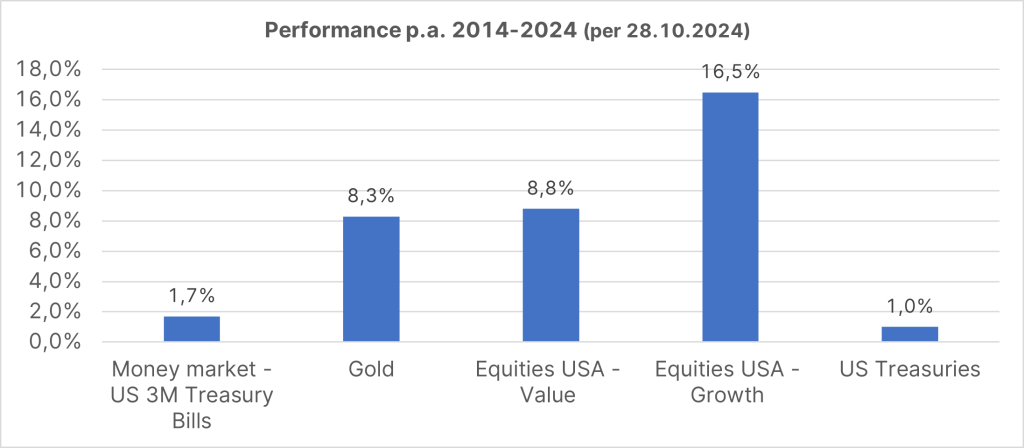

By comparison, the performance of these asset clases in the past ten years:

Please note: Past performance is no reliable indicator for future value development.

Source: LSEG Datastream; please note: equities USA – value = MSCI USA Value index, equities USA – growth = MSCI USA Growth index, money market = ICE Bofa US 3M Treasury Bill index, Treasury bonds = ICE BofA US Treasury & Agency index; indices displayed, no direct investment possible.

So, what now?

Well, inflation in the USA has gone down further, most recently to 2.4%; i.e. significantly lower than at the end of 2023, but still above the target of 2%. US economic growth is still robust, but we expect to see a noticeable slowdown in momentum in 2025. This is indicated above all by the fact that the number of people losing their jobs and not finding new ones is increasing substantially.

The US Federal Reserve began lowering key-lending rates in September to counter the expected economic downturn. From experience we know that monetary policy measures always need time to take effect. We therefore believe that it makes sense to build up positions that protect a portfolio against the investment risk of an economic contraction, be it inflationary or disinflationary.

And what about Bitcoin?

In theory, Bitcoin, as the digital gold of the 21st century, should display the same portfolio characteristics as gold itself. In practice, however, Bitcoin is increasingly establishing itself as a traditional form of investment by means of marketable investment vehicles (Bitcoin ETFs) and is therefore reacting much like traditional forms of investment to changes in liquidity on the financial markets. Personally, I would therefore classify Bitcoin along the lines of a technology share in terms of its portfolio characteristics and enter it into the field of disinflationary expansion. The idea being: if Nvidia is doing well, then Bitcoin will do well, too.

Note: the companies listed here have been selected as examples and do not constitute an investment recommendation. Please note that investing in securities involves risks as well as opportunities.

Conclusion

In our mixed funds, we invest in a broad range of asset classes, such as equities in developed and emerging markets, short- and long-term government bonds, investment grade and high-yield corporate bonds, and alternative assets such as gold and commodities.

In doing so, two specialist aspects of management are always particularly important to us, regardless of whether a fund follows a traditional or a sustainable investment approach:

- The basic orientation of a fund, which we call the strategic allocation, follows as widely a positioning as possible in order to effectively spread the structural risk in the portfolio.

- And in tactical asset allocation, which represents the short-term deviation from the strategic asset allocation, we actively manage the weightings of the individual asset classes in order to navigate the portfolio through the economic and investment cycle in an optimal way.

A team of analysts and economists supports us who, on the one hand, take care of equity selection (Tesla or BMW) and, on the other hand, provide concise economic forecasts.

With this know-how, we actively manage your assets and adjust our positioning according to the circumstances. As an investor, you do not have to worry about the changing seasons and any adjustments to your portfolio. This is what we take care of for you.

Investing in mixed funds

Mixed funds invest in several asset classes (e.g. equities and bonds). This gives the fund managers more leeway with these funds.

👉 Read more

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.