Bernhard Ruttenstorfer, Senior Fund Manager of ESPA STOCK TECHNO

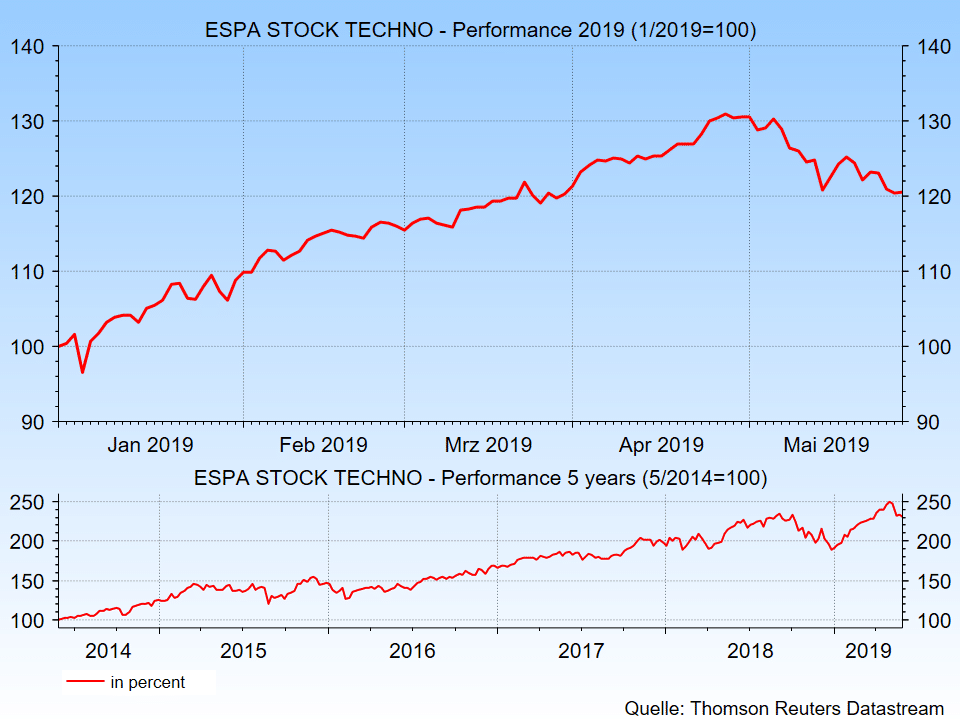

After a strong set-back in December 2018, technology shares have staged a fantastic comeback in the first four months of the year. IPOs like the ones by the transportation network companies Uber and Lyft or by the online graphics provider Pinterest have drawn attention from the media. The profits of most technology companies have also matched or slightly exceeded expectations. What caused the latest rally? What does the technology sector benefit from, and what perspectives do investors have? This is what we were discussing with Bernhard Ruttenstorfer, Senior Fund Manager of ESPA STOCK TECHNO.

In your opinion, what are the reasons for the strong performance in 2019?

The rally in Q1 was largely due to the excessive losses in Q4 2018, which was an irrational sell-off. In Q1, investors have used the lower prices to build positions in the technology sector. This is of course based on a positive outlook on business, which the market expects to improve further from 2020 onwards. The equity market has this expectation already priced in. Q1 company earnings have matched or even exceeded expectations. Software companies have been particularly convincing. We regard 2019 as year of transition, with only minor earnings growth.

Are equities overvalued at this point or do you still see potential?

A price increase of about 20 percent (source: Reuters on the basis of a global technology equity index) within a few months does of course affect the valuation. But we have to differentiate: there are segments with very ambitious valuations such as for example some providers of cloud software and mobile payment services. As far as the latter ones are concerned, the valuations are largely justified because the market is growing significantly, and companies are profitable and only subject to minor earnings fluctuations. Here, we are talking about companies like Paypal, Mastercard or Visa. They are the structural winners in payment transactions and have benefited from changes in consumer behaviour, which manifests itself in more transaction via internet and smartphones. The semiconductor market is attractively valued. Here, we saw a slump in the second half of 2018. Now the market is on the rebound with demand recovering. Overall, the valuations in the technology sector are still attractive, and there is no reason why prices should not rise further.

Note: Past performance is not indicative of future development.

What are the themes that have potential? What are the key aspects of your investment strategy?

All of them are innovations that are or will be affecting the cycle of products, their production, sales, and distribution all the way to the consumer (please see the box “The drivers of the technology boom”). We can see themes like automation, the Internet of Things, Artificial Intelligence, self-driving (“autonomous”) cars, mobile payment transactions, cyber security etc.

As far as software is concerned, cloud outsourcing is still a hot topic, as is video gaming with its gigantic growth prospects, and in connection with it the payments transaction providers. In the ESPA STOCK TECHNO funds we currently prefer software providers: prices fluctuate less significantly than for semiconductors. The product prices are just more stable.

Companies like Lyft, Uber, and Pinterest have done IPOs this year. Are there any other technology companies in the pipeline? How important is the stock exchange for such companies?

The USA is the engine of innovation and therefore also head and shoulders above the rest when it comes to the stock exchange: US stock exchanges see the biggest and most important IPOs. Also, the share prices in China have been affected more severely by the trade conflict than US tech companies. One example is Huawei, which was put on a black list – a move that blindsighted the stock exchanges. This means that US companies cannot supply Huawei with products any longer. This is of course a hurdle and detrimental for both parties to the conflict. I am convinced that that trade conflict will ultimately only be a source of irritation though. It does not change the radical shift that companies and consumers are subject to (on the basis of virtual reality). Many sectors have to brace themselves for significant changes: from car dealerships to print media.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.