One thing is beyond discussion: sustainable investing has long since become respectable and shed its initially slightly alternative image. In the past five years alone, the volume of sustainable mutual and special funds in Austria has more than quadrupled[1].

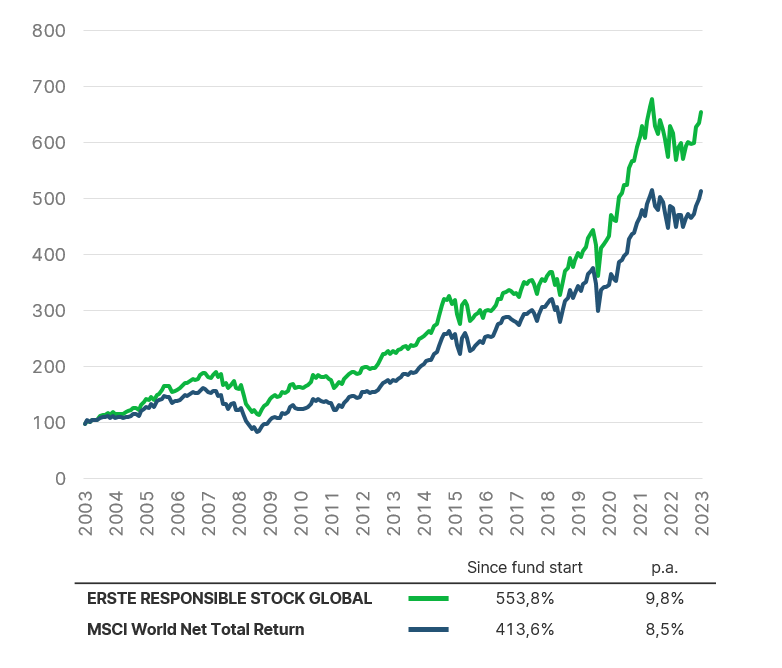

The boom in green securities is not only due to the increased environmental awareness of private and institutional investors, but also to their positive performance: funds that take into account environmental, social, and corporate governance parameters, i.e. the so-called ESG criteria, when constructing their portfolios have in some cases significantly outperformed “normal” funds in recent years. This is also illustrated by comparing the sustainable and broadly diversified Article 8 equity fund ERSTE RESPONSIBLE STOCK GLOBAL with the well-known MSCI World Net Total Return index.

Green wave: sustainable funds have recently outperformed their traditional competitors. Source: Erste Asset Management, gross performance at the end of 07/2023. Please note: the indices mentioned were only used for comparison and have no bearing on the discretion of the management company in the selection of assets. Past performance is not indicative of the future development of a fund.

Five key drivers of sustainable investment

As successful as the past few years have been, the future is sometimes viewed with a critical eye:

- Will sustainability remain in focus or is the environment for sustainable investments increasingly dire as other issues are (becoming) more “urgent”?

- What if climate change deniers gain the upper hand?

Gerold Permoser, Chief Investment Officer at Erste Asset Management counters this: “Sustainability and ESG are here to stay, they will continue to play an important role in the future.” Asked about the reasons for his confidence, Gerold Permoser explains: “From our point of view, there are above all five medium- to long-term key drivers that make the case for sustainable investments.”

Driver no. 1: Changes in the political economy

While the order of economic policies was quite clearly regulated in the past, things are currently changing – from attitudes to inflation to the changing role of the state in the economy. Companies are also expected to do more than in the past: merely generating profits is not enough. They also have to assume social responsibility. All this has led to ESG becoming a central issue at both the corporate and the state level in recent years. In addition, Brussels has given out strict requirements to pave the way for the EU’s ambitious climate targets. “We do not expect this to change again any time soon. Rather, the financial power of the states alone will not be sufficient to tackle global decarbonisation. We will continue to need the private sector for this,” Gerold Permoser summarises.

Driver no. 2: The supply chain situation

The outbreak of the Corona pandemic has shown how fragile and complex supply chains can be. This is precisely why it is important to monitor them closely and optimise them, also with regard to sustainability. After all, risks can lie dormant along a company’s supply chain that lead to environmental damage or social problems – from non-compliance with labour laws and loophole-ridden environmental regulations to a lack of ethical standards. In this area, too, the EU is putting on the pressure and setting the pace: the planned EU Supply Chain Act is to get companies to commit to carefully dealing with environmental and social aspects in the entire supply chain, including their own business area. Companies need to proactively develop strategies to address these challenges and build a resilient supply chain.

The importance of this topic is exemplified by the “China globalisation story”, as Gerold Permoser summarises. A paper from Harvard University analysed how China manages its state sector. One of these strategies is to commit foreign companies to Chinese standards. What happens when these values collide with another value system? What if companies no longer want to be part of the Chinese state economy? Or when their customers and investors want something different from them? Difficult questions already arise here, if we take the example of cotton or the processing of cotton. If a company publicly declares that it does not want to process cotton from Xinjiang because Uyghur forced labour could be involved, it has to expect repression from Beijing. However, if one does not take this into account, one could be excluded from ESG funds for the same reason.

Driver no. 3: Demographic change

The fact that the baby boomers of the 1960s are gradually retiring comes with a massive impact on the labour market. The search for suitable replacements is becoming increasingly difficult for companies. In the fight for the best talent, companies must therefore become more attractive and position themselves more diversely and broadly. This includes, for example, measures that address the work-life balance, alternative leadership concepts, and the elimination of the gender-pay gap. Many substantial ESG issues will keep companies busy in the coming years if they want to prevail in the market.

Driver no. 4: Technological revolution

From photovoltaics to wind power: the expansion of renewable energies is one of the crucial tools in the fight against climate change. In this process, more and more new environmental technologies will be available that are currently under development. For example, green hydrogen will play an important part in the future due to its transport and storage properties; as will smart grids, intelligent electricity networks that connect small, local grids with the existing infrastructure. They help to avoid peak loads and thus become increasingly important in decentralised energy production. With ESG investments, investors will also be able to benefit from this technological progress in the future.

Driver no. 5: Climate change

The fifth driver for sustainable investments is climate change itself. “Current natural disasters show that climate change has reached the heart of society worldwide and has a strong impact on our daily lives,” Heinz Bednar points out. The more frequent severe weather events also pose an economic and financial risk. Crop failures cause higher food prices and thus higher inflation rates. In the future, it will therefore be common practice to include climate forecasts in the financial market outlook. Companies that prepare for these challenges also minimise climate-related financial risks.

Green investments to change the world

In conclusion, Heinz Bednar and Gerold Permoser encourage people to see sustainable investment as an effective tool for a more liveable world: “As insignificant as it may seem to oneself, every single decision in favour of a green investment is relevant.” According to the two financial experts, the trend towards sustainable investment is already having an effect: “As investors put more and more money into sustainable companies, they also have an incentive to meet growing sustainability standards. This fundamental change with respect to the flow of capital is generating significant changes across entire industries towards sustainability.”

Sustainable pioneer for more than 20 years

As the largest provider of sustainable funds in Austria and one of the most important sustainable investment companies in Germany and Switzerland, Erste Asset Management manages a sustainably invested volume of EUR 16.6bn (as of 31 July 2023).

The minimum ethical standards of all Erste AM mutual funds call for:

- no controversial weapons

- no food speculation and

- no investments in coal.

When selecting assets for the various funds, Erste Asset Management applies strict selection criteria from all angles of sustainability: environmental, social, and corporate governance data, i.e. the so-called ESG criteria, are used to establish an ESGenius rating created specifically for this purpose. The rating forms the basis for the assessment of companies. An additional best-in-class approach ensures that the most sustainable companies are selected in each industry.

Our green commitment and the associated know-how are also reflected in objective assessments: for example, the sustainability and ethical range of funds of Erste Asset Management received several awards from Forum für Nachhaltige Geldanlagen e.V. (FNG; Forum for Sustainable Investment) in 2022. All 16 funds submitted by Erste AM received the FNG Seal, one of the most important awards for sustainable investment funds in the German-speaking world. In addition, all funds submitted were awarded the top mark, i.e. a three-star seal of approval.

Risk notes ERSTE RESPONSIBLE STOCK GLOBAL:

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK GLOBAL as described in the Fund Documents.

Advantages for the investor

- Broadly diversified investment in equities in developed markets.

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Legal note:

Prognoses are no reliable indicator for future performance.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

[1] Market report Sustainable Investments 2023, Forum Nachhaltige Geldanlagen e.V. (Forum for Sustainable Investment

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.