Green bonds are securities that are allocated to specific energy and environmental projects and are intended to contribute to a climate-friendly transformation of the economy. According to a study by the Climate Bonds Initiative (CBI), they reached a record level of $269. 5 billion in 2020.

While the international climate conference in Paris in December 2015 set off a strong increase in the issue volumes of green bonds, the publication of the Sustainability-Linked Bond Principles by the International Capital Market Association (ICMA) in June 2020 was a catalyst for the issue of sustainability-linked bonds (SLBs). The fact that the ECB announced on 22 September 2020 that it would start accepting SLBs as lodged collateral from the beginning of 2021 created additional support. This step by the ECB should not be underestimated and constitutes a change in direction, given that the ECB had previously excluded bonds with adjusted coupons for example as a consequence of rating downgrades.

Chart 1 – issue volumes

In the first half of 2021, 108 SLBs were issued at a total volume of USD 50bn, i.e. 8% in terms of the green and social bond segment. Some investment houses envisage a similar volume for the second half.

The market bases its definition of SLBs on the Sustainability-Linked Bond Principles of ICMA (June 2020), which is a voluntary self-commitment for issuers. According to the document, SLBs are bonds where one feature (e.g. coupon, maturity, or redemption) hinges on whether and to what extent issuers reach ESG goals within a defined period of time. The aforementioned Principles stipulate the following five rules:

- The chosen key performance indicators (KPIs) should be relevant to, and significant for, the core business; they are to be measurable and externally verifiable.

- The sustainability performance targets (SPTs) should be ambitious, have an external benchmark, and be in line with the sustainability strategy of the issuer.

- The most important rule (which also has to be documented in the bond prospectus) requires that the features of the bond be adjustable in dependence on whether the KPIs fulfil the SPTs. The most frequent example is the adjustment of the coupon. In case SPTs cannot be calculated reliably (for example as the result of regulatory changes or a merger), alternatives are to be defined.

- The debtor agrees to report at least once a year on the development of the KPIs in relation to the SPTs and the effect on a potential adjustment of the bond features.

- The audit is to be handled by an external expert such as auditor or environmental consultancy.

Essential differences to Green Bonds

Readers familiar with ESG practices will notice a crucial difference to the EU standard of green bonds. According to the EU standard, the issue proceeds of green bonds have to finance exclusively green projects that are in line with the climate and environmental goals of the EU Taxonomy. By contrast, SLBs do not come with any clause about the use of the proceeds from the issue. The proceeds can be allocated to general corporate goals. This flexibility allows for a bigger circle of debtors who can obtain sustainable finance. Among them are issuers who do not have enough green or social projects available as well as issuers who do not have the capacities or the intention to comply with the reporting obligations that come with green bonds. For example, the consumer goods sector is still underrepresented within the green bonds segment; also, while car manufacturers may find it increasingly easier to present green projects in view of the imminent electrification, other issuers in the sector may regard SLBs as welcome alternative.

Lapse of earmarking

The SLBs’ lack of a dedicated purpose of the proceeds is in line with the wish of many sustainable investors to assess sustainability holistically on the corporate level instead of the level of the individual project. This also ensures an increase in debtor diversification. Initially, the utilities sector was prominently represented. Recently, the oil and gas sector has caught up substantially (e.g. Eni, Repsol, TotalEnergies). We expect further issuers from “brown” sectors as well as smaller issuers and those who are in the transitional phase towards more sustainable technologies. If the SLB supports a climate change or decarbonisation strategy of the issuer, one might use the term “transition bond”[1].

The chance of a coupon increase in case the issuer misses their target constitutes a conflict of interest for ethically oriented investors. Is it legitimate to make money on the back of a missed sustainability target? Is the financial gain only a compensation to the investor for the possible downgrade of the rating due to higher environmental and climate risks faced by the company? In a general comparison with green bonds, the SLB investor has to face the challenges of false labelling and greenwashing, because flexible KPIs and tailor-made SPTs can be tempting from the debtor’s perspective.

An increasing number of issuers has agreed to reduce greenhouse gases and to increase the share of renewable energy carriers. The new taxonomy is likely to be of gradually higher significance to the KPIs. A utility company might then publish what share of its energy sources was in line with the EU Taxonomy, or a bank might define its targets on the basis of the green asset ratio. Every standardisation supports the acceptance rate, but it does so at the expense of flexibility. TotalEnergies announced in February that from that point onwards it would only issue SLBs anymore whose SPTs were linked to greenhouse gas emissions that could be controlled directly by the company (Scope 1 and 2, GHG Protocol Corporate Standard).

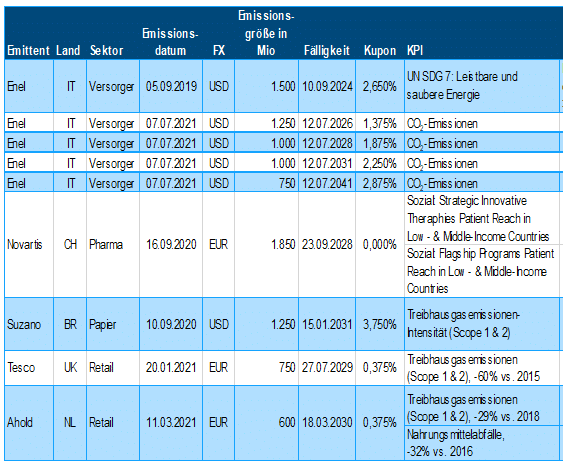

Table 1 shows some examples of SLBs. We selected Enel 2.65% 2024 because in September 2019 it was the first one to commit itself to a UN Sustainable Development Goal (SDG). The following four Enel bonds, issued in July 2021, represent the biggest SLB transaction to date (USD 4bn) on aggregate. The Novartis issue is interesting from various angles: 1) it used to be the biggest issue, and 2) the KPIs refer to social parameters, and there are two conditions both of which have to be met so as to avoid a coupon increase. Suzano, based in Sao Paulo, issued the first SLB from an emerging market.

Table 1 – Sustainability-Linked Bonds

While green bonds often receive an expensive pricing in the consumer sector (e.g. Daimler or VW) – i.e. they come with a “greenium” in that they enter the market inside the spread curve of ordinary bonds – there are so far no real signs that SLBs would carry a similar premium.

Investor scepticism vis-à-vis the flexibility on the issuers’ side may be responsible for that. Chart 2 illustrates the swap spread[2] priced in euro for the three selected SLB issues on the primary market, as compared with the secondary market curve of the bonds of the respective debtor. When using a standardised trend line on the basis of a 2nd degree polynomial, we find that SLBs are not priced more expensively than ordinary debt securities of the same debtor. The light blue dot represents the respective SLB, whose details can be found in table 1.

Chart 2 – Issue spread versus secondary market (2nd degree polynomial trend line)

SLBs are challenging due to their complexity. The need for analytic engagement rises; after all, additional questions about the adequacy of the SPTs within the general corporate context, about the their achievability and measurability, about whether the ESG principles are a part of the company’s DNA, and whether the coupon is incentive enough for sustainable change have to be answered. Therefore, we regard SLBs less as an alternative and more as a complement to green, social, and sustainability bonds.

Conclusion

Given their complexity, SLBs also present a challenge. The analysis effort is increasing, as additional questions need to be answered, such as the appropriateness of targets (SPTs) in the general corporate context and their achievability and measurability, or whether ESG principles are part of the company’s DNA and the coupon incentives are sufficient for sustainable change. We therefore see SLBs not so much as an alternative as a complement to green, social and sustainability bonds.

Depending on how the acceptance of SLBs develops among determined sustainability investors, SLBs can also be used in funds of initial asset management such as the ERSTE RESPONSIBLE BOND EURO CORPORATE or ERSTE ETHIK ANLEIHEN.

[1] https://www.icmagroup.org/assets/documents/Sustainable-finance/Sustainability-Linked-Bond-Principles-Related-questions-February-2021-170221v3.pdf (1-2)

[2] Corporate bonds are priced above the swap curve in the Eurozone. In the past two years, the 5Y and 10Y swap rates have on average been about 35bps higher than the yields of the comparable German government bonds.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.