After around a year, the Dutch government under Prime Minister Rutte collapsed in the summer of 2023 due to disagreement over migration policy. It came as a surprise that long-serving Prime Minister Rutte decided not to stand again in the next elections.

After more than thirteen years in office, making him the longest-serving prime minister in Dutch history, he paved the way for a new candidate and the most exciting elections in the Netherlands for a long time.

Diverse candidates

Both the left and the right of the political spectrum were hoping for renewal. Among others, the (European) political heavyweight Frans Timmermans stood for the Greens/Labor Party alliance.

Justice Minister Dilan Yeşilgöz stood for the Liberals as Rutte’s successor, giving the Netherlands the opportunity to have a woman as head of government for the first time.

The former Christian Democrat Peter Omtzigt ran as a candidate for the newly founded NSC (New Social Contract) out of dissatisfaction with the political climate. He was also immediately seen as a possible candidate for the government presidency.

On the clear right side of the spectrum, the anti-immigration PVV (Freedom Party) under the leadership of Geert Wilders, the long-time leader and founder of the party.

The election result

Up until election day, no party emerged as the clear favorite in the polls, although the PVV was able to make up a lot of ground in the final spurt. The proportion of undecided voters remained unusually high until the very end.

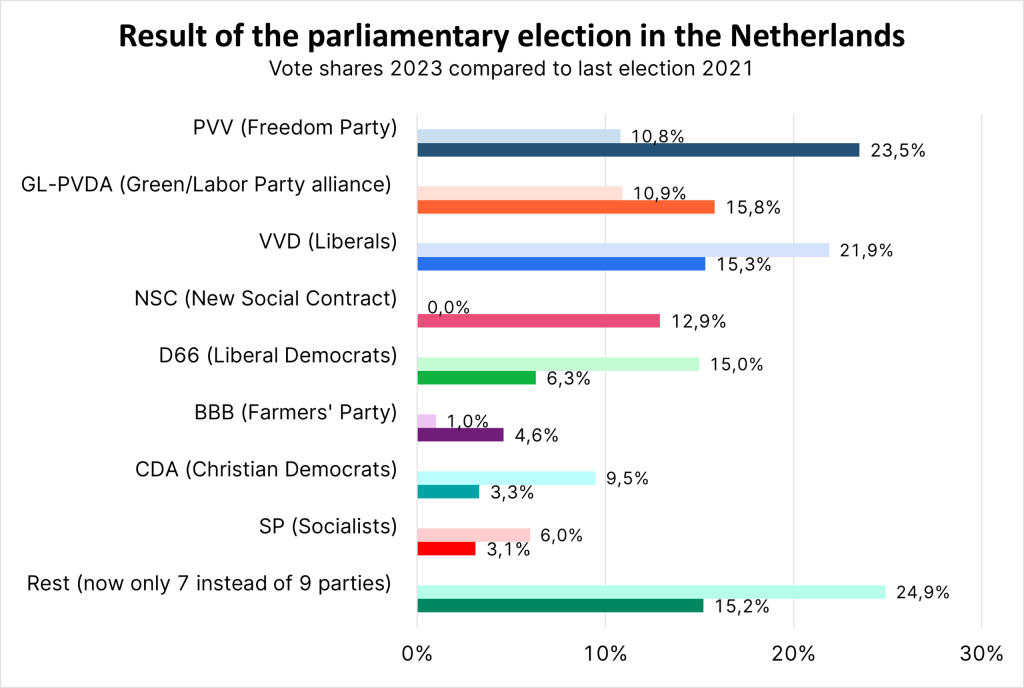

The even higher than expected share of the vote for the PVV, which is clearly the largest parliamentary group in the Netherlands with more than 23% (37 out of a total of 150 seats), caused a shock wave in the Netherlands. The shift towards populist parties illustrates the dissatisfaction of the Dutch with traditional politicians and the political responsibility of the government.

In contrast, there was hardly any reaction on the capital markets. The Dutch political landscape is inherently fragmented and although the PVV has one of the largest parliamentary groups in the country, it has to make compromises when forming a government in order to enable a majority government:

While the left side of the spectrum is still rather fragmented, voters on the right have made a clearer choice compared to 2021 The biggest beneficiary of this, is the PVV. In general, however, the political landscape in the Netherlands is less fragmented after the elections.

Possible government variants

Immediately after the elections, a coalition between the PVV and the two more center-right parties VVD (Liberals) and NSC (New Social Contract), as well as the farmers’ party BBB, was seen as the most likely.

Within a few days, however, the VVD has ruled out participating in a government after slipping from first to third place. This means that only a minority government would be possible on the right side of the spectrum. Since the Greens/Labor Party alliance would never form part of a government with Wilders due to major differences, such a minority government is currently the most likely option.

The penultimate minority government

Mark Rutte’s first cabinet was also a minority government, consisting of the right-wing liberal VVD and the CDA, tolerated by the PVV. Together with the PVV, the coalition had 76 out of 150 seats in the Second Chamber of the Dutch Parliament.

On April 23, 2012, this cooperation came to an end due to a dispute over budget cuts in the wake of the euro crisis. These budget negotiations were not supported by the PVV, as a result of which the minority government did not receive a majority for the negotiations.

The austerity plans were approved three days later with the help of the opposition parties D66, GroenLinks and ChristenUnie.

In the subsequent new elections, many voters switched from the PVV to the VVD, meaning that Geert Wilders was sidelined for the time being. With the current result, the roles have probably been reversed, with Geert Wilders in the position of Mark Rutte in 2010.

Geert Wilders as Prime Minister

It is questionable whether Geert Wilders as a person is viable as Prime Minister, let alone whether he actually wants to take on the role. He has had personal protection for more than a decade, his home address is secret and his office in the parliament building is set up as a safe room due to serious death threats. He rules his parliamentary group with an iron fist and a new PVV party leader is not easy to find. In general, there are doubts within his own ranks about having enough personnel for a cabinet.

First steps towards a new cabinet

The next step is for Parliament to appoint one or more “informants”. They have the task of finding out which parties would be prepared to conclude a coalition agreement. Their role may also extend to the actual coalition negotiations – but this could also be the task of another informant.

In general, the negotiations surrounding a new coalition can take a long time – last time it was 299 days. The average time to form a government in the Netherlands is around 140 days.

Originally, Gom van Strien, a member of parliament for the PVV, was put forward as an informant candidate. However, after he was suspected of fraud from within his own ranks, he resigned before taking office. The new informant who is to explore the possibilities of a future coalition is a member of the Labor Party and a former minister.

As already mentioned, however, the Labor Party will in all likelihood not participate in a government with Geert Wilders. This shows the difficulties the PVV has in finding enough capable personnel within its own ranks.

Economic policy consequences

From an economic policy perspective, it is still too early to predict the effects of such a government. It is worth mentioning that the PVV is considered Eurosceptic. However, in polls such as those conducted by the European Commission, Dutch citizens are overwhelmingly in favor of the European Union and the euro. It is unlikely that Geert Wilders will be able to win through with potential government partners.

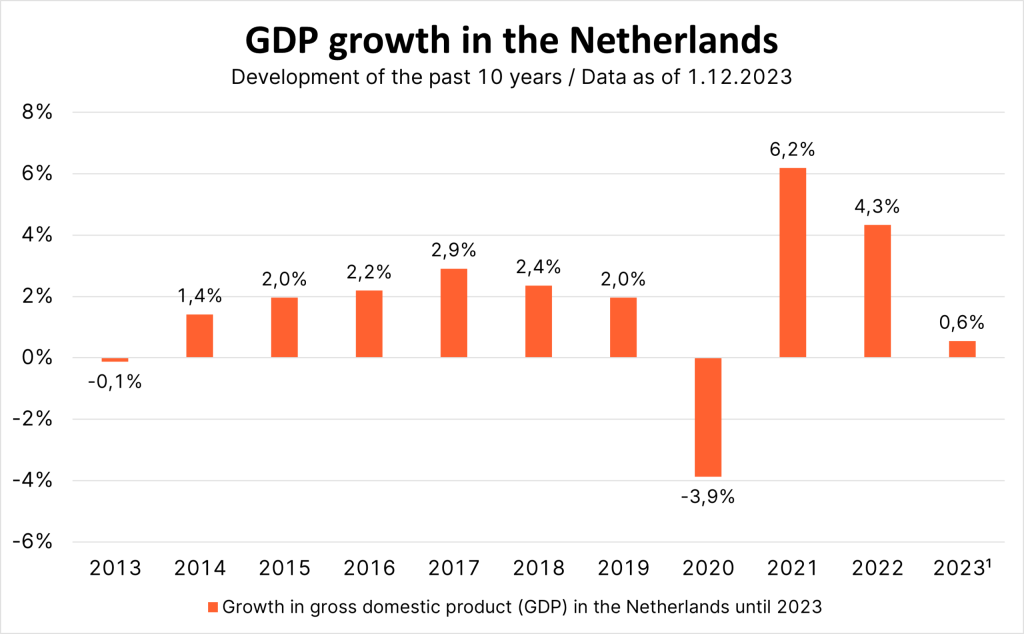

Source: statista.com / IMF; 1 forecast

Note: Past performance is not a reliable indicator of future performance.

The Freedom Party also advocates populist economic policies with a clear desire for higher social spending. In this respect, too, they are likely to be disciplined by potential coalition partners in view of the Dutch tradition of sound budgetary policy.

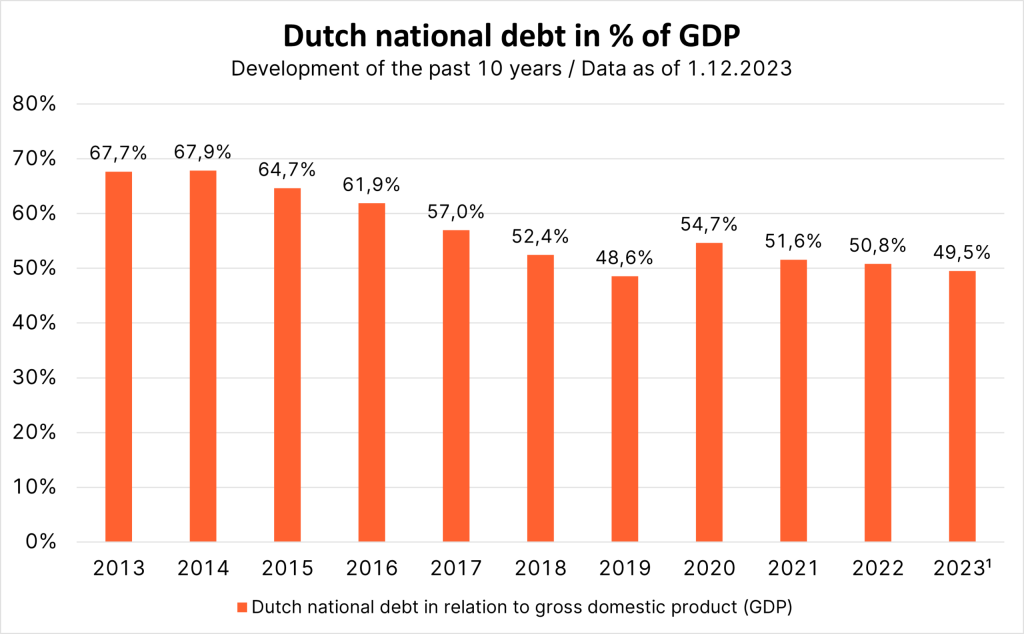

Source: statista.com / IMF; 1 forecast

Note: Past performance is not a reliable indicator of future performance.

It is also certain that the Netherlands’ public finances are in a healthy state, with debt amounting to just 50% of GDP. In fact, as mentioned above, Dutch government bond yields are stable despite the surprising election result.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.