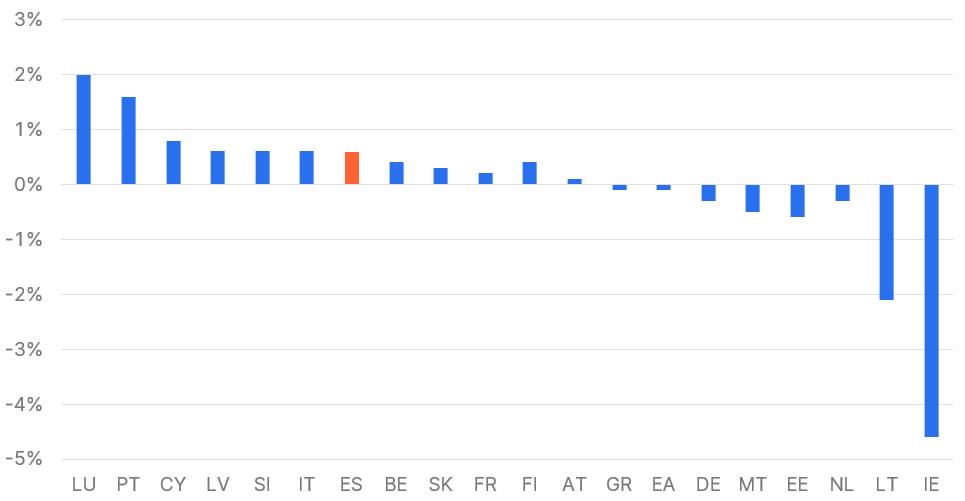

In the first half of this year, economic activity in the euro area slowed down. The different developments in the individual sectors and countries are worth highlighting. For example, growth was stronger in the service sector than in manufacturing and stronger in the southern countries – such as Italy and Spain – than in Germany and France.

Euro area: Q1 real GDP growth quarter-on-quarter

Source: Eurostat, Data as of 13.07.2023; Note: Past performance is not a reliable indicator for future performance.

From an economic perspective, Spain in particular is showing resilience, unlike other countries in the euro area. At the national level, however, the southern European country is now preparing for a hot, close and unpredictable early election.

What happened?

After poor results in the regional and local elections on 28 May 2023, Spain’s incumbent Prime Minister Pedro Sánchez of the Partido Socialista Obrero Español party (PSOE) called early elections for 23 July. Thus, the fifth parliamentary election in the past nine years will now take place in the summer, five months earlier than originally planned. Sánchez, who has governed in a coalition with the Podemos party since 2019, has come under constant criticism recently despite the relatively strong performance of the Spanish economy and a series of pro-worker legislative measures.

To get a sense of what the political landscape might look like after the July ballot, one can look to the Valencia region. In the region around the port city on the south-east coast of Spain, the Partido Popular (PP for short) and the Vox party have agreed on a basic agreement a good two weeks after the outcome of the regional elections.

Another change in the political landscape after the election in Spain?

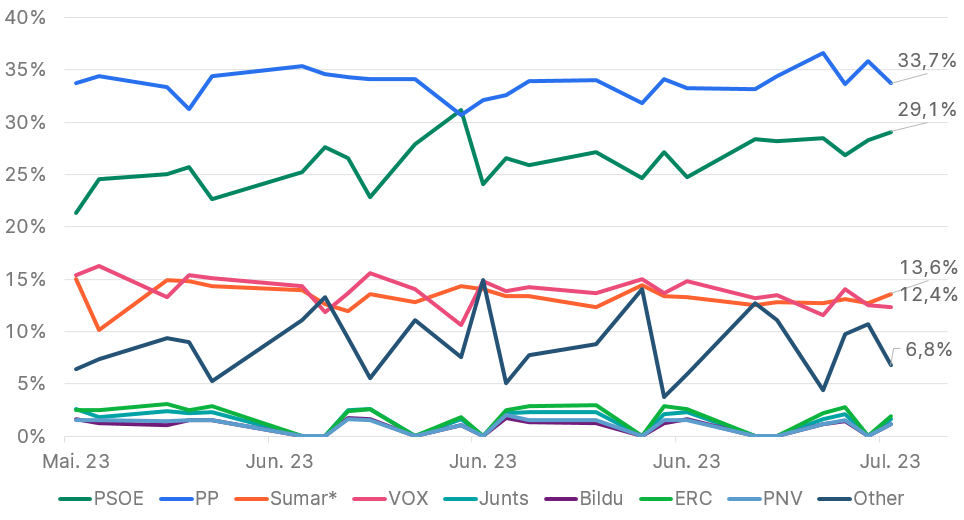

The latest opinion polls currently indicate that a change in the electoral landscape in Spain is quite possible and that the region of Valencia can be used as a good indication for Spain as a whole. What is remarkable, however, is how the poll ratings of the various parties have changed over time. Initially, the polls showed a comfortable lead for the main opposition party, the Partido Popular with Alberto Núñez Feijóo as its leading candidate. But recently this trend has clearly reversed and the gap between the two parties with the most votes (PP & PSOE) has become much smaller. Thus, the election outcome is also becoming more uncertain.

Election polls over time

Source: National polling institutes, Data as of 13.07.2023

According to the latest polls, the PP is in the lead with about 34% of the vote, but the gap with the PSOE, with about 29%, has narrowed considerably. Competing for third place, with some distance, are the Vox (most recently about 14% of the vote) and Sumar parties. Currently, Vox is leading by a modest margin.

But in Spain, votes do not necessarily mean parliamentary seats. The reason for this is the proportional electoral law in force in the southern European country. The size of the constituencies varies from very large (e.g. Madrid, 37 seats) to much smaller ones (e.g. Ceuta) with one seat each. The formal hurdle for entering parliament is 3% of the electoral vote. As a result, however, a much higher share of the vote is required in smaller constituencies to elect MPs to parliament. In this respect, small differences in votes can make a much bigger difference in terms of majorities in parliament. This represents an uncertainty factor and makes this election a close race.

Three weeks before the election, however, the opinion polls point to a change of government. With an average of 30% in the various national polls, the Partido Popular party would claim 138 seats in parliament. If the Vox (about 14% of the vote) were to side with the PP, which is the current baseline scenario, the PP-Vox coalition would have a combined total of about 180 seats – four more than needed to form a government.

Summer as a decision-making factor?

For many observers, however, it is not so much the predicted close race that is a cause for concern, but rather the chosen election date. A landmark political decision on a Sunday in the middle of midsummer, when at least 10 million of the 37 million eligible voters are on holiday, represents an unpredictable factor of uncertainty. Prominent here is the election-related uncertainty of how many voters will be away from their hometowns and return to vote or vote by absentee ballot.

Critical observers see the early election date of PSOE party leader Sanchez as an aim to depress the turnout and thus turn it more to his advantage. In this respect, it can be summarised that in addition to the countless variables that are decisive in this election, the unusual timing could also play a major role in determining the result.

Old acquaintances or new terrain?

As a baseline scenario, a change in government is emerging with the election on 23 July this year. While a formal coalition between the PP party and Vox is the most likely scenario, it cannot be ruled out that the PP could govern alone, but with parliamentary support from Vox. Thus, Spain would enter a new political terrain. The resulting political changes are not yet foreseeable, but a few points can be inferred from the public statements of PP politicians. In his recent appearances, PP party leader Alberto Núñez Feijóo advocated measures to promote capital investment, increase productivity and tighter budget controls.

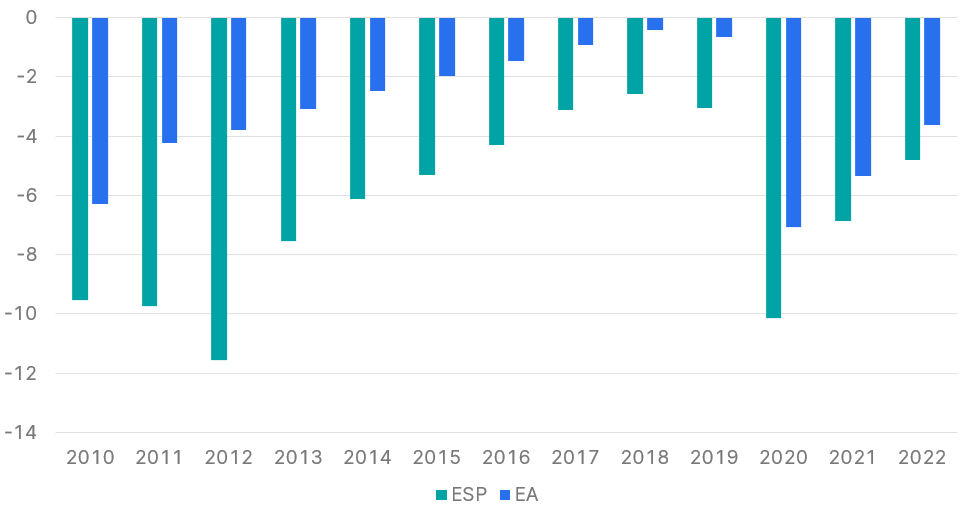

In the alternative scenario, the current government under Pedro Sánchez remains in power. The agendas of the current governments were mainly determined by the pandemic and insofar dominated by social issues. For example, a pension increase of 9% and an 8% increase in the minimum wage were decided in the current government. Fiscal discipline was to some extent rather in the background and played a subordinate role. For many observers, however, it is precisely fiscal consolidation that poses the real challenge for Spain.

True task: Fiscal consolidation!

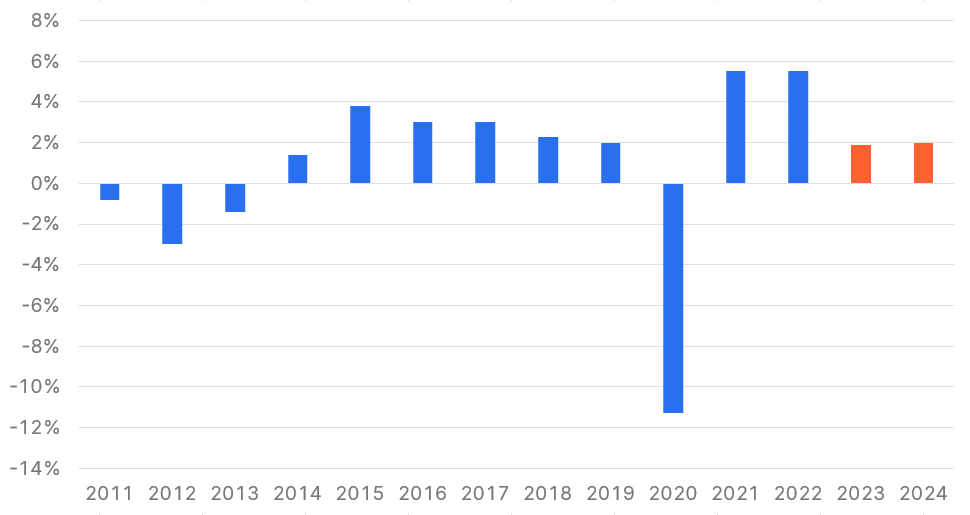

As outlined at the beginning of this blog post, the Spanish economy has recently shown resilience. Particularly noteworthy here are the strong labour market and the tourism sector, even if the first signs of a slowdown have recently become visible on the labour market. As far as the outlook is concerned, the European Commission estimates in its “Spring 2023 Economic Forecast” (publication date: 15.05.2023) real growth for Spain of 1.9% in 2023 and 2.0% in 2024.

Real GDP growth compared to the previous year

Source: Eurostat, Data as of 13.07.2023; Note: Past performance is not a reliable indicator for future performance.

Despite recent strong growth – and booming tax revenues – the budget deficit remains relatively high as spending has kept pace with inflation. Reducing the deficit further in the future could be a difficult challenge, as elections will take place shortly before the 2024 budget negotiations start and the incoming government may have to rely on external support from regional parties. This could put additional pressure on spending.

Budget deficit in % of GDP of Spain & euro area average

Source: OECD, Data as of 13.07.2023; Note: Past performance is not a reliable indicator for future performance.

Outlook and conclusion

In summary, a close race is emerging in the early elections in July. The baseline scenario represents a change in the political landscape, with a PP government and a possible need to support the Vox party. But even here there are certain factors of uncertainty. These would be, among others, the current trends in the election polls, the unusual timing of the election and the uncertainty about future fiscal policy. Thus, it can be assessed that Spain has rather low but increasing political risks at the moment and moderate, fiscal policy risks in the medium term.

The above-mentioned points may have been partly responsible for the fact that the yield premium of a 10-year Spanish government bond has underperformed a 10-year German federal bond, but also other comparable European countries.

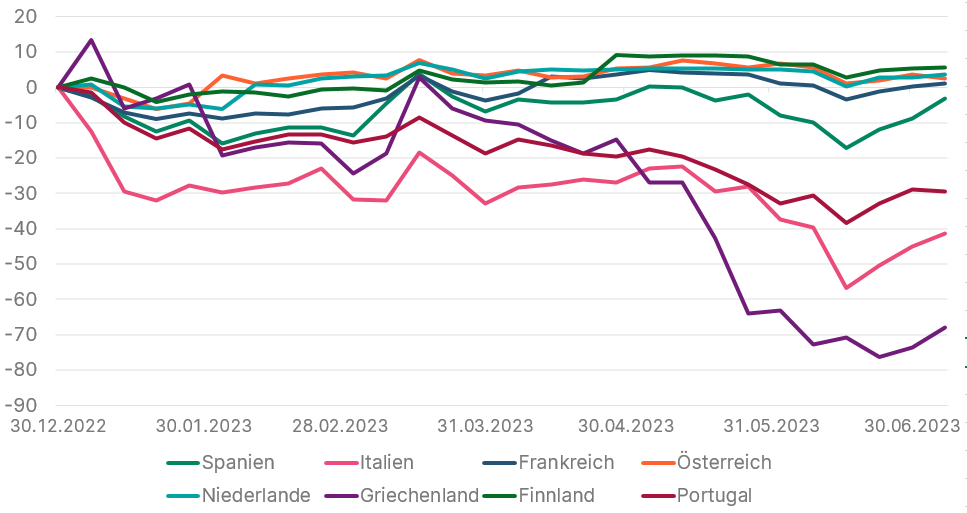

Yield spread: Development since the beginning of the year in basis points

Source: Bloomberg, own calculations, Data as of 13.07.2023; Note: Past performance is not a reliable indicator for future performance.

On a relative basis, however, it can be said that both the rather low but rising political risks and the moderate medium-term fiscal policy risks appear lower than in some comparable countries. Spanish government bonds can thus certainly represent an attractive investment.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.