A clear sense of style is not only important in fashion, but more and more so in equity management as well. But what does “style” mean in equity management? Do stylistic preferences change over time, like in fashion? If so, what triggers those changes? Questions upon questions, but before we go into detail in part 2 of this series, let us first clarify what we mean by style(s):

When we talk about style, we refer to a portfolio of shares that have certain features in common. These features are decisively different from the overall universe of all shares. If all shares have said feature(s) in common, the portfolio has it/them too. We call that style or factor.

There are numerous styles around, and they were at first created by academics and later taken over by financial professionals.

Value:

Value denotes a portfolio that consists of shares with a low PE (price/earnings ratio) and/or a low PBV (price/book value ratio). We should like to point out that “value” and “undervalued” are not the same thing. A PE of 10x for a share gives no indication as to whether the share is undervalued or overvalued.

Growth:

Growth refers to shares that show above-average earnings growth, ideally in the future rather than in the past. Of course, the future values can only be estimated, i.e. they cannot be measured. Some index providers equate growth (shares) with “expensive”, e.g. an above-average PBV in the MSCI. This approach is not ideal, although there is probably no ideal approach in this context.

Quality:

In contrast to growth, quality is more easily measurable. These are companies with above-average profitability (e.g. return on equity, i.e. ROE), low leverage, and stable earnings. Here, earnings only have to be stable, not necessarily above-average.

Momentum:

Momentum-shares are those that have outperformed the market in the past, e.g. in the past three, six, or twelve months. There is no standardised definition. The assumption is that outperformers in the past will also be outperformers in the future.

High dividend:

As the name suggests, this group of shares offers an above-average dividend yield.

Size:

Size in this context means market capitalisation. Shares tend to be put into the categories: small caps, mid-caps, and large caps; occasionally, more detailed categories are used. At this point, the categorisation into small caps and large caps shall suffice for us.

Styles and funds:

A clear sense of style in a fund context means that every fund investor knows what style is dominant in the fund. There are fund managers who time the factors according to market assessment, while others stick to one specific style. It is important to know the style because an investment in the fund is tantamount to a market assessment.

If the investor buys a value fund, (s)he implicitly believes in a strong economy with rising inflation and yields. The preference of growth or quality, on the other hand, indicates a belief in moderate economic growth and continued low inflation and interest rates as well as a flat yield curve.

The ideal funds for investors with no opinion of the market (i.e. a neutral stance) and unwilling to form one are so-called blend funds, i.e. funds that are broadly diversified and have no bias either way.

How do I get information on the style of a fund?

Fact sheets and KIIDs (Key Investor Information Documents) are available on the internet for every fund. These documents inform about the way a fund manager goes about managing any specific fund and ideally also contain information on the style, including its definition.

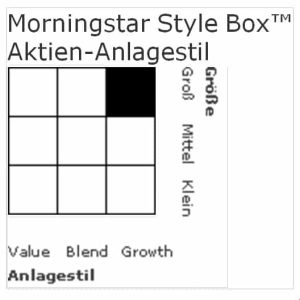

In addition, the website of Morningstar (www.morningstar.at) has information on funds available. It also features the so-called Morningstar Style Box. This chart shows in what segment a fund focuses its investments. In our example below, the fund is mostly invested in large caps/growth.

Sample Morningstar Style Box:

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.