The announcement by the US government of new tariffs on almost every country in the world sent a strong shockwave through the financial markets last week. In the wake of the market turbulence, many countries responded with countermeasures. On Wednesday evening, the US President finally backtracked and announced on the social media platform Truth Social that he had ordered a 90-day pause for most of the new tariffs. This pause would apply to all countries willing to negotiate with the United States. During this time, a reduced tariff of ten per cent will apply. Explicitly excluded: China. In fact, Trump even raised the tariff on Chinese imports to a total of 125 per cent. Trump continues to take a confrontational approach with the world’s second largest economy.

On Wednesday evening and Thursday, the markets reacted to the turnaround in Trump’s tariff poker with pure relief. On Thursday, the stock markets in the US again closed with losses – so the situation remains volatile.

We take a look at the rest of the world’s reaction to Trump’s tariff plans and ask Chief Investment Officer Gerold Permoser what consequences can be expected and how we, as an asset manager, are acting in the current situation.

What is the background to the tariff poker?

The list of countries presented by Trump at the announcement showed increased tariffs of 10 to 50 per cent for a long list of major trading partners. According to Trump, the US had raised its tariffs in all cases where it currently charges less than its partners.

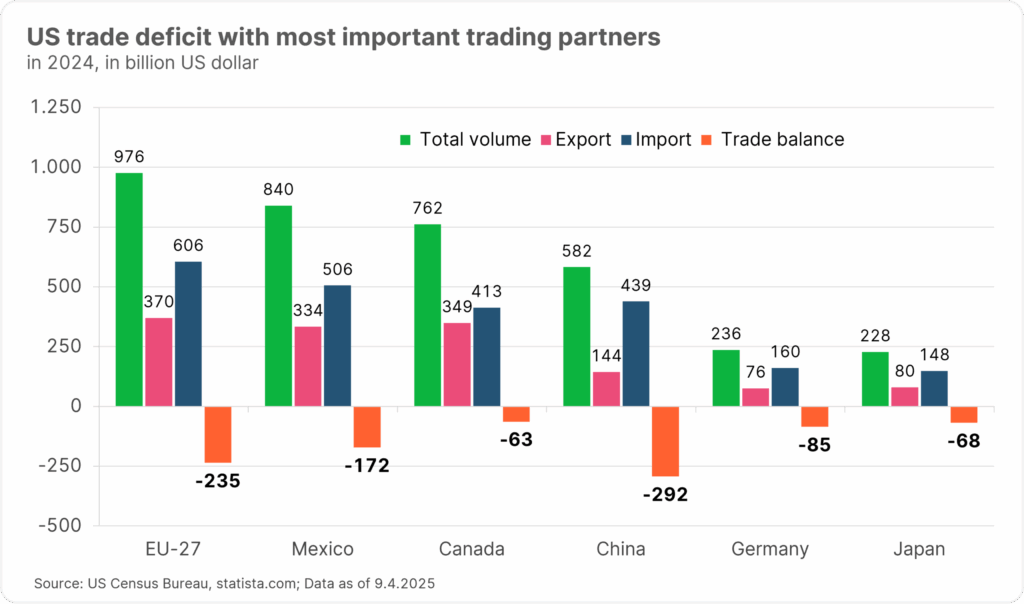

The US president wants to use the tariffs to correct alleged trade imbalances and relocate production to the US. This should also reduce the trade deficit with many countries, which is a thorn in Trump’s side. At the same time, the tariff revenues are to be used to finance his expensive election promise of major tax cuts. The motto is ‘What they do to us, we do to them,’ Trump emphasised. In fact, however, the list of new tariffs is not based solely on the tariffs imposed by other countries on US products. VAT and other factors that, according to Trump, lead to an unfair market distortion, are also included.

Last week, US President Donald Trump’s announcement of new tariffs on many countries caused turbulence on the international stock markets. Copyright: ANGELA WEISS / AFP / picturedesk.com

Experts immediately warned of the consequences of an impending trade war for the global economy. ECB President Christine Lagarde fears negative effects worldwide. The damage would depend on the extent of the tariffs, how long they lasted and whether they triggered successful negotiations, Lagarde said immediately after Trump’s announcement. Italy’s head of government, Giorgia Meloni, who is actually close to Trump, also expressed criticism. She called the new tariffs ‘wrong’.

Economists also expect negative effects for the US itself. US Federal Reserve Chairman Jerome Powell recently warned of rising inflation and slower economic growth. ‘Although the tariffs will most likely cause at least a temporary increase in inflation, it is also possible that the effects will be longer lasting,’ Powell said after the new tariffs were announced.

EU proposes free trade area, but also decides on countermeasures

In response to the special tariffs on steel and aluminium that are already in force, the EU announced on Wednesday that it would impose countermeasures of 25 per cent on numerous US products, including meat, grain, wine, wood and clothing, as well as chewing gum, vacuum cleaners and toilet paper. In a statement on Wednesday, the EU Commission emphasised that the countermeasures could be suspended at any time if the US agreed to a fair and balanced outcome to the negotiations. It is not yet clear whether the EU will also withdraw its countermeasures after the announced pause in US tariffs.

EU Commission President Ursula von der Leyen also announced that she would push ahead with the expansion of trade relations with other countries, citing India, Thailand, Malaysia and Indonesia as examples. She also referred to the already planned agreements with the South American trade bloc Mercosur, as well as Mexico and Switzerland. 83 per cent of global trade takes place outside the US, von der Leyen said.

China responds with counter-tariffs of the same amount and signals confrontation

China has already responded with counter-tariffs, signalling a collision course. Trump had imposed tariffs of 34 per cent on imports from the world’s second largest economy. Among the countries that ‘take advantage’ of America, China is the ‘biggest offender,’ the US president wrote on his Truth Social platform. Beijing immediately announced counter-tariffs of 34 per cent on US imports in response to Trump’s tariff decisions. In addition, export controls for seven rare earths would be introduced, the Chinese Ministry of Commerce stated. Furthermore, Beijing has blacklisted eleven US companies, which makes it de facto impossible for the affected companies to continue trading in China or with Chinese companies.

The Chinese government is taking a confrontational approach to the trade dispute with the US government. The USA currently has the largest trade deficit with China. Source: US Census Bureau, statista.com

In retaliation, the US president has threatened to impose even higher tariffs of 50 per cent on Chinese products if China does not back down. Trump gave the Chinese leadership until Tuesday to withdraw the 34 per cent counter-tariffs announced by Beijing. Beijing responded immediately. If the US continued to insist on this course of action, ‘China will definitely see it through to the end,’ the Beijing Ministry of Commerce announced. If the US escalated its tariff measures further, ‘China will take decisive countermeasures to protect its own rights and interests,’ the Ministry of Commerce said.

On Wednesday, the Chinese government made good on its threat and raised its tariffs to 84 per cent, whereupon Trump, as mentioned above, raised the tariff on Chinese imports to 125 per cent. The signs are clearly pointing to confrontation between the US and China.

What happens next?

Back and forth – that seems to be the US president’s current approach to tariffs. But does this mean that the trade war with far-reaching consequences for the global economy has now been cancelled? ‘We believe that the trade conflict at the global level is not over yet and continues to harbour the potential for further volatility in the markets,’ comments Alexander Lechner, Head of Multi Asset Management at Erste Asset Management. In particular, a further escalation between China and the US remains a major source of uncertainty.

FAQs on the current market turmoil

The international stock markets are under pressure. New tariffs, geopolitical tensions and the concern about rising inflation and interest rates are unsettling investors worldwide. Many are now asking themselves: What does this mean for my portfolio? Should I act – or better wait and see? In our FAQ, Gerold Permoser answers the most important questions and explains how we at Erste Asset Management are dealing with this situation.

The stock markets are in turmoil – what has happened?

The introduction of new tariffs has caused considerable uncertainty in the global financial markets. Tariffs slow economic growth, reduce corporate profits and can lead to a temporary increase in inflation. The result: broad price losses in almost all markets. Nevertheless, the pause on a large proportion of the tariffs announced yesterday showed that markets can react very quickly to positive news. Nevertheless, it is still unclear whether we have already seen the peak or whether this is the beginning of a longer volatile phase. Despite the 90-day pause, it should be noted that the tariffs on Chinese imports were actually raised significantly. China is one of the most important trading partners with the US – so this has very far-reaching effects.

What does this mean for inflation and interest rates – and how will it affect my invested money?

Tariffs can cause prices to rise in the short term – a so-called one-off effect. This can cause inflation to rise. Whether and to what extent central banks respond to this with interest rate hikes depends on whether the effect is sustainable. Rising interest rates weigh particularly heavily on high-growth technology stocks, while for banks it is potentially a good situation. It is important to stay calm and act with a cool head. Panic is rarely a good advisor.

Will the value of my equities drop sharply now?

The markets have already reacted sensitively to the announcement of new tariffs, particularly in affected sectors such as consumer goods. But trade conflicts are nothing new – let’s remember President Trump’s first term in office. Often, the markets show stability again after the initial shock reaction, especially when negotiations are in prospect – a pattern that we are also seeing now after Trump’s announcement yesterday. A broadly diversified investment strategy – for example, through asset management or mixed funds – can at least cushion such fluctuations to some extent. But even in such funds, there are of course risks that need to be considered.

Should I take my money out of the market now and wait?

Emotional decisions almost always lead to suboptimal results on the capital markets. Those who pursue long-term goals should stick to them. Market timing, i.e. the attempt to time an investment exactly right, rarely works reliably, even for professionals.

What has the asset manager Erste AM done in the last few days?

We have already positioned ourselves cautiously and reduced our risk – specifically by:

- being underweight in equities,

- being underweight in the US and overweight in Europe,

- and holding a position in gold.

In view of the current situation, we have taken further measures: we are reducing risk by selling bonds with low credit ratings from Europe and Asia. In return, we are building up positions in European government bonds – because we expect the tariff dispute to have a rather deflationary effect in Europe.

Why doesn’t Erste AM reduce the equity allocation further?

We are deliberately not making any further reductions in promising investments at present – for the following reasons:

- A lot of negative news has already been priced in. Markets often overreact at first before a more realistic assessment takes hold.

- The US government has signalled that the tariffs announced represent an upper limit – this gives rise to hopes for room for negotiation.

- In the US, criticism of the tariffs is growing, even within the Republican Party. The Senate has passed a bill against new tariffs on Canada with the support of four Republican votes (a decision in the House of Representatives is still pending).

- Despite the current uncertainty, equity valuations are now more attractive again than they were just a few weeks ago.

Which sectors or asset classes are particularly at risk now – and which are less so?

Companies that are particularly at risk are those that rely heavily on exports – especially manufacturers in China. US companies could also be affected if tariffs are introduced after the announced break and other countries respond with further countermeasures.

Developments could be positive for:

• companies with a domestic market focus and active supply chain management,

• the energy and agriculture sectors – for example, in the event of rising subsidies,

• and ‘safe havens’ such as gold or European government bonds.

Note: Please be aware that investing in securities involves risks as well as opportunities.

Will this affect my equity fund?

Yes – but the impact depends heavily on the fund. Broadly diversified funds with a global focus and several sectors are generally more resilient to short-term fluctuations. If you invest regularly – for example, via a savings plan – you can even buy cheaper during weaker market phases. Therefore, it makes sense to remain invested for the long term and not to react to short-term developments.

Please note: the average cost effect for savings plans becomes smaller as the term progresses. The accumulated savings then behave more and more as if you had invested the entire amount in a single investment. Depending on market developments, a one-time investment can also be more favourable. Investing in securities involves risks as well as opportunities.

US tariffs cause market turbulence

You can find the latest information and insights on the US tariffs and the reactions on the stock market here 👉

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.