The most important global stock markets are heading for a successful year just before the turn of the year. Despite tariff conflicts, inflation, the war in Ukraine and fears of an AI bubble, many of the most important share indices made significant gains this year and rose to new all-time highs towards the end of the year.

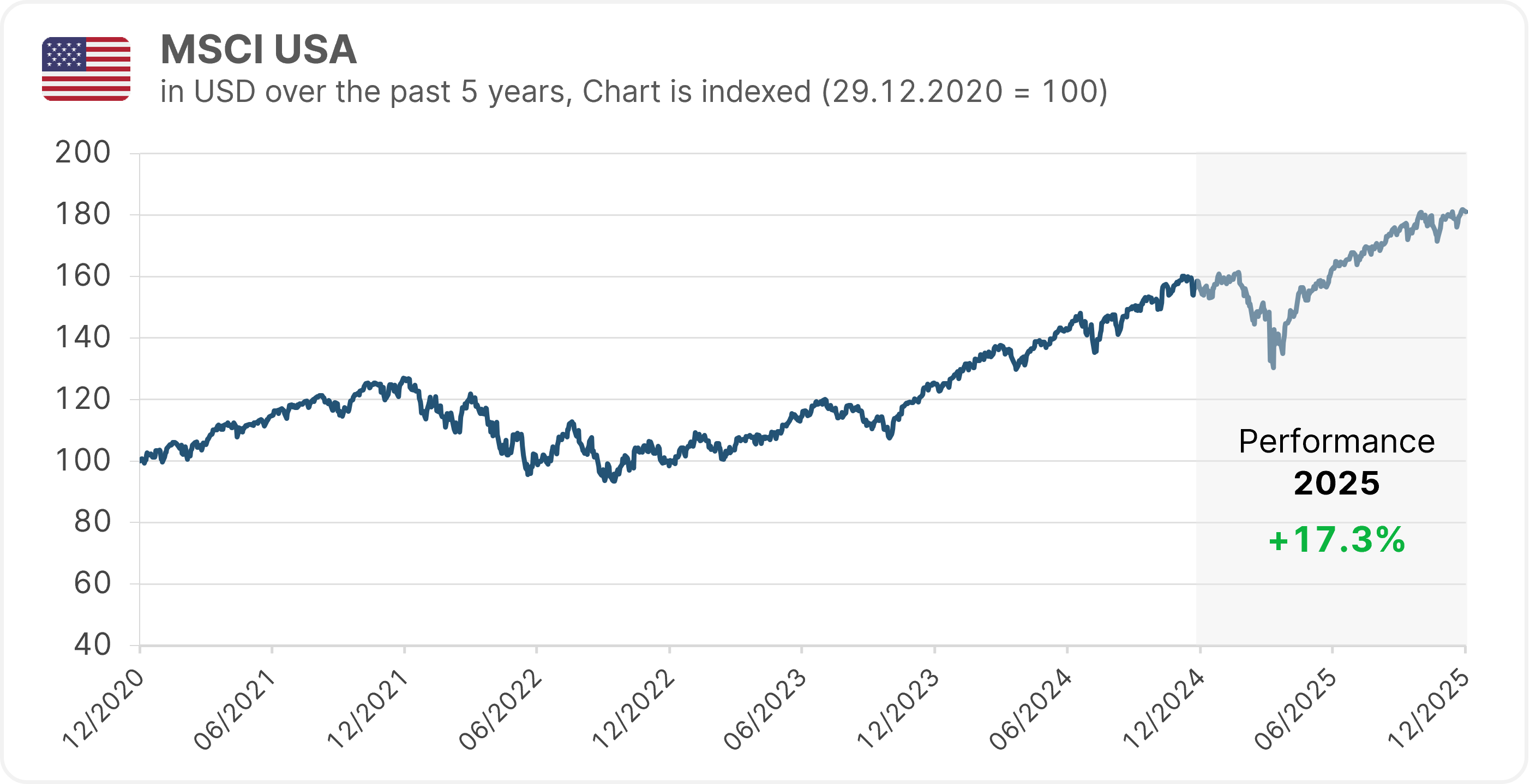

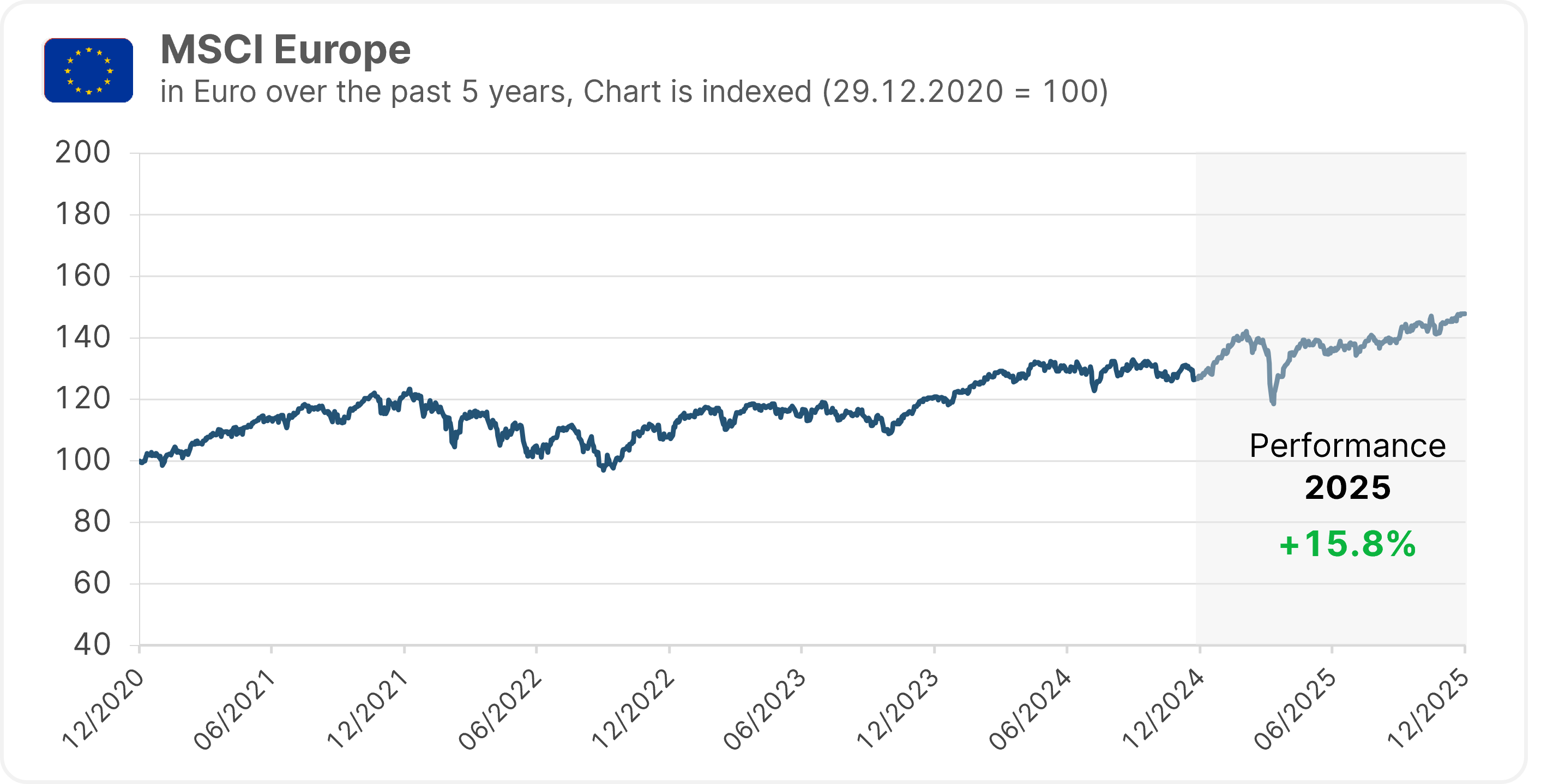

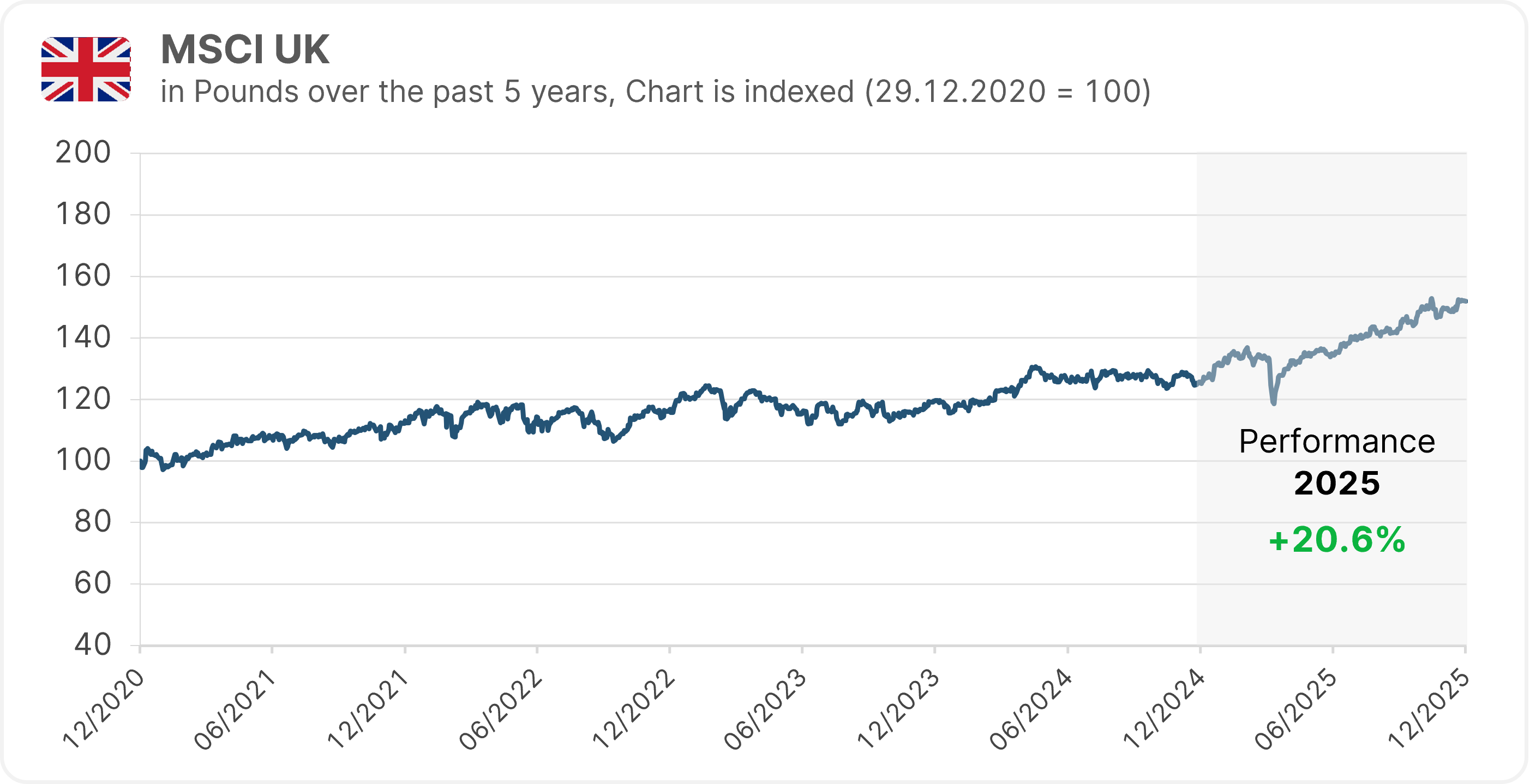

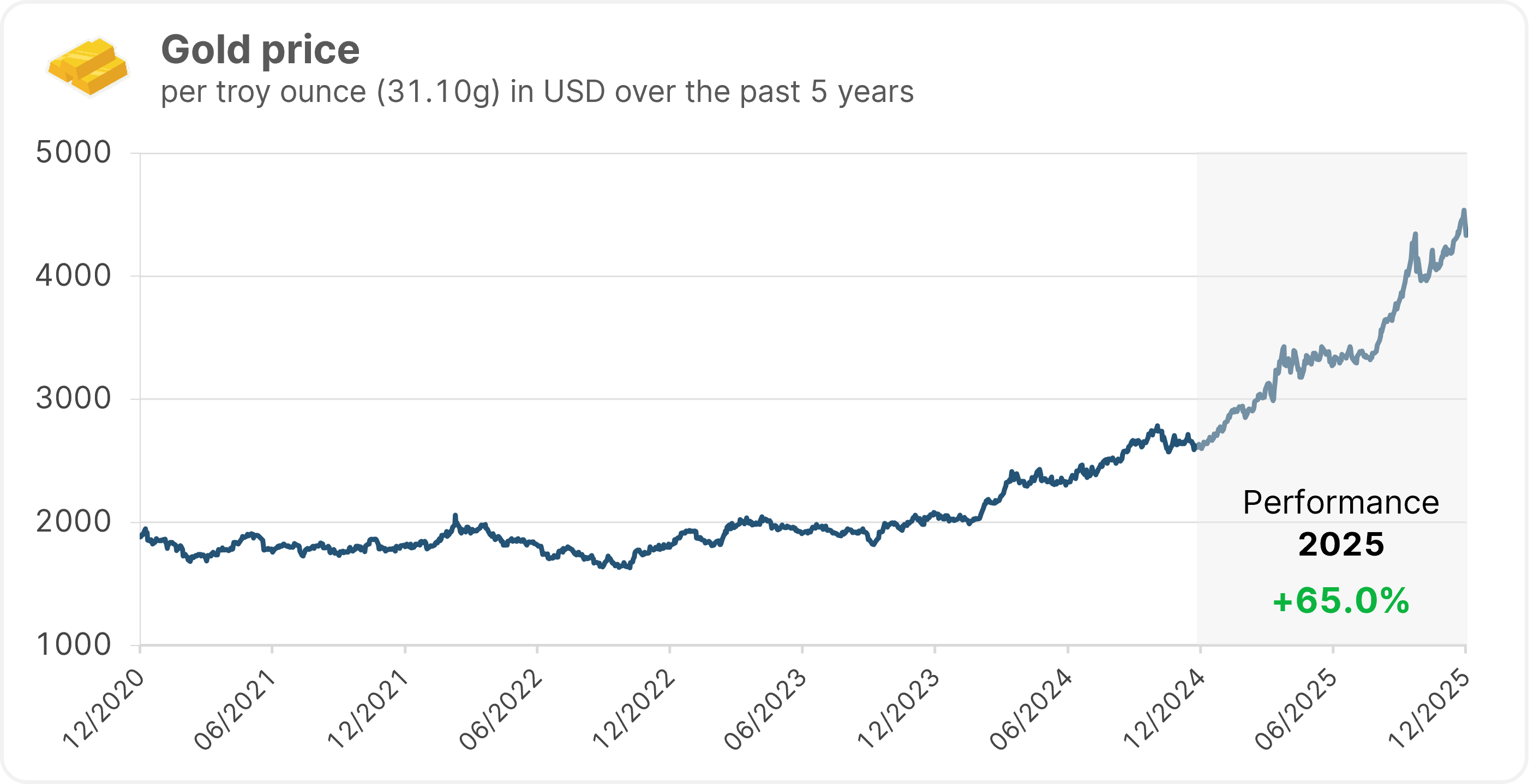

The MSCI USA (in US dollars) recently posted an annual gain of around 17%. In Europe, the MSCI Europe, the MSCI Germany in Germany (both in euros) and the British MSCI UK (in British pounds) have gained between 15 and 20 percent so far this year. All four indices reached new all-time highs in the fall. The Austrian share index ATX also set a record at the end of the year, the first new all-time high since 2007. The prices of the precious metals gold and silver also reached new highs this year.

Note: Please note that investing in securities involves risks as well as opportunities. The companies mentioned in this article have been selected as examples and do not constitute investment recommendations. Past performance is not a reliable indicator of future performance.

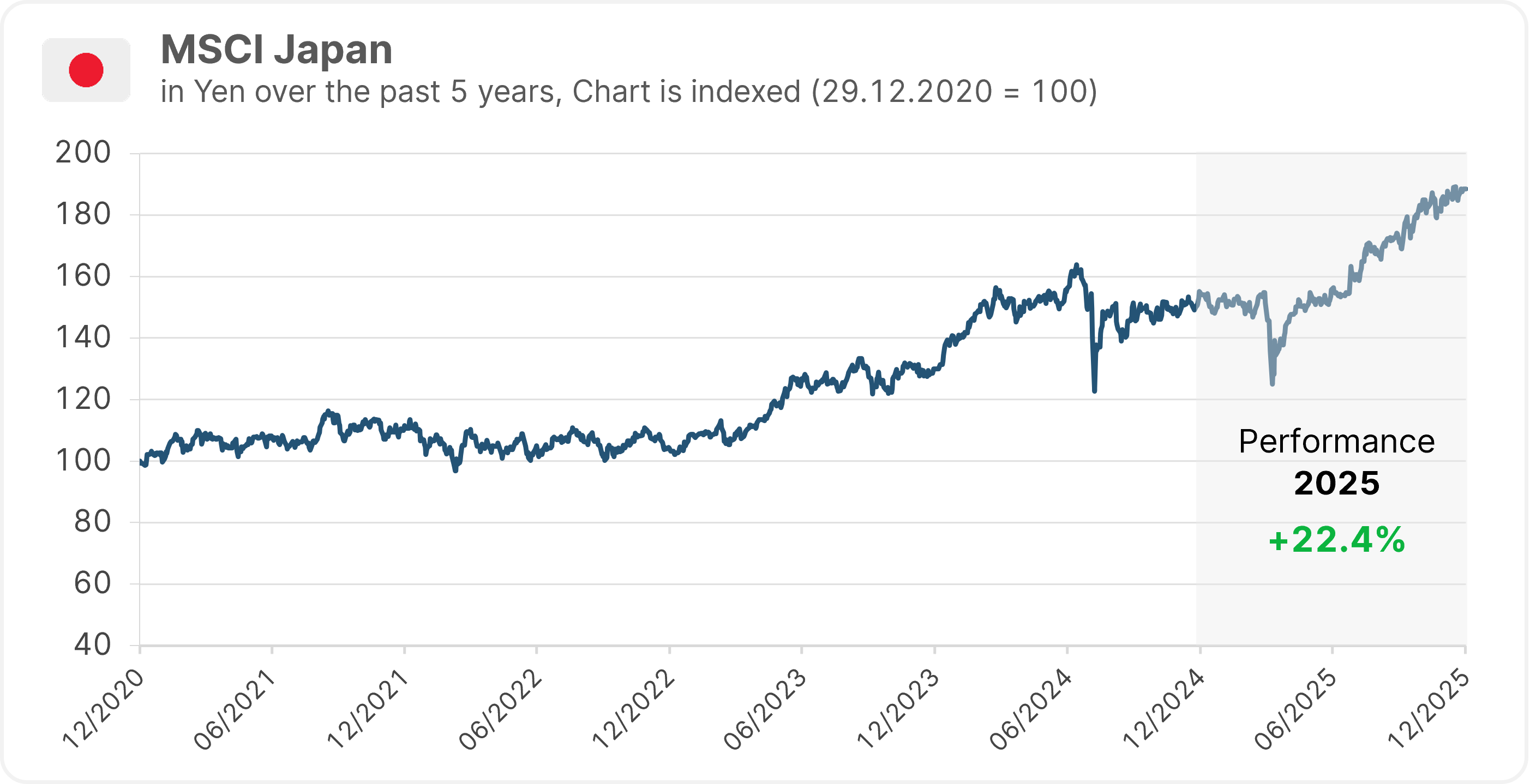

Performance of selected indices & asset classes

Equities USA

Equities Europe

Equities UK

Equities Germany

Equities Japan

Equities China

Gold price

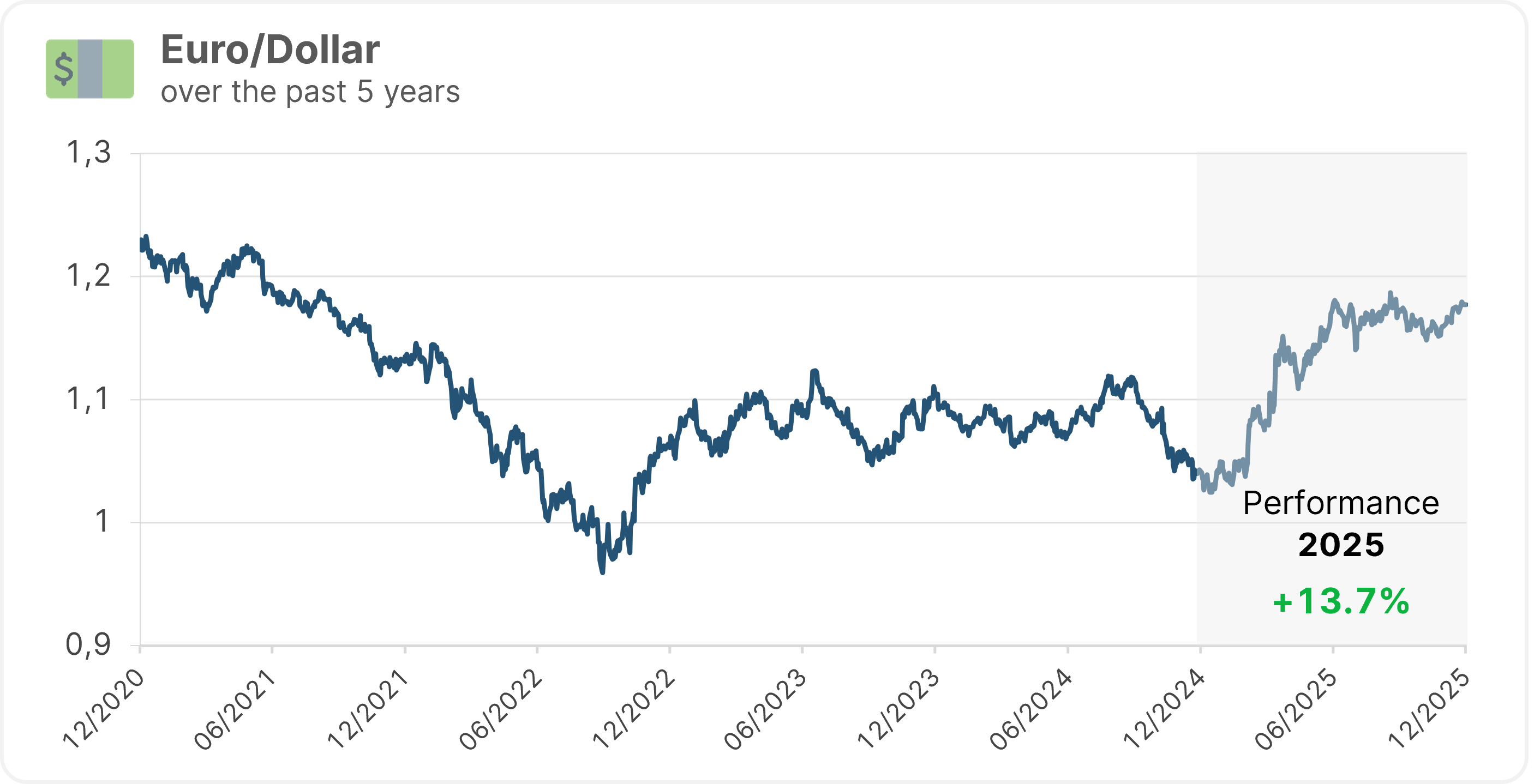

Euro/Dollar

Source: LSEG Datastream, all data as at 29.12.2025

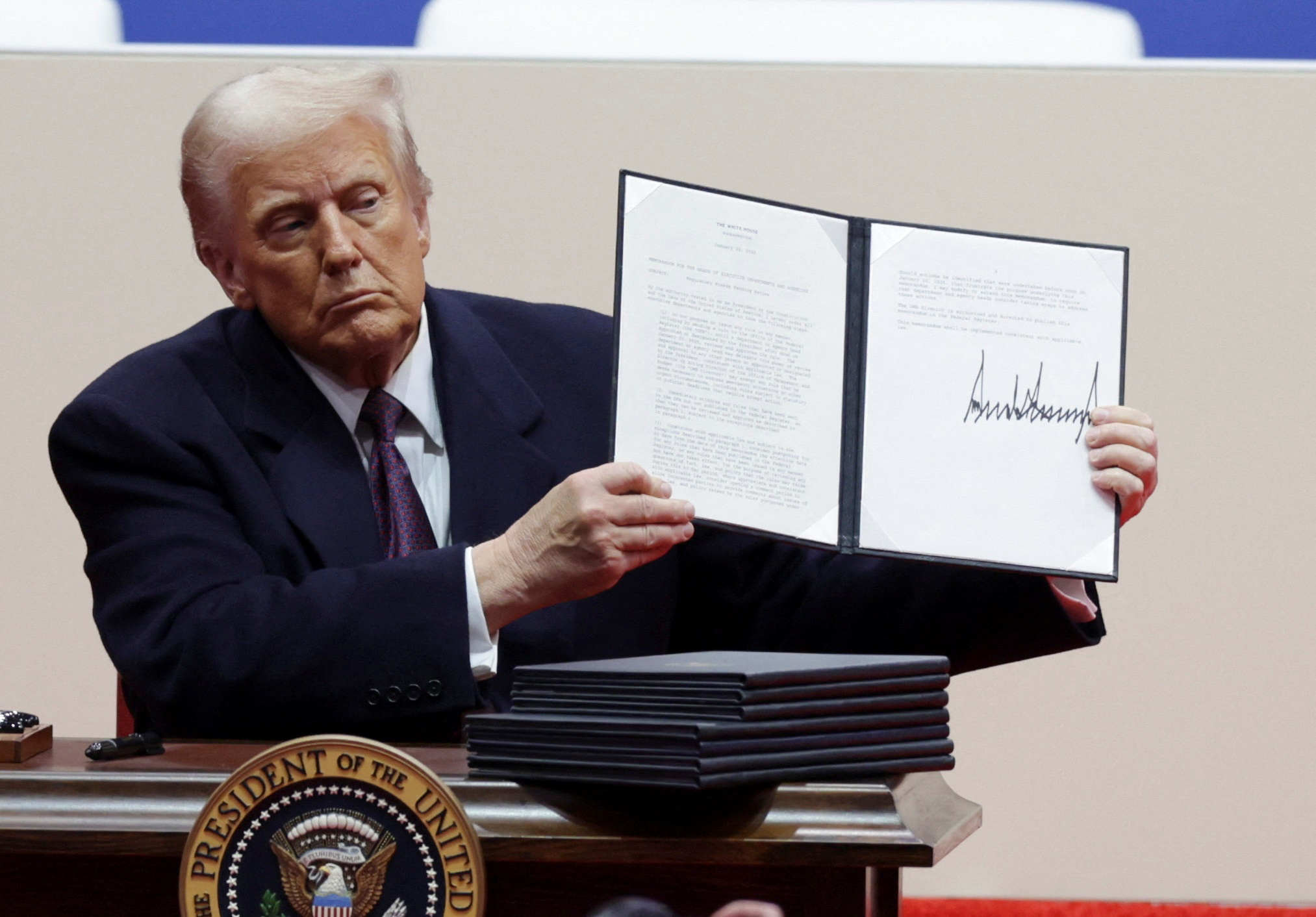

US President Trump’s inauguration marked the start of the year

The start of the stock market year was dominated by the inauguration of US President Donald Trump. The new president’s tariff plans in particular worried stock market players right from the start. Just a few weeks after his inauguration, Trump launched his tariff round-up with significant tariff increases on products from Canada, Mexico and China. This was followed in the spring by a wave of new tariffs on products from the EU and numerous other trading partners. Over the course of the year, the US reached compromises with the EU, the UK, Japan and many other countries and concluded new trade agreements.

Shortly after his inauguration, US President Donald Trump announced extensive tariff plans. Image source: APA-Images / REUTERS / Mike Segar

The trade dispute with China has escalated in particular. Trump had at times announced tariffs of 100 percent and more on Chinese goods, while China countered with the prospect of counter-tariffs of a similar magnitude. China also exerted additional pressure with export restrictions on rare earths, which are urgently needed by the US high-tech industry. In October, the two countries reached an agreement in the tariff dispute, and the export of rare earths remains in place for the time being. China is already struggling with its own domestic problems: industrial production in the country has recently continued to shrink and the real estate crisis is also having an increasing impact on consumer behavior. According to recent studies, China’s economic growth may have recently been significantly lower than expected.

Fed recently lowered key interest rates, ECB kept interest rates stable for the time being

The trade conflicts also fueled fears on the stock markets of resulting price increases for imported products in the USA and thus a surge in inflation. The interest rate decisions of the US Federal Reserve, which would have to counter higher inflation with higher interest rates, were therefore followed with particular interest this year.

The interest rate decisions also had a political component, as Trump put verbal pressure on Fed Chairman Jerome Powell to lower interest rates despite fears of inflation. Although Powell stood firm and emphasized the Fed’s independence in its decisions, the Fed recently lowered interest rates three times in a row to a level of 3.5 to 3.75 percent in light of the gloomy situation on the labour market. In doing so, the Fed was operating partly “flying blind”. Due to the temporaryshutdown of many US authorities in the fall, numerous important US economic indicators were temporarily not published or not determined at all.

Fed Chairman Jerome Powell has often faced pressure from US President Donald Trump this year to cut interest rates despite fears of inflation. Image source: APA-Images / AFP / SAUL LOEB

Meanwhile, the European Central Bank (ECB) recently kept the key interest rate for the eurozone stable. In December, the ECB Governing Council left the key deposit rate at 2.0 percent for the fourth time in a row. Prior to this, the key interest rate was halved from four to two percent in eight steps between mid-2024 and June 2025. The euro also benefited from the drifting apart of interest rates: The single European currency was still at around 1.04 dollars at the start of the year, and most recently held at just under 1.18 dollars at the end of the year.

New German government approves huge investment package

The beginning of the year was also marked by a change of government in Germany, the EU’s largest economy. In April, the candidate for chancellor of the victorious CDU/CSU Union reached an agreement with the SPD on a new coalition government. The focus was on a planned package of EUR 500 billion for investment in infrastructure. The infrastructure package was received positively on the stock market, with construction stocks in particular rising sharply in initial reactions.

Tech stocks continue to be in the spotlight with AI boom

Shares in the IT sector were also in focus worldwide against the backdrop of the ongoing AI boom. In particular, those companies that provide the necessary infrastructure in the form of data centers and storage for the development of AI tools were able to make strong gains in some cases. AI chip market leader Nvidia also remained in the spotlight. In the fall, fears of a possible AI bubble and exaggeration circulated on the stock markets, and many tech stocks gave back some of their gains. However, some stocks held up well, with Nvidia shares still up around 23% for the year (as at 29.12.2025) despite the correction in the fall.

Note: Please note that investing in securities involves risks as well as opportunities. The companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

Ukraine war and defense stocks in focus this year

All developments in the Middle East and around the war in Ukraine were also closely followed on the stock markets this year. The conflicts in the Gaza Strip also led to major spikes in crude oil prices at times. However, against the backdrop of a ceasefire between Israel and Hezbollah and a US peace plan, the price of the benchmark Brent crude oil recently returned to levels of around USD 60 per barrel (159 liters).

US President Trump’s new security policy also led to a rethink in Europe, with many European countries announcing a significant increase in arms spending in light of the war in Ukraine. As a result, the shares of defense companies also rose significantly. Shares in the leading German armaments company Rheinmetall , for example, were the talk of the town and have tripled in price in some cases since the beginning of the year. Recently, however, defense stocks have also retreated somewhat. The markets are now keeping a close eye on the ongoing negotiations for a peace settlement in Ukraine.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.