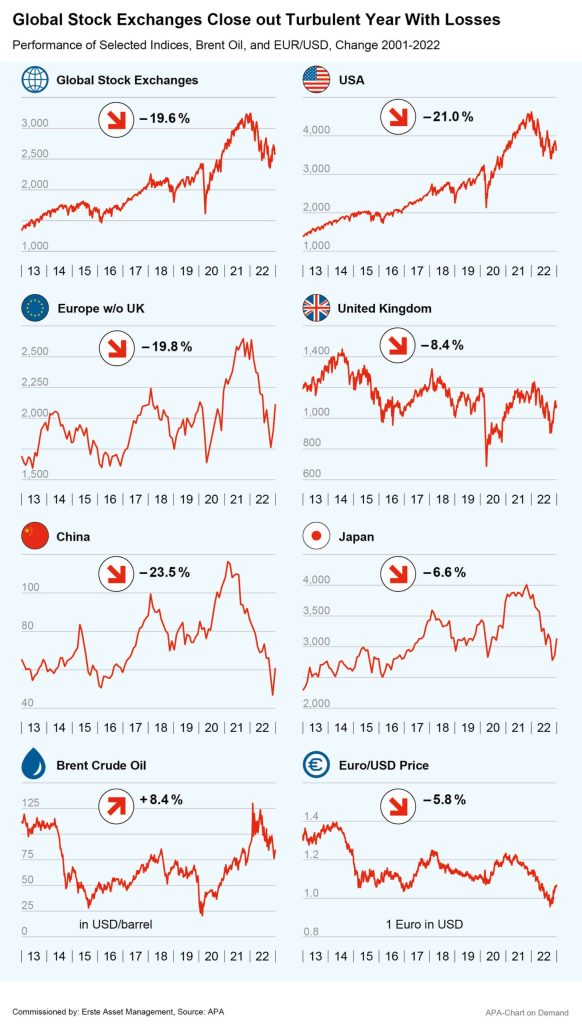

The turn of the year marked the end of a difficult and lossy year on the stock markets. After two years of Corona pandemic, 2022 was dominated by Russia’s invasion of Ukraine, with many stock exchanges suffering double-digit losses. The MSCI World Index, the benchmark for global stock market performance, dropped by almost 20 per cent over the course of the year, the US Dow Jones stock index and the Japanese Nikkei each dropped by around 9 per cent. The Euro Stoxx 50 lost nearly 11 per cent in 2022.

The Ukraine war led to rapid oil and energy price increases which, together with the economic recovery during spring, caused inflation to soar. At the beginning of 2022, the price for a barrel of Brent crude (159 l) was still just under 78 US dollars. Immediately following the invasion, the price for Brent shot up to over 100 dollars, nearing the 120-dollar mark at times.

Unsurprisingly, the beneficiaries of the oil price increases were oil company shares. Shares of US energy company Chevron were the Dow Jones’s top gainers, with 53 per cent annual gain in 2022. In London, shares of oil giants BP and Shell climbed to the top of the FTSE with gains of nearly 40 per cent. At the same time, the Ukraine war and the resulting fears of energy shortages in many countries accelerated the trend towards sustainable and renewable energies, but also the reconsideration of nuclear power.

Interest Rate Turnaround Ends Era of Cheap Money

The price increases also fuelled quickly rising fears that the central banks would react to the high inflation by raising key interest rates after a long phase of record-low interest, ending the era of cheap money for the immediate future. The US Federal Reserve Bank already raised its interest rates seven times in the past year and recently signalled further interest rate increases. The Fed’s key interest rate now lies between 4.25 and 4.50 per cent. The ECB proceeded somewhat more cautiously with four rate hikes.

Central banks are currently presented with a difficult balancing act: on the one hand, they are trying to keep price increases in check by raising interest rates, which is also intended to prevent negative effects on consumer sentiment and thus on the economy. But increasing interest by too much would have a negative impact on the already shaken economy.

A fair number of technology shares came under strong pressure with the interest rate turnaround in the past year. Tech companies need money for expensive investments that only pay off in the future and therefore suffer particularly from interest rate increases. In the US, the tech-oriented Nasdaq Composite Index lost around 33 per cent over the course of the year, performing significantly more poorly than the Dow Jones.

Oil and Gas Prices Pulling Back

Monetary policy remains a major theme for the new year. However, the latest figures show some hope. The eurozone’s inflation rate decreased slightly to 10.1 per cent in November after having reached a record high of 10.6 per cent in October. Inflation is also expected to have peaked in the USA. Many economists expect the central banks to end their series of interest rate hikes in 2023.

This is also supported by the recent energy price developments. Oil prices recently pulled back significantly, with price for Brent hovering around 82 USD at the turn of the year. At the outset of the year, the European gas price continued its recent decline thanks to unusually mild winter temperatures. On Monday, the TTF futures contract for Dutch natural gas started trading at 70.30 EUR per MWh, marking the lowest natural gas price since before the start of the Ukraine war.

Economic Data Gives Hope for Recovery in 2023

The latest economic data also gives hope for a good year. In Q3 of 2022, the US economy grew faster than previously assumed. Gross domestic product (GDP) increased by 3.2 per cent for the year. However, good economic data is currently being received with mixed feelings on the markets, as it also may lead to further interest rate hikes.

In the eurozone, GDP grew by 0.3 per cent in Q3 compared to the previous quarter, and while many experts expect a temporary recession in the winter, recent surveys suggest it could be weaker than originally assumed. The S&P-Global Purchasing Managers’ Index for the private sector recently increased by a full point to 48.8 points and is now approaching the 50-point mark that divides recession from economic growth. Some economists therefore do not want to rule out a positive surprise in the new year.

The markets will also continue to keep a close eye on the Corona pandemic in 2023. Worries about COVID on the stock markets have returned at the turn of the year after the latest developments in China: after China’s government surprisingly abandoned its strict zero-COVID policy and lifted its severe restrictions, the number of COVID cases in the country is soaring again.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.