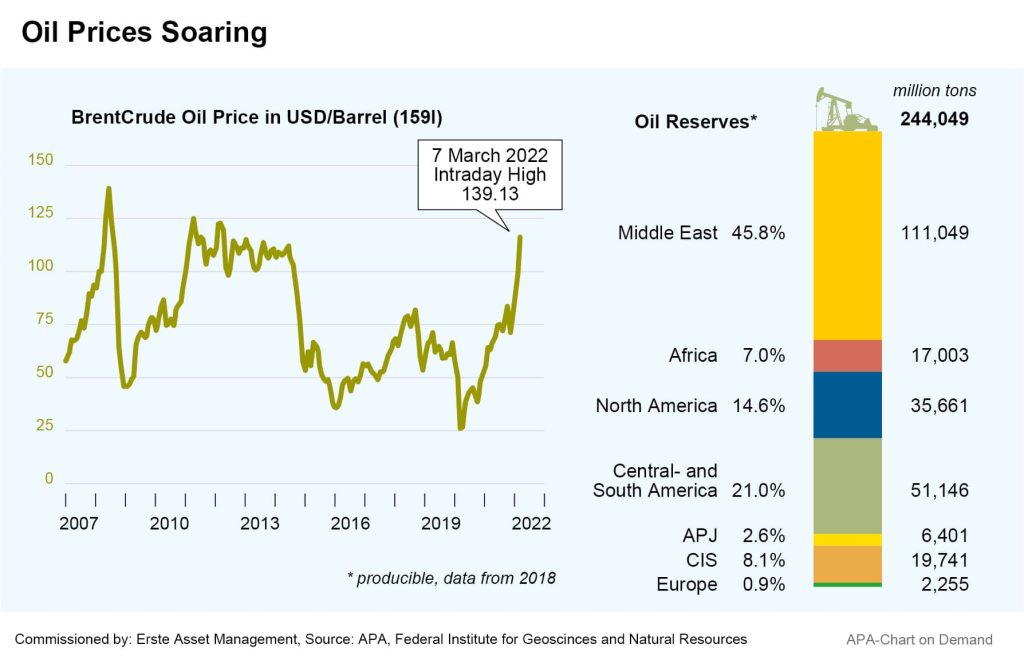

Crude oil prices have recently stabilised a little shy of their last highs after their recent bull runs. Against the background of Russia’s invasion of Ukraine, the price for a barrel (159 liters) of North Sea Brent crude oil rose to just under 140 USD at the beginning of the previous week – the highest price since 2008. In 2022, the reference oil brand reached a historical record price of nearly 150 USD. The oil price increases also further fueled growing fears of high inflation and counteracting interest rate hikes by central banks. The oil price rally was driven by concerns about supply shortages in case of disruptions or a general shutdown of oil imports from Russia vital to many countries.

However, the prospect of releases of strategic oil reserves, compensation from increased oil imports from other countries, and a possible resumption of oil exports from Iran and Venezuela have recently led to a slight easing in the oil market. At the close of the week, Brent oil price was only slightly above 110 USD per barrel. Russia itself has recently given assurances that it will continue to meet its oil supply obligations. However, the sanctions imposed by many Western countries against Russia following its invasion of Ukraine could also mean a halt to oil imports from Russia.

USA and UK ban Oil Imports From Russia

The initial sanctions against Russia’s financial sector have already resulted in Russian oil finding fewer buyers in the West, as they massively complicate the associated payment processing. Meanwhile, the US has also imposed a general ban on imports of oil from Russia. The UK plans to stop importing Russian oil by the end of this year, weil a phase-out of Russian gas is being looked into.

In the EU, which is more dependent on Russian imports, the issue is still under discussion. At a summit meeting last week, EU leaders could not yet bring themselves to agree an oil and gas embargo. Stopping imports of oil, gas and coal would be one of the EU’s harshest punitive measures for Russia, which is economically heavily dependent on commodity sales. According to the International Energy Agency (IEA), about 45 per cent of Russia’s budget in January came from taxes and tariffs on oil and gas exports. Conversely, however, an import freeze would also hit some EU countries themselves rather hard, such as Austria and Germany, which are currently highly dependent on gas and oil from Russia.

EU Plans to Quickly Reduce Dependence on Russian Oil and Gas

EU leaders are therefore seeking to develop a strategy by May on how the union can become independent of Russian oil, gas and coal by 2027, EU Council President Charles Michel said on Friday after the EU summit. The IEA is also working on such strategies and plans to present a 10-point program as early as March on how oil consumption can be significantly reduced in a short timespan. The energy agency already presented a 10-point plan on how the EU can quickly and drastically reduce its dependence on Russia’s gas supplies earlier this month.

The G7 group of seven leading industrialized nations is working on similar strategies as well. In the long term, the G7 countries are continuing to focus on expanding renewable energies and a general shift away from fossil fuels. In the short term, however, hopes are also pinned on production increases by other countries. At their meeting last week, the energy ministers of the G7 countries therefore appealed to the largest oil exporters, and in particular to the OPEC countries, to consider increasing their oil and gas supplies.

In early March, the expanded 23-member group OPEC+ of oil-producing countries, which includes Russia, had still confirmed its course of only a gradual and moderate expansion of crude oil supply despite the current situation. An ambassador from the United Arab Emirates recently held out the prospect of the country advocating higher oil production, but then backed down again. According to analysts, however, production increases are likely to be an issue at the upcoming OPEC+ meeting in late March.

End of Sanctions Against Iran and Venezuela Could Bring Return to the Oil Market

Fears of oil supply shortages are also likely to be eased by the prospect that a possible lifting of sanctions against Iran and Venezuela could bring oil exports from the two countries back onto the market. Under the new US President Joe Biden, talks on a nuclear agreement with Iran were back on track. In Vienna, Iran and a group of countries have been negotiating over the Middle Eastern country’s nuclear program for several months.

A rewrite of the nuclear agreement, which was scrapped under former US President Donald Trump, is intended to prevent Iran from building a nuclear weapons program while allowing it to use nuclear energy for peaceful purposes. An agreement could also bring a lifting of sanctions against Iran, which would also allow Iranian oil to return to the world market.

Venezuela is also hoping that the sanctions against Russia will provide it with a new role in the energy market. The country has the world’s largest oil reserves, but has itself recently suffered from sanctions against its authoritarian government as well as mismanagement. As a result, production volumes in Venezuela fell drastically: while the country produced 3 million barrels daily 20 years ago, that number was as low as 668,000 barrels recently. However, Venezuela wants to boost its oil production strongly again now.

The US has already signaled interest in oil from Venezuela after it stopped Russian oil imports. Representatives of the US government already promised the country an easing of sanctions that have been in place since 2019, on condition that oil is delivered to the US, Reuters agency reported, citing informants in the negotiating circle. However, a first round of negotiations between government representatives of both countries seems to have failed to yield an agreement – one of the reasons being that the US continues to push for free presidential elections, Reuters reported.

Finally, the short-term oil supply is to be secured through liquidation of strategic reserves. The US and its allies have already put some of their oil reserves on the market in response to the rising oil prices. At a meeting in early March, the IEA member states already agreed to release 60 million barrels, with the US supplying the larger part of the amount, 30 million barrels. Most recently, the IEA has signaled its willingness to release even more reserves if necessary.

Long-Term Goal is to Overcome Dependence on Fossil Fuels

In the long term, however, the strategy of many industrialised countries is to accelerate the planned phase-out of fossil fuels in light of current events. EU Commission President Ursula von der Leyen now sees the European Union at a “crossroads.” Europeans must end their dependence on Russian fossil fuels such as natural gas, oil and coal and massively expand renewable energy production, von der Leyen said at the close of the last EU summit on Thursday. This should mean no oil and gas imports from Russia by 2027. The G7 also see the expansion of renewable energies and those with low CO2 emissions as the most important instrument for energy security. For this reason, the climate targets of the global community are being confirmed, according to the latest meeting of the G7 energy ministers.

Commodity stocks on an upward trend

There is still a long way to go before we are truly independent of fossil fuels. The demand for commodities is currently high. Shares of companies in the commodities sector were one of the few asset classes to show positive performance in the current environment. An addition to the portfolio can make sense for diversification reasons, especially since the economy is in the recovery phase after the pandemic and the demand for commodities is unlikely to weaken or the supply bottlenecks in many parts of industry must first be resolved.

ERSTE STOCK COMMODITIES invests worldwide in companies in the commodities sector. The investment strategy aims to achieve a balanced portfolio from the basic materials and energy sectors as well as a stronger weighting in companies from the developed markets. Environmental and social factors as well as corporate governance factors are integrated into the investment process.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE STOCK COMMODITIES as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK COMMODITIES, consideration should be given to any characteristics or objectives of the ERSTE STOCK COMMODITIES as described in the Fund Documents.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.