New budget 2019-2021

The engine of economy in Slovakia is running on a good momentum. In recent years it has been going through a cyclical upswing. Let us take a look at the drivers, but also consider potential threats going forward.

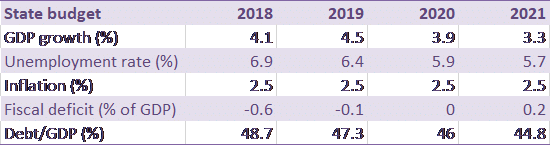

On 10th October, the ruling political party SMER, approved the draft state budget for the subsequent three years, i.e. until 2021. It is projected that the fiscal deficit will reach 0.6% this year and narrow to 0.1% in 2019. In 2020 the country should have a balanced budget, in 2021 even a slight surplus of 0.2%. This is complemented by favourable debt levels relative to GDP which is expected to reach 49% this year (51% in 2017), and should gradually trend towards 45% by 2021 due to an expected consolidation of public finances. This is well below the 60% Maastricht threshold, but more importantly significantly less than the Eurozone average of 86.8%.

Missing structural reforms

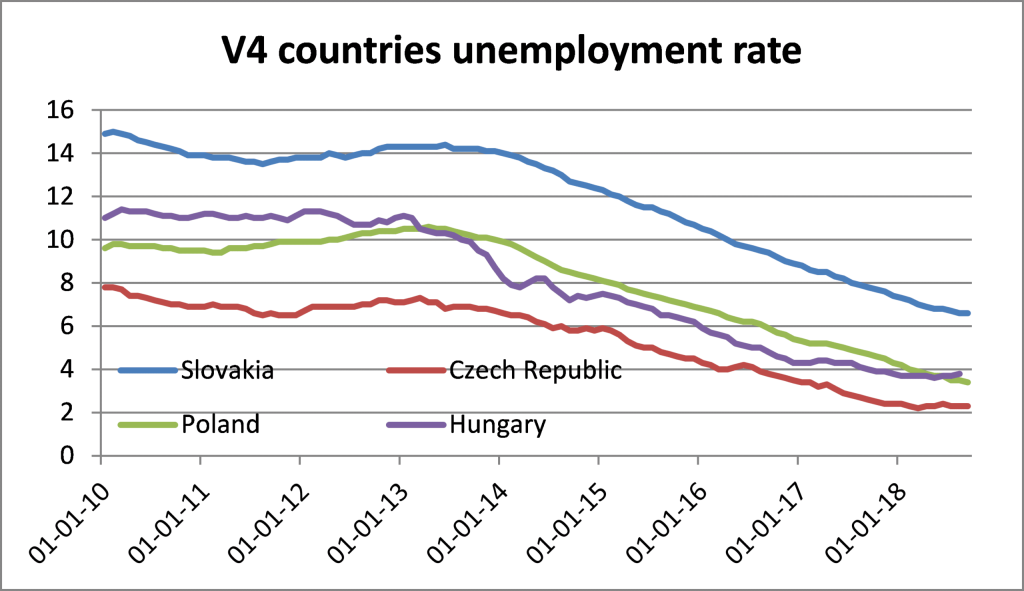

On the other hand, the budget does not mention crucial structural reforms which Slovakia needs to remain competitive – education, infrastructure development or road construction are the key topics. The overall unemployment rate stands at historic lows of 6.5%, which is close to full employment. Despite being the highest from the Visegrad 4 (V4) countries, high demand for skilled labour continues. This is, however, causing a slight divergence between the supply and demand for the labour force – shortage of skilled labour, putting constraints onto a further growth potential. As a natural step, it would seem that more resources should have been allocated towards education and research and development in order to meet the needs of the labour market, and thus help to improve value-added growth of Slovakia.

Source: Ministry of Finance of the Slovak Republic; Slovenská sporiteľna, a.s.

Jaguar Land Rover

On 25th October Jaguar Land Rover opened its production plant in Nitra, which is expected to strongly contribute to GDP growth, reaching 4.5% next year as per the budget proposal. This marks the arrival of the 4th car manufacturer to Slovakia. The notion of over-reliance of auto exports definitely comes to the forefront given that car production should rise by some 40% in the next half-decade. It currently represents 35% of Slovakia’s industrial production and 40% of all industrial exports. Slovakia is the world leader in the coefficient of the number of cars produced per 1000 citizens which currently stands at 0.192 cars per person per annum. The leading export markets for locally produced vehicles are Germany, Austria and other CEE markets. This may be considered as an advantage as the world is currently stuck in the U.S. and China trade dispute which is adding unnecessary uncertainties. On the other hand the country could feel the knock-on secondary effects of trade tariffs through subcontractors.

Growth driven by…

It the light of the positive economic sentiment and the GDP growth driven primarily by domestic demand, household consumption and investments, growth of both domestic and corporate credit has simultaneously accelerated. Retail and corporate loans advanced in 2017, by roughly 12% and almost 10%, respectively. To prevent a situation when things would spiral out of control the Slovak National Bank implemented a regulation on debt-to-income (overall indebtedness should not exceed 8x the annual net income of a household), and loan-to-value (maximum of 90% of the real estate value) ceiling. Moody’s estimates domestic credit growth at roughly 6% through 2021, whilst loan-to-deposit ratio of the commercial banks should rise from a current 90% to exceed 100%, indicating further expansion, though at a more moderate pace.

In Q2 Slovak Republic issued its first 50-year bond, with an issue size of 500m EUR and a coupon of 2.25%. Investors shower big interest and oversubscribed the issue was by 3x. It is the longest bond issued in the CEE region in the past 10 years, and the longest Slovakia has ever issued. This placement on the capital markets can be viewed as measured and successful, utilising historic low cost of debt.

To sum up, Slovakia is expected to enjoy a prolonged period of growth at least through 2021, the main drivers of which should be industrial production – primarily thanks to auto industry, household consumption, growth of credit, and investments. This can however be curtailed by inappropriate placement of the government budget at the expense of structural reforms, such as that of the educational system which has a lot of room to be tailored for the needs of the market. This would arguably enable Slovakia to close the gap to its V4 counterparts in such indicators as the unemployment rate and GDP growth.

Source: Bloomberg

Disclaimer: Past Performance ist not a reliable indicator for future developments.

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.