After several “mini-shocks” throughout the year such as inflationary fears in the USA and a temporary crisis of trust in connection with Italian government bonds, quite a bit of uncertainty has already been priced into the market. Will the current phase, which is characterised by rising share and bond prices and that comes with credit risk be only a short-lived one? Or have the markets generally entered calmer waters?

Significant global growth

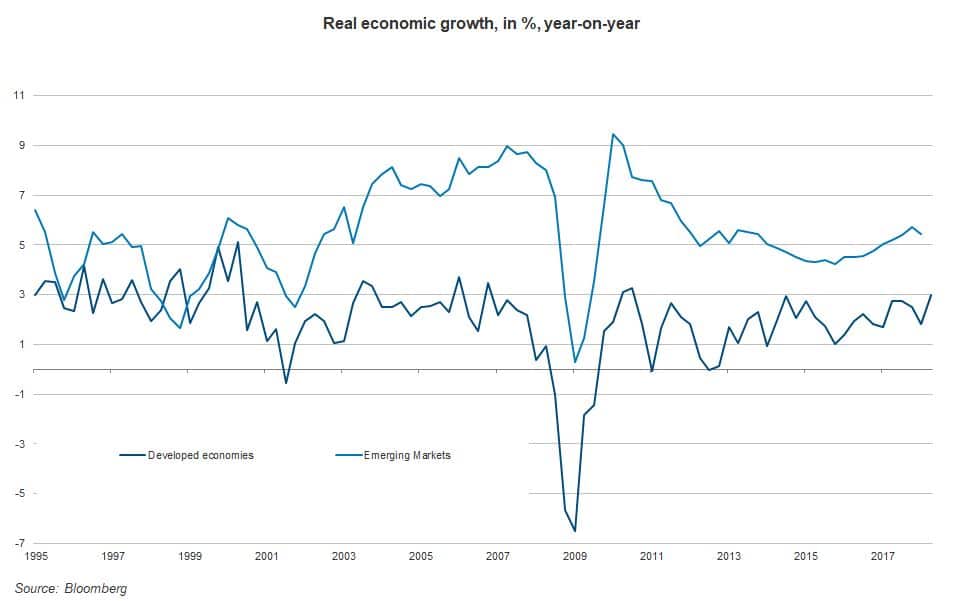

At 3.5% q/q (annualised), real global GDP continued to grow strongly in Q2. Important leading indicators such as the global purchasing managers’ index (services and manufacturing) suggest an only slightly lower value for the ongoing quarter. However, a few leading indicators have embarked on a negative trend, among them the purchasing managers’ index for the manufacturing sector, the ratio of newly created credit to nominal GDP in China, global exports of goods, and survey-based indicators that aim to reflect the assessment of the future (Ifo index, ZEW indices, Philadelphia Fed Index, Reuters Tankan Survey).

Note: Past performance is not indicative of future development.

Particularly strong growth in the USA

Global economic growth experienced an upswing from the second half 2016 to the end of 2017 across many countries. In 2018, the USA has basically been the only country to still experience this kind of growth acceleration (to 3% in the first half of 2018). By contrast, the economic growth in other regions and countries has fallen (Eurozone: from 2.8% last year to 1.4% in the first half of 2018). At the very least, the leading indicators suggest a stabilising growth differential.

Growth risk in China

China recorded a high real economic growth rate of 6.7% (y/y) in Q2. However, this indicator is traditionally unsuitable for the assessment of the economic cycle. Other indicators such as credit growth and the GDP deflator are more useful, and both have been on the decline for a while.

The Chinese economic policies have already involved loosening measures. The money market rates have fallen in the year to date by more than two percentage points (3M Shibor* currently at 2.82%). The currency has depreciated relative to a currency basket by 5% since the middle of May. The government has announced the expansion of government spending. We can see that in contrast to earlier stimulus measures, there is no positive credit impulse this time. It is unclear whether these steps are a response to an already existing or a potential future bout of weakness due to the escalation of the trade conflict with the USA. The import data for July (+27.3% y/y after 14.1% in June) suggest the latter.

*Shanghai Interbank Offered Rate www.shibor.org

Inflation risks in the USA

The currently most important economic characteristic of the financial market is the divergence in the composition of global economic growth. Even though the growth differential between the USA and other countries is not rising anymore, the USA will hit full capacity sooner than others, given the already very low unemployment rate (3.9% in July) and the fact that economic growth is about one percentage point above potential. This boom phase implies a staggered increase in inflation.

US central bank could break ranks

For the monetary policy, this relationship means as a first step an increase in key-lending rates to a level where they are neither supportive nor dampening to economic activity, i.e. to the neutral level. The Fed economists Laubach and Williams estimate that this neutral level of the key-lending rate, when adjusted for inflation, is at about 0.60%. By adding the symmetric inflation target of the Fed, we get a nominal neutral key-lending rate of 2.60%. However, this percentage constitutes the lower limit, because the real neutral key-lending rate is not constant (N.B. the expansion of the budget deficit in particular suggests an increase); and an accelerating rate of inflation would force the central bank to raise the actual key-lending rate above the neutral key-lending rate.

Generally speaking, central banks in the developed economies are facing low unemployment rates and, at the same time, low inflation. This means that the very supportive monetary policies are reduced moderately (USA), slowly (ECB), or not at all (Japan). The USA might break ranks by following a strategy of significant rate hikes if inflation were to pick up after all.

Higher tariffs have a knock-on effect on inflation

The trade conflict between the USA and the rest of the world reinforces this tendency. The goal of higher tariffs is to cut imports. In other words, the idea is to move production from abroad to the home market. If it works, it supports domestic demand. However, the US economy is already operating at near-full employment, i.e. at full capacity. The intended expansion of production capacity (more production facilities, factories, lorries, rail tracks, robots) will occur, if at all, only with a time lag. Unless imports dropped as a result of higher import tariffs (i.e. in a situation where production is not fuelled, conversely to the plan), all that would happen is that import prices would increase. Said increase would come in the form of lower profit margins and/or higher consumer prices. This means that tariffs have an inflationary effect either way, once the economy is operating at full capacity. In addition, higher tariffs in the USA reduce export growth in the rest of the world. This means that inflation and actual real economic growth are hampered. In summary: higher US tariffs are detrimental to the synchronicity between the USA and the rest.

The ride remains a bumpy one

Even though we can see stabilisation take hold of the markets, the overall situation remains bumpy. The lack of synchronicity between the USA (inflationary environment) and the rest of the world (persistently low inflation), especially with China (possibly deflationary environment) could cause trouble in the foreseeable future. The gradual escalation of the trade conflict between the USA and China supports this tendency.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.