The major semiconductor manufacturing enterprises have reported significant increases in sales and profits for Q1. While business continues to be driven by the booming demand for AI chips, solid order volumes from other sectors such as automotive and computer manufacturers contributes to the good figures. However, the outlook and forecasts at the quarterly presentations were mixed in view of the uncertainties surrounding the US tariffs. While some companies were confident, other industry giants gave more cautious outlooks.

Note: The companies mentioned in this article have been selected as examples and do not constitute investment recommendations.

TSMC reports surprisingly good figures

The quarterly figures from Taiwanese semiconductor giant TSMC were surprisingly good. The group increased its surplus in the first quarter by a better-than-expected 60 percent to 362 billion Taiwanese dollars, or just under 10 billion euros. TSMC’s revenue grew by just under 42 percent, its strongest growth since 2022. The group benefited from high demand for AI servers and smartphones, as well as pull-forward effects ahead of the US tariffs coming into effect.

TSMC acts as a contract manufacturer, producing chips for other prominent semiconductor companies such as Nvidia, so the TSMC figures can be considered a benchmark for the industry.

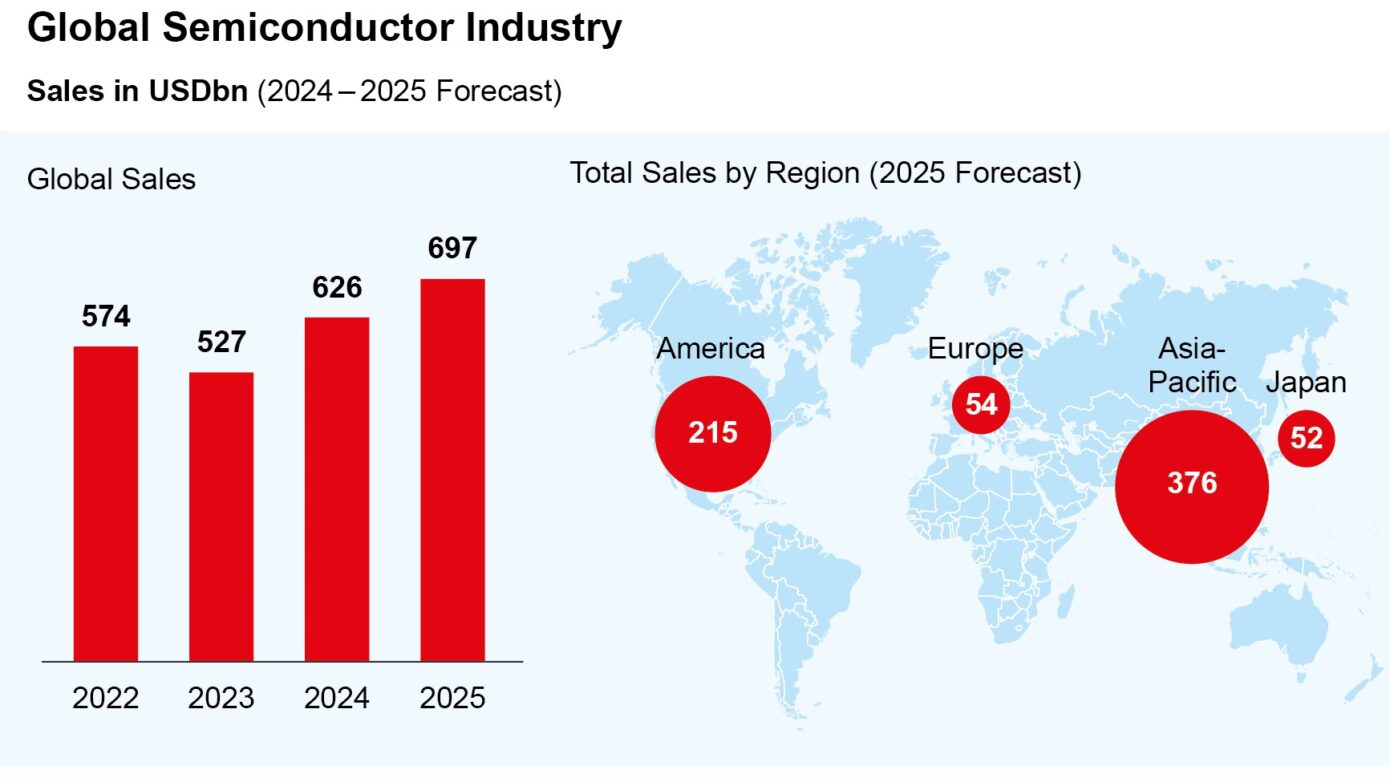

Note: Past performance and forecasts are not reliable indicators of future performance. Source: APA/WSTS/Gartner; data as of 7 May 2025 – APA Grafik on Demand, commissioned by Erste Asset Management

Samsung surprises, Intel falls further behind

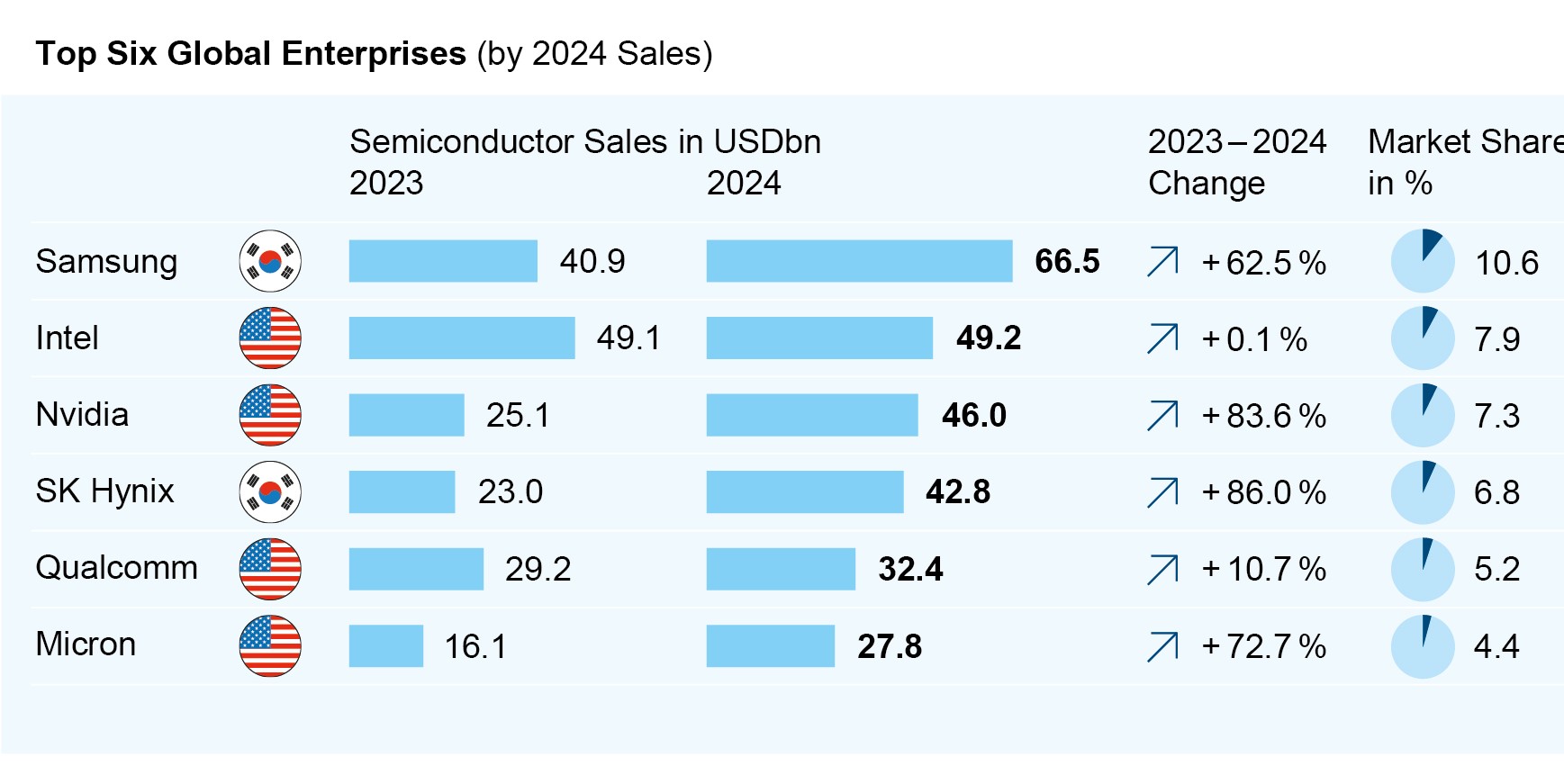

Samsung also recently posted good figures. The South Korean chip manufacturer reported a profit of roughly EUR 4.1bn for Q1, which marks an increase of 1.2 per cent compared to the previous year. Sales between January and March rose by 10 per cent. According to market research company Gartner, the group, which also manufactures electronic products such as televisions and smartphones, generated sales of around USD 66.5bn in 2024 with semiconductor products alone. This puts Samsung back in the Gartner ranking’s top spot, pushing its competitor Intel into second place.

Meanwhile, Intel remains mired in crisis for the time being, disappointing stock market expectations with its quarterly figures and sales forecasts. In the first quarter, the chipmaker’s sales stagnated at $12.67 billion. The former industry leader is losing market share in PC and server processors to its competitor AMD and continues to suffer from missing out on the AI boom. Since the company has not yet achieved the hoped-for turnaround through acquisitions of AI start-ups, Intel now wants to take on global market leader Nvidia with its own developments.

Nvidia remains the undisputed market leader

For the time being, however, Nvidia remains the undisputed market leader in high-performance chips for AI applications. The company is considered the proverbial shovel maker that has benefited most from the AI gold rush. The AI boom has recently brought the company further record sales. In February, Nvidia reported a jump in revenue of 78 percent to $39.3 billion for the past quarter.

The semiconductor business for data centers nearly doubled to $35.6 billion. Given the high demand, this business continues to boom. According to calculations by market researchers at Gartner, the market for chips for AI data centers nearly doubled from $65 billion in 2023 to $112 billion last year.

Note: Past performance and forecasts are not reliable indicators of future performance. Source: APA/WSTS/Gartner; data as of 7 May 2025 – APA Grafik on Demand, commissioned by Erste Asset Management

Donald Trump’s tariff plans prompt companies to bring production back to the USA

In light of US President Donald Trump’s tariff plans, the outlook for the major semiconductor companies is mixed. Computer chips and some electronic products have been exempted from US tariffs, but only temporarily. Not only tariffs on chips, but also tariffs on many electronic products such as smartphones would indirectly hit the semiconductor industry hard.

Despite the good quarterly figures, Samsung no longer dared to provide an outlook for the current quarter. The company referred to “growing macroeconomic uncertainties due to recent global trade tensions and slowing global economic growth”, making it “difficult to predict future developments”.

The tariffs could also affect US companies, as many US semiconductor companies manufacture in other countries. Some US companies are therefore considering relocating part of their production to the US. Nvidia, for example, has announced plans to invest several hundred billion dollars in the US over the next four years. The world’s largest AI chip manufacturer wants to build servers for artificial intelligence worth up to $500 billion there with the help of partners such as contract manufacturer TSMC. Relocating manufacturing to the US is Trump’s stated goal. “Taiwan took our chip business away from us,” the president said, “we want it back in the US.”

Export restrictions to China hit the industry even harder

Not only the tariffs, but also the US export restrictions to China for certain chips are currently affecting the semiconductor industry. Nvidia, for example, expects high costs due to the restrictions. For Q1 alone, these would amount to USD 5.5bn. The US government has imposed export controls on the H20 chip, a chip primarily used for artificial intelligence, to China for an indefinite period. The US authorities want to prevent the most state-of-the-art chips from being sold to the People’s Republic.

Under Trump’s predecessor Joe Biden, the US already had barriers to the sale of the latest high-performance chips to China in place. As a result, Nvidia was only able to supply Chinese companies with a scaled-down and slower version called H20. However, even these chip systems are now subject to export restrictions.

Conclusion

The semiconductor industry has remained robust despite global uncertainties and trade conflicts. Companies such as TSMC and Nvidia are benefiting from continued growth in demand for AI chips, while others such as Intel are struggling with challenges. However, US tariffs and export restrictions on China are having an additional impact on semiconductor companies. The environment could become more difficult, as evidenced by the mixed outlook and forecasts reported by companies in their latest financial results.

For investors who are interested in the semiconductor industry or technology in general and would like to invest in this sector, the ERSTE STOCK TECHNO equity fund could be worth a look. The fund invests in promising future technologies – its largest holdings include industry giants in the chip sector such as Nvidia and TSMC.

Risk notes ERSTE STOCK TECHNO

Please note that investing in securities also involves risks besides the opportunities described.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE STOCK TECHNO as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK TECHNO, consideration should be given to any characteristics or objectives of the ERSTE STOCK TECHNO as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.