Donald Trump’s ‘One Big Beautiful Bill Act’ is intended to bring comprehensive tax cuts in the United States. Critics point out that the bill would significantly increase the United States’ already high budget deficit. Particular attention has recently been focused on a series of planned measures against foreign investors, summarised in Section 899 of the bill. What does this passage say and what are the potential consequences for investors and the US stock markets?

What is Section 899?

Section 899 is a tax policy measure that is part of the ‘One Big Beautiful Bill Act,’ which was passed by the US House of Representatives on 22 May 2025. The bill still needs to be passed by the Senate and signed by the president before it becomes law. It is aimed at so-called ‘discriminatory foreign countries’ which, according to the US government, disadvantage US companies through measures such as:

- Digital services taxes

- OECD’s Under-Taxed Profits Rule (international minimum taxation)

- Diverted Profits Tax (taxes on diverted profits)

In addition, the draft law provides for an additional option for ‘any other tax determined by the Secretary,’ which entails a certain degree of arbitrariness or unpredictability in terms of applicability.

Main contents in the current version

The measure takes effect automatically as soon as a country introduces one of the aforementioned types of tax or is classified as discriminatory by the US Treasury in a quarterly report. This affects not only individuals, but also companies, investment funds and government institutions such as pension funds and sovereign wealth funds.

The regulation stipulates that income from US sources – including dividends, interest, licence fees and, in certain cases, capital gains – will be subject to an additional withholding tax of five percentage points per annum from the ‘applicable date’ up to a maximum of twenty percentage points. This increase is independent of existing double taxation agreements and is considered controversial under international law. Special wording allows the maximum tax rate to be increased to up to 50% on certain capital gains in some cases. Section 899 also requires affected investors to provide extended tax and regulatory disclosures.

Note: Past performance is not a reliable indicator of future performance.

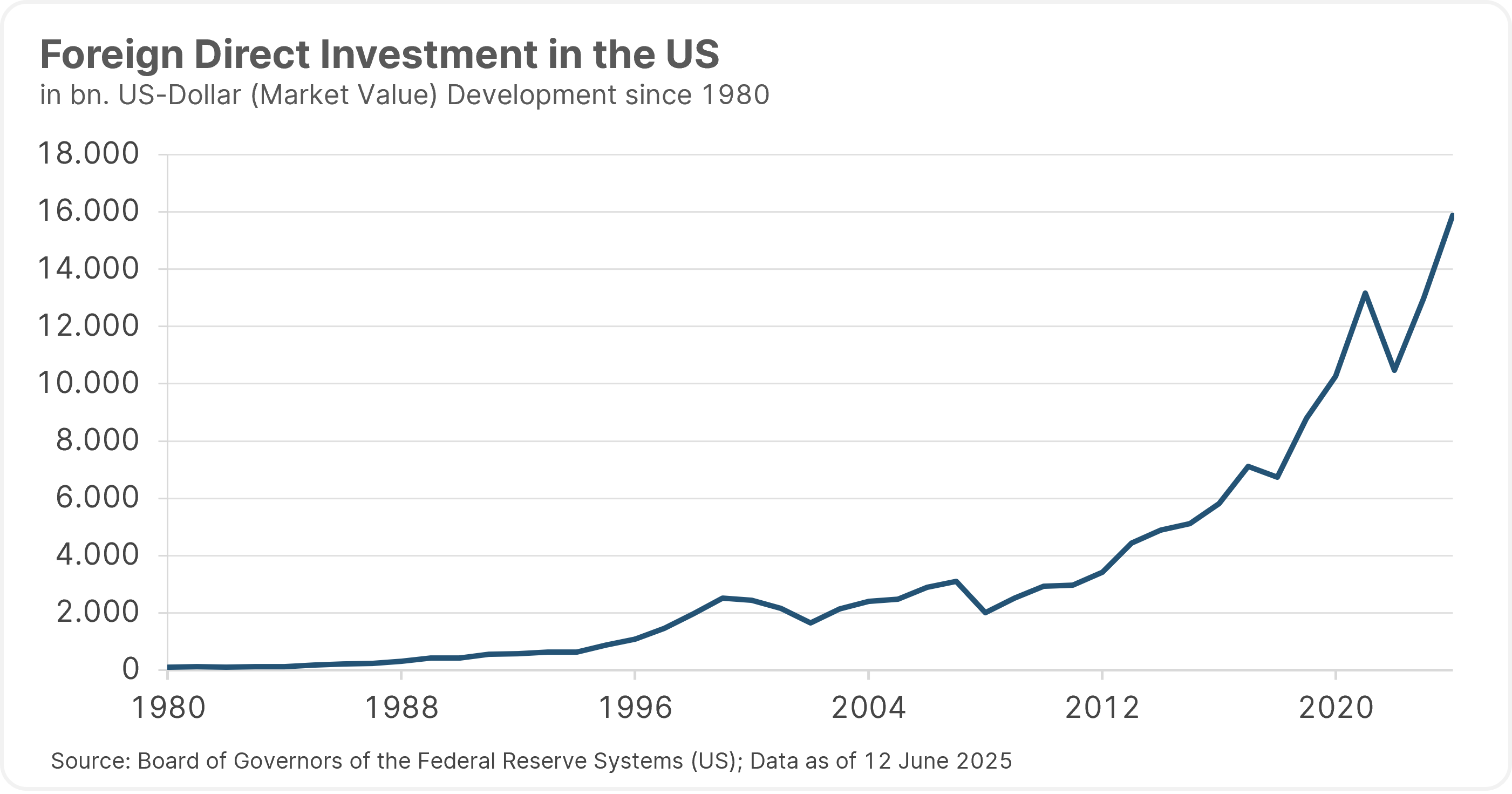

Foreign direct investment in the United States has risen significantly in recent years. International investors hold a considerable share of US assets.

What is the current legal situation?

The House of Representatives has passed the ‘One Big Beautiful Bill.’ Now it must pass the Senate. The Senate may introduce amendments that could delete or weaken Section 899. This is particularly likely if moderate Republicans or Democrats express concerns (e.g., about WTO violations or impacts on capital markets).

If the Senate and House of Representatives pass different versions, a compromise will be negotiated – here too, Section 899 may be deleted or modified. The President must then sign the bill into law for it to become effective. However, if the process reaches this point, this is likely to be a mere formality.

Reconciliation procedure to ensure compliance with the law

In an initial draft, the ‘unfair taxes’ were not explicitly mentioned in the text of the bill. However, as the provisions in the ‘One Big Beautiful Bill’ are generally very controversial measures, it will probably be necessary to pass them through a reconciliation procedure in the Senate, as otherwise a filibuster could cause the process to fail. A filibuster is a parliamentary tactic in the US Senate whereby senators can block a vote on a bill by engaging in endless debate or delaying proceedings.

The reconciliation procedure allows laws to be passed by a simple majority (51 votes) instead of the qualified majority (60 votes) that would otherwise be required. However, the Byrd Rule must be fulfilled for this to happen. This rule states that only provisions with a direct impact on federal budget revenue and/or expenditure may be included in such a law.

That is why the tax increases on foreign investors have been firmly enshrined in law – to prevent them from being classified as ‘purely politically motivated’ and subsequently repealed. Nevertheless, there are still other potential hurdles for the passage. Lawsuits could follow on the grounds of violations of WTO rules or double taxation agreements. OECD negotiations could also create political pressure to reverse the measure.

What impact could the tax increases have?

Section 899 could lead to a significant shift in international capital flows, as foreign investors would be deterred by the increased withholding taxes. This would reduce the attractiveness of the US as an investment location, undermine its ‘safe haven status’ and could impair the growth potential of the US economy in the long term. At the same time, there is a risk of retaliatory measures by affected countries. International trade and economic cooperation would suffer as a result. The measure thus stands at the crossroads between fiscal sovereignty and global economic integration.

A decline in foreign demand for US securities – especially government bonds – could lead to an increase in long-term interest rates. If large institutional investors from Europe or Asia reduce their US holdings, the US Treasury would have to offer higher yields to find new buyers. This would increase financing costs for the government, businesses and households and could limit the monetary policy flexibility of the Federal Reserve.

Weakening of stock and bond markets in the US looms

US equities could come under valuation pressure as international investors reduce or hedge their exposure. Sectors with high foreign ownership, such as technology, pharmaceuticals and consumer goods, would be particularly affected. The measure could also lead to increased volatility, as uncertainty about the tax treatment of foreign investors weighs on market sentiment. In the long term, there is a risk of structural weakening of the US stock markets as a global capital market.

The US bond markets – especially the market for Treasuries – could lose depth as a result of Section 899 if foreign central banks, pension funds or sovereign wealth funds reduce their holdings. This would not only impair liquidity, but also undermine the role of the US dollar as a reserve currency. At the same time, spreads between US and non-US bonds could widen, leading to a fragmentation of global bond markets.

Trump’s TACO strategy

Donald Trump’s political line in 2025 will continue to be characterised by contradictions, tactical U-turns and rhetoric that is difficult to predict. This is particularly evident in the so-called ‘TACO’ strategy – a term circulating in the financial world that stands for ‘Trump Always Chickens Out’.

He describes the recurring pattern in which Trump first announces drastic measures such as high tariffs, only to water them down or postpone them shortly afterwards when the markets react negatively. In May 2025, for example, he announced a 50% tariff on EU imports, but postponed it two days later after a phone call from EU Commission President von der Leyen. In public, Trump defends these U-turns as ‘negotiating tactics,’ but for investors and political partners, this makes him completely unpredictable.

The result is increasing market volatility and growing mistrust in the reliability of American trade policy, the consistency of announced measures and, last but not least, the credibility of presidential announcements.

Conclusion 🔎

Section 899 of the ‘One Big Beautiful Bill’ in its current form represents a far-reaching tax policy innovation that specifically imposes tax surcharges on investors from countries with special digital taxes or international minimum taxation rules. This measure was deliberately designed so that it can be passed without cross-party support in the US Senate. It poses significant risks to the attractiveness of the American financial market: capital could be withdrawn, interest rates could be influenced and the economic stability of the US could be undermined.

Section 899 exemplifies a new era of economic policy-making in which tax laws are used as a geopolitical lever. Given President Trump’s actions so far in his second term, it seems likely that this provision is primarily intended as a strategic tool to influence international tax and trade negotiations – without necessarily being fully implemented. However, if the law is passed in its current form, confidence in American assets is likely to suffer significantly.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.