On January 1st 2019, Romania will assume the Presidency of the Council of the European Union at a time when the country is slowly, but surely, turning from a growth champion to a reckless child within the EU.

On the political front, ongoing blows to judicial independence from the Social-Democrat government have reached fever pitch this summer, after continuous digs started in early 2017. The proposed changes were met with protests from the civil society, and drew criticism from EU institutions, including the Venice Commission (advisory body of the Council of Europe on constitutional law). As the fight against corruption is visibly weakening, it is not excluded that Romania will soon join Poland and Hungary on the list of EU countries facing Article 7 procedures. The political agenda will run hot next year, given that upcoming elections for European Parliament will be held in May 2019 and Presidential elections will be held in November-December 2019.

Slowing economy

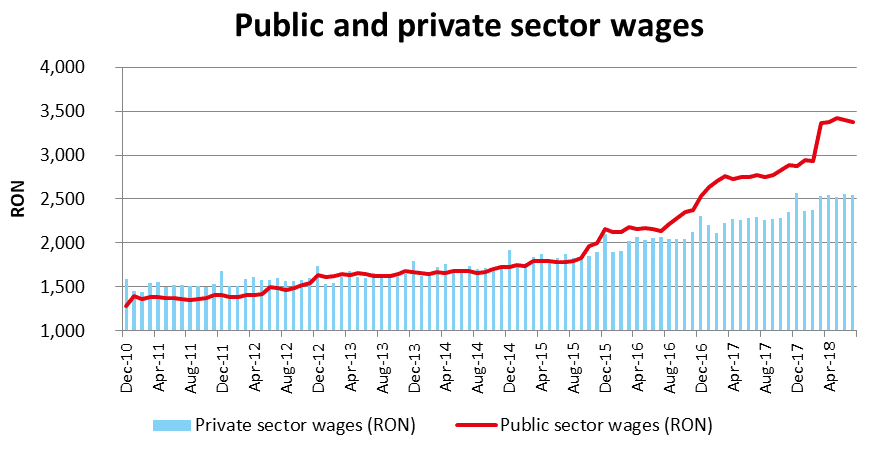

Meanwhile, political noise clouds the recent unfavorable developments in the real economy. GDP grew by 6.9% in 2017 boosted by significant fiscal easing measures, but IMF projects that growth will decelerate to 4.0% in 2018 and 3.4% in 2019. After being uplifted by consecutive increases in minimum wage, public sector wages and public pensions, consumption slowed down markedly in H1’2018. In addition, financial conditions have tightened notably starting with September 2017, as the National Bank of Romania (NBR) adopted a more restrictive monetary policy to fight the expected increase in inflation. Despite three rate hikes in 2018 from 1.75% to 2.50% and likely interventions from the NBR in the forex market to slow RON depreciation, inflation remains stubbornly high above 5.0%. It is expected to decline below 4.0% in the coming months due to statistical base effects, but remains outside the Central Bank target interval.

Developing a twin deficits problem

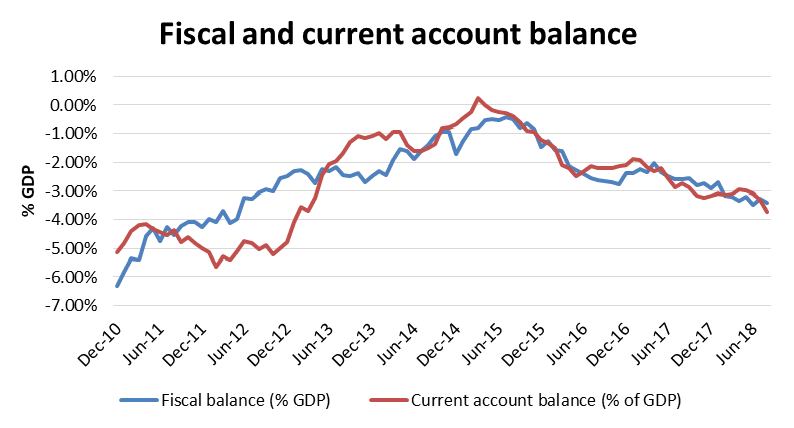

In light of these developments, the government faces a difficult dilemma: it either reduces the ballooning social spending bill to cap the budget deficit at 3.0% in 2019 or it risks facing even higher rates. Given the government’s populist agenda and 2019-2020 being election years, the latter option is the more probable one. Romania has been steadily developing a twin-deficit problem, which stands out among neighbor countries. Romania’s macroeconomic vulnerabilities have been on the rise since 2016, as prudent fiscal policies were quickly reversed. Fiscal deficit was barely kept at 3.0% in 2017 despite the stellar growth performance and it is projected to surpass 3.5% in 2019. This gave rise to mounting fears that the government will decide to dismantle pillar two of the mandatory private pension system. Ceasing all payments into mandatory pensions would bring budget revenues of about 0.8% of GDP and could temporarily ease the fiscal burden. Changes to the mandatory private pension system could be proposed in 2019.

Source: Erste Asset Management GmbH

Forecasts are not a reliable indicator for future developments.

Rising wage growth and slow productivity advance have been eroding the country’s cost competitiveness, as the current account deficit widened to 3.7% of GDP in August 2018. Together with an overvalued RON and slowing Eurozone growth, Romania’s exports will likely suffer. Moreover, structural and investment fund inflows from the EU have yet to pick-up. A strong recovery is unlikely in the coming months as the government is cutting back public investments. As such, FDI and EU fund inflows are insufficient to cover the current account deficit, which leaves RON vulnerable to external shocks. The Central Bank has already spent significant FX reserves to prevent a sharper nominal depreciation.

Source: Erste Asset Management GmbH

Forecasts are not a reliable indicator for future developments.

What’s next?

Current political and fiscal developments leave Romania vulnerable to a potential rating downgrade, which would make it lose the investment grade status. Even without a deterioration in its credit ratings, Romanian bonds suffered a sharp correction since September 2017. As the effect of the Central Bank hikes and rising inflation was more significant, local currency bonds took the first blow. Meanwhile, hard currency bonds in EUR remain wider than their fair value, but performed relatively better than the local currency ones due to ECB’s expansionary monetary policy.

Assuming the Presidency of the Council of the European Union at the same time as Brexit could be Romania’s opportunity to regain its shine as a true growth champion and supporter of European values such as democracy, freedom and rule of law. It remains to be seen the extent to which it will capitalize on this opportunity.

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.