At the moment, the market participants are finding themselves faced with the challenge of having to differentiate between the underlying trend (signal) and random fluctuations (noise). In recent weeks, some economic indicators have been below expectations, some inflation indicators have been above expectations, and central banks have sent out signals that might suggest the abandonment of their expansive stance. A stagflationary environment (no growth, high inflation) would indeed be negative for numerous asset classes. But the underlying trend suggests a different, more positive environment.

In theory, the development over time of the indicators is following an economic shock, this time triggered by the pandemic. A sharp decline is followed by an equally sharp increase during recovery; the initially mercurial recovery caused by the re-opening measures is then followed by declining, but still above-average growth for several quarters. In the right environment of supportive economic policies and the absence of new virus variants, this trend can continue until full employment has been achieved.

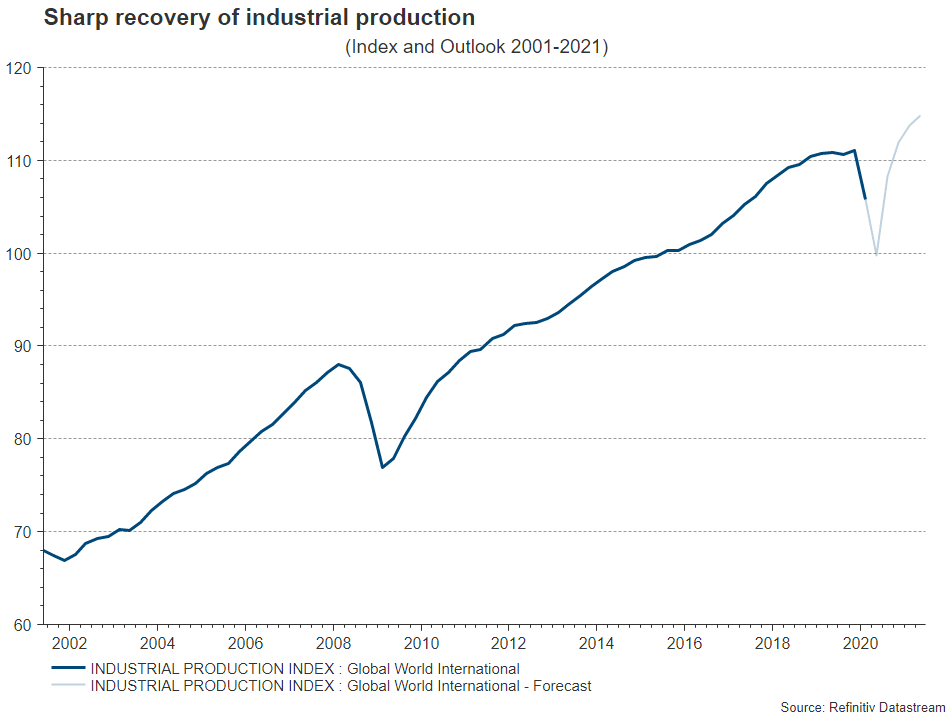

Chart: sharp recovery of industrial production

Note: Past performance is no reliable indicator for future performance.

While reality sometimes deviates from theory, the indicators by and large support this narrative.

Robust profit development of the companies

Resilience: in numerous countries, the impact of the lockdown measures on GDP was less significant than expected in Q4 2020 and Q1 2021. The earnings development of Q1 2021 in the corporate sector came also as a positive surprise in many cases.

Optimism: the global and survey-based leading indicators are largely positive and thus suggest accelerating growth.

Heterogeneity: growth does not accelerate equally across all countries, nor by an equal degree. The differences are due to the pandemic development (high case numbers in India, third wave in Europe in spring), economic policies (fiscal packages in the USA), the economic structures (i.e. the ratio of contact-intensive and cyclical sectors), and the different capacities in healthcare management (i.e. lower in the emerging markets) and in economic policies (i.e. necessary interest rate hikes and less fiscal wiggle room in some emerging markets).

Distortions: some US economic indicators were weak in April. This was the result of the very strong March indicators due to the fiscal stimulus measures (i.e. normalisation in April) and of the bottlenecks in production (i.e. increase in order backlog).

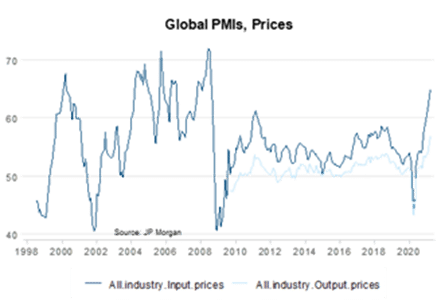

Bottlenecks: the swift recovery has led to a situation where in some sectors supply cannot keep up with demand. This has resulted in increased prices for industrial metals, wood, energy, maritime transport, in lower production in supplier segments (cars), labour shortages in partial segments, and longer delivery times. Indeed, producer input and output prices have increased drastically on a global scale according to survey-based indicators. In accordance, producer prices have increased above average as well. The often-quoted rise in inflation in the USA in April (+0.9% m/m, core rate) was mainly due to the re-opening measures (hotels) and supply shortages (automotive sector).

Chart: higher input and output prices in the corporate sector (diffusion index)

Note: Past performance is no reliable indicator for future performance.

Transitory rise in inflation: in the most-likely-case scenario, these price developments are of a temporary nature. The necessary requirements for a structural rise in inflation are sustainably high economic growth rates after reaching full employment (N.B. expansive monetary and fiscal policies create a positive output gap) and rising inflation expectations from consumers and companies setting off a wage-price spiral. At the moment, even the USA is far from reaching full employment (N.B. employment 8.2 million below pre-covid levels). While the long-term inflation expectations have increased, they really represent a normalisation.

Weakening in China: the signs of an underlying weakening are becoming more plentiful. In particular, credit growth is falling. The negative credit impulse will weigh on domestic economic activity and also affect global export activity. This is counterproductive for a global recovery.

Soft versus hard indicators: the survey-based (soft) indicators have already increased to very high levels, suggesting a drastic improvement or hard indicators such as GDP and employment. While falling soft indicators in the coming months would not come as a surprise, they would not indicate an economic decline, but the normalisation of the initially high growth rates in Q2 and Q3.

Conflict of goals: the central banks in the developed economies are faced with a conflict of goals. They want to keep their foot on the gas for as long as possible (i.e. low key-lending rates, bond purchase programmes) in order to support the economy. The goals of the US Fed are maximum employment and an inflation rate of slightly above 2% to ensure the long-term inflation expectations remain stable at 2% (and do not fall). However, a sustainably expansive stance increases the risk of a bubble on the financial markets. The solution: slow and cautious tapering of the expansive policies.

Abandonment of expansive stance: more and more central banks (Bank of England, Bank of Canada) are indeed signalling the tapering of their bond purchase programmes via forward guidance. Even the Fed is talking about it and may make an announcement in summer. The big central banks remain cautious on key-lending rates in their forward guidances. The general stance seems to be: let’s wait until the goals (2% inflation, full employment) have been reached. This means the focus is on the past, not on projections. The initial interest rate hike in the USA could happen at the end of 2022. In contrast, some smaller central banks (Hungary, Czech Republic, Norway) have indicated interest rate hikes for this year already. Brazil, Russia, and Turkey are in a different ballpark altogether. Elevated inflation risks have already led them to step up key-lending rates significantly.Fundamentals: the vaccine programmes and the resulting re-opening measures, the high private savings ratio, catch-up effects, the fiscal stimuli (especially in the USA), and the expansive monetary policies will lead to high GDP growth rates in the coming quarters. The catch is that a lot of the good development has been priced into the low risk premiums of the various asset classes and that the government bonds will probably (continue to) rise. Generally speaking, as long as yields rise less significantly than profit growth rates, equities will remain attractive. However, high asset valuations lead to elevated volatility.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.