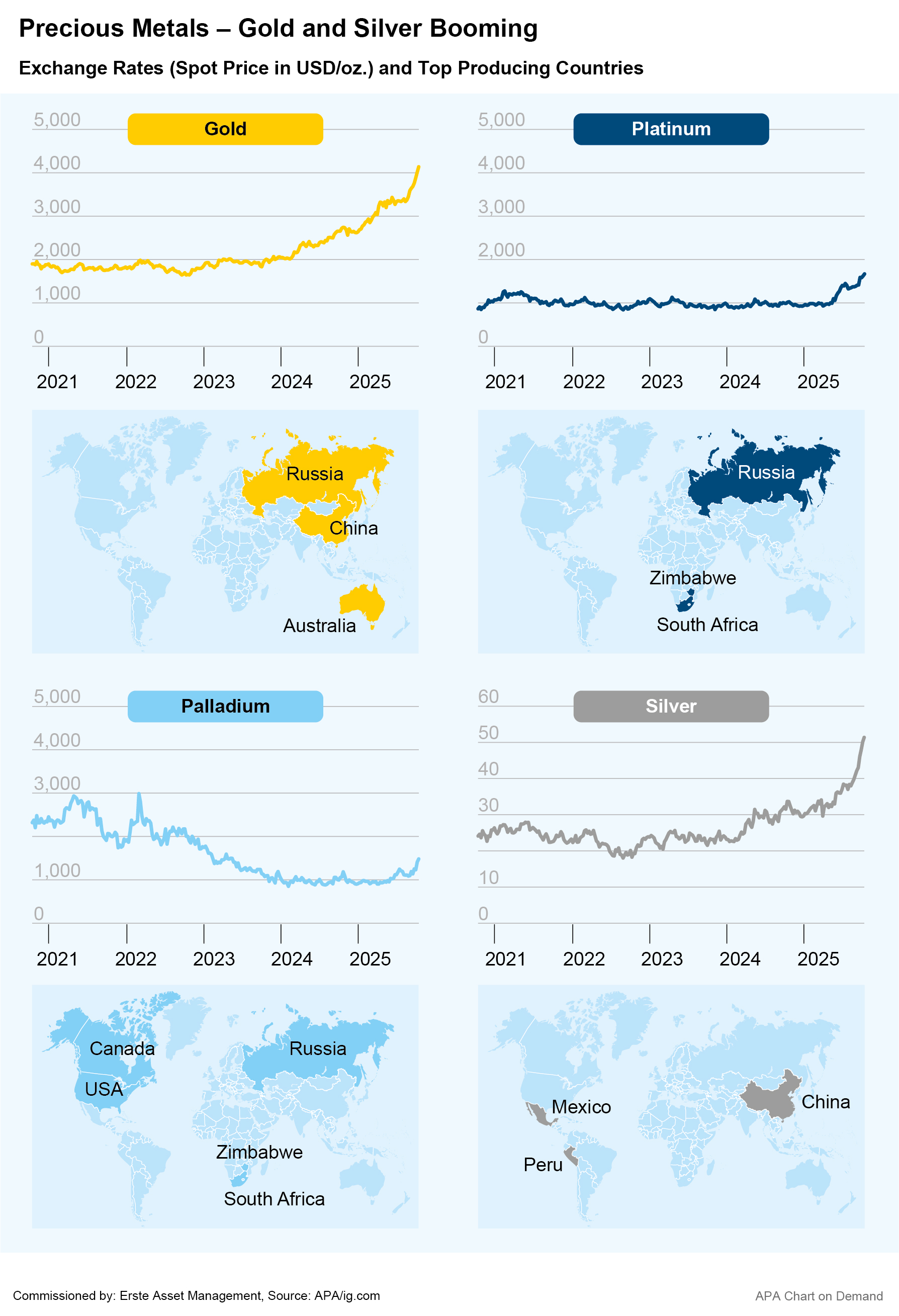

The recent rally in precious metal prices has not only pushed the price of gold to new record highs. Silver recently reached a new all-time high of over USD 53 per ounce, an increase of around 80 per cent since the start of the year, outperforming even gold’s impressive run.

The tense geopolitical situation, uncertainties surrounding the US trade conflicts and the US government shutdown are likely to continue to drive investors seeking security towards precious metals such as gold and silver, which are considered safe investments. Precious metals are also benefiting from expectations of falling interest rates, which make alternative forms of investment such as government bonds less attractive.

Note: Please note that an investment in securities entails risks in addition to the opportunities described. Past performance is not a reliable indicator of future performance.

More than half the demand for silver this year from industry

Unlike gold, however, silver is not only used for financial investments and jewellery, but is also urgently needed in the production of electronic components. According to data from the Silver Institute, industrial demand for silver rose by 4 per cent to 681m ounces in 2024, reaching a new record high for the fourth consecutive year. More than half of the global demand for silver comes from industry alone.

Among other things, silver is used as a raw material in car manufacture, the electronics industry, the production of wind turbines and photovoltaics. In particular, the shift towards renewable energies and rising electricity requirements could drive the demand for silver even further. According to the Silver Institute, demand for photovoltaic systems alone was just under 200m ounces in 2024. The AI boom is driving up the price of silver doubly, as both the greater demand for electronic components and the rapid expansion of power-hungry AI data centres are driving up demand for silver.

Silver supply continues to decline

At the same time, silver supply continues to decline. According to the Silver Institute, total demand for silver in 2024 was 1.16bn ounces versus a supply of only 1.02bn. Silver production from mines has declined significantly in recent years. The Silver Institute forecasts an expansion in silver production and a 1.4 per cent increase in supply this year. However, demand for silver is still expected to exceed supply for the fifth consecutive year in 2025.

In addition to gold and silver, prices for other precious metals have also been soaring this year. The price for palladium has risen by over 60 per cent since January, while platinum increased by nearly 80 per cent. As with silver, platinum is also experiencing a supply shortage. In industry, platinum is mainly used by the automotive sector for catalytic converters. And while demand in this sector could decline somewhat in view of falling car sales and the shift to electric mobility, according to experts, demand for jewellery could rise if the jewellery industry increasingly uses platinum as a cheaper alternative due to the gold price rally.

Industrial metals in high demand due to AI boom and energy transition

The AI boom could also further bolster demand for industrial metals. The build-out of power grids required for power-hungry AI data centres is also increasing demand for copper. Like silver, copper is also likely to benefit from the energy transition. Electric cars require more copper than combustion engines. In addition, Copper is also considered indispensable in photovoltaics. This is offset by a recent further decline in copper production. The US government now considers copper to be a critical mineral, and in the European Union it is regarded as a strategic raw material.

Finally, there could also be a shortage of rare earths, which are urgently needed by the high-tech industry. The 17 elements in this group are found in numerous products, from smartphones, electric motors and semiconductors to turbines. According to a study by consulting firm McKinsey, around one million people in Germany alone work in industries that are heavily dependent on rare earths as raw materials.

China tightens export controls on Rare Earths

China, the world’s largest supplier of rare earths, recently announced it will tighten export controls on these coveted raw materials. Exports are subject to a complicated approval mechanism. The Chinese government has also issued new regulations for mining and processing. In addition, technologies and expertise for the extraction and processing of rare earths will only be passed on upon approval in future.

China is currently using its role as the world’s leading producer of rare earths as leverage in negotiations with the US. Rare earths are found in high concentrations in China. But while they are not as rare as their name suggests, extracting these mineral resources is difficult and harmful to the environment because they are bound in other raw materials, and China has greatly refined this process.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.