Only a few more weeks, and 2019 will be history. This also puts a button on a decade that was characterised by numerous political and economic events on the financial markets. These events were vastly different from each other, straining the sentiment of investors. Sometimes we saw moments of glory that would fuel market euphoria; sometimes, warning signs would emerge, advising caution.

A turbulent decade is coming to an end

We regard the recovery on the equity markets in the wake of the financial crisis in 2008 and the positive development of many companies as highlights. The crucial question about the future of the euro is closely linked to the financial problems of entire states such as Greece, while still unclear situations such as the imminent Brexit and the trade conflict between the USA and China as well as Europe have been the Sword of Damocles above the markets.

Bright results at the stock exchange in 2019

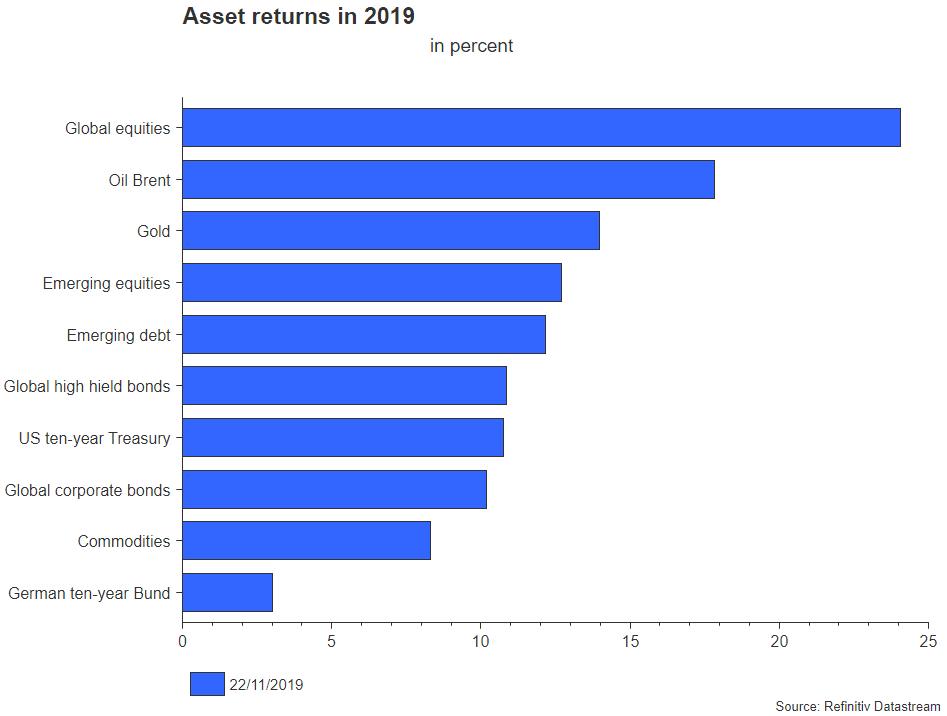

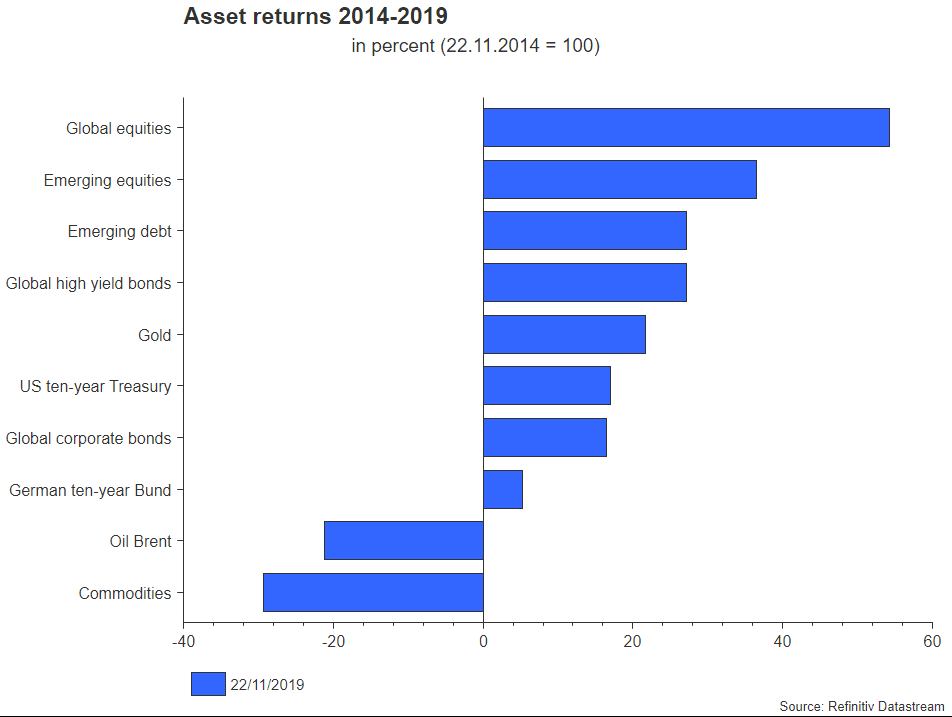

“Black December” last year showed how quickly nervousness could catch the markets off-guard: the willingness to take risks by investors swiftly switched to a defensive mode, leaving the stock exchanges with a negative annual result. Fortunately, 2019 was a different kettle of fish. Generally speaking, in 2019 we did not only experience significant rises on the stock exchanges, but indeed almost all asset classes recorded gains.

Unexpected bond upswing on the back of yields at record lows

After the slump prior to Christmas 2018, the original scenario at the outset of the year 2019 was completely different: many equity markets had suddenly become “cheap” despite the fact that the economic news had not really deteriorated. Also, hardly anyone had expected any further increases in credit-safe bonds. The international central banks loosened their monetary and interest rate policy in order to prevent the economy from weakening (see below). While interest rates were cut step by step in the USA, the period of interest rates close to or below zero was extended in Europe. Yields fell further below their already low levels until September, which led to an unexpected and sharp rise in bond prices.

No economic crisis in the foreseeable future

People have been talking about a possible weakening of the global economy for months now. While some economic indicators suggest slightly less vigorous economic activity at this point, we are nowhere near a recession. It is true that the forecasts for 2020 have been revised downwards almost across the board, but there is no need to worry (please also see the forecast by the International Monetary Fund and the OECD. Privat consumption and the low unemployment are supporting the global economy. Inflation remains low.

Funds benefited from positive capital markets

All in all, 2019 has been a decidedly good year for the financial markets. As of mid-November, all important asset classes have recorded significant gains, and the equity markets have even posted double-digit returns, some of them above 20%. The funds of Erste Asset Management have also benefited from the upswing, resulting in a positive picture from a 5Y perspective:

Note: Past performance is not indicative of future development.

Note: Past performance is not indicative of future development.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.