Poland will be holding parliamentary elections on 15 October. While the national-conservative PiS won an absolute majority in the lower house of parliament in the last elections in 2019, this time the outcome is more open. Although the PiS (“Prawo i Sprawiedliwość”, english “law and justice”) is holding a clear lead in the polls with 36-38% of the vote and rising voter support, it falls short of an absolute majority.

This upward trend has come mainly at the expense of the far-right Confederation (10-12%), which is regarded as a potential government partner for the PiS after the elections. The moderate opposition bloc (Civic Platform PO (30%), Third Way (8-10%), The Left (5-8%)) has achieved largely stable results in the polls in recent weeks.

Election system favours bigger parties

The Polish electoral system for the lower house of parliament distributes seats according to a proportional list system that favours larger parties. A coalition must pass an 8% threshold to qualify, while the 5% threshold is relevant for a single party. The Left is running at these elections as one party and seems relatively certain to pass the 5% hurdle. By contrast, the Third Way is a coalition, and this alliance therefore has a harder time entering parliament.

The PiS is trying to score points in the election campaign with the distribution of generous social benefits and an anti-EU stance. Accordingly, it has made national defence and migration its main campaign issues. A success for the opposition PO at the elections, on the other hand, depends to a large degree on how strongly it can mobilise women voters in particular. The smaller parties/blocs suffer from the strong polarisation and cannot make any gains in the polls. All in all, the polls indicate a close result. Several government constellations are therefore within the realm of possibility for the new legislative period.

Will the expansive monetary policy be continued?

In our base-case scenario, the PiS leads a majority or minority government with the help of the Confederation. In such a case, we would expect the expansive monetary and fiscal policy to continue. However, it remains questionable how much of the election promises will be implemented. Fiscal consolidation is likely to slow down, with the budget deficit falling from 5.3% of GDP this year to only 4.5% of GDP in 2024. Moreover, the blocked EU funds from the Reconstruction and Resilience Facility and the EU budget 2021-27 are unlikely to arrive as early as next year.

Note: Past performance is not a reliable indicator for future performance.

EU money if the opposition wins

In the event of an opposition victory, we expect a positive reaction from the markets. The main reason for this is the expected release of EUR 77bn in cohesion funds from the EU budget 2021-27 and EUR 36bn in funds from the Reconstruction and Resilience Facility. Given the equally excessive election promises of both the PO and potential coalition partners, there is a high degree of uncertainty about the prospects for faster fiscal consolidation in 2024.

The composition of the central bank’s Monetary Policy Committee will only change in the medium term. The members appointed mainly by the old government would not be taking decisions nearly as “pro-government” as under a PiS government.

Conclusion

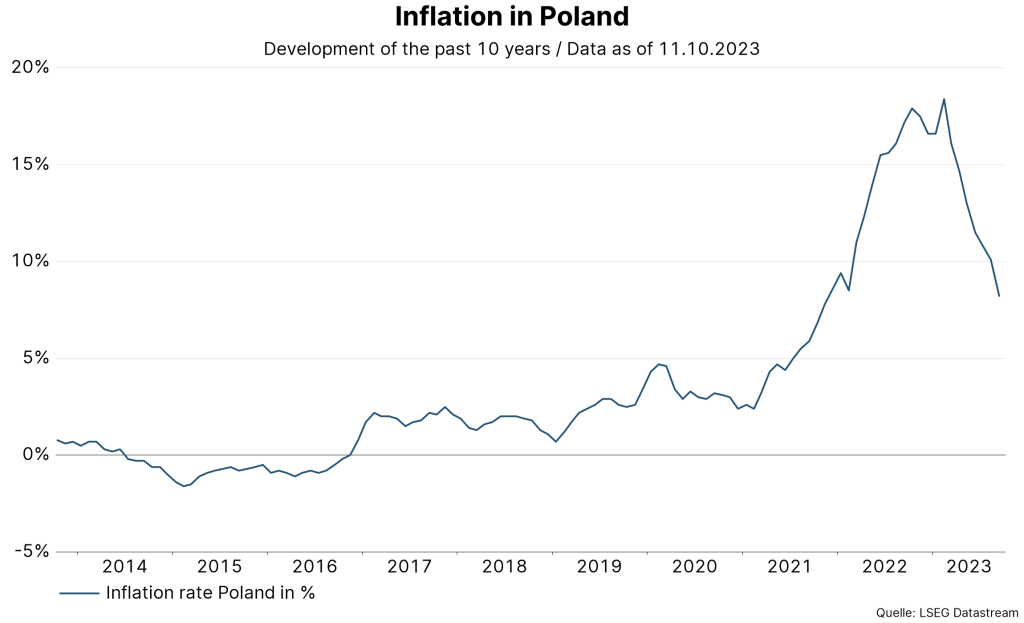

The parliamentary elections in Poland are taking place against the backdrop of a weakening economy. Interest rate hikes to combat inflation rates not seen since the 1990s and the global economic slowdown have had a negative impact on aggregate demand: Poland has not experienced a more significant drop in consumption since 1996.

Inflation rates, supported by electricity and fuel price cuts, have returned to single digits. This development will enable the Polish central bank to implement further interest rate cuts. At the same time, the rather expansive fiscal policy should put pressure on local government bond yields via high issue activity.

We envisage a substantial weakening of the zloty only if the combination of monetary and fiscal policy becomes too expansive or an increase in global risk aversion leads to a flight to safe havens. On the other hand, supported by a balanced current account, the zloty would benefit from an economic recovery or, due to its proximity, from an end to the war in Ukraine.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.