The first half of 2019 is behind us. Many asset classes recorded significant gains. At the same time, the falling tendency of numerous economic indicators has suggested a slowdown in GDP growth. How do these two go together?

Stagnation in the manufacturing sector

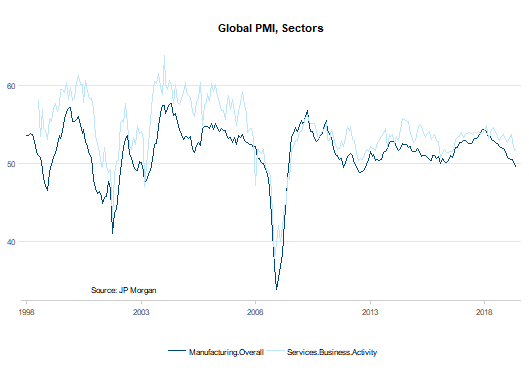

From the second half 2018 to Q1 2019, the global economy was growing above potential. This is the crucial growth rate of 2.5 to 3.0 percent that can be expected in the long term (i.e. for more than one economic cycle). The goods sector was on the weaker side. Both industrial production growth and capex growth fell to lower levels, and goods exports even decreased. The leading indicators for these sectors, e.g. the global purchasing managers’ indices for the manufacturing sector (see the graph “Global purchasing managers’ index, sectors”, time series “Manufacturing overall”) suggest a further weakening towards stagnation for production and investment and a further shrinking for goods exports.

Erosion in the service sector

By contrast, the service sector remained comparably strong until Q1. The global purchasing managers’ index for the service sector increased slightly in June, but the downward trend since last year remains clear (see the graph “Global purchasing managers’ index, sectors”, time series “Service business activity”).

Global purchasing managers’ index, sectors

Source: JP Morgan. Note: Past performance is not indicative of future development.

Growth below potential

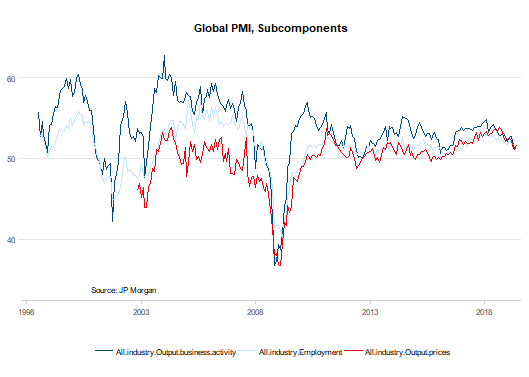

In a combined analysis of the sub-component of output for the manufacturing and the service sector, the recent value of 51.2 suggests a real global GDP growth rate of 2.0 percent to 2.5 percent (annualised; please see the graph “Global purchasing managers’ index, sub-components”, time series “All-industry Output/business activity”).

Weaker employment growth

The labour market remains strong across many parts of the world thanks to the economic boom of recent years. In other words, unemployment is low and wage growth is rising slowly but surely. This supports income and consumption growth, although here, too, we can see weakening tendencies (please see the graph “Global purchasing managers’ index, sub-components”, time series “All-industry Employment”). If economic growth were to really fall below potential, this would come with a decline in employment growth.

Downward pressure on inflation

The inflation rates in the developed economies are low. At the same time, both market- and survey-based inflation indicators are falling (please see the graph “Global purchasing managers’ index, sub-components”, time series “All-industry Output Prices”). The risk profile for the inflation outlook has shifted significantly from rising to falling inflation, together with economic growth below potential.

Global purchasing managers’ index, sub-sectors

Source: JP Morgan. Note: Past performance is not indicative of future development.

Declining risks

At the same time, the downside risks have fallen on the back of two developments:

At the end of June, China and the USA announced at the G-20 summit in Japan that they were going to resume negotiations. This holds at bay an immediate escalation of the trade and technology conflict. Until further notice, the USA will not increase its tariffs on Chinese imports any further. Of course, there is still conflict potential in the medium and long run.

Secondly, numerous central banks have switched to a looser monetary policy. As for the USA, the market has priced in rate cuts of a total of one percentage point within a year. A rate cut of 0.25 percentage points at the end of July is very likely. Only last September, the markets were expecting rate hikes of a total of 0.8 percentage points.

Looser monetary policy

The normalisation of the key-lending rates (i.e. rate hikes) and of the central bank balance sheets (shrinking) implemented by the end of 2018 were at odds with the economic weakening. Now, central banks have signalled loosening, and some have already reacted by cutting their key-lending rates. The arguments brought forward by the central banks come from three different categories:

First: little room for manoeuvre. The distance of the key-lending rates from the lower threshold of interest rates is small for most central banks at this point. In the past, central banks would react to a recession by cutting key-lending rates by numerous percentage points. This is now no longer on the table. Rate cuts into negative territory are a very limited option.

Second: significant estimation errors. The central banks use several economic models to forecast the core variables employment and inflation. But every forecast model comes with errors. Therefore, central banks do not only look at fixed values of forecast, but also at the distribution around those values; and due to the inherent uncertainty of models, they use more than one models. For a number of years now, the inflation forecasts (“increase”) derived on the basis of the labour market have not materialised. The so-called Phillips curve that postulates a link between inflation and unemployment rate has been subject to increased levels of criticism. Also, the modelling of a trade conflict has a high level of implied uncertainty. In addition, the bandwidth of the estimated neutral key-lending rate (i.e. the rate that is neither dampening nor supportive to economic growth) is wide.

The first two lines of argument imply a quicker reaction to a deteriorating environment than would have been traditionally the case.

Third: changes in reaction. How should the central bank react to the economic environment? At the moment, the main question is whether the past should be taken into consideration. In many countries, inflation has been below the inflation target of the respective central bank for years. If the central banks wanted to achieve their long-term inflation target (often around 2%), this would require a rate of inflation in the coming years above the inflation target. Such a perspective shift would, however, require an even looser monetary stance.

Outlook

The most important reasons for the comprehensive asset price increases are the comparably early reaction by the central banks to the deteriorating economic environment and the truce between the USA and China. The outlook for the second half of the year hinges in particular on one question: how strong is the negative roll-over from the weak goods sector to the service sector, employment, and inflation? This will have a crucial bearing on the earnings development of companies. Earnings were down in Q4 2018 and Q1 2019. As long as the central banks manage to stabilise economic growth slightly below potential and no external shock occurs (trade conflict, hard Brexit, war with Iran), the outlook remains cautiously optimistic for risk asset classes (f.e. equities, corporate bonds). However, we do not expect prices to continue rising above average.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.