The eyes of the international business world are currently fixed on Vienna. At the OPEC headquarters in downtown Vienna, the oil cartel’s member states and its allies are currently haggling over production volumes, and thus the further development of oil prices, via video conference. According to OPEC sources, the first informal negotiations over the weekend have been fruitless.

At their meeting on Monday, the OPEC members themselves agreed on the need to extend their production restrictions for a further three months from January. This was announced by Algerian Minister of Energy Abdelmadjid Attar, who currently holds the rotating OPEC presidency. However, the most difficult part still lies ahead: on Tuesday, the OPEC members still have to get their allies from the extended circle of the so-called OPEC+ on their side in further negotiations.

After the official OPEC meeting on Monday, negotiations with the OPEC+ are due to start on Tuesday, with the principal question being whether informal OPEC leader Saudi Arabia, with its desire to maintain the current production restrictions, will prevail against the wishes of other important OPEC+ producing countries such as Russia.

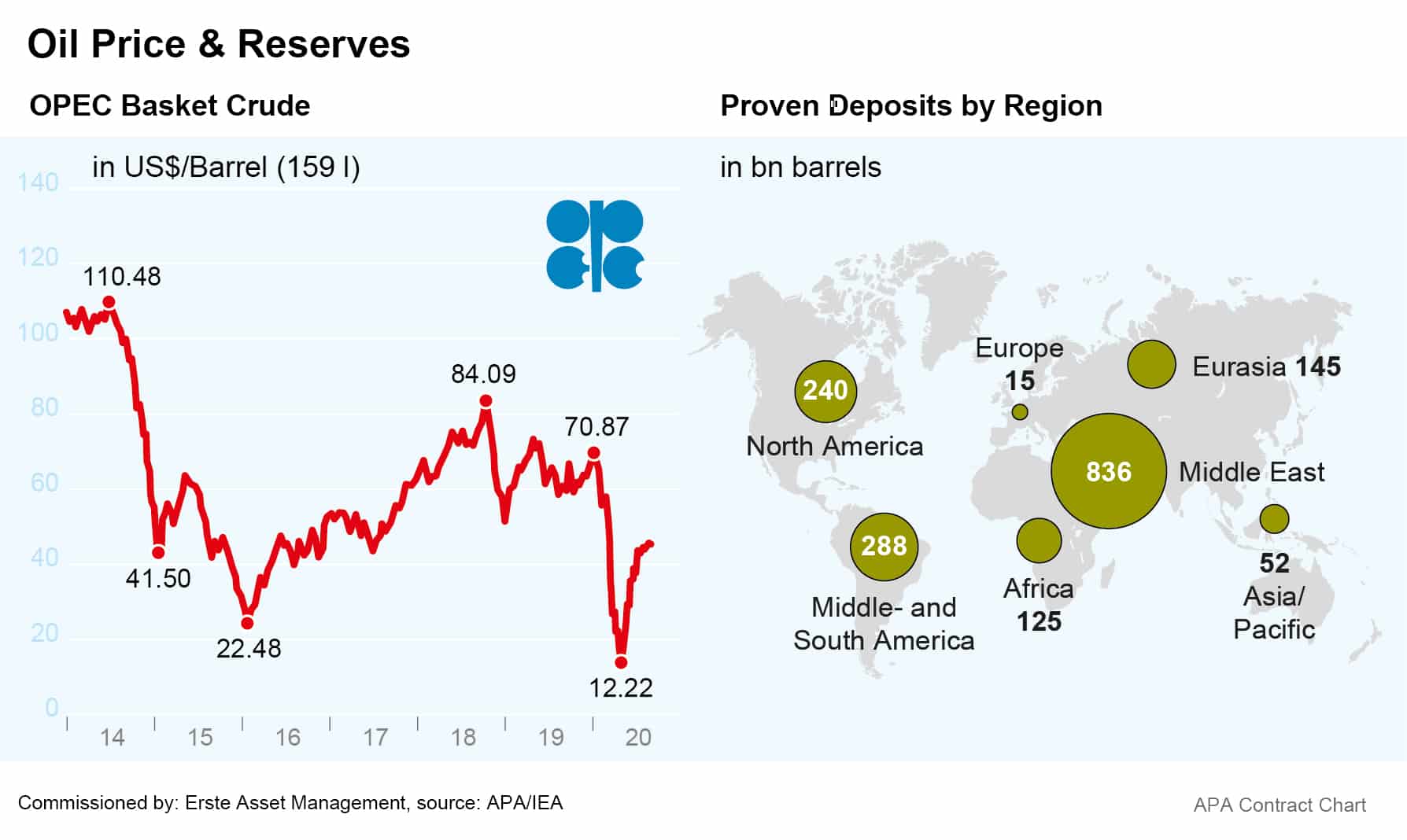

The current production restrictions were decided in response to the corona pandemic and the resulting plummeting demand for crude oil. The barrel price for Brent Crude, the European reference oil, had dropped from USD 70 a barrel in April to less than USD 20. US WTI oil even fell to levels around USD 10 per barrel.

In April, OPEC and its partners had agreed to cut production by 9.7 million barrels (à 159 litres) per day to counter the fall in oil prices due to the pandemic. This quantity of oil corresponded to about 10 per cent of the global oil supply. In August, some of the production cuts expired, and as a result, production only had to be cut by 7.7 million barrels.

In autumn, OPEC had lowered its forecast for oil demand in 2021 to 96.3 million barrels per day in view of the surprisingly strong global second corona wave. As the background for the revised forecast OPEC cited its forecasts for global economic growth, which had also been revised downwards, in its monthly report. Consequently, the markets initially expected production cuts to be maintained at the upcoming OPEC meeting.

Oil prices also suffered from the expected resumption of Libyan oil production. The blockade of key oil fields and export ports in Libya by General Khalifa Haftar’s troops had brought oil production in the crisis-ridden country to a temporary halt this year. In September, however, Haftar had announced an end to the blockade.

Hopes for a vaccine fuel demands for increased funding

However, with the recent progress in potential vaccine candidates awaiting approval, hopes for a recovery in oil demand have increased. As a result, Brent oil prices recently rose to levels close to USD 50 per barrel. However, this also increased the desire of several oil-producing countries to increase production somewhat again.

According to OPEC insiders, Saudi Arabia and other important OPEC countries want to extend existing agreements and production cuts by three to four months. Saudi Arabia fears an oversupply and thus setbacks in the reduction of stock levels.

However, some of OPEC+’s allies are pushing for production increases. Russia, for one, is expected to advocate a gradual increase in production come January. The country is economically highly dependent on its oil exports and has therefore suffered particularly from the pandemic. According to some circles, Kazakhstan is also opposed to maintaining the existing production limits.

In any case, the further direction oil prices will take now depends on the outcome of the OPEC negotiations. According to Russia, the disagreements in the oil alliance are not as strong now as they were in spring, when a price war between leading oil-producing countries put additional strain on oil prices. However, OPEC circles are preparing for particularly difficult negotiations.

According to analysts, the markets are likely to have priced in a continuation of production cuts. A continuation of production restrictions and the prospect of corona vaccines should support oil prices further. Recent figures show that major investors in the major commodity futures markets have also increased their bets on higher oil prices.

However, should the negotiations fail, experts expect oil prices to drop significantly. A continuation of global travel restrictions in particular could lead to a severe drop in oil prices, in which case experts at the German Institute for Economic Research (DIW) see oil prices falling as much as down to USD 25 per barrel.

Setting the course for the US shale oil industry too

The OPEC decision is also crucial for the US oil industry, which has been severely hit by the pandemic this year. This is because the oil price level determines which production facilities can be operated profitably. Shale oil producers in particular are heavily dependent on oil price developments.

The fracking method, controversial for environmental reasons, in which oil is pressed from rock layers, requires expensive investments. When oil prices are low, shale oil producers therefore make losses. However, if oil prices continue to rise, the US could soon find itself among the world’s largest oil exporters.

Oil stocks with a strong year-end spurt

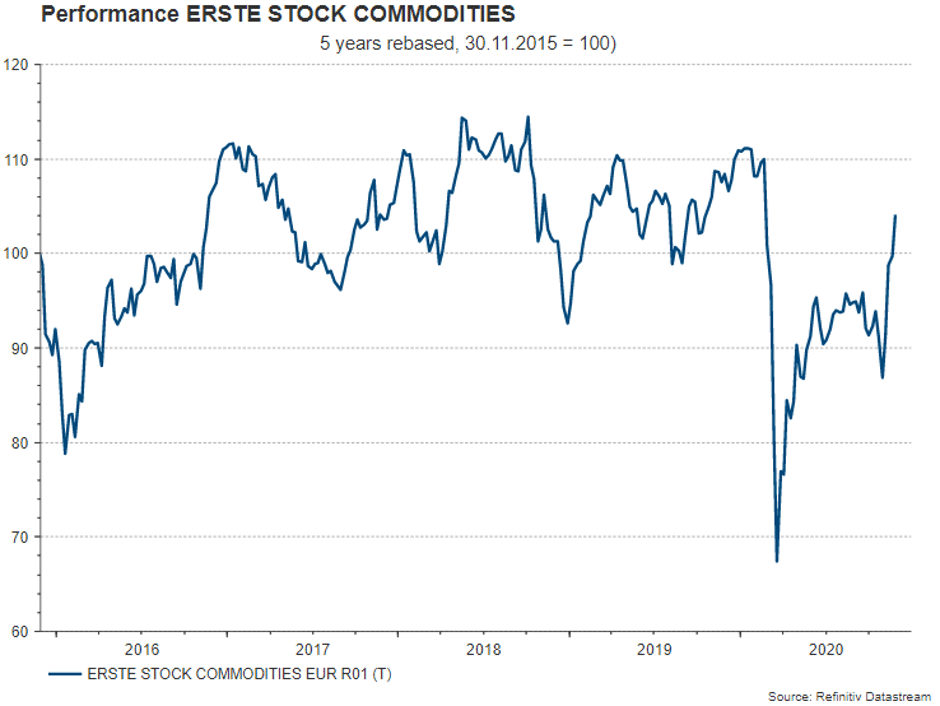

As a result of global exit restrictions and plant closures, oil stocks came under severe pressure in spring. With the recovery of oil prices, they gained terrain over the course of the year and experienced a strong upward push in November. With the prospect of a pandemic vaccine and the hope that economic activity will normalise next year, this trend could continue. Conversely, setbacks in the fight against the lockdown or failure to reach agreement on oil production in the main oil-producing countries could lead to renewed setbacks.

The ERSTE STOCK COMMODITIES equity fund offers the opportunity to benefit from a continued recovery in the commodities sector. Companies in the oil and gas sector and related equipment, refinery and transport companies currently account for around half of the fund’s assets.

Conclusion: OPEC members and their allies are once again struggling to reach a joint decision on production volumes and thus the further development of oil prices. Since the low in June, things have been picking up again. This is also benefiting oil stock prices. They express the hope for a normalisation of economic life in 2021.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.