Germany’s first federal government coalition of the Social Democratic Party (SPD), the Free Democratic Party (FDP) and the Green Party – called the “traffic light” coalition for the parties’ traditional colours – has now been in office for just under two weeks and is starting its planned renewal programme at the most difficult time imaginable: In addition to the Corona pandemic and extensive climate targets the difficult economic situation presents numerous challenges. A possible further Corona wave and ongoing supply chain problems could put a damper on Germany’s recovery.

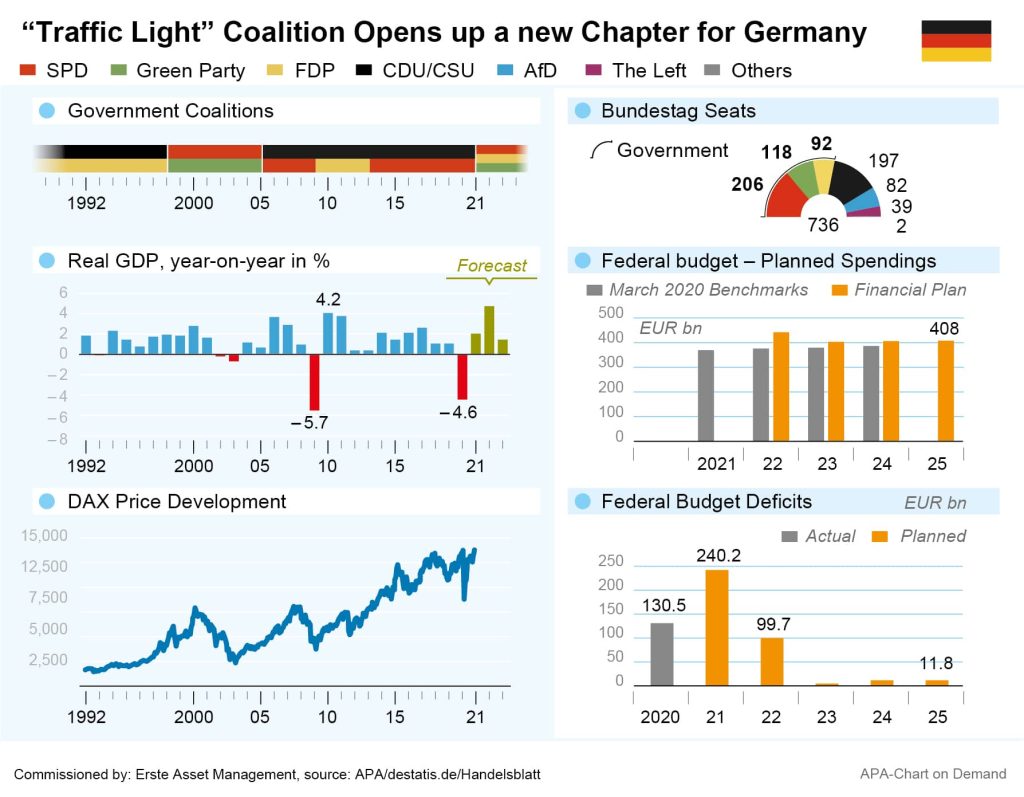

Against this backdrop, the German ifo Institute recently revised its growth forecast from 5.1 to 3.7 per cent for 2022. The Kiel Institute for the World Economy (IfW) recently lowered its forecast from 5.1 to 4.0 per cent. Growth concerns are compounded by fears regarding inflation and interest rates. Inflation, for example, fueled by soaring energy prices, jumped to 5.2 per cent in November, its highest level since 1992.

Accelerated Switch to Green Energy and Expansion of Power Grids

However, the economy is hoping for positive stimuli from the coalition’s agreed environmental and economic policy goals in the coalition agreement. The top priority for the new government is climate protection and limiting global warming to 1.5 degrees as set forth in the Paris Agreement. To this end, Germany is to become climate-neutral by 2045. An important cornerstone of this plan is an energy transition: 80 per cent of energy demand is to be supplied using renewable sources by 2030. The switch to environmentally friendly forms of energy, as well as the expansion of the power grids required for this, is to be accelerated.

Specifically, for example, the coalition aims to accelerate approval procedures for power grids and wind turbines. In their initial reactions, the major power companies welcomed the “traffic light” government’s plans. Naturally, the country’s largest network operator, E.ON, is expected to benefit from this. The power grid business is the energy provider’s biggest source of income. The planned faster approval of wind turbines is likely to play into the hands of green energy company RWE, as is the expansion of sustainable energy. This should also benefit the builders of such turbines, such as Nordex or Siemens Energy. On the other hand, the planned accelerated coal phase-out by 2030 instead of 2038 as previously planned could have a negative impact on RWE’s business.

Planned Acceleration of Automotive Industry Transformation

The new government also wants to actively support the transformation of the automotive industry toward electromobility. “Our goal is at least 15 million fully electric passenger cars by 2030,” the coalition agreement states. Germany’s major automotive groups have already commented positively on the government’s plans. BMW, for example, emphasised its commitment to expanding the charging infrastructure for EVs. The automotive sector has traditionally played a particularly important role in Germany’s economy, but has recently suffered badly from supply chain problems and in particular the ongoing semiconductor shortage.

Other sectors and companies could also benefit from the new government’s plans: The coalition wants to create a fair framework for effective climate protection in international air traffic. This is good news for Lufthansa, as a purely German kerosene tax would have put it at a competitive disadvantage. The German Federal Association of German Housing and Real Estate Enterprise Registered Associations welcomed the coalition’s plans to build 400,000 homes a year and simplify building permit and planning processes. However, there is criticism of the plan to extend rent control until 2029. The state’s cultural and creative industries are also hoping for positive stimuli, for example regarding copyright regulations.

Criticism of Planned Supplementary Budget

In contrast, there was criticism from several quarters of the new government’s spending and financing plans. The coalition parties have agreed on the “most expensive common denominator,” said Markus Jerger, managing director of the German Bundesverband mittelständische Wirtschaft. “The price for this will be paid by businesses and citizens.” Without tax increases, the various projects, such as the expansion of renewable energies, can only be financed through new debt, Jerger said.

The plans for climate change and pandemic control require extensive spending, but the traffic light coalition government also wants to keep within the debt limit and forego tax increases, planning to achieve this through a series of politically controversial measures in the short term: on Monday, for example, the government plans to have a supplementary budget of EUR 60bn passed.

Owing to the Corona crisis, the budget for 2021 includes a record-high new federal debt of EUR 240bn. However, EUR 60bn of this was not needed and therefore not borrowed. Instead of incurring less debt, this sum is now intended to be made available to the Energy and Climate Fund for investment in the coming years so that it does not lapse. Several opposition politicians now see the transaction as an unconstitutional ploy to circumvent the debt ceiling. German Finance Minister Christian Lindner, on the other hand, has defended the supplementary budget as a necessary way to make up for important cancelled investments.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.