Films are often about the so-called American Dream – “from rags to riches”. Here, it could also be called: “From DVD rental to successful streaming service”. What Netflix has achieved over the past few decades is almost film-worthy. After all, it is an unrivalled success story and a good example of how important the high-yield market can be for innovative companies.

[gtranslate]

Beginnings

Netflix was founded in 1997 as a DVD rental service after Reed Hastings, one of the co-founders, was annoyed by the high fees for late returns at video rental company Blockbuster. Originally, Netflix sent DVDs by post and, from 1999 onwards, it already relied on a subscription model including an online ordering service. However, the internet speed was still too slow to make streaming practical. But as technology was catching up, Netflix recognised the opportunity and launched its streaming service in 2007. This decision was so ground-breaking that it ultimately even led to the closure of Blockbuster, the former giant of the video store industry.

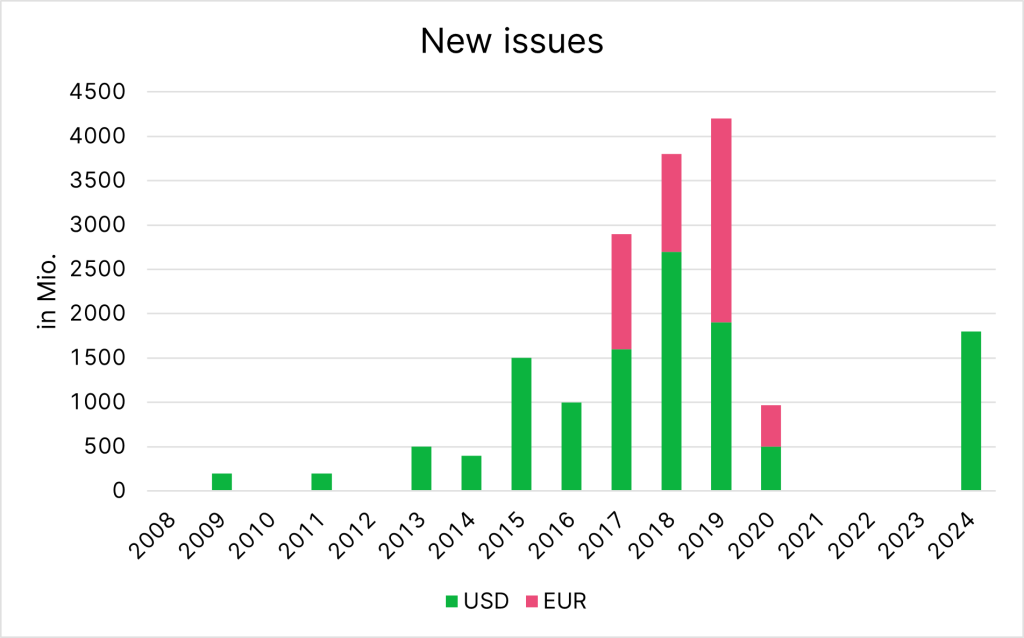

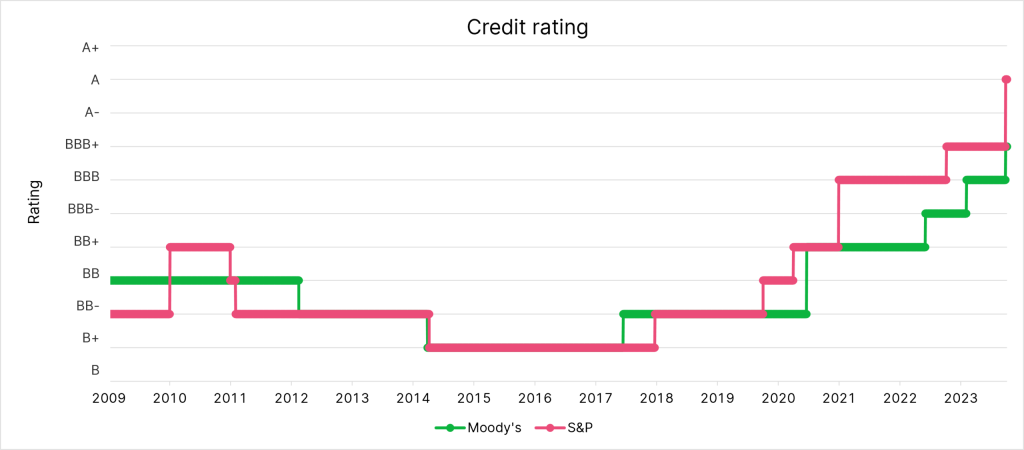

Even then, the business model was working well, and Netflix has not made a loss in a single year since 2002. Netflix’s first bond was issued in 2009 at a still relatively manageable size of USD 200mn. The purpose was to repay credit lines, initiate share buybacks, and meet general expenses. The bond was rated Ba2 and BB- by Moody’s and S&P, i.e. only two and three notches below investment grade, respectively. The coupon was an attractive 8.5% including a spread over US government bonds of no less than 5.28%. Anyone who remained invested in this bond over the entire term until November 2017 therefore made a good profit from the up-and-coming company.

Leveraged growth strategy

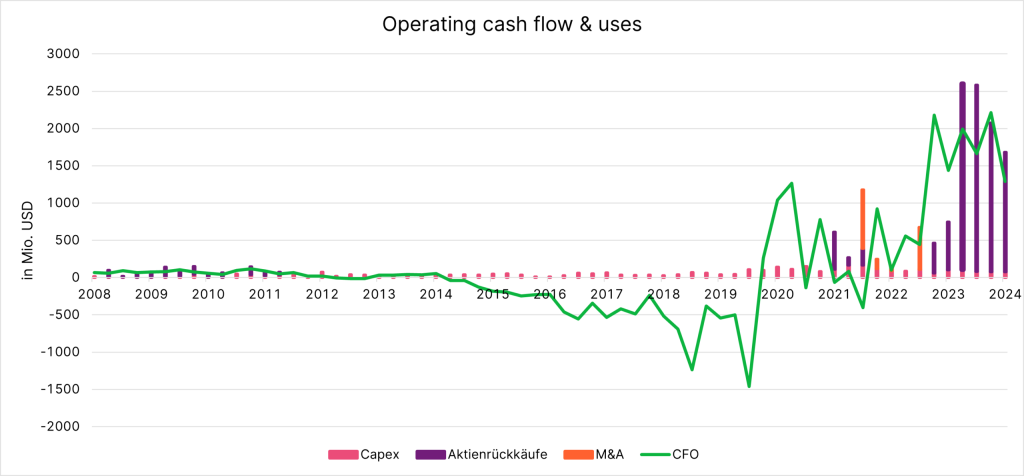

From 2010 to mid-2011, the company experienced its first major upswing and the share price increased rapidly. In June 2009, Netflix launched its “Netflix Originals” programme, which initiated the production of its own content. In September 2010, Netflix expanded to Canada and began its international expansion. However, the capital raised and the cash flow generated were not only used for growth, but also for a USD 300mn share buyback programme, which was announced in June 2010. This also temporarily increased the company’s debt.

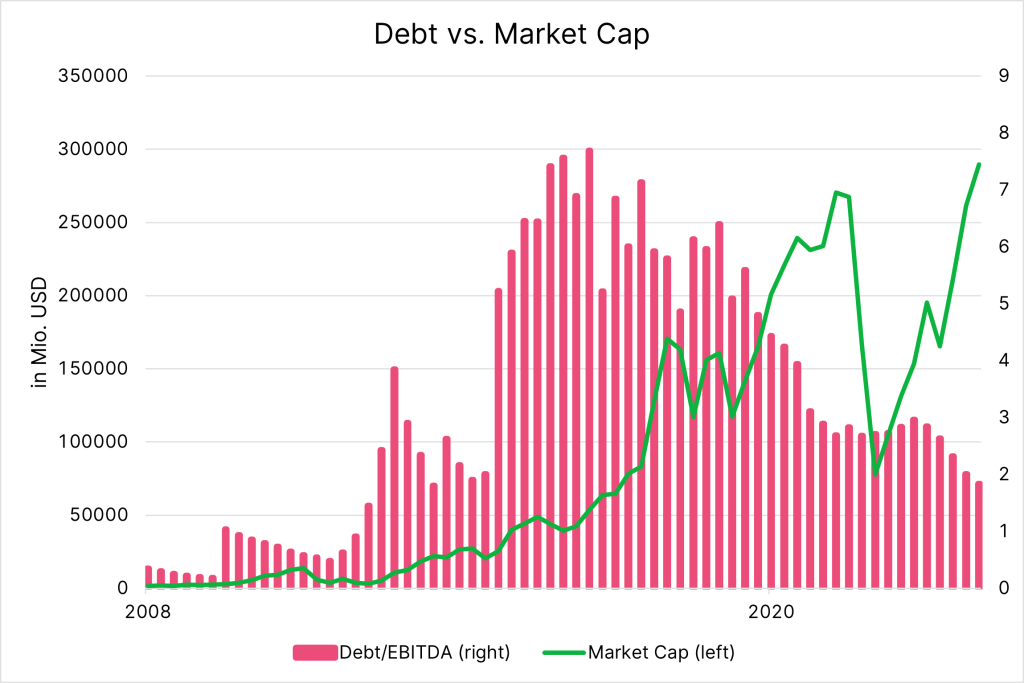

Earnings before interest, tax, depreciation and amortisation (EBITDA); used as a proxy for the cash flow of a company. Source: LSEG Datastream

The first reality check came in autumn 2011. Netflix raised its prices and announced the spin-off of Qwikster for DVDs. From then on, Netflix would only offer streaming. A bold move, but one that did not go down well with customers and shareholders. Netflix lost 800,000 customers, and the share price fell by 75% within four months. The rating agencies also reacted to the changes with downgrades. At S&P, Netflix was now rated BB+ (one level above investment grade), but even fell to BB- in 2011, and Moody’s downgraded Netflix to Ba3 in 2012.

In December 2011, Netflix raised a further USD 400mn through the sale of ordinary shares and convertible bonds. This heralded a new course of growth. In the years that followed, Netflix expanded into Europe and the rest of the world, produced hit series such as “House of Cards” and continued to grow. In order to finance further growth, Netflix increasingly relied on debt capital and placed more and larger high-yield bonds every year. The capital was mainly invested in rights for series and films and in-house productions, and while the number of users and revenue continued to grow, so did debt.

S&P and Moody’s responded to this in 2015 with a further downgrade to B+ and B1.

Source: LSEG Datastream

However, this did not stop Netflix from sticking to its investment strategy. In 2017, the company issued a EUR 1.3bn bond for the first time, and by the end of 2018, total debt was already above USD 10bn, which corresponded to almost 40% of assets at the time. After soaring until 2018, the share price took a temporary break in 2019.

In 2020, Netflix was finally able to establish itself in global households due to COVID-19, resulting in a massive increase in earnings.

Since 2021, the cash flow has therefore not only been invested in content, but also distributed to shareholders again through share buybacks. Although there was a shortly lived slump in 2022, as with other tech shares, the share price recovered quickly.

Source: LSEG Datastream

Netflix has turned into a rising star

The development of the credit rating during this period is particularly impressive. Things have been looking up again since 2018, but Netflix retained its high-yield rating from both Moody’s and S&P until 2020. In October 2021, S&P was the first to upgrade Netflix by two notches from BB+ to BBB. Moody’s followed suit in March 2023 to Baa3. However, this did not clarify whether the company could establish itself in the investment grade sector. After all, the streaming market was now highly competitive and, in addition to Netflix, services such as Disney+, HBO Max, and Apple TV+ were also trying to gain market share.

The company then took the final, again controversial step towards success in early 2023, when it significantly increased subscription prices in many countries and took action to prevent users from sharing their passwords with others. While many feared that this could lead to losses, Netflix continued to increase user numbers and is now so profitable that it generated an operating cash flow of USD 7bn in 2023. The ratio of debt to profitability has been falling rapidly since 2017, and the rating agencies have reacted accordingly. After Netflix was upgraded to Baa2 and BBB+ in 2023, which already corresponded to a relatively low default risk, Moody’s and S&P recently upgraded Netflix again after very good quarterly figures.

In the meantime, S&P has already awarded the company an A rating, and Moody’s a Baa1 rating. This means that S&P currently rates Netflix even higher than Disney.

Sources: Moody’s, S&P

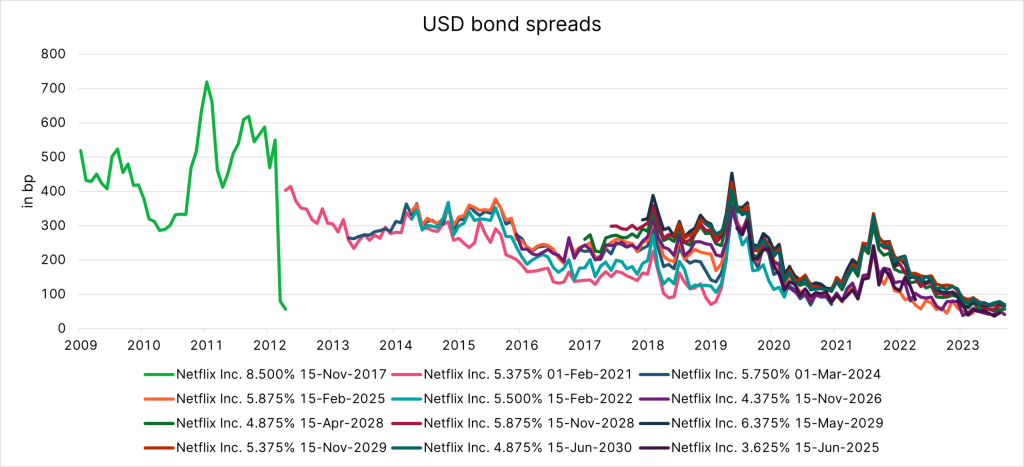

Development of spreads

Spreads over government bonds have narrowed massively since the first bond issue in 2009, as illustrated by the chart below. In 2011, the default expectation rose sharply following the planned spin-off of Qwikster, but we have also seen a short-term widening in 2018, 2020, and 2022. However, these were less the result of decisions made by Netflix and were driven more by the market as a whole. Since 2022, the spreads have converged exceptionally, which is due to the company’s good performance. Even the changeover at the beginning of 2023 has left bond investors unaffected. No wonder, given that net debt currently only roughly corresponds to annual EBITDA anymore.

Source: ICE

On 30 July, Netflix issued bonds as an investment grade company for the first time and was correspondingly swarmed by investors. There were orders totalling USD 19bn for the USD 1.8bn ( 10Y and 30Y) issue. The maturities in the coming year are thus already covered. This means the rating upgrade has already paid off for Netflix, as the company only had to pay a spread of 80bps and 100bps, respectively, over US Treasuries for the long maturities.

Conclusion: High yield market thrives on success stories like Netflix

Netflix’s history shows that success is not straightforward and that important strategic decisions that are diligently pursued over the long term have to be revised at short notice due to the market situation. The high-yield market thrives on such success stories and was created for this purpose in the 1970s. On the one hand, it provides risk capital for innovative young companies and is available as an additional source of financing alongside credit lines. On the other hand, it also offers private and institutional investors the opportunity to participate in this growth with high returns.

Money tip: seizing the potential of high-yield corporate bonds

The ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD bond fund could be an interesting alternative for investors who want to seize the potential on the bond market on the one hand and invest their money sustainably on the other. The actively managed fund invests primarily in the major high-yield markets in the USA and Europe, and the portfolio currently consists of 165 securities. In addition, sustainability aspects are taken into account when selecting securities in accordance with Erste AM’s proven responsible approach.

Hinweis: Die hier angeführten Unternehmen sind beispielhaft ausgewählt worden und stellen keine Anlageempfehlung dar. Der Fonds verfolgt eine aktive Veranlagungspolitik und orientiert sich nicht an einem Vergleichsindex. Die Vermögenswerte werden diskretionär ausgewählt und der Ermessensspielraum der Verwaltungsgesellschaft ist nicht eingeschränkt.

Chanes and risks in overview

Benefits for investors

- Investment in selected bonds from sustainable (ethical) issuers.

- Ethics Advisory Board regularly reviews sustainability.

- Foreign currencies are mostly hedged against the euro.

- Diversification across a wide area of global high-yield bonds.

Risks to bear in mind

- Rating downgrades can lead to losses.

- Elevated risk due to medium to low debtor credit rating of the participating companies

- The price of the fund may be subject to significant fluctuations (volatility).

- Foreign exchange fluctuations may affect the fund price performance.

- Capital loss is possible.

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act.

Notes ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the investment company’s part.

For further details on the sustainable strategy of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD and on the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852) please refer to the current prospectus, point 12 and the appendix, “Sustainability principles”.

When deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD, please take into account all features and goals of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as described in the fund documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.