P rices are falling on the capital markets – as is my fund! Am I heading for a total write-off, or do crises also offer opportunities? What am I supposed to do with my s Fonds Plan (s Fund Savings Plan)?

rices are falling on the capital markets – as is my fund! Am I heading for a total write-off, or do crises also offer opportunities? What am I supposed to do with my s Fonds Plan (s Fund Savings Plan)?

Note: Depending on the performance of the investment fund, the performance of an s Fonds Plan will differ from that of a single investment (higher or lower). A loss of capital is possible in both cases.

Our 6-point strategy is meant to answer frequently asked questions and give you food for thought in the investment arena.

Two important general rules as introduction:

- If you have decided to build capital gradually and over a longer period via the s Funds Savings Plan, you should not let short-term fluctuations affect you.

- It is not important where prices are today, but where they are at your investment horizon.

“Have we seen times like these before, and when will they be over again?”

Many of our investors have never experienced a crisis with significant losses on the financial markets. Therefore, their worries about their investments are understandable. Let’s first have a look at the past.

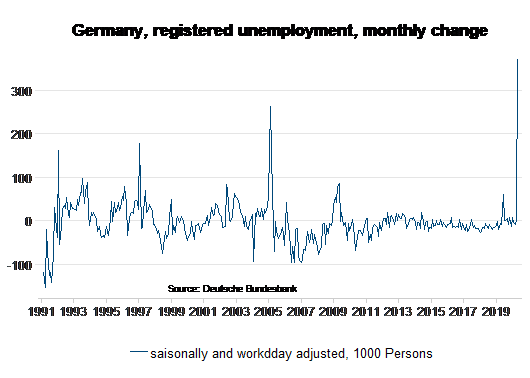

25Y global equity index / logarithmic scale, initial value = 100%,

27 Mar 1995 – 27 Mar 2020

Russian crisis / 2001: bursting of the dotcom bubble / 9/11 / 2008 financial crisis / Euro government debt crisis / Emerging markets crisis / COVID-19 crisis Chart: global equity market (Index), 25Y, initial value = 100 % Note: this is an index, no direct investment possible Source: Refinitiv Datastream Disclaimer: the past performance of an investment is not indicative of its future development

In the past 25 years, we have seen numerous crises with significant effects on the equity markets. They have all had one thing in common: they were overcome, and the share prices bounced back. They may have lasted for shorter or longer periods of time, but the psychology behind them was always the same. Once prices are heading south, many retail investors become scared that they might fall even further and start panic-selling their shares.

Questions from our investors, and what we as investment experts have to say to them:

1. How long can this phase of the crisis and of elevated price fluctuations last?

The current crisis was triggered by a virus that primarily affects the health of people. In order to find a solution, massive containment steps had to be taken that disrupted our daily routine and thus the economy. The duration depends on how quickly the spreading of the virus can be contained and a medical solution can be found. The various states took fiscal measures in order to absorb the impact on the economy. The central banks have launched comprehensive programmes to stabilise the financial markets.

2. My equity fund has lost a lot of value – will this be permanent?

All crises have had an impact on the equity markets. The resulting losses were both significant and painful for investors. However, they were also temporary. Once the crisis had been overcome, the company earnings recovered and re-embarked on their earlier growth path. As a result, share prices and equity funds rebounded as well. Patience and resilience are two crucial requirements for success in investment.

3. I pay monthly into my s Funds Savings Plan. Should I stop now?

Assuming that the crisis can be overcome, the effects on the financial markets should not exceed the short to medium term. Investors who build capital by paying regularly into a fund savings plan usually have a very long investment horizon. In the long run, the attractiveness of equities will not change, from today’s perspective. If you sell your fund shares now, you not only realise your losses, you also miss out on the chance of participating in the market rebound.

Let’s look at a simple example: you invest EUR 100 per month, and the price of the fund you chose was EUR 100 per share as well last month. Therefore, you bought 1 share last month. Then, the global share prices (and the calculated value of your fictitious fund) fell by 30%. This means the price of your fund is EUR 70. You get about 1.4 fund shares this month for your EUR 100. In other words, you get more for the same amount. In high street shops, you would call it a “sale”. The longer the prices remain low, the more months you can buy fund shares for less money.

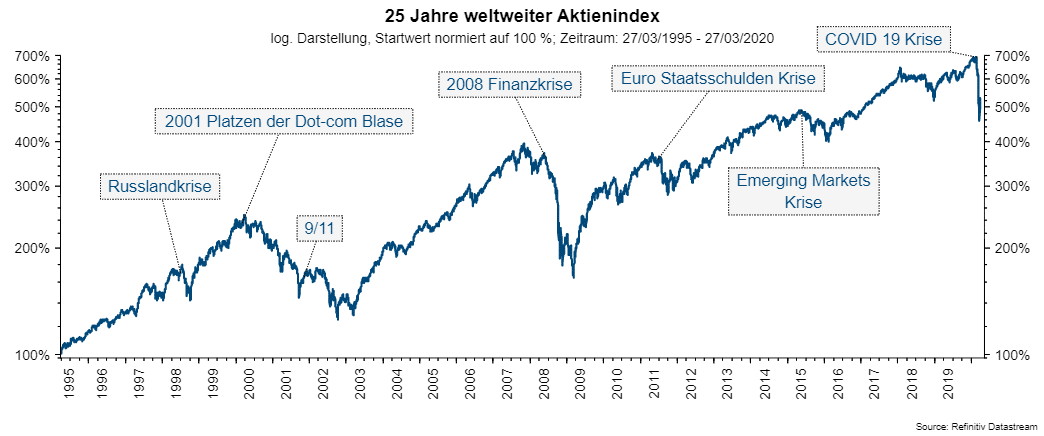

Many experts have compared the current situation to the financial crisis in 2008, although the causes are very different. The chart below focuses on one segment of the earlier chart above, on the performance during that particular crisis, and on how long it took to recover the losses:

3Y global equity index – financial crisis 2008 Monthly data, initial value = 100%, 31 December 2007 – 31 December 2010

2008 financial crisis / Average price at 76% Chart: global equity market (Index), 3Y, initial value = 100 % Note: this is an index, no direct investment possible Source: Refinitiv Datastream Disclaimer: the past performance of an investment is not indicative of its future development

If you had bought shares (as illustrated by the global equity index) at the beginning of 2008, you would have incurred a loss of more than 50% a year later; you would have had to hold the shares until the end of 2010 – i.e. three years – to be (almost) back at the original purchase price. Every point in the chart represents one month’s worth of constant investment. The average price in the observed period was about 76% of the initial value. You got that price by simply sticking to your strategy. The model does not account for the additional shares that one would have bought in addition at the lower prices while keeping the investment sum constant. This means that with a lump sum, you would have been above 90% of the initial value at the end of 2010, but by investing regularly, you would have already turned a profit.

The opportunity to buy at low prices does not come along that often. The s Fund Savings plan does that automatically, if you maintain your monthly investments.

4. The prices are very low now. Should I start with a larger initial amount?

Significant price cuts caused by crises have in the past proven good moments to invest, because ultimately all crises have been overcome. Nobody knows whether in the current crisis we have already seen the markets bottom out or whether prices will fall further. What we have seen in the past is that during times of falling prices, the fear of further losses overwhelms many investors, keeping them from investing more money. One potential strategy is to split the amount set aside for investment and invest it via smaller deposits for example over the coming twelve months.

5. Maybe shares are too risky? Would it not be better to invest in safe government bonds or, even better, leave it all in the savings account?

The savings account is a form of investment with which many Austrian feel comfortable. There are no price fluctuations, and access to the money when needed is easy. However, interest rates (i.e. the return on such investments) have been almost zero for years. And the picture gets even less attractive for safe government bonds (e.g. Austrian government bonds). Prices across the maturity spectrum are so high that the yield (i.e. the return until maturity) is negative. If you are looking for safety, the savings account is a good alternative. However, this form of investment does not even protect you against inflation. This means that a loss in purchase power (i.e. the value of money) is already built into this alternative.

6. How safe is my money in a fund? What if my bank goes bankrupt?

Regardless of price movements, one has to ask what could or would happen to my money that I invested in a fund if for example my bank went bankrupt. Here, the good news for all fund investors is that investment funds are special assets. This means that these assets belong to the investor. If your bank or the investment company were to file for bankruptcy, your money would be protected, because it would not be part of the estate.

Conclusion

Investing in the s Fund Savings Plan is like building a house: brick by brick, over a long period of time. During that time, there may be hail before the roof has been put up. The result is moisture in the cellar. The important thing is to have a construction plan and to stick to it. Once the house is finished and you can sit on your couch in the living room, all the stress has paid off.

For your s Fund Savings Plan, this means: your capital is being built slowly and over a long period of time. There will always be setbacks. But you should keep your eyes on the prize. The s Fund Savings Plan is the perfect instrument to reach your goal especially during difficult times.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.