The EU parliamentary elections showed a slight strengthening of the right-wing parties. At the same time, the left-wing and center parties were moderately weakened accordingly. We reported on the outcome of the election and reactions to it on our investment blog.

Major effects can be found at state level. In Germany as well as in Italy and France, the right-wing parties (Alternative for Germany, Fratelli d’Italia and Rassemblement National) made considerable gains. At EU level, the integrative forces retain the majority. The focus is currently on the early elections in France.

Renew Europe loses significantly

The right-wing parties’ share of the vote rose from 17% to 18%. In contrast, the share of the left-wing and green parties fell from 15% to 12%. The center parties lost only slightly from 59% to 56%. However, the European People’s Party (EPP) gained 10 seats to 186. The non-attributable vote share rose from 9% to 14%. It is worth noting that the party of French President Emmanuel Macron (Renew Europe) lost the most seats (from 102 to 79). In response, Macron called early elections to the French parliament for June 30 and July 7.

Possible effects of the shift to the right

The right-wing parties have emerged stronger from the EU elections. But what impact could a shift to the right have in the EU? Here is an overview of the possible implications on several levels:

- Integration: The growth of EU-critical (right-wing) parties is offset by the trend of increasing geopolitical tensions. This external pressure supports the need for more cooperation between states (integration). This includes the issues of capital market and banking union as well as common EU bonds. However, the further partial surrender of national sovereignty has become even more difficult due to the popularity of right-wing populist parties.

- Security: The issue of “national security” will probably also lead to increasing defense spending in the future. This also applies if the war in Ukraine comes to an end. The peace dividend has disappeared and pressure from the USA to increase the proportion of NATO spending in all NATO countries has increased.

- Social affairs: At the same time, spending on social affairs is unlikely to be reduced. This is also due to increasing populist pressure.

- Budget: The combination of more defense spending and no savings in the “rest” implies that budget deficits will hardly be reduced in the coming years. A further increase has even become more likely.

- Industrial policy: In addition to geopolitical tensions, the fragmentation of the global economy is increasing. The trend towards more protectionist industrial and trade policies is being reinforced by a higher proportion of populist parties. In principle, this means higher costs (tariffs, production becomes more expensive) with the risk that inefficient companies are kept alive.

- Productivity: Unfortunately, more industrial policy does not necessarily imply higher productivity growth (rather the opposite). A policy for productivity-enhancing measures was only on the agenda of a few parties.In addition, as mentioned, the prospect of more inclusive policies (capital markets union) has been somewhat dampened.

- Energy transition: The strengthening of the anti-establishment stance could cause the issue of the “energy transition” to slip down the list of priorities somewhat.

- Immigration: An important electoral motive for the popularity of right-wing populist parties is the issue of “immigration”. From an economic perspective, lower growth in the working-age population means lower real economic growth.

- Economic growth: In addition, productivity could suffer if immigration is restricted too much and without reflection (skilled workers, key workers).

Macron takes flight to the front

The announcement of new elections in France came as a surprise. Macron has fled to the front. His party (Renaissance) fell to just 14.5%.Le Pen’s party (Rassemblement National), on the other hand, achieved a very strong result of 31.5%. The move has been described as risky by political analysts. Macron’s reasoning could be to make the right-wing populist approach appear less practicable by participating in government. On the other hand, Le Pen could apply Giorgia Meloni’s strategy and open up towards the center.

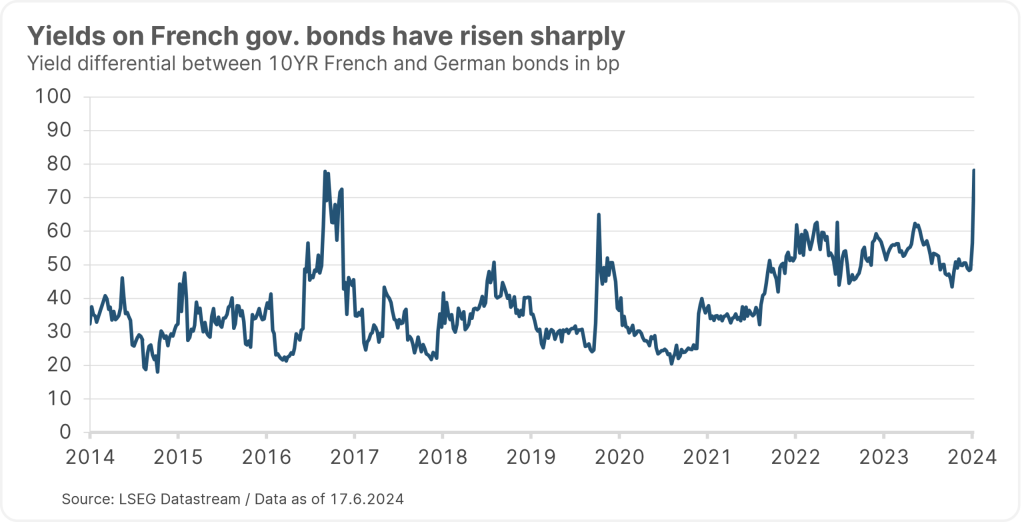

The impact on the markets is significant, but at least not yet relevant. The yield differential between French and German government bonds has risen from 49 basis points to 77 basis points. The prospect of a more nationally oriented policy in France (and in other countries) is generally damaging to the EU and the euro. The most likely scenario is that Macron will be a “lame duck” until the presidential elections, even if Le Pen’s party does not achieve an absolute majority in the second round.

Long-term trends are little affected

The EU election has strengthened the centrifugal forces in favor of the centripetal forces. In aggregate, however, the effects are minor. The outcome of the elections in France represents an important uncertainty. As long as the integrative forces in the EU are not weakened too much, there will be little change in long-term political trends.Even before the shift to the right, economic forecasts pointed to low economic growth (low productivity, adverse demographics), a rising public debt ratio (defense, social issues) and inflation above the central bank target (industrial policy, fragmentation of the global economy).

The EU elections will not change these trends, but may give them a somewhat more nationalistic orientation. After the elections in France, the next important election dates will be the parliamentary elections in Germany next year and the presidential elections in France in 2027. Both elections have the potential to further weaken cohesion in the EU.

Integrative steps have become less likely

The prospect of an improvement in low productivity growth has been dampened by the outcome of the EU elections. This is because the strengthening of nationalist forces has made further integrative steps less likely.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.