Summer is here, the New Year’s resolutions have long since disappeared in the rearview mirror, and in the mirror there is only a hint of the longed-for beach figure to be seen. How nice it would be to get rid of the last stubborn five kilos by means of a miracle cure. Since 2022, semaglutide has been available on the market as just such a drug. Time for an interim assessment.

Semaglutide – the unexpected goldmine

With semaglutide, an active ingredient from the GLP-1 receptor agonist group, the Danish company Novo Nordisk actually only wanted to develop a drug for diabetes 2 patients that, in comparison to the similar liraglutide, has to be injected weekly instead of daily. However, animal studies already showed a strong appetite-reducing effect in addition to the expected insulin-regulating effect. In 2021, a double-blind study provided the first tangible evidence of weight loss in human subjects. Novo Nordisk shares subsequently chased from one high to the next.

A thick ethical dilemma

Unsurprisingly, the wonder drug with the brand name Ozempic was immediately consumed on a grand scale off-label (as it was only approved for diabetes-2) and from 2022 officially approved as Wegovy by the rich and apparently not-quite-beautiful. Since Novo Nordisk could not meet the massive demand with its production, it came to the ethically questionable situation that affluent Hollywood actors came to their injection, while financially weak diabetes patients had to wait for the potentially vital drug.

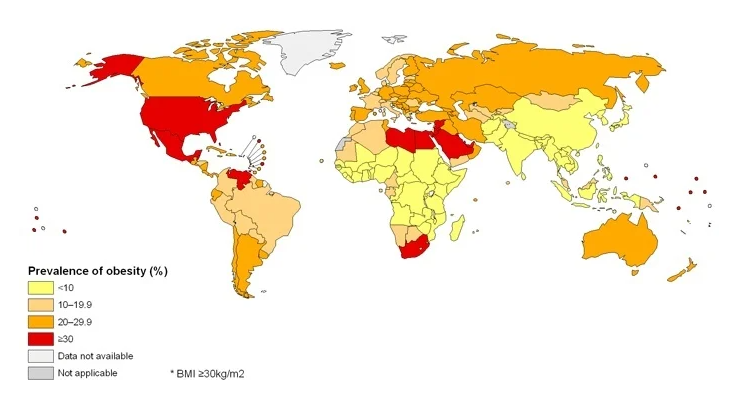

Obesity – no longer a luxury problem

Whereas obesity at the turn of the millennium was clearly a side effect of the over-saturated lifestyle in industrialized nations, today a large proportion of obese people live in developing countries. Particularly in Latin America and the Middle East, rising prosperity often brought with it a displacement of traditional eating habits in favor of convenience food. Wegovy will do little to remedy this situation, since it costs USD 1,300 and EUR 300 per month in the USA and Europe, respectively, if the costs are not covered by health insurance. Studies assume a minimum treatment period of one year for significant weight loss that is sustainable at least in the medium term.

EMA reviews side effects

Semaglutide was not originally conceived as an all-purpose drug. Originally, risk assessments contrasted with the fight against diabetes-2, where the benefits clearly outweighed the risks. In addition to various gastrointestinal problems, which are usually more common at the start of treatment, the European Medicines Agency (EMA) is now looking into possible psychological side effects after two cases were reported in Iceland in which patients developed suicidal thoughts. Studies in mice also showed an increased risk of thyroid cancer, but this has not yet been established in humans.

Rude awakening for fitness and diet industries

Away from health risks, Wegovy is also causing economic upheaval. Already hard hit by the pandemic, the fitness industry faces an existential threat, especially if slimming drugs become much cheaper. The food industry is also looking at developments with growing concern. On the one hand, the growth market of low-calorie diet products is in danger. On the other hand, semaglutide does work by reducing appetite, thus causing a general reduction in consumption.

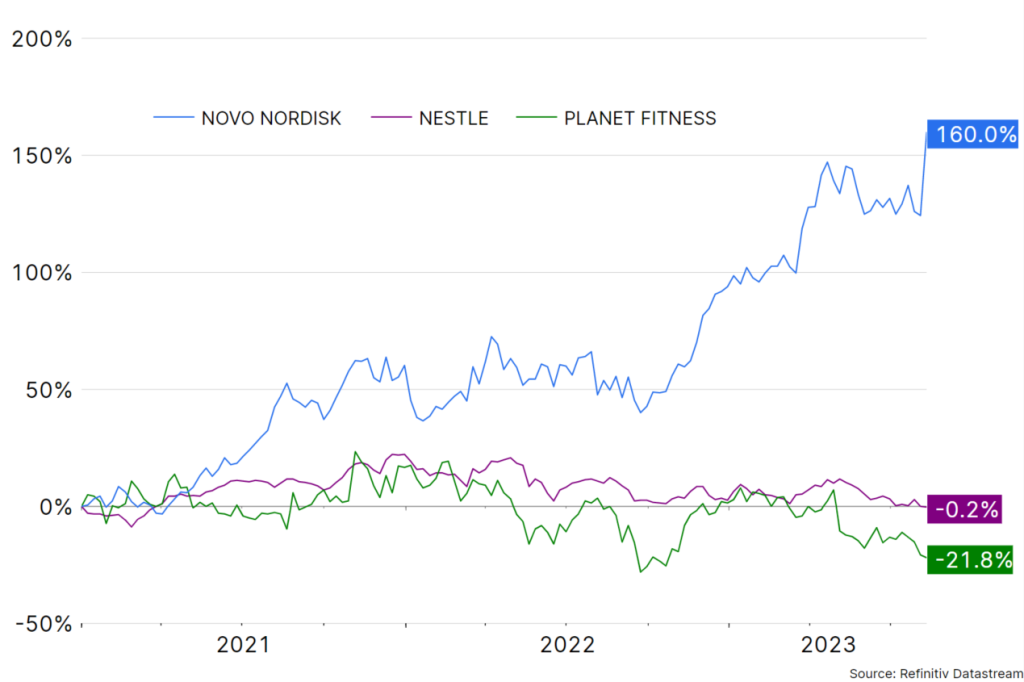

Since 2021, when semaglutide was found to reduce weight, Novo Nordisk’s stock has more than doubled, while food giant Nestle hasn’t budged and listed gym chain Planet Fitness has lost more than 10%.

Wegovy came into focus again only last week. Positive study data on the drug caused the Novo Nordisk share price to jump by more than 16%. The study showed that taking Wegovy reduced the risk of a serious cardiovascular event such as stroke by 20% in overweight or obese people with a history of heart disease.

Source: Refinitiv Datastream; Chart is indexed (01.01.2023 = 0%); Note: Past performance is not a reliable indicator of future performance. Data as of 14.08.2023

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.