These days a fund that has drawn the attention of many investors is celebrating its first birthday: the megatrend fund ERSTE FUTURE INVEST. The performance to date is respectable. Despite the corona pandemic, the fund has recorded comfortable gains, outperforming important stock exchange indices.

Active fund management pays off. We have talked to the man who is responsible for the selection of the exciting high-potential companies: fund manager Bernhard Selinger is always on the lookout for innovative companies. Here, he is taking a look behind the scenes with us.

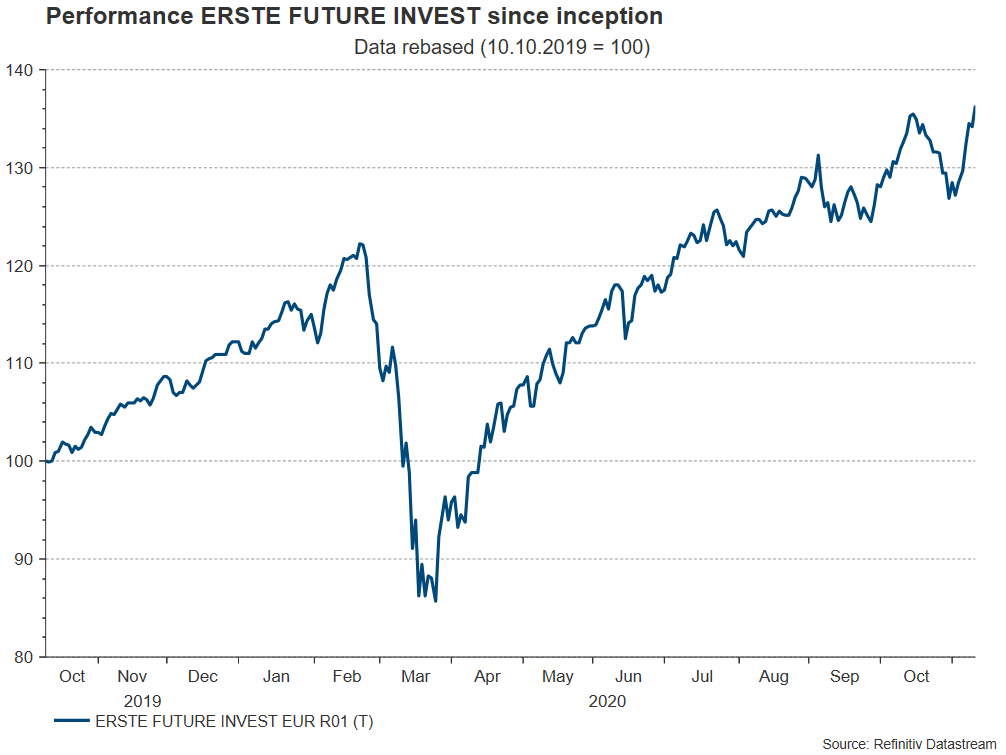

The first year was a true success story. Assets under management of ERSTE FUTURE INVEST have now exceeded EUR 200mn. Investors who have been with the fund since the beginning have recorded gains of 25.24% (as of 30 October 2020, source: OeKB).

*Performance calculated on the basis of the OeKB method. It assumes the full reinvestment of the dividend and takes into account the management fee and performance-based fees, if any. Any one-time load fee (of up to 5.00%) and any individual transaction fees or ongoing fees (e.g. account of depositary fees) are not accounted for by the model. Past performance is no reliable indicator for the future development of a fund.

Where has this excellent performance come from?

Good luck always helps when you’re investing, especially when it comes to timing. But the success of ERSTE FUTURE INVEST runs deeper: it is the broad mix of megatrends that we have consistently followed since the launch of the fund. Companies from the healthcare, technology, and environmental sector reacted differently to the lockdown in March. Healthcare, as anti-cyclical portion of the portfolio, remained largely stable, whereas technology reacted to the market relatively early on. At the same time, the technology sector was also among the ones to benefit most from the subsequent recovery, at a point where many companies from the environmental sector were still under pressure. The broad mix of themes has had a stabilising effect on the fund.

Ultimately, we achieved an above-average result for our investors, and we are happy about it. It shows that we are on the right way and that in the long run, broad diversification pays off.

What was the impact of COVID-19 on the various trends? Who were the winners, who the losers?

Of course, the pharmaceutical sector and the quest for a vaccine were prominently positioned in the discourse – which does not mean that that sector was the winner hands down. The production of medical disposable products such as masks or gloves was being ramped up enormously. As we all know, sourcing masks was not easy in the beginning, and disinfectants were in heavy demand as well. Manufacturers of diagnostic equipment and equipment for corona tests also benefited from COVID, if you allow this term. The US company Abbott Laboratories, for example, can hardly satisfy the demand for quick antigen tests at the moment.

On the surface, the medical sector seems to be the industry most focused on COVID – but other sectors benefited as well, such as online retailers or home office.

Online retailers are the winners of the COVID crisis, no doubt about it. Completely new customer groups have been unlocked who would not have bought online before and tried it for the first time during lockdown. User stats show: the majority of people stick to it and continue buying online. And those who were already experienced online buyers even upped their game on that front. But this is not only about shopping. Practically overnight, millions of people had to stay home and completely restructure their workday. Modern technologies helped deal with the stress and stay in touch with the own company and clients. Spare-time use of video streaming services and gaming increased rapidly. According to some estimates, Netflix and YouTube account for a joint quarter of all global internet traffic at this point. The global demand for server infrastructure in order to deal with the large volume of data is accordingly big. GDS Holdings, an operator of data processing centres in China, is one of the beneficiaries of this situation.

Green technology remains on the growth path irrespective of the corona crisis. Is this the political will to move things along?

That is probably the case. People have changed their angle in China, in the USA, and in Europe (Green Deal). Here, the clear focus is on the expansion of renewable energy from wind and solar sources. In the field of mobility, we have also seen a lot of activity: hydrogen has been increasingly used in public transit (i.e. metropolitan buses) to store renewable energy. The hydrogen stored in pressure tanks generates electrical power with the help of a fuel cell, and this power drives the electric engine of the vehicle. Prominent examples of companies in the ERSTE FUTURE INVEST fund which have bet early on such trends are the energy utility company Iberdrola and the producer of hydrogen pressure tanks, Hexagon Composites.

Many of the applications and processes are linked to the idea of digitisation. To what extent are we all already fully transparent? Have we ended up in an Orwellian reality?

We are not quite there yet, luckily. It is important to critically scrutinise new developments ever so often. From a historic perspective, technological change would bring economic progress. During the Industrial Revolution, steam engines for the first time allowed for the exchange of goods over longer distances. That’s how international trade was created.

Telecommunication facilitated the global exchange of ideas and laid the foundations for current developments. Software platforms enable the users to communicate and collaborate with each other regardless of where they are based. The digital turn offers a lot of potential. However, we do not have to subject every area of life to it. We just see a lot of fields – both professionally and privately – where it makes sense because things become easier and more efficient.

As the name already suggests, ERSTE FUTURE INVEST is a fund that relies on future themes. What are the themes that could make the coming 20 years exciting, and which of those are investable right now?

The Achilles heel of the digital economy is full coverage with stable and fast internet. Some 46% of the global population do not have that sort of access, which impedes the economic development across many countries in Africa and South East Asia. Since ordinary telecoms infrastructure (fibre optics, mobile telephony masts) is very expensive, numerous companies are currently planning on taking internet to even the most remote regions of the world via a system of linked satellites. They communicate via laser while orbiting the Earth at a speed of about 7km/sec. A great technical feat of a handful of highly specialised companies – to ERSTE FUTURE INVEST, the chance to invest early in a promising trend.

Conclusion: in its first year, ERSTE FUTURE INVEST has achieved what many investors had hoped for: a long-term perspective, a broad mix of themes, and the certainty that many pioneering developments are still ahead of us. Participating in megatrends can pay off when adhering to the principle of diversification and keeping a long-term horizon.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.