At a glance

🤝 EU attracts attention with trade deals

🏦 Kevin Warsh nominated as new Fed chairman

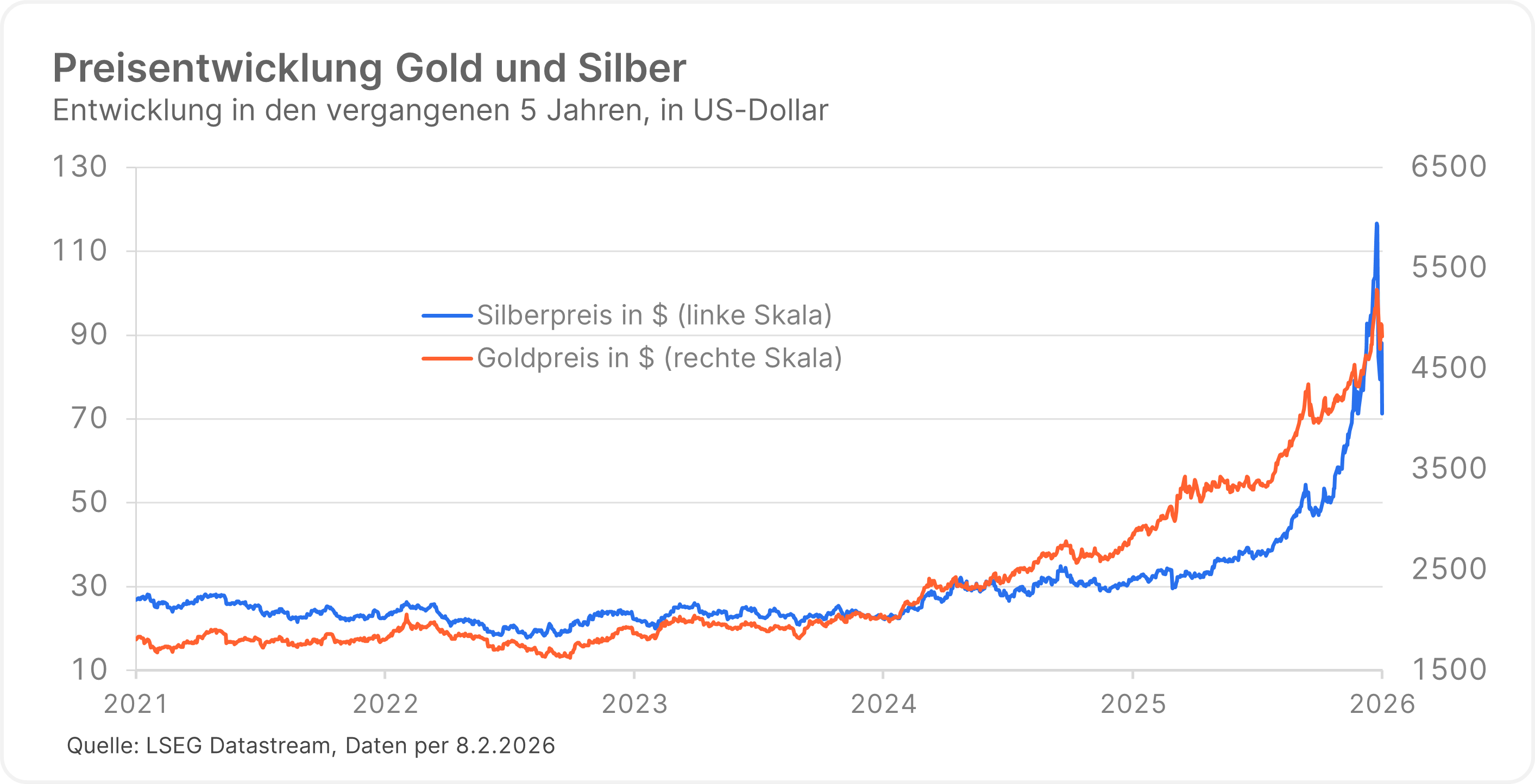

🪙 Gold and silver prices plummet to historic lows

🎢 Volatile reporting season in the US

We are starting the new year in the same way that the old one ended. The flood of news is enormous and the markets are trending positively despite the perceived high level of uncertainty. The nomination of Kevin Warsh as the new Fed chairman recently caused irritation on the markets. Gold and silver experienced a historic sell-off, which was also exacerbated by the previous price decoupling.

As expected, the density of supposedly relevant news remains extremely high. At the beginning of the year, the focus was still entirely on the conflict surrounding Greenland. Even though the discussions had no economic relevance, Donald Trump’s threat to use military force in extreme cases, even against a NATO partner, represented a new dimension. In any case, it was obviously a wake-up call for European leaders, who responded with unity and determination to the US tariff threats. The conflict has calmed down for now, but it will only be a matter of time before Trump starts another row with a new tweet.

This is probably why Europe is trying to broaden its base and is making waves with two new free trade agreements. After more than 20 years of negotiations, agreements have been reached with both the MERCOSUR countries and India. Even though ratification has been delayed due to political resistance, it is a step in the right direction.

New Fed chairman: Now it’s official

For weeks, there has been speculation on the markets about who could succeed Jerome Powell as chair of the US Federal Reserve. At the end of January, Trump revealed the secret. Even though Kevin Warsh had always been considered one of the favorites, the nomination still came as a surprise. Warsh is certainly an accomplished expert who has previously served on the Fed’s governing board.

Nevertheless, the markets reacted negatively. This is primarily because Kevin Warsh is considered a monetary policy hawk due to his previous time at the Federal Reserve. Accordingly, fighting inflation would be his top priority, which would go hand in hand with a restrictive monetary policy – i.e., interest rates that tend to be higher than expected. This is another reason why the US dollar has appreciated since then and gold and silver have experienced a historic price decline.

However, Warsh’s nomination was only the last straw that broke the camel’s back. A loss of 20% for gold and 40% for silver in just two days would be more typical of cryptocurrencies than of an asset commonly classified as a “safe haven.” Trading data and price developments show that (reinforced by private investors) the price has recently increasingly resembled an object of speculation. The correction is beneficial in the long term and, despite high volatility, gold remains an important diversifier in a portfolio context.

Please note: Past performance is no reliable indicator of future value development.

AI stocks: Outside hooey, inside phooey?

Similar to precious metals, software providers have recently taken a beating. Concerns that AI could completely replace companies such as SAP in the future led to a massive price correction. Paradoxically, AI beneficiaries such as Alphabet and Amazon have also suffered recently (Note: the companies listed have been selected as examples and do not constitute investment recommendations). Despite continued strong financial results, the immensely high investment plans in AI infrastructure are viewed critically. The market is currently undergoing a sector rotation, although similar attempts in the recent past were short-lived.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.