The abundance of our times allows for excessive consumption. The amount of clothing, in particular, that is available to us knows no boundaries. Off the shelf or made by designers – we can find everything we want in shops nearby. But how about the working conditions around the jeans and shirts that we like to wear?

Are workers on the other side of the globe paid rates that allow them to make a living? Low wages are just one aspect of a complex supply chain that is being increasingly put into question. A lack of safety measures in the factories and generally low health standards are hard-hitting accusations, and they are coming not the least from investors.

Working conditions and safety standards in the textile industry under scrutiny

Various incidents in the past such as the collapse of the nine-story Rana Plaza structure in Bangladesh in 2013 that was home to five textile factories and killed 1,138 people cast a dubious light on the working conditions and safety standards in the textile industry. Many of the companies there vehemently refused to take responsibility for the shortcomings that had caused the tragic accident and to compensate the affected families financially.

It took more than two years for a compensation agreement between the companies, the government, and the unions to be hammered out (for details, please see the report on publiceye.ch and the Erste AM blog entry “Bangladesh and the current status of the textile industry”). But at least something positive came from the tragedy, even though this will not alleviate the suffering of the people affected.

A change of heart because of corona?

We have seen a change of heart in recent years: both among consumers and investors are increasingly questioning how and under what conditions our clothes are being made, especially in the wake of the corona pandemic. Thousands of corona cases in Italy are due to Chinese immigrants who often work as sole traders for the Italian fashion industry without documents, insurance, or healthcare (source: FAZ, 23 February 2020, “The corona virus and Italy’s relationship with China“).

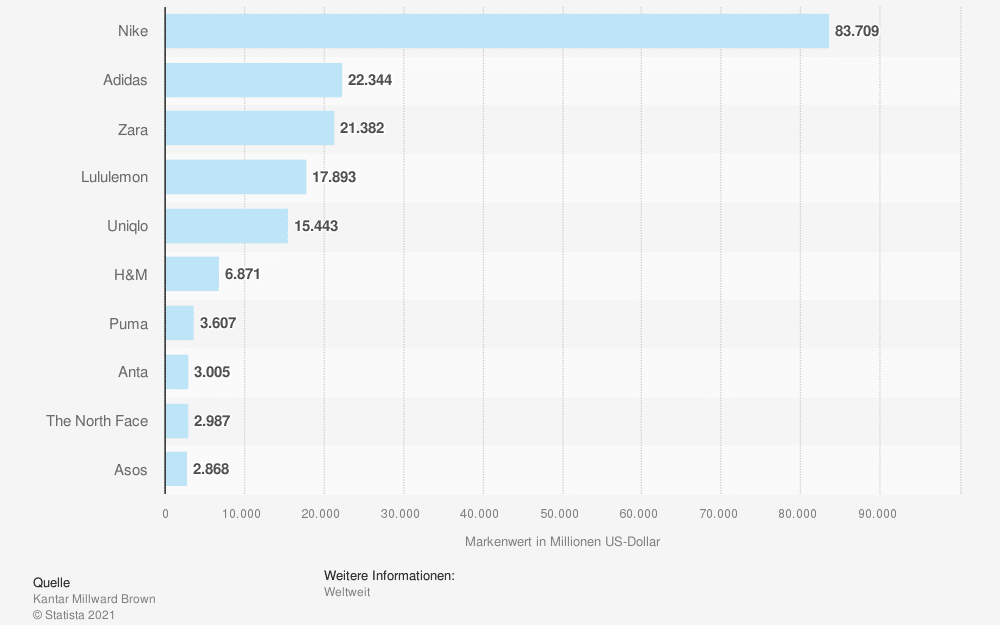

Consumers and investors are increasingly calling out the large textile and sports goods manufacturers. They have come under rising pressure and have been held accountable to take steps in order to prevent basic worker and human rights from being violated. The aggregate brand equity of the most valuable fashion labels in the world amounts to about USD 84bn (see chart). Social media and their influence on consumers exert additional pressure on the companies: any wrongdoing on their part can spread across the world within seconds. A bad image can easily lead to a downgrade. A company that gets involved in a scandal may lose sales and market value.

Brand equity of the most valuable apparel brands worldwide in 2021 (in Mio. US-Dollar)

Government tightens regulation of supply chains

Given the pressure exerted by the public, governments have started to pay attention as well. The German Bundestag, for example, passed a law on 11 June that regulates the commercial prudence in supply chains (i.e. the so-called Supply Chain Act). This Act is meant to obligate German companies to take better responsibility for the respecting of human rights and environmental standards.

As required by the German government, the Act affects the entire supply chain. It also concretises the duty of humanitarian care and environmental protection, to the extent that environmental risk can lead to human rights violations (source: documents from the German Bundestag). The EU also wants to focus more on the duties of humanitarian care of the supply chain. It intends to lay down the guidelines within the framework of a social taxonomy, based on the United Nations Guiding Principles on Business and Human Rights. The Platform on Sustainable Finance, an expert group working for the EU Commission, has published two draft versions of the social taxonomy. It wants to present its final report with its recommendations to the Commission in autumn of 2021.

All these initiatives substantiate the fact that the social aspect (S) is becoming increasingly relevant in investments. The S is one of the pillars of ESG – three letters that symbolise sustainable investing: environmental, social, and governance.

The pandemic has revealed numerous problems but has also created new solidarity in society. Social issues are coming to the fore – and this is where the newly created fund ERSTE FAIR INVEST puts its focus. “We invest in solid and successful companies that also assume responsibility in society. These companies not only do the right thing, they are also economically successful,” explains fund manager Bernhard Selinger.

„By not buying textiles from Bangladesh, you are not helping anyone“

Bernhard Selinger,

Fund manager ERSTE FAIR INVEST

As far as the fashion and textile industry is concerned, it does not help anyone if you just don’t buy goods made in Bangladesh, where the working conditions are bad. This only punishes the locals who make their living from textiles. It is better to call on the companies that buy such textiles wholesale to assume responsibility in the supply chain and to ensure no human rights violations occur.

This will facilitate sustainable improvements for local people. It is what the allocation of ERSTE FAIR INVEST is based on. Adidas and Lululemon Athletica are exemplary in this field. The NGO “Know the Chain” has awarded these two listed companies good ratings with respect to their control over their supply chains and provisions against human right violations.

CONCLUSION: the working conditions and healthcare standards in the supply chain of the textile industry have come under increasing criticism from the public. Catastrophes such as the one in Bangladesh have led companies to change their attitude and have also attracted the interest from governments. ERSTE FAIR INVEST supports improvements.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.