Although volatility and uncertainty remain particularly high in the capital markets, there has been some stabilization and, most recently, a slight recovery in the equity markets since last week. The primary driver for the current investor sentiment is and remains the Ukraine war, where despite the ongoing Russian bombardment of Ukrainian cities, at least on the diplomatic side initial progress is visible. Both Russia and Ukraine have recently shown a willingness to compromise, and especially Putin’s statement that occupation of Ukraine is not his goal gives rise to justified hopes for successful peace negotiations. It seems that the tough economic sanctions imposed by the West are having an effect – with inflation estimated at 12.5% according to the Ministry of Economy, it is therefore hardly surprising that Putin is already preparing the Russians for high unemployment and difficult times ahead.

Commodity markets calmed down

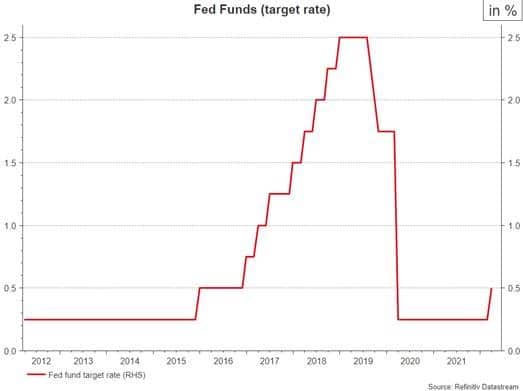

In line with the latest progress, the commodity markets have also calmed down noticeably recently – for example, the price of North Sea Brent crude oil was recently quoted at around USD 100 again after almost USD 140 in the meantime. However, even at these levels, the pressure on inflation will remain high, and for this reason the U.S. Federal Reserve yesterday initiated the interest rate turnaround, as expected. Jerome Powell raised the U.S. key rate by 0.25% and presented himself as a brash fighter against inflation, which shot up in the U.S. to 7.9% recently. After all, 7 interest rate steps are now expected in the coming year. Contrary to the textbook, the stock markets were nevertheless friendly, which is probably mainly due to the fact that the U.S. economy is ultimately also trusted a tighter monetary policy.

Fed Funds (target rate; 2012-2022)

Source: Refinitiv Datastream

China back into the focus

In addition to the influencing factors already mentioned, China has also recently come increasingly back into the focus of investors. On the one hand, the omicron variant is also spreading in the Middle Kingdom, as a result of which numerous regions recently had to go into lockdown due to the zero-covid strategy of the government in Beijing. The Shenzen region, which is home to the world’s third-largest container port and important technology centers, is also at a standstill, for example, thus putting further strain on the already tense supply chain problems. Nevertheless, the local stock markets have been experiencing a real price fireworks in the last few days, after official statements said that the financial markets are to be stabilized, the real estate and technology sectors are to be supported and the economy is to be further stimulated.

Numerous uncertainty factors

Even though the general news situation has gradually improved over the past few days, it is probably still a bit too early for us to increase our risk ratios at the moment. On the one hand, we are quite active and broadly diversified and, on the other hand, numerous uncertainty factors are likely to remain in the short term with regard to the war in Ukraine but also with regard to the economic situation. Volatility is therefore likely to continue.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.