The financial markets started this week with high volatility. The US leading index S&P 500 suffered a loss of more than 2% since Monday, while the European index EuroStoxx 600 is almost 3% lower. Three developments were decisive for the losses:

1. Market participants’ concerns due to disappointing corporate outlooks in the U.S.

2. The war between Russia and Ukraine

3. The impact of the lockdown measures in China.

The corporate reporting season for the first quarter of 2022 is going well, in line with our expectations. Nevertheless, some companies are scaling back their forecasts for the rest of the year, such as General Electric or Netflix.

The technology exchange NASDAQ was particularly hard hit by these developments, suffering a daily loss of almost 4% yesterday. The reason was the nervousness of investors ahead of the corporate results of Alphabet (Google) and Microsoft.

The Google parent company Alphabet actually missed analysts’ expectations after the close of trading due to weaker advertising revenues in Europe and setbacks at the video service YouTube. After the stock exchange closed, the share then fell by about 6%. Microsoft, on the other hand, was able to exceed expectations.

The concerns about the company’s results are also accompanied by an escalation of the confrontation between Russia and Western countries. At a meeting on Tuesday, the U.S. and its allies promised new deliveries of heavy weapons to Ukraine. This was accompanied by Russian Foreign Minister Sergei Lavrov’s statement that the threat of “nuclear war should not be underestimated.” In addition, the Polish gas supplier and the Bulgarian Energy Ministry announced that Russia would cut off its gas supplies today, Wednesday.

This caused a significant increase in gas prices on European energy exchanges. North Sea Brent crude oil also traded higher by 3.3% on the day on Tuesday and currently costs USD 105.7 per barrel.

Chinese equity markets gained in today’s Asian trading session (CSI 300 +2.9%), ending a two-day losing streak after the Chinese government announced further support measures in the form of infrastructure investment. Nevertheless, the CSI 300 is down 3.6% since the beginning of the week as China maintains its zero-tolerance policy on Covid-19.

These developments have strengthened safe haven demand in recent days. The yield on U.S. 10-year government bonds fell about 10 basis points to 2.76% since Monday. Similar declines were also observable in Germany.

What will we observe in the coming days?

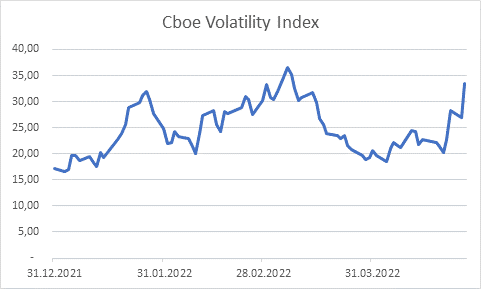

We expect increased volatility in the coming days as well due to the developments described above. The VIX volatility index, which reflects the expected fluctuations of the S&P 500, rose to a level of 33 in the last trading sessions. The high since the beginning of the year was 36. This corresponds to daily movements in the S&P 500 of approximately 2%.

The halt of gas supplies to Poland and also Bulgaria yesterday was a reminder for many market participants that a possible escalation of the war in Ukraine could drive up energy prices, especially in Europe. We will therefore continue to maintain our allocation to gold and commodities in general in our portfolios.

In terms of corporate earnings in the U.S., we continue to see the possibility of disappointment in individual companies. Companies such as Netflix, which benefited from developments during the pandemic, could be particularly affected. Nevertheless, the first quarter reporting season is going well. So far, about 25% of the companies in the S&P 500 have published their results, with 80% exceeding expectations.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.