At the end of May this year, I had the opportunity to attend a conference organized by Bank of America in Seoul, the capital of South Korea. The event offered in-depth insights into the country’s economic and technological developments through panel discussions, direct talks with companies and an impressive factory visit to Doosan Enerbility. Although landmark parliamentary elections were imminent at the time, the mood was characterized by optimism and a spirit of innovation.

Note: The companies mentioned in this article have been selected as examples and do not constitute an investment recommendation.

The conference

The Bank of America conference in Seoul was an inspiring gathering of business leaders, investors and innovators. Panel discussions and direct conversations with companies allowed me to understand the dynamics of the South Korean economy, especially in the field of automation.

The direct talks focused largely on the financial sector. Korean banks naturally play a central role in the South Korean economy. Large banks such as Kookmin Bank, Shinhan Bank and Hana Bank offer comprehensive financial services, from personal accounts to corporate financing. Solid results are expected for Q2 2025 with no major surprises. However, from a bond investor’s perspective, we rate the risk premiums as very low compared to other regions.

The themed presentations in turn focused on advances in automation technology, which plays a key role in industry in South Korea. Unicorn start-ups (non-listed companies with a valuation of at least one billion US dollars) and established companies presented solutions ranging from AI-supported manufacturing automation to autonomous logistics systems. These presentations highlighted how automation strengthens the competitiveness of South Korean industry, particularly in the semiconductor, automotive and shipbuilding sectors.

Doosan Enerbility: pioneer in sustainable energy solutions

A highlight of the conference was the visit to Doosan En erbility’s production facility in Changwon. Doosan Enerbility, founded in 1962, is known worldwide for its expertise in the energy sector . The name “Enerbility” – a combination of “Energy” and “Sustainability” – reflects the company’s commitment to sustainable energy solutions. Upon entering the plant in Changwon (our cell phone camera lenses were glued, by the way), we were impressed by the sheer size and organization of the facility, which even includes its own restaurant and hotel for customers.

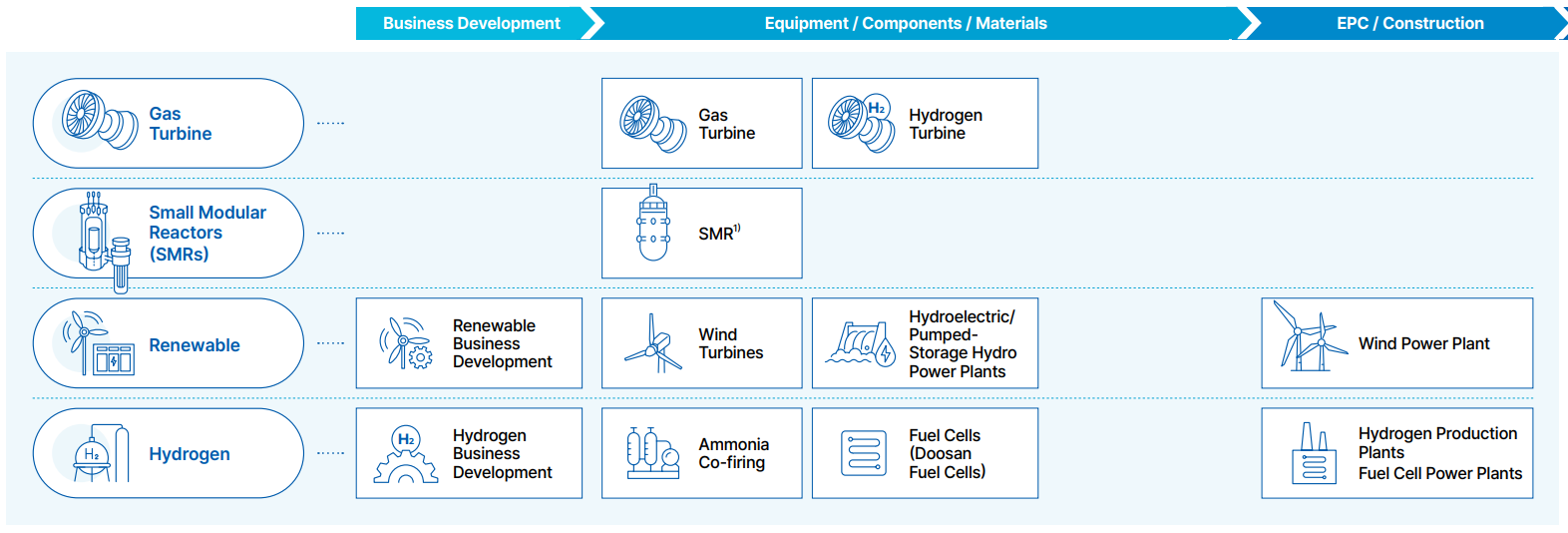

Doosan Enerbility is focusing on four key growth areas:

- Gas turbines

- renewable energies

- Hydrogen

- and Small Modular Reactors (SMRs).

Doosan Enerbility’s growth areas and value chain at a glance. Source: Doosan Enerbility

The plant is a center for state-of-the-art manufacturing technologies, including the production of steam turbines, generators, boilers and components for nuclear power plants. The 3D printing factory, which according to Doosan is the largest of its kind in South Korea, was particularly fascinating. High-precision components for gas turbines and prototypes for the aerospace and defense industry are produced here. The use of 3D printing since 2014 shows how advanced Doosan is in the integration of modern technologies.

Global Player

With projects in over 40 countries and a strong presence in Asia, Europe, the Middle East and North America, Doosan Enerbility is a global player in heavy industry. In the field of hydrogen, the company is working on the development of hydrogen gas turbines and has launched Korea’s first hydrogen liquefaction plant project. These efforts underscore Doosan’s commitment to the energy transition. During the tour, an engineer explained in detail the forging process for reactor pressure vessels, in which temperatures of around 1,260 °C are reached. The passion and expertise of the employees was palpable, and it was impressive to see how craftsmanship and high-tech production go hand in hand.

Another highlight was the visit to the foundry and forging workshop, where huge metal components for power plants are manufactured. The precision with which these components are produced for demanding environments such as nuclear power plants or offshore wind farms was remarkable. The factory visit made it clear that Doosan Enerbility is not only focusing on nuclear energy, but is also investing in renewable energy and hydrogen technologies, with automation playing a central role.

Please note: Investing in securities entails risk and advantages.

Economic prospects

Doosan Enerbility’s economic situation is promising. For the second quarter of 2025, operating profit is expected to be around twice as high as in the previous quarter. These expectations are driven by a robust order situation.

The company secured significant contracts, including an order worth KRW 964 billion (approx. USD 700 million) and supply contracts for gas turbines in Saudi Arabia worth KRW 340 billion (approx. USD 248 million). These contracts cover the supply of steam turbines and generators for power plant projects.

The recent elections have reduced the political uncertainty in South Korea, which had previously weighed on the markets. President Lee’s ambitious KRW 45.6 trillion fiscal program aims to boost the South Korean economy in the second half of 2025 through large-scale measures. These include universal cash payments to citizens, support for small and medium-sized enterprises (SMEs), promotion of the AI sector and investment in infrastructure. This expansionary fiscal policy is intended to stimulate private consumption and investment while reducing the pressure on the Bank of Korea (BoK) to take immediate monetary policy measures.

The gross supply of Korean government bonds will increase by around 45% in 2025 compared to the previous year, which is due to high spending. The KOSPI, South Korea’s benchmark index, has recorded strong growth of around 33% since the start of the year, making it the best-performing market in Asia. This could dampen demand for government bonds. The Bank of Korea is likely to adopt a wait-and-see approach, as the fiscal stimulus will allow it to act cautiously in the face of persistent inflation risks.

Note: Past performance is not a reliable indicator of future performance.

Conclusion: South Korea at the forefront of automation

The Bank of America conference in Seoul was an inspiring experience that highlighted South Korea’s innovative strength in the field of automation. The plant visit to Doosan Enerbility showed how automation in heavy industry promotes efficiency and sustainability.

With a stable political environment and a clear focus on research and development, South Korea is well positioned to shape the future of the industry. Doosan Enerbility exemplifies the combination of tradition and innovation by utilizing automation to play a leading role in nuclear and renewable energy.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.