Table of contents

- Approaching the end of the hiking cycle in developed markets

- Growing nervousness about the US debt ceiling

- Investors’ views on emerging markets

- Geopolitical uncertainties as a significant risk factor

- Conclusion

In April, the International Monetary Fund/World Bank Group spring meetings in conjunction with a conference organised by J.P. Morgan for investors focusing on emerging and frontier markets took place in Washington D.C. and I participated on behalf of Erste Asset Management.

Thanks to a wide range of high-ranking representatives from the financial sector, various emerging market countries’ governments and central banks, think tanks, media and academics, the meetings offer highly valuable insights into current and upcoming global concerns in both economics and politics. Moreover, the conference serves as a platform for investors covering emerging markets to exchange thoughts and views.

Among all the diverse subjects which were covered throughout the panel discussions and interviews, the following topics have represented the most outstanding and shared global concerns among the conference’s participants as also highlighted at the closure of the event.

Approaching the end of the hiking cycle in developed markets

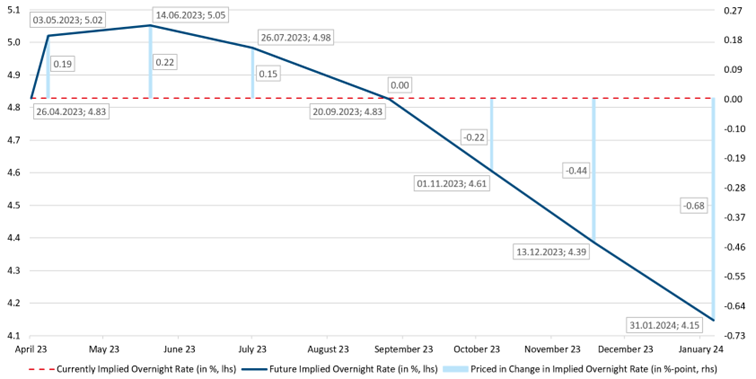

Despite the fact that markets are currently pricing in cuts in the key policy rates across developed markets during the second half of 2023, it is rather unlikely that such an action will be undertaken by the Fed before a recession materialises in the US economy as the inflation remains too elevated. The consequence is that terminal rates across developed markets will both establish themselves on even higher levels to reach a new equilibrium and will remain there for a longer period than currently anticipated. As of now, the market consensus is that the US federal funds effective rate will reach a peak of 5.05% by the FOMC meeting on 14 June and afterwards decline already by the next scheduled meeting in July to reach a level of 4.15% at the beginning of 2024 (Figure 1).

Figure 1: Priced in policy rate hikes and cuts for the USA as of 26 April 2023. The magnitude of hikes and cuts are implied using Fed fund futures. Any bar above (below) the currently implied overnight rate, which represents the US federal funds effective rate (currently at 4.83%) and acts as a reference level here, depicts a hike (cut) in the federal funds target rate’s upper bound (currently at 5%). The values next to the bars constitute the expected percentage point change in the implied overnight rate. The dates within the boxes are those of the next FOMC meetings and the values behind are the post-meeting implied overnight rates. Data source: Bloomberg. Chart: Own chart.

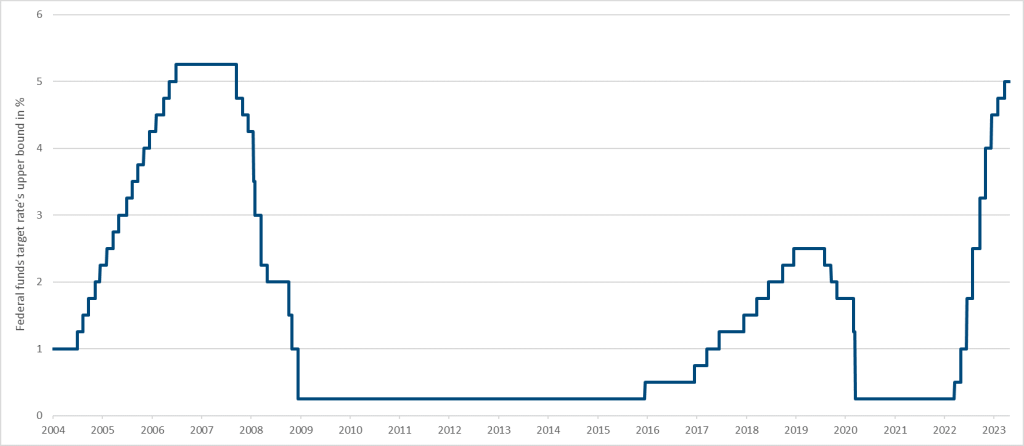

As a reference, the time series of the federal funds target rate’s upper bound is illustrated in Figure 2. Since March 2022, the Fed has raised this key interest rate from its historical low of 0.25% to the current level of 5.00% in just twelve months. Thereby, the US key interest rate is almost back to the level of 2007 (5.25 %), the peak at that time shortly before the onset of the global financial crisis.

Figure 2: Time series of the federal funds target rate’s upper bound in percent since January 2004 as of 26 April 2023. Data source: Bloomberg. Chart: Own chart

According to the results of a survey conducted among the conference participants, more than nine out of ten respondents expect that the aforementioned US recession will set in during the first half of 2024 at the latest. Despite this assessment and the recent troubles caused by the global banking crisis earlier this year, the US economy still appears to be robust and a terminal rate of 5.25% might turn out to be not restrictive enough to slow down the economic pace as much as required to prevent it from overheating.

Growing nervousness about the US debt ceiling

In contrast, three months after the US debt ceiling has been reached in January, anxiety around the potential of an unprecedented US default continues growing. The Treasury Department’s “extraordinary measures”, which ensure that the government can still service its payment obligations, buy time until early June, although it is likely that this deadline could be stretched out by a couple of weeks. Suggestions, on how to circumvent a negotiated solution with the US Congress, do not seem to be viable and therefore the US government eventually has to find a compromise with the opposition.

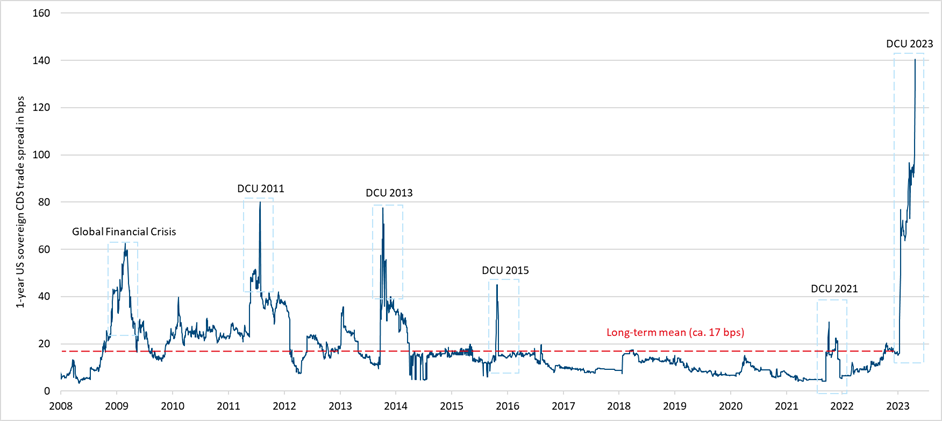

Figure 3: Spikes in the 1-year US sovereign credit default swap (CDS) trade spread during times of debt ceiling uncertainty (DCU) as of 26 April 2023. The long-term mean of the CDS trade spread is calculated using data from January 2008 until December 2022. Data source: Bloomberg. Chart: Own chart.

As depicted in Figure 3, the 1-year US sovereign CDS spreads have been strongly sensitive to debt ceiling uncertainties.

What are CDSs?

A CDS is a credit derivative concluded between two parties that enables trading in default risks of bonds, loans or debtors. The protection buyer pays a premium (spread) to the protection seller and receives a compensation payment from the protection seller if the debtor is unable to pay his debt. The CDS spread thus reflects the market price for the credit risk.

The famous cases of 2011 and 2013, when similar situations prevailed like now, the trade spread rose up to 80 basis points (bps). In comparison, the debt ceiling uncertainties in 2015 and 2021, which are considered to have been no close calls with respect to the debt limit, also caused the spread to rise considerably above the long-term average of circa 17 bps. The global financial crisis and the accompanying spike in the spread serves as a good benchmark to assess the significance of the spikes due to debt ceiling uncertainties. The current rise in the spread, with a level of 140 bps, has to be put into perspective, accordingly, namely signalling a considerably higher risk of a technical default on US treasuries than during the last debt ceiling uncertainties. This risk also poses a threat to emerging markets as the they would be impacted negatively through indirect spill over effects.

Furthermore, some government representatives and monetary policymakers signalled that any threat to their local financial stability would be addressed timely and swiftly although there are currently no significant signs that such a risk is looming. Nevertheless, well-founded worries subsist that substantial parts of the respective economies, which rely on and survived thanks to a low interest rate environment, might get into trouble due to tighter credit conditions.

Investors’ views on emerging markets

Most of the investors at the conference expect that the USD will end down more than 2% against an overall basket of emerging market currencies at the end of the year. Almost a quarter of the respondents anticipate that bonds denominated in emerging markets currencies with unhedged FX exposure will post the best performance in USD terms this year, followed by cash. On the contrary, the worst performance in USD terms is expected for global equities by a third of the interviewees, with Japanese government bonds coming in second.

With respect to emerging market assets, more than a third of the investors stated that they are mostly prone to increase their exposure towards local rates whereas hard currency sovereign bonds were ranked second by a fifth whilst hard currency corporate bonds came in last. Considering geographic regions, Mexico, Brazil and the frontier markets in general turned out to be the biggest favourites, being chosen by almost one in three, five and ten respondents, respectively. On the other hand, when asked to name the region where the investors will most likely reduce their exposure in, nearly thirty percent ranked China first.

One of the most interesting results was that, albeit half of the respondents stating that they do not have any ESG allocations in their investment portfolios which is rather the norm with respect to emerging markets, one third of them planned on increasing their stakes in ESG-conform assets. This might be interpreted as a sign that even investors focusing on developing markets have started to regard the ESG trend as becoming more and more important in their field of investments, too.

The de-globalisation and realignment of current supply chains is seen as the most relevant investment theme over the next five years. Regarding the energy market, which plays a crucial role in the balance of payments of many emerging markets, more than 90 percent of the interviewees assess that the price of Brent oil will stay below USD 90 per barrel at the end of the year.

Geopolitical uncertainties as a significant risk factor

Additional to economic worries, the political relationship between the USA and China is still very much constrained. One of the biggest issues in this respect is the diminishing degree of communication between the two sides which enhances the probability of an unintentional incident which might grow larger to end up in an open confrontation between the two countries. Therefore, the reestablishment of direct communication channels at the top level of diplomacy to avoid misunderstandings appears to be crucial now.

On the other hand, the war between Ukraine and Russia has reached a stalemate and is widely regarded as a frozen conflict. Western governments are likely to continue supporting Ukraine both in economic and military means. Nevertheless, as of today, political analysts regard the possibility of a Ukrainian outright win as unlikely. The same holds true for Russia, as the latter is also unlikely to determine the outcome using force. Thus, eventually, a political solution to the conflict appears to be more likely despite the contrary political positions of both countries.

Conclusion

This year’s convention was mostly dominated by concerns around developed market central banks’ future path with respect to their monetary policies and the subsequent impact on emerging market economies. A widespread recession among many developed markets seems to be likely for the near future, whilst the global economy is likely to remain resilient and avoid a sharp downturn despite reaching only moderate growth rates. Furthermore, political tensions around the world add to the economic uncertainty.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.