In recent years, ESG factors have become increasingly important for companies to consider in their decision-making process. Many businesses recognise the importance of sustainable practices and seek ways to improve their ESG performance. One such way is through the use of an app.

At Erste Asset Management, we have developed the “ESGenius” App that helps us to track and report our ESG activities, like, for example, our engagements. We document our engagement activities across three channels:

- Engagements with local companies

- Collaborative engagements

- Thematic dialogues with companies

This allows us to track the sustainable practices of companies over time, identify areas of improvement, and allocate resources accordingly. Moreover, this section provides us with the functionality to evaluate the effectiveness of our engagement efforts and adjust our approach, as necessary.

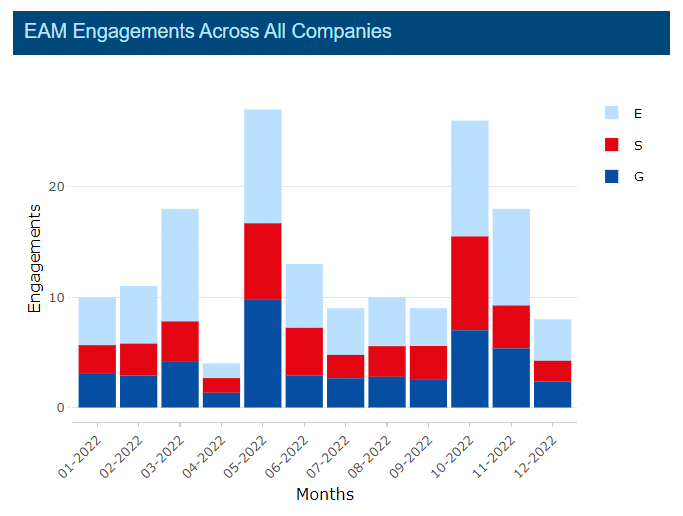

In the following, please find an overview of our engagement activities in 2022:

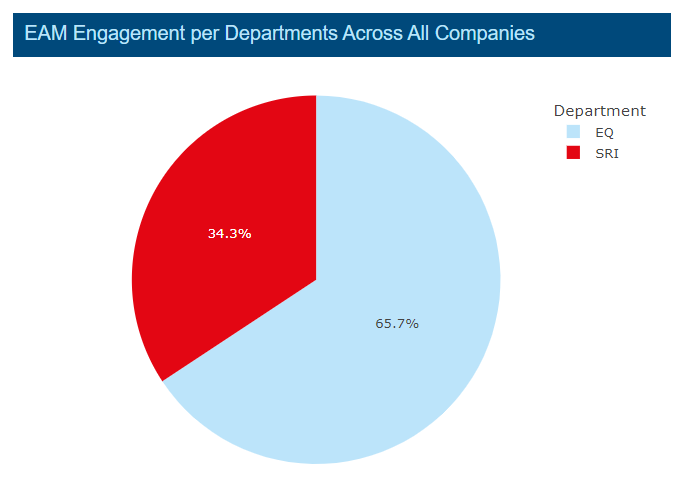

As shown in the graph, last year, two thirds of our engagement activity was conducted by our fund managers from the Equity team, while one third was carried out by the Responsible Investment team, with environmental topics as a primary focus.

To effectively use the information in the app, we have decided in favour of a form of reporting that drills down to a detailed, meeting-specific level. It includes information on the number and names of managers/analysts who joined the meeting, notes on the logistics of the meeting (virtual, face-to-face or e-mail), more detailed information on the contents and whether E, S, or G areas were tackled. On the basis of this documentation we can follow up and proceed with what has already been discussed.

An engagement that was documented very well in our App focused on cleantech companies and was organised by our partner Sustainalytics. Erste AM, together with other investors, met 20 cleantech companies (mostly virtually) in 2022. We discussed a wide range of ESG agendas, such as the traceability of (local) raw materials sourcing and supplier audits, water management, diversity matters, and ESG reporting.

Cleantech: Sustainable products, sustainable value chain?

Clean technologies are important to combat climate change and to fulfil economic and societal needs. That being said, they also create environmental and social challenges along the various stages of the value chain. The aim of our collaborative engagement activities was to support and encourage companies operating in the cleantech industry to pay the necessary attention to all stages of the supply chain.

In this context it is crucial for companies to respect the human rights of local communities and to fully consider the environmental impact of their production processes at various sites, of the raw materials they source, and of the renewable energy they generate (if any). Likewise, basic labour rights of employees, such as healthy and safe working conditions, the freedom of association, the right to collective bargaining, and the prevention and/or containment of child or forced labour, must be ensured in plants and factories by means of comprehensive processes. Sustainable products are only sustainable if their impact across all stages of the value chain is taken into account.

The companies we have engaged with are headquartered in China, Japan, South Korea, the United States, Denmark, France, Germany, Switzerland, and the UK. Geopolitical tensions and cultural differences aside, the engaged companies share a sense of urgency for the sustainability agenda and support a low-carbon and socially just economy. The internationally escalated accusations of large-scale forced labour practices in the Chinese Province of Xinjiang also affected this engagement.

Engagement case study: First Solar

One of the companies we have engaged with several times in recent years, is First Solar. In 2022 we met representatives of the company in two virtual meetings and discussed a wide range of ESG topics with the main focus still on climate and social challenges: to monitor social performance in the supply chain, First Solar screens its suppliers for example on the basis of the cleanliness and safety of their facilities, minimum wages, working hours, health & safety practices, non-discrimination, and conflict minerals.

For the cases where non-compliance with one of these factors was identified, corrective action plans were put in place at the specific location. This was meant to ensure that for example the requirements concerning working hours were being fulfilled or that emergency response programmes were being improved. First Solar also requires its suppliers to adhere to the RBA (Responsible Business Alliance) code of conduct, which covers health and safety in detail.

Our engagement with Schneider Electric

Another cleantech company we engaged with was Schneider Electric: in March 2022 we held a call with the company, represented by Schneider’s Group Sustainability department and Investor Relations department. For the 2021-2025 period, the new Schneider Sustainability Impact (SSI) programme has been implemented, focusing on numerous transformative initiatives established to help meet the company’s 2025 climate-related targets. “The Zero Carbon Project”, which is a part of the programme, aims to partner with 1,000 suppliers which are responsible for 70% of Schneider Electric’s upstream carbon emissions to support the global transition to a low carbon future. As part of the project, future carbon emissions (covering scope 1&2) of partnering suppliers should be reduced by 50% by the year 2025.

As documented in our App, the parameters of this project have also been discussed in former meetings with the company. We were able to ask the company pertinent questions, such as for example how the “best” suppliers (in terms of carbon transition) could be or indeed were rewarded and what co-operative alliances could be of interest in this regard.

Conclusion: improved ESG performance thanks to our ESGenius App

Thanks to this and similar features of our ESGenius App, we can make informed decisions and take action to improve our ESG performance. In particular, the engagement section provides valuable insights that help us identify areas where we need to divest assets in case companies are not putting enough effort into improving their sustainable practices. Overall, our ESGenius App plays a critical role in our commitment to sustainable practices and responsible corporate behaviour.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.