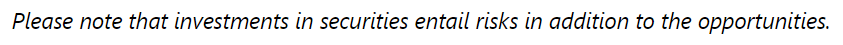

Despite inflation and high interest rates, the latest market research data gives hope for another strong US holiday season. Based on an economic forecast model, the National Retail Federation (NRF) expects sales of between USD 957bn and 967bn for the holiday season from November to December. This would represent growth of 3 to 4 per cent compared to the previous year’s holiday sales. According to a market study published in September, management consultant firm Deloitte is forecasting sales of between USD 1.54tn and 1.56tn and an increase in sales of 3.5 to 4.6 per cent for the period from November to January.

Holiday Sales in the US

As of 06.11.2023; Note: Past performance is not a reliable indicator for future performance. Prognoses are not a reliable indicator for future performance.

Not only retailers, but also the stock markets are hoping for strong holiday business in the US. Unlike in more export-orientated countries, domestic consumption is a crucial factor for the world’s largest economy. The retail sector plays a special role here, and holiday sales in particular. The latest retail data gives further cause for optimism. In September, US retail sales rose by 0.7 per cent compared to the previous month, significantly more than expected.

According to Deloitte and NRF, the solid labour market now also gives hope for strong holiday business. According to an opinion poll commissioned by the NRF, Americans intend to spend an average of around USD 875 on gifts, food and decorations for Christmas this year, 42 dollars more than last year.

Growth rates in holiday sales expected to return to pre-pandemic levels

According to Deloitte and NRF forecasts, sales are therefore likely to reach record heights again, although growth rates will be significantly more moderate than in the previous year. The Deloitte experts attribute this to lower price increases, while the savings accrued during the pandemic are also likely slowly running out.

The NRF analysts see the more moderate growth rates as a return to normality after the shopping boom during the pandemic driven by the stimulus package. According to NRF figures, holiday sales growth averaged 3.6 per cent in the years from 2010 to 2019.

Continuing boom in online retail sales

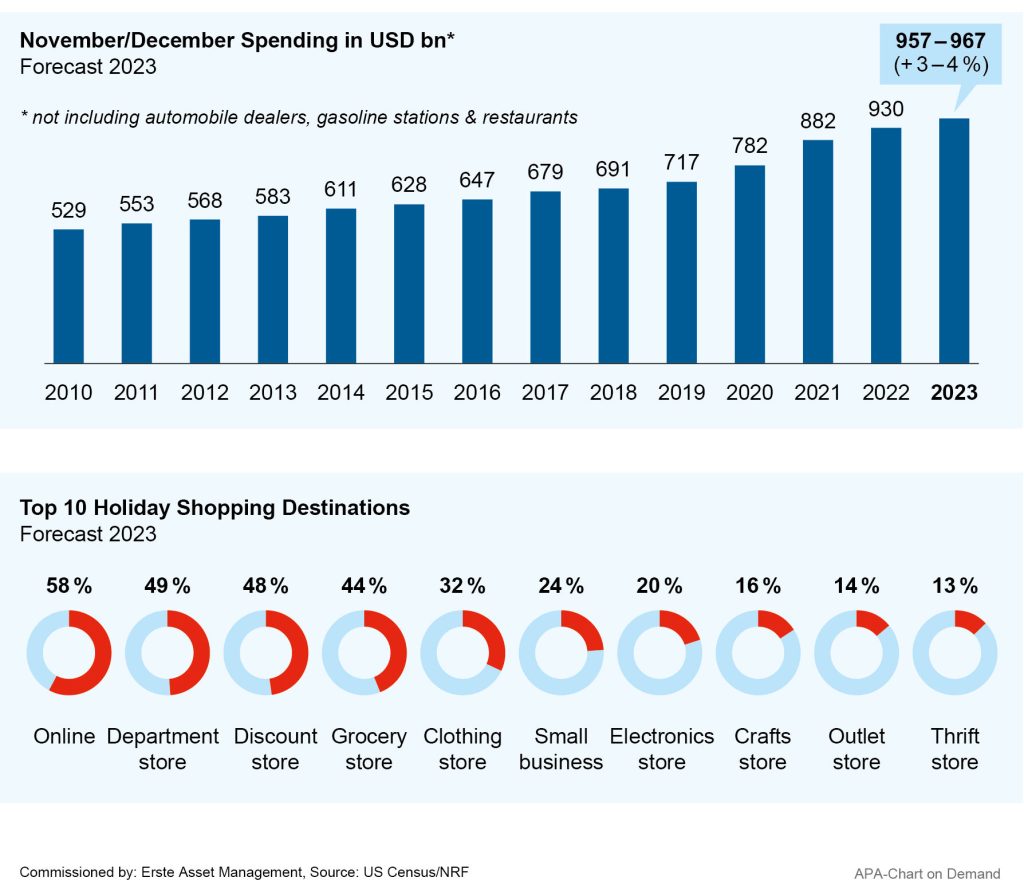

Online sales are also expected to reach new record levels, increasing online’s share of overall business further. According to the NRF opinion poll, 58 per cent of Americans intend to do their Christmas shopping online this year. The boom in online retail during the Covid lockdowns very likely had a lasting impact on consumer behaviour, according to the NRF experts.

The NRF forecast model shows growth in sales outside physical shops of between 7 and 9 per cent to between USD 274bn and 279bn for the holiday season. Deloitte predicts an increase in e-commerce of 10.3 to 12.8 per cent to USD 278bn to 284bn for November to January. The market researchers at Adobe Analytics expect online sales to increase by 4.8 per cent to around USD 222bn between November and December.

According to the Adobe data, consumers are likely to spend more money via mobile devices than via desktop devices for the first time. The bottom line is that the share of online sales is likely to increase in almost all key product categories, with only clothing expected to see something of a return to the in-store shopping experience.

According to Adobe, this year’s online boom is likely fuelled by special offers with record discounts and flexible payment options. “Buy now, pay later” has become mainstream, according to the Adobe experts. In addition, discounts are at unprecedented levels. During Cyber Week alone special offers are expected to generate online sales of 37.2 billion for retailers – 5.4 per cent more than in the previous year.

Expected top sellers: Lego, Barbie, PlayStation, iPhones – and Birkenstock sandals

Adobe expects the strongest special offers for toys, electronic products and clothing. Accordingly, Adobe analysts expect toys such as Lego or products tying into the Barbie film, games consoles such as Sony’s PlayStation 5 and Xbox as well as the iPhone 15, headphones and e-readers to be among this year’s holiday business bestsellers.

This year’s Adobe list also includes Birkenstock sandals among the expected bestsellers. The shoes made by the long-standing company based in Germany have recently become really hip in the US. The Barbie film, in which the iconic main character wears Birkenstock sandals in several scenes, also contributed to the surge in popularity. The shoe manufacturer’s owners recently capitalised on the Barbie hype with an IPO and floated Birkenstock shares on the New York Stock Exchange in October.

How to invest in the US stock market?

ERSTE RESPONSIBLE STOCK AMERICA includes some of the largest and highest-turnover US consumer goods companies. The fund invests exclusively in the US equity market. In addition, the responsible sustainability criteria of Erste Asset Management apply to the investment process. The fund is therefore suitable for investors who wish to invest in the US equity market in a sustainable manner. Please note, however, that investing in securities involves risks as well as opportunities.

Notes ERSTE RESPONSIBLE STOCK AMERICA

Advantages for the investor

- Broadly diversified investment in North American stocks (US and Canada).

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK AMERICA as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK AMERICA, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK AMERICA as described in the Fund Documents.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.