At the beginning of September, the FED announced a significant change in their policy: They officially announced the implementation of “average inflation targeting”. This allows to have a higher inflation rate for a period of time instead of being closely held to the target inflation rate of 2%.

Why did the FED announce this shift in its policy? Is inflation returning in the agenda? In this article, we intend to show the policy requirements for high(er) inflation.

Crisis mode: Governments and Central banks had to react

The pandemic brought a sharp downturn of the global economy. In order to restore economic welfare, the Central banks offering full monetary support. At the same time, governments implemented fiscal policy tools – huge stimulus packages.

- These rescue packages result in huge budget deficits. The OECD expects fiscal primary deficits of more than 10% in their member countries this year. This will lead to rise in government debt in % of GDP by estimated 28 %-Points.

- It is widely expected that the spending programs will be extended in the next years. This will result in additional debt.

- The financing of these measures is essentially done by the central banks. Since the begin of the crisis, the big 4 central banks (US FED, ECB, BoE, BoJ) have expanded their balance sheets by purchasing assets worth 3,7 trn USD.

- The major central banks also continue to be the largest purchaser of governmental debt – regardless of the yield. Therefore, the long-term interest rates of its member states remain low despite soaring amounts of issued debt.

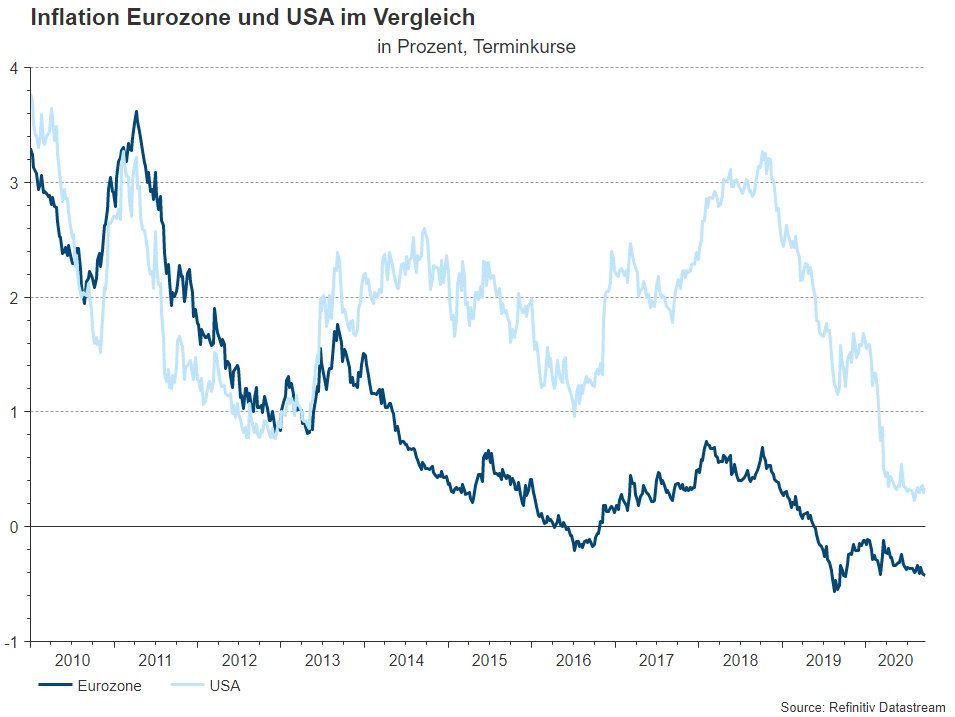

Interestingly, these monetary and fiscal interventions had a limited effect on inflation. There has been no rise of the CPI in major countries since the beginning of the pandemic.

A economic new approach on the rise

At first glance, it seems that the authorities just did what had to be done. But we assume that out of this crisis a new economic approach – a paradigm shift – emerges. This shift will affect governments (fiscal side) and central banks (monetary side).

a) Fiscal Side

- The pandemic was the “Whatever it takes”-moment for governments. They reacted with massive spending. As a result, austerity is no virtue anymore.

- The general public is in favour of those measures. In contrast to the global financial crisis in 2008, when support was “only” used for financial institutions, most parts of the population benefit directly now.

- As a result, it becomes possible for governments to handle a much higher level of debt and primary deficits in local currency. And we assume that governments are willing to do so.

b) Monetary Side – expansion of the toolbox

- To keep interest rates low, central banks can introduce “yield curve control”. Low interest rates would reduce the Interest payments by the government despite an increase in debt. We assume low or even negative interest rates in the major economies for the time being.

- In addition, the threat of rising inflation can be mitigated with the concept of “Average inflation targeting”. Central banks would get more flexible on the target rate without having to give up their credibility completely.

- There is limited alternative for investors: All four major central banks face the same economic challenges. By providing similar monetary solutions, investors can not “escape” from low interest rates. The majority wants to be invested in developed markets.

The path to high inflation – and back

In order to see rising inflation, the current fiscal and monetary measures would have to be extended:

- Even after a significant rebound of the economy, governments and central banks would stick to the chosen path. Neither side wanted to be blamed for “killing” the recovery.

- A rise in inflation would very likely be a result of rising labour costs. This would require a return to full employment and a continuation of economy growth.

- If high inflation rates arise, they would stay for sometime in our opinion. High inflation would be beneficiary for governments as the level of debt in % of GDP is reduced.

- Finally, the authorities would have to stop the party: Governments would stop the fiscal measures (primary deficits) while central banks would raise interest rates, stop yield curve control measures as well as bond purchasing programs.

Is it a likely scenario?

We recognise a significant change by the central banks in their view of inflation. The announcement of the FED could be seen as opening the path to higher inflation. We would also expect similar statements of other major central banks.

As a result, the current “Zeitgeist” on the fiscal side as well as the usage of instruments on the monetary side could lead to higher inflation in the mid-term.

However, as long as high inflation is tolerated for a short period of time only, the overall macro-economic effects could be positive. It goes without saying that this is a risky path – the central banks must closely monitor the situation and act on a very short-term basis if necessary.

Risk note: Past performance is not a reliable indicator of the future performance.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.