During the global pandemic, the most important central banks loosened their already expansive monetary policies further and thus stepped up money supply again. They are doing everything to ensure that the global economy picks up momentum after months of hard constraints. This strategy has been particularly successful in the USA and in China. Some sectors such as the semiconductor industry can hardly keep up with demand. All of a sudden, inflation has become a topic. Investors who want to absorb a strong increase in prices can do so via various routes: with equities or with real assets such real estate or gold.

The ERSTE REAL ASSETS fund, currently available for subscription, offers investors a mix of about 50% of global equities, 17% real estate funds, and 33% gold (mostly in the shape of exchange-traded commodities (ETCs)).

Today, we want to look at the role of gold in the portfolio and have asked the gold expert from Erste Group Research, Hans Engel, for an assessment.

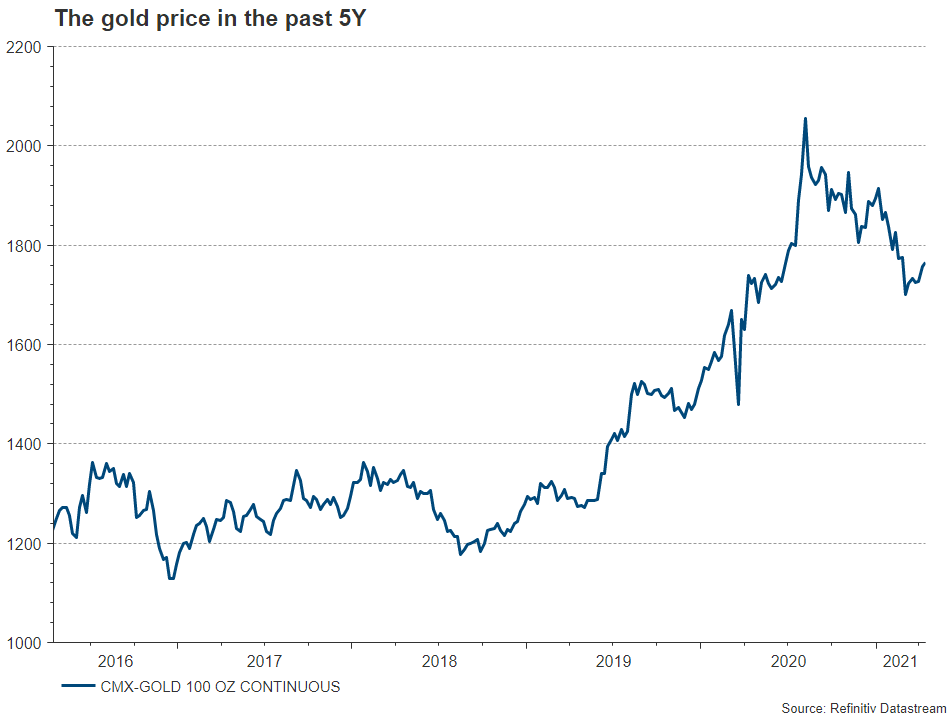

The gold price fell by 5.9% in the first quarter (in euro terms). Given that gold is an asset that is supposed to excel in stability, that is quite a bit. Has gold lost its shimmer?

We have to see the bigger picture here. In the almost five years from the end of 2015 to August of 2020, the price of gold nearly doubled. The current consolidation in the wake of years of outperformance is therefore not all that surprising. I would even call it healthy. Gold also outperformed most stock exchanges last year: the gold price (in USD) increased by 24%, whereas the broad US equity market only gained 16%.

What was the reason for the decline in Q1? What factors were decisive?

The decline of the gold price was largely caused by the fact that investors shifted their funds to a significant degree into riskier asset classes such as equities or corporate bonds in view of the expected economic development this year. Gold was less in demand in such an environment. Government bond prices also came under pressure, which led to rising yields in the USA. This caused the opportunity cost of holding gold to rise.

Can you contextualise the topic of inflation – or inflation expectation – and gold?

The rate of inflation is higher and more volatile this year, which leads to fluctuating real yields. The lower real yields are, the more significantly the gold price reacts by spiking. However, the price-driving effect is not as strong as it was during times of negative real yields. A drastic increase in yields is unlikely, given that the global central banks will probably not raise their key-lending rates for several more years due to the low rate of inflation. The massive volume of government bond purchases by the central banks will keep yields low.

How has gold demand developed in recent months?

We have a full set of data available until the end of 2020. In Q4 2020, demand was down 28% relative to Q4 2019. Due to the effects of the spreading of COVID-19 and the rise in the price of gold, jewellery demand fell by 13% during the same period of time. However, the sales of bullions and coins increased by 10%. The global central banks stepped up their holdings marginally. Consolidation has continued this year: in March, global gold ETFs lost 107.5 tonnes (i.e. USD 5.9bn, or 2.9% of assets under management) and thus recorded an outflow in the fourth month of five. According to the World Gold Council, assets held in gold worldwide amount to USD 194.5bn or 3,574 tonnes, which is equal to the numbers of June 2020. Since the high of assets held in gold in November 2020, holdings of ETFs have fallen by almost 9% in tonnes, which is more or less in line with the decline in the price of gold during that period.

Would you say that after its consolidation, the gold price has bottomed out? Could demand pick up in the coming months, and if so, why?

I have no crystal ball and there are driving factors that can change quickly, e.g. the surprisingly fast rise in US Treasury yields. Gold is currently attractive mainly for reasons of diversification. An uptick in the volatility of equity markets in the coming months should result in the foreseeable stabilisation of the gold price. We expect a slight increase in the price of gold for Q2 to a range of USD 1,750 to USD 1,780. In the long run, the gold price should move in a moderate upward. This means there is some upward potential.

Legal note:

Prognoses are no reliable indicator for future performance.

Risk notes according to 2011 Austrian Investment Fund Act:

ERSTE REAL ASSETS may make significant investments in investment funds (UCITS, UCI) pursuant to section 71 of the 2011 Austrian Investment Fund Act.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.