Germany will elect a new Bundestag (Federal Parliament) on 26 September 2021. For the first time in 16 years, it will be an election without Angela Merkel running for office. The media focus is currently on the three parties that are ahead in the polls, i.e. SPD, CDU/CSU, and the Greens. After two out of three scheduled TV debates, 75% of voters seem to have come to a decision.

SPD and the Greens would record drastic gains relative to the 2017 elections, whereas CDU/CSU would incur heavy losses. But recent weeks have shown that peaks in polls are fickle and the potential for significant changes is still there.

Trend and reversal

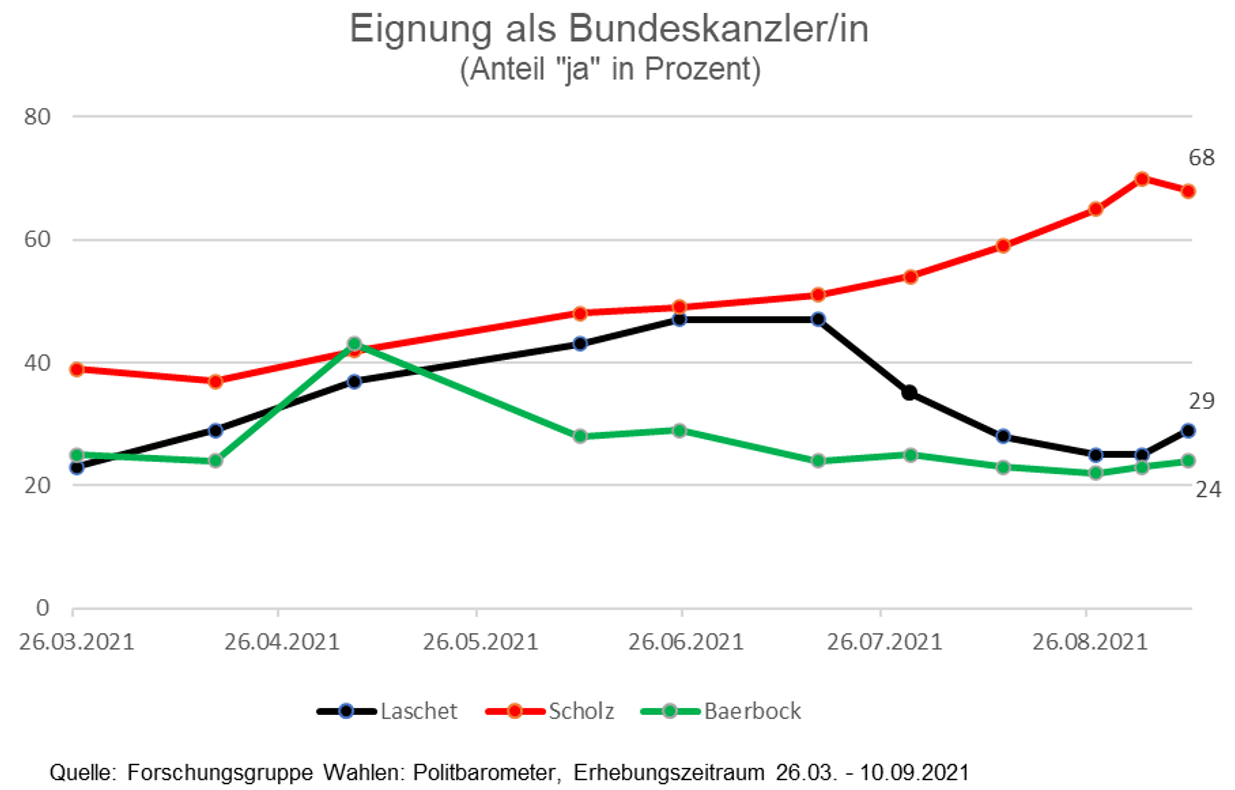

Throughout the election campaign, the three leading parties, i.e. SPD, CDU/CSU, and the Greens, have gone through a rollercoaster of voter confidence. The poll ratings of Annalena Baerbock (the Greens) have slumped from a peak in April that suggested a possible election win on the back of an embellished CV, ancillary income, and accusations of plagiarism. At this point, a win seems to be illusory despite the significance of environmental protection as important factor in voting and the statistical margin of error.

Olaf Scholz (SPD, Minister of Finance) has only been supported by positive sentiment for a few weeks. In recent days, critics have been piling on accusations though (shortcomings in the Wirecard scandal, Cum-Ex transactions with MM Warburg, investigation launched by federal prosecution against a finance state secretary). This could lead to an abrupt end of favourable polling results.

Armin Laschet (CDU/CSU, Minister-President of North Rhine-Westphalia) has had to dodge “friendly fire” ever since his election as top candidate. Public criticism of the corona policy under Angela Merkel and gaffes at public appearances during the flood catastrophe in North Rhine-Westphalia in July have cost him the lead in recent polls.

The persistently weak poll ratings of CDU/CSU and their candidate for chancellor have caused a change of heart within the political alliance. An appearance with the eternal opponent Markus Söder and joint campaign events with Angela Merkel are meant to bring a trend reversal. But Olaf Scholz seems too far ahead at least in the “suitable for chancellor” polls (which are similar to polls about a candidate’s appeal) to be within reach for Laschet.

The contents and concepts

The three strongest parties do not differ much in terms of the core of their political project. The parties share their support for international cooperation and a pro-European stance (that manifests in different approaches) as well as their rejection of the current political course of Russia. We do not expect an imminent change of course.

The proposals for the ecologisation of the economy are significantly more diverse. A verdict by the Federal Constitutional Court demands a detailed regulation of climate protection by the end of 2022, and among the population, the environment is one of the most important factors in their voting decision.

The German economy is going to change sustainably. Decisive steps have to be taken to switch from fossil fuels to renewable technologies such as solar and hydrogen power. Companies in sectors like energy production (coal), steel and cement production, the automotive industry, and the chemical industry will have to adjust their long-term strategy and their business models to a smaller or larger extent. This requires long-term planning reliability for the necessary investments.

The construction of off-shore wind parks, solar and voltaic panels and the necessary infrastructure to deliver the energy to the consumers will be essential. R&D in storage technology and investments in the digitisation and expansion of the broadband network are crucial to remain competitive and attractive as centre of commerce and industry.

The wiggle room of the next government is sizeable and will allow for extensive effects of guidance. In order for the measures to be accepted, the costs have to be distributed in a balanced fashion among the stakeholders. The concepts aimed at achieving this could not be more different from each other.

CDU/CSU:

- Maintenance or reduction of government debt

- Support of innovative power of companies, continued use of combustion engine

- Reduction of bureaucracy, no tax increase, relief for families

- No state-controlled pricing for carbon taxes

SPD:

- Investments in public transport, digitisation, and housing

- Carbon neutrality by 2045

- Minimum wage increase

- Protection of the pension system (no increase in the retirement age)

The Greens:

- Annual investments of EUR 50bn for ecologisation, a dedicated ministry for environmental protection, early exit from coal (currently scheduled for 2038)

- Minimum wage increase, transfer payments from carbon tax revenues

- From 2030: newly registered cars have to be emission-free

- Higher capital requirements for banks

On the basis of current polls, we may see an election premiere in that for the first time three parties might be necessary to form a coalition. A “traffic light”, “Jamaica”, or “Grand” Coalition with three parties (if necessary) are the most likely scenarios of all mathematically possible majorities. The coalition talks should be difficult and time-consuming. According to recent statements, a left coalition seems to be rather unlikely (and associated with a high potential of political surprise and irritation).

If the rising poll ratings for the centre-left parties were to be confirmed at the elections, their programmes could be reflected more significantly in the future governmental agreement. Possible effects are a more expansive fiscal policy on the one hand and a stronger focus on social aspects such as the increase of the minimum wage or transfer payments. Price caps for high energy prices (e.g. indexing) are possible.

A loose fiscal policy would continue to support economic growth. Companies are currently grappling with delivery bottlenecks, which in recent months has led to limited capacity and noticeable price hikes in many areas. Further price increases for goods and services (e.g. as a result of minimum wage hikes) could further fuel inflation fears, influence expectations at future wage negotiations, and ultimately cause higher yield expectations on the capital markets.

We have to wait and see what impact Angela Merkel’s successor will have on political discourse and the decision-making process on a European level. Many problems on the horizon will require a concerted European effort; the political ideology of the future head of government will play a more or less important role in the negotiations for such concerted effort.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.