On the commodity markets, oil and gas prices have recently risen massively again, fueling new fears of inflation. Prices continued to be driven by the strong recovery in demand, which was less affected by the wave of omicron-variant infections than initially feared. For example, the monthly contract for gas on the European market recently came close to its previous mark of 100 euro per MWh, having dropped to 65 euros at the turn of the year. The recovery, following a temporarily good supply situation and mild temperatures in December, thus only lasted for a short time.

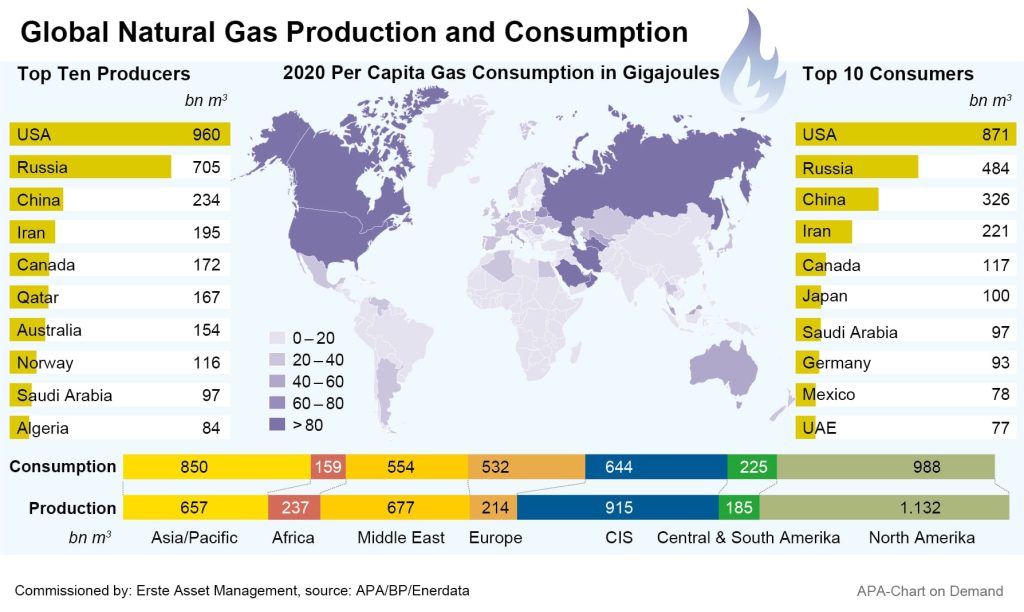

Gas prices continue to be driven by increased demand. Following the lockdowns due to the pandemic, global economy has picked up again. At the same time, many countries are relying on gas as a bridging technology during the transition to renewable energies, with the EU Commission planning to classify gas and nuclear power as environmentally friendly. This is the EU’s response to the revival of coal-fired power triggered by the renewed demand for energy. Gas produces less carbon dioxide than coal, making it the lesser of two evils.

Tensions With Russia Fuel Fears of Gas Supply Shortages

In addition, recent geopolitical tensions with Russia over the Ukraine conflict are driving fears of natural gas supply shortages. Russia has recently massed around 100,000 troops on its border with Ukraine, but denies any invasion plans. The EU obtains about a third of its gas needs from Russia. The fear is that any US sanctions against Russia over the Ukraine dispute could affect supplies. According to insiders, the US government has already explored contingency plans for gas supplies to Europe with energy companies.

Representatives of the US State Department have discussed capacities for higher delivery volumes with the companies in case Russian gas supplies are interrupted, industry and government sources said last week, with the talks including postponing maintenance work to keep gas production high. According to the energy companies, a large-scale loss of natural gas from Russia would be difficult to replace, citing tight global gas supplies. It was not initially known which corporations had been approached.

Dispute over commissioning of the Nord Stream 2 gas pipeline

In view of the tensions with Russia, the German-Russian gas pipeline Nord Stream 2 also became a political issue. The Baltic Sea pipeline is intended to transport gas from Russia to Germany, bypassing Ukraine. The pipeline has been completed but is not yet in operation. While US President Biden opposes the project, he has repeatedly made it clear that good relations with Germany are more important to him than punitive measures against the project, which was already largely completed when he took office about a year ago.

Yuri Vitrenko, Chairman of the Board of Ukrainian energy company Naftogaz, fears that once Nord Stream 2 goes into operation, no more Russian gas will be piped through his country. Russia wants to ensure that a military invasion will not have negative consequences for trade with Europe, said Wirtrenko in an interview with the Süddeutsche Zeitung. Foreign policy experts from the German CDU/CSU and Green Parties want to stop the Baltic Sea pipeline if Ukraine is actually attacked.

In any case, according to experts, an end to the gas price increases is not apparent for the time being. The UK’s largest gas utility, Centrica, believes that the current rise in energy prices is not just a short-term spike. „The market suggests that high gas prices are here to stay for the next 18 months to two years,“ British Gas owner Centrica’s CEO, Chris O’Shea, told the BBC last week. He said there was no reason to believe the trend would reverse in the near term.

Gas Price Hikes Put Utilities and Consumers on Edge

According to current industry estimates, British households are facing more than 50 per cent higher bills for electricity and gas than before. In Germany, too, the rise in gas prices has already put consumers and suppliers on the spot and prompted politicians to take action. Some German energy discounters have stopped supplying private customers at short notice because of the increased purchase prices for electricity and gas. The local basic suppliers, mostly municipal utilities, then have to take over and purchase additional energy. The German Bundestag is therefore already considering regulating discount suppliers of electricity and gas more closely.

But even the major suppliers are already having to respond to the gas price increases. The German energy group Uniper, for example, has obtained support worth billions from its parent company Fortum and the development bank KfW. Gas and electricity companies like Uniper use hedging transactions when buying and selling. These are often done well in advance of delivery. If in the meantime – as recently – there are sharp price changes on the wholesale markets, advance payments have to be made for these hedges.

Meanwhile, oil prices continued to rise at the start of the week. A barrel (159 liters) of North Sea Brent Crude oil cost USD 86.42 on Monday morning. Brent Crude oil is currently trading just below its highest level since 2014. Experts cite several reasons for the price increases, including production losses in major producing countries such as Libya. This is exacerbated by the recently weakened dollar, which makes crude oil cheaper for interested parties outside the dollar area and drives demand from there.

Profiting from the rise in energy prices

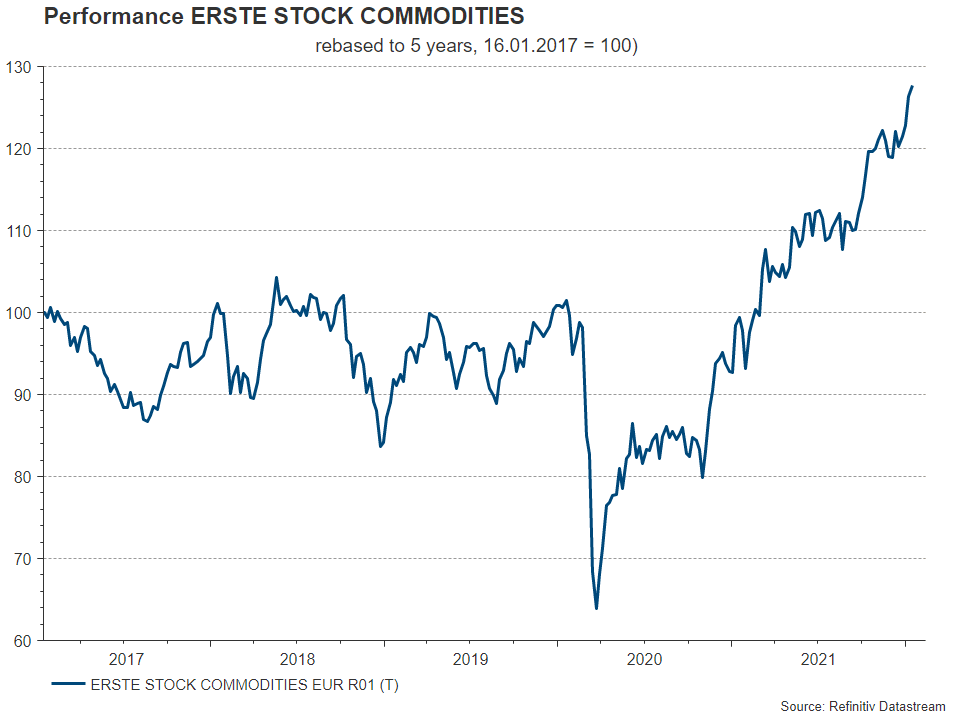

The rise in energy prices in recent weeks and months as a result of the recovery after the numerous lockdowns has had a positive effect on the shares of energy and commodity companies. They have slipped into a favourite role in the equity markets. Valuations are moderate to favourable compared to other sectors and stocks, and an investment also beckons substantial dividend income.

The ERSTE STOCK COMMODITIES fund invests worldwide in attractive commodity companies. Approximately two-thirds of the portfolio is currently focused on shares in the oil and gas industry. As with shares in general, high price fluctuations must be expected. A minimum retention period of six years must be planned. The fund is suitable as an addition to an existing equity portfolio.

CONCLUSION: Energy prices are going through the roof at the moment. The causes are both political and economic. Shares in the energy and commodities sector offer potential for further price increases.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.