In recent days, we have seen a remarkable event on US and European stock exchanges that had not been experienced previously. Retail investors got together online and agreed to buy shares in companies where hedge funds had bet on falling share prices (also referred to as short-selling).

This collaborative action drove up the share prices of the respective companies, resulting in billions of losses for the hedge funds. It all started with the shares of the retailer GameStop, and in its wake, other companies also skyrocketed where hedge funds had taken significant short positions. The share remains volatile, only yesterday it lost a great deal of value again.

What is behind these events? What could be the effects?

GameStop – Background

Within just a few days, GameStop became synonymous with a tug of war between retail investors and large hedge funds. The company is a retailer of new and used game consoles and computer games. Founded in 1996, it now operates about 5,600 shops across the USA, Canada, Europe, and Australia. The business model remained profitable for a long time, and sales recorded significant growth. In 2002 the company passed the USD 1bn threshold in sales, and ten years later, it recorded sales of USD 9.55bn.

However, in more recent years the online competition has started to affect sales which gradually decreased to an estimated USD 5bn for the past fiscal year. At its peak, the company would post earnings of more than USD 400mn per year, whereas now GameStop is deeply negative. Aggregate losses for 2018 and 2019 amounted to more than USD 1bn. As a result, a new management was brought in, unprofitable shops have been closed, and the company has generally been restructured.

The success of these measures was limited, and the scepticism of investors increased over time; the question of the company’s viability was being asked ever more frequently. This attracted hedge funds that invest in the shares of companies which they consider to be heading for even more dire straits, expecting the shares to fall.

Hedge funds betting on falling share prices

While the vast majority of investors bet on rising share prices, there are also those investors who bet on falling ones. To this end, they borrow shares from banks or brokers for a fixed period of time and sell them on the market. The goal is to buy these shares back on the market later at a lower price before they have to be returned (i.e. delivered) to the banks/brokers. The difference between selling price and the price of buying them back later is the profit (or loss) the investors make. This procedure is called short-selling.

For normal share investments, the loss is capped at 100% of the capital employed (e.g. total loss after the company went bankrupt), but the possible profit is (theoretically) unlimited. Conversely, the crucial feature of short-selling is that the possible profit is limited at 100% (bankruptcy), but the potential loss is without limits (e.g. recovery of the company and a spike in the share price). That is why in the case of GameStop, some hedge funds incurred billions worth of losses.

If the short-seller bets the wrong way and the share price rises against the odds, the previously (short-) sold shares have to be bought back as quickly as possible. This further boosts the price spiral. The result are even higher losses for even more short-sellers who now also have to buy back shares to cover their positions, which ultimately further boosts their losses. This is generally referred to as short squeeze.

GameStop turns into pawn

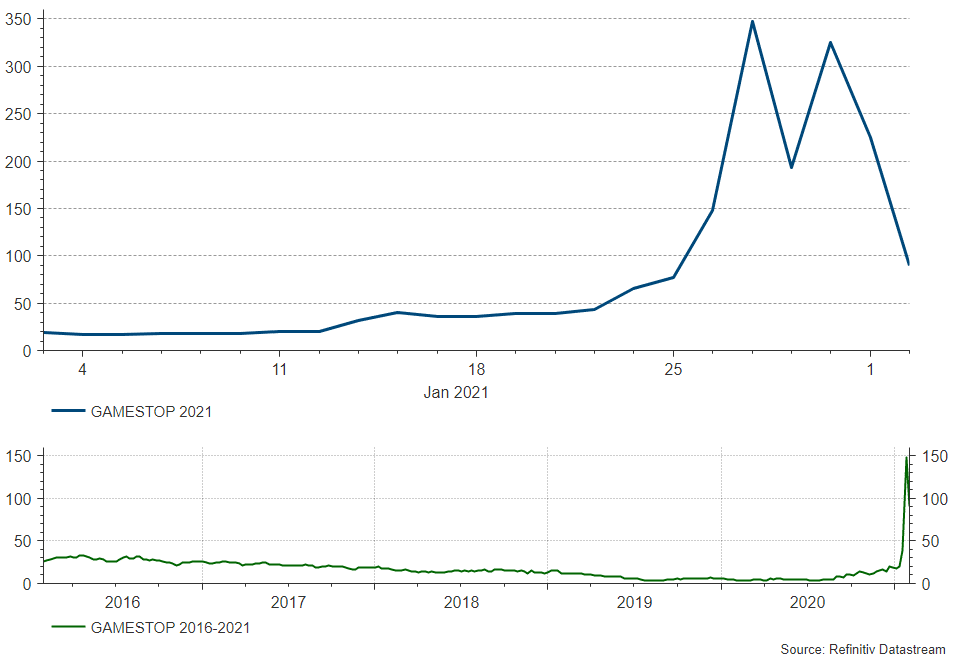

Since its IPO in 2002, the share of GameStop had been fluctuating in three waves between USD 2.50 and slightly above USD 40. On 21 January 2021, the share closed at USD 43. At this point, the hedge funds, having made a negative assessment of GameStop’s future, had sold short more than 140% of the outstanding shares. The constant increase of the shorting meant that pressure was gradually being built on the share price of GameStop.

In the following six trading days, the price exploded. For a while, it reached USD 483, which meant a gain of +1,022% within that short period of time. By US standards, GameStop is a medium-sized company whose market capitalisation prior to the rally had been around USD 2.7bn. At the closing of 28 January, it was capitalised at almost USD 23bn.

How could the share price skyrocket in such a manner against the background of this overhang of short-sold shares?

Share price of GameStop since the end of 2020 & in the past 5 years and

The epicentre of the rally was the internet platform Reddit. Reddit is a social news aggregator, i.e. a website where registered users can post content. Such content may be a link, a video, a picture, a survey, or a text.

Groups of retail investors have organised across numerous internet forums, among which the Reddit messenger board “r/wallstreetbets” is probably the biggest one with four million users, swapping investment tips. One of the most actively discussed tips in recent weeks was GameStop. A retail investor who had been invested in GameStop since 2019 and would regularly provide others with news on the share informed the community that numerous hedge funds had been short-selling the company’s stock. This resulted in some sort of flash mob, where countless investors started basically supporting that member of the community by buying shares in GameStop against the big hedge funds. However, these investors not only bought the shares, but also options on the shares, thus achieving bigger leverage. This way, they pushed the share price of GameStop to previously unseen heights within days.

A fund manager quoted by the Financial Times described the situation this way: “wallstreetbets is now the biggest fund in the world as far as its ability to move markets is concerned. The people are super-confident and use their leverage.”

Robinhood

The online trading platform Robinhood Markets Inc. played a special role in these events. This online broker was founded in 2013 in California and does not charge transaction fees. Robinhood’s source of revenue is, on the one hand, the sale of user data, and on the other hand the company also earns revenues from the deposits of clients and the interest on credit lines it grants. This business model has met with very positive feedback among retail investors; at the moment, the company has 13 million clients with USD 20bn worth of invested assets.

A majority of the transactions was done over Robinhood, which is why the platform decided it was necessary to restrict the trading of GameStop shares and similar ones at some point.

Market Impact

GameStop was only the point of origin; within hours, “r/wallstreetbets” lists were circulating with shares that had been short-sold particularly hard by hedge funds. Retail investors now started buying these shares as well and pushing up their prices. Among them were established companies such as Bed Bath & Beyond and Nokia. Estimates put the amount of capital lost by hedge funds on the back of these events at around USD 70bn.

These activities have often been likened to the fight of David versus Goliath, and the investments of the retail investors were compared to the actions of the Anonymous movement. Capital was being redistributed from the big (hedge funds) to the small investors. Truthfully though, the motivation of many investors was probably the hope for a quick buck.

Also, retail investors were not the only ones to jump on that bandwagon. Institutional investors realised what was going on and started buying shares from those companies that had been shorted the most. Case in point: BlackRock – which is now the biggest shareholder of GameStop.

General turbulences on the equity markets were another direct effect of the short squeezes. In order to be able to cover the short positions, hedge funds had to sell other shares from their holdings. This led to falling prices on the overall market.

The direct negative impact should remain limited. None of the affected hedge funds had to be closed so far; closure would have had knock-on effects on banks and brokers due to payment defaults. Such a negative spiral has so far been averted – not the least because in the most critical cases, capital injections from other hedge funds have been permitted. Melvin Capital, with assets of more than USD 12bn at the beginning of 2021 half of which had disappeared as a result of the short squeeze in connection with GameStop, received a capital injection of USD 2.75bn from its competitors, Citatel and Point72.

Ultimately all the activities will come to an end once the short positions have been closed. This seems to have been largely the case for the most prominent name, GameStop. The biggest short sellers (Melvon Capital and Citron Research) announced last week that they had closed their positions in GameStop. Citron Research also announced that it would in the future abstain from speculation based on short-selling. Given this development, it is only a question of time before retail investors will be running out of investment opportunities that are based on this modus operandi.

Long-term effects

Still, the long-term implications for the financial markets are not yet foreseeable. Most notably, many retail investors agreed on a concerted action. This prompts the question of legality, because generally speaking, any form of share price manipulation is illegal. However, in this case the intention was to push up the price so as to set off a short squeeze.

At this point, the SEC has only announced it will be monitoring the events closely. The Commission clearly tries to avoid the kind of negative publicity that would come with any form of support of the big hedge funds in their fight against small retail investors.

Another issue is the pricing that occurs on the stock exchanges in general. The share price should theoretically reflect the fair value of a company. In reality, that is not always the case, as has been proven by excesses in both directions, up and down. Overall, the US stock market in particular tends to be relatively efficient. Flash mobs at the stock exchange, however, unhinge common notions of valuation, which makes stock exchanges more unpredictable.

Last but not least, the most recent events have shown a behavioural pattern among investors that reminds us strongly of the late 1990s. Large numbers of retail investors flock to the stock exchange without any care for risk. This has not only been exemplified by the current short squeeze, but also by the recent explosion of the trading turnover of US over-the-counter (OTC) shares or of the significant share price gains of companies that are making losses. The current willingness to assume risk is high, and many investors are not aware of it or accept it in the hope of quick gains. Either way, it is the sign of an overheated market. This does not mean that we are back in a situation like in 2000, but it is certainly a warning signal.

Conclusion

Overall, the recent short squeeze should not have any significant impact on the financial system, as painful as it may have been for the affected hedge funds and their clients. The losses incurred so far are absorbable, and the turbulences on the markets have been contained. But above all, the strategy currently applied by retail investors has an expiry date. The opportunities will be gone once all bigger short positions have been closed.

Thus, we should regard the short squeeze primarily as warning signal. In the age of internet, there is always the chance that a critical mass of retail investors will get together for concerted action. This phenomenon per se is nothing negative, except it leads to extremely irrational price movements and investments that fail to take into account risk whatsoever.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.