As expected, incumbent Emmanuel Macron and right-wing candidate Marine Le Pen qualified for a runoff voting in the French presidential elections on Sunday. After the count of 97 per cent of votes, Macron came in at 27.6 per cent, ahead of Le Pen at 23.4 per cent.

The candidates of the former popular parties, the Socialists and Conservatives, suffered heavy losses: left-wing politician Jean-Luc Mélenchon came third with just under 22 per cent. Far-right Éric Zemmour received 7 per cent of votes, overtaking Conservative Valérie Pécresse, who came in at 4.8 per cent, according to Interior Ministry data released Monday morning. Green Yannick Jadot received 3.4 per cent of votes, and Socialist candidate Anne Hidalgo received 1.3 per cent.

In Brussels and Berlin, the outcome of the second voting round is anticipated with some anxiety. A victory by populist Le Pen would be a shock for many politicians, as France is one of Germany’s most important political and economic partners, and the Paris-Berlin axis is a driving force in the EU. In Brussels, Macron recently renewed his efforts to present himself as a reformer of the EU. Le Pen, a fervent EU-skeptic, on the other hand, threatens to conduct a fundamental reorientation of the French course, putting Europe into a subordinate role. Confrontations with Brussels would be inevitable if Le Pen were to implement some of her election promises.

Financial Markets Hope for Macron Victory

The financial markets are awaiting the second voting round scheduled for two weeks from now with an equal degree of tension. A re-election of Macron would stand for stability and is likely to be positively received by the capital markets, while a possible victory by Le Pen could lead to unrest on the markets. “If Le Pen won, it would result in turbulence on the financial markets,” Lars Feld, the personal economic adviser to German Finance Minister Christian Lindner (FDP) and former head of the economic experts, told the news agency Reuters. “There is no telling what this would entail for stability in the euro area.”

The main cause of uncertainty is Le Pen’s critical stance toward the EU and NATO, but also her economic policy plans. If the right-wing candidate wins, this could lead to declines on the French stock market, increases in yields on French government bonds and also put pressure on the euro. In the run-up to the election, the bond market already anticipated the higher risk: French bonds saw a dip, their yields in return rose.

Pollsters see Macron Just Ahead of Le Pen

Polls continue to see Macron ahead of Le Pen in the runoff; however, according to the pollsters, this time it is likely to be much closer than in the runoff between the two in 2017, when Macron won with 66.1 per cent of votes. The decisive factor now is how well the two opponents succeed in mobilising voters outside their camp.

The economic policy plans of the two leading candidates will also play an important role in the election. According to polls, the French are not satisfied with Macron’s economic policies to date, although the unemployment rate has fallen significantly.

In the final quarter of 2021, the unemployment rate in France fell to 7.4 per cent. Barring a statistical outlier at the start of the Corona pandemic, this is the lowest level in 13 years. Macron’s tax cuts and measures to make the labour market more flexible during his first term in office helped France’s companies to become more competitive, but also sparked accusations from the opposition of him being a “president of the rich.”

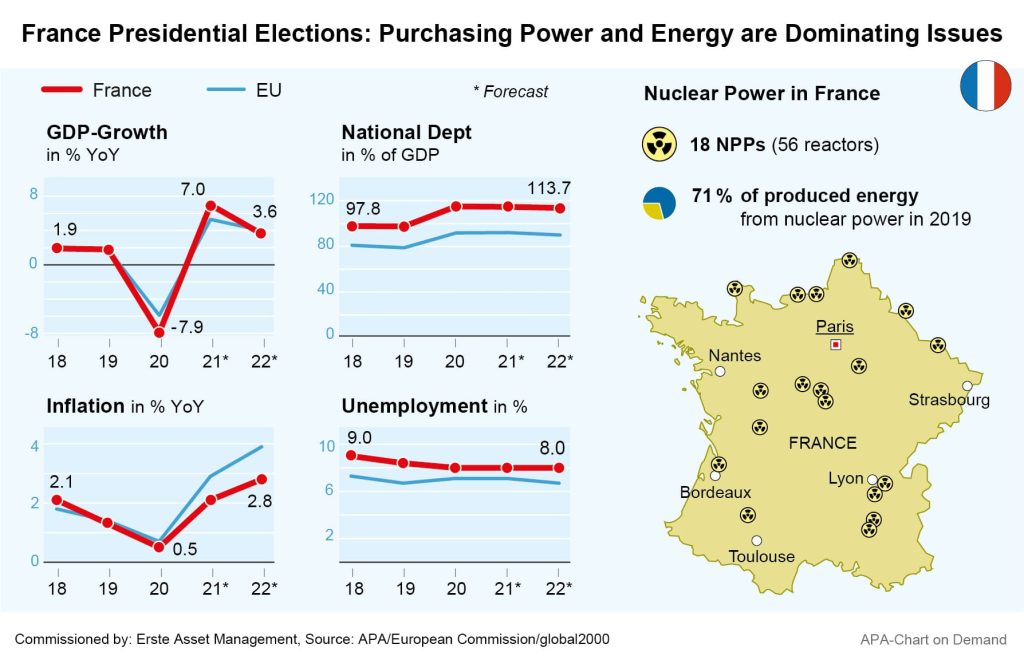

Energy and Purchasing Power are the Dominating Campaign Issues

A defining issue in the election campaign is also inflation and, in particular, soaring energy prices. In March, consumer prices in France rose by 5.1 per cent, with energy and food being the main price drivers. Le Pen is promising her voters that she wants to strengthen the purchasing power of the French with a hefty VAT reduction on gasoline. She expects her planned reduction from 20 to 5.5 per cent to save each household 340 to 350 euros per year. Outside of Paris, France has numerous medium-sized cities where dependence on private vehicles is high.

In his election campaign, Macron had initially focused on rather unpopular issues such as raising the retirement age and stricter requirements for social benefits. The 42 different pension systems place a heavy burden on the French welfare system. During Macron’s first term, massive protests followed after he heralded the pension reform. Because of the pandemic, he did not pursue the plans any further. Macron now advocates a minimum pension of 1,100 euro, arguing that French people must “work more” to finance the social system. The president wants to further reduce unemployment and aim for full employment.

Macron Backing Nuclear Power and Renewable Energy

However, Macron has also recently placed greater emphasis on bolstering purchasing power in his election campaign, proposing to link pensions to the rate of inflation come summer and also planning to further cap natural gas and electricity prices. The Ukraine war has naturally brought energy prices, which are already high, into even sharper focus. To make France even more independent in its energy supply, Macron is counting on both an expansion of nuclear power and a higher share of renewable energies.

France relies heavily on nuclear power, partly because it is largely emission-free in terms of global warming and gives the country a comparatively good carbon footprint. Currently, France gets about 70 per cent of its electricity from nuclear power plants, the highest ratio in the world. However, the existing reactors are becoming increasingly vulnerable, and building new ones is considered expensive and time-consuming. Back in November, Macron announced the construction of a new generation of nuclear power plants. Against this background, the French energy group EDF recently announced the buyback of its turbine business from the US group GE. Steam turbines play an important role in nuclear power plants.

CONCLUSION: The run-off election for the French presidency in a fortnight is shaping up to be a close race. What concerns both candidates is the preservation of purchasing power and the high prices for oil and natural gas. The financial markets reacted calmly to the election results for the time being.

Explanations of technical terms on investment and securities can be found in our Fund Glossary: Fund Glossary (erste-am.at)

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.