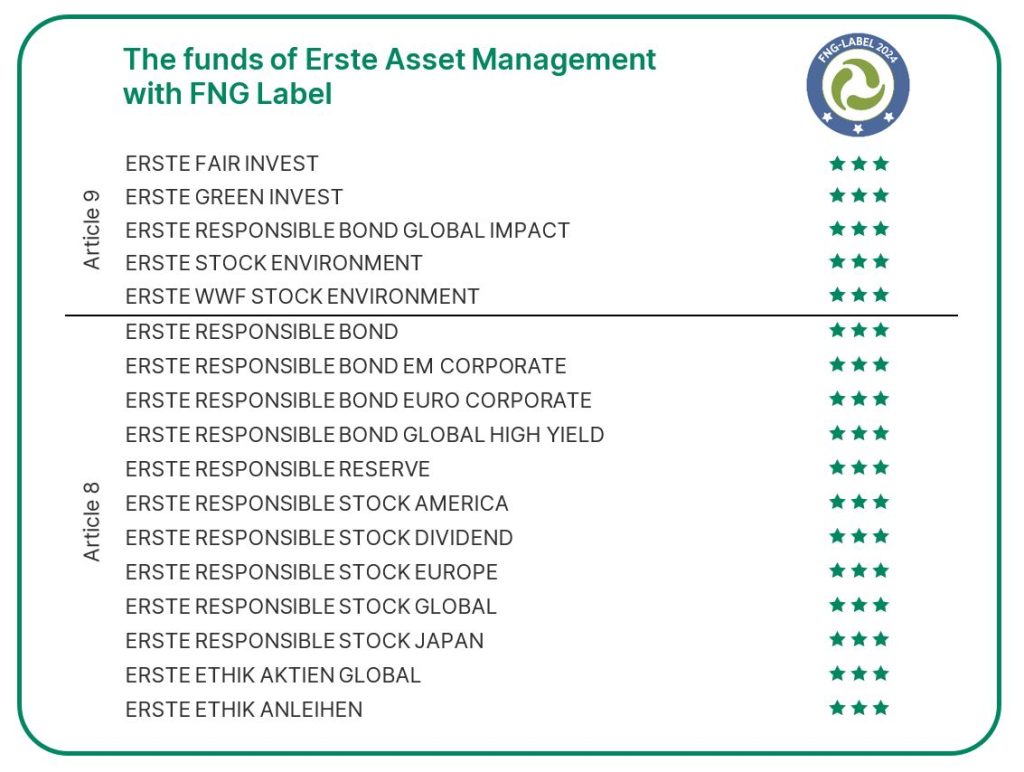

Strict criteria, a clear investment process, and many years of expertise pay off, as illustrated by our results in this year’s award of the FNG Label by Forum Nachhaltige Geldanlagen (FNG; Forum for Sustainable Investments). All 17 funds submitted by Erste Asset Management were awarded the quality label for sustainable investment funds, capturing the top rating of three stars.

The FNG Label is one of the most prestigious and important labels in the German-speaking world and is therefore regarded as a clear quality criterion for sustainable funds. Also, the sustainability-oriented Japan equity fund ERSTE RESPONSIBLE STOCK JAPAN received this honour for the first time.

Every third euro invested is held in a sustainable investment product

Sustainability is becoming increasingly important to investors. While funds that take into account the criteria E (“Environment”), S (“Social”), and G (“Governance”) in the investment process were still considered niche products a few years ago, ethical-ecological investing is now firmly established. This is also substantiated by current market data.

According to the latest market report on sustainable investments (“Marktbericht Nachhaltige Geldanlagen”; available only in German) published annually by Forum Nachhaltige Geldanlagen, every third euro invested in Austria is already held in a sustainable investment product.

Sustainability labels are becoming more important and provide guidance to investors

Erste Asset Management (Erste AM) has been one of the pioneers in the German-speaking market for sustainable investments for over 20 years. The first environmental equity fund was launched back in 2001. This was followed in 2006 by the co-operation with WWF Austria.

However, the increasing abundance of products and funds in the sustainability sector makes clear standards and guidelines all the more important. As a result, independent sustainability labels are also becoming increasingly relevant. They provide guidance to investors in the world of sustainable investing with uniform standards and clearly defined test criteria. “There is a very strong demand for quality labels on the sustainable fund market. This has been shown by the reactions to the European Commission’s Disclosure Regulation. Unfortunately, however, this demand cannot be satisfied by classifying a fund as Article 8 or 9. These classifications merely define how transparently the underlying processes must be disclosed,” comments Walter Hatak.

Hinweis: Please note that investing in sustainable investment funds entails risks as well as opportunities.

What are the distinctive features of funds that bear the FNG Label?

The FNG Label is based on a minimum standard, which includes certain transparency criteria, the consideration of labour and human rights, and environmental protection. The companies the respective fund invests in must be explicitly scrutinised for sustainability criteria. If other requirements defined in a tiered model (for example institutional credibility and dialogue with companies in the form of engagement and voting) are also met, the label can bear up to three stars. In addition, all funds must undergo an extensive review process every year.

Further information https://www.erste-am.at/en/private-investors/sustainabilityon our sustainable investment approach and our sustainable funds can be found on our website.

Risk notices

ERSTE FAIR INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE FAIR INVEST and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE FAIR INVEST, please take into account all features and goals of ERSTE FAIR INVEST as described in the fund documents.

ERSTE GREEN INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE GREEN INVEST and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE GREEN INVEST, please take into account all features and goals of ERSTE GREEN INVEST as described in the fund documents.

ERSTE RESPONSIBLE BOND GLOBAL IMPACT

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE BOND GLOBAL IMPACT and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL IMPACT, please take into account all features and goals of ERSTE RESPONSIBLE BOND GLOBAL IMPACT as described in the fund documents.

ERSTE STOCK ENVIRONMENT

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE STOCK ENVIRONMENT and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE STOCK ENVIRONMENT, please take into account all features and goals of ERSTE STOCK ENVIRONMENT as described in the fund documents.

| Risk notes according to 2011 Austrian Investment Fund Act The Investment Fund will permanently invest at least 85% of its assets in shares of ERSTE WWF STOCK ENVIRONMENT (master fund). |

ERSTE WWF STOCK ENVIRONMENT

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE WWF STOCK ENVIRONMENT and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE WWF STOCK ENVIRONMENT, please take into account all features and goals of ERSTE WWF STOCK ENVIRONMENT as described in the fund documents.

ERSTE RESPONSIBLE BOND

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE BOND and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE BOND, please take into account all features and goals of ERSTE RESPONSIBLE BOND as described in the fund documents.

ERSTE RESPONSIBLE BOND EM CORPORATE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE BOND EM CORPORATE and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE BOND EM CORPORATE, please take into account all features and goals of ERSTE RESPONSIBLE BOND EM CORPORATE as described in the fund documents.

ERSTE RESPONSIBLE BOND EURO CORPORATE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE BOND EURO CORPORATE and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE BOND EURO CORPORATE, please take into account all features and goals of ERSTE RESPONSIBLE BOND EURO CORPORATE as described in the fund documents.

ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD, please take into account all features and goals of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as described in the fund documents.

ERSTE RESPONSIBLE RESERVE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE RESERVE and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE RESERVE, please take into account all features and goals of ERSTE RESPONSIBLE RESERVE as described in the fund documents.

ERSTE RESPONSIBLE STOCK AMERICA

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE STOCK AMERICA and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE STOCK AMERICA, please take into account all features and goals of ERSTE RESPONSIBLE STOCK AMERICA as described in the fund documents.

ERSTE RESPONSIBLE STOCK DIVIDEND

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE STOCK DIVIDEND and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE STOCK DIVIDEND, please take into account all features and goals of ERSTE RESPONSIBLE STOCK DIVIDEND as described in the fund documents.

ERSTE RESPONSIBLE STOCK EUROPE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE STOCK EUROPE and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE STOCK EUROPE, please take into account all features and goals of ERSTE RESPONSIBLE STOCK EUROPE as described in the fund documents.

ERSTE RESPONSIBLE STOCK GLOBAL

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE STOCK GLOBAL and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE STOCK GLOBAL, please take into account all features and goals of ERSTE RESPONSIBLE STOCK GLOBAL as described in the fund documents.

ERSTE RESPONSIBLE STOCK JAPAN

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE RESPONSIBLE STOCK JAPAN and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE STOCK JAPAN, please take into account all features and goals of ERSTE RESPONSIBLE STOCK JAPAN as described in the fund documents.

ERSTE ETHIK AKTIEN GLOBAL

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE ETHIK AKTIEN GLOBAL and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE ETHIK AKTIEN GLOBAL, please take into account all features and goals of ERSTE ETHIK AKTIEN GLOBAL as described in the fund documents.

ERSTE ETHIK ANLEIHEN

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. For further information on the sustainable structuring of ERSTE ETHIK ANLEIHEN and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE ETHIK ANLEIHEN, please take into account all features and goals of ERSTE ETHIK ANLEIHEN as described in the fund documents.

| Risk notes according to 2011 Austrian Investment Fund Act In accordance with the fund provisions approved by the Austrian Financial Market Authority (FMA), ERSTE ETHIK ANLEIHEN intends to invest more than 35% of its assets in securities and/or money market instruments of public issuers. A detailed list of these issuers can be found in the prospectus, para. II, point 12. |

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.