If you want to lay a financial foundation for yourself or your children, you will find it hard to avoid securities. This is because savings interest rates are still well below inflation – and this will not change much in the foreseeable future. Anyone interested in a fund savings plan as an alternative should follow five “golden rules” to ensure success.

Advice 1: Know, what you are saving for – set your investment goal

The first step when it comes to investing money: determine what you are saving the money for. No matter if you want to treat yourself to something at a later date, such as a trip or a car; or if you want to pay for your children’s education. If you set yourself a goal when saving, you will usually be more disciplined and stick to your plan.

Advice 2: allocate enough time by starting early

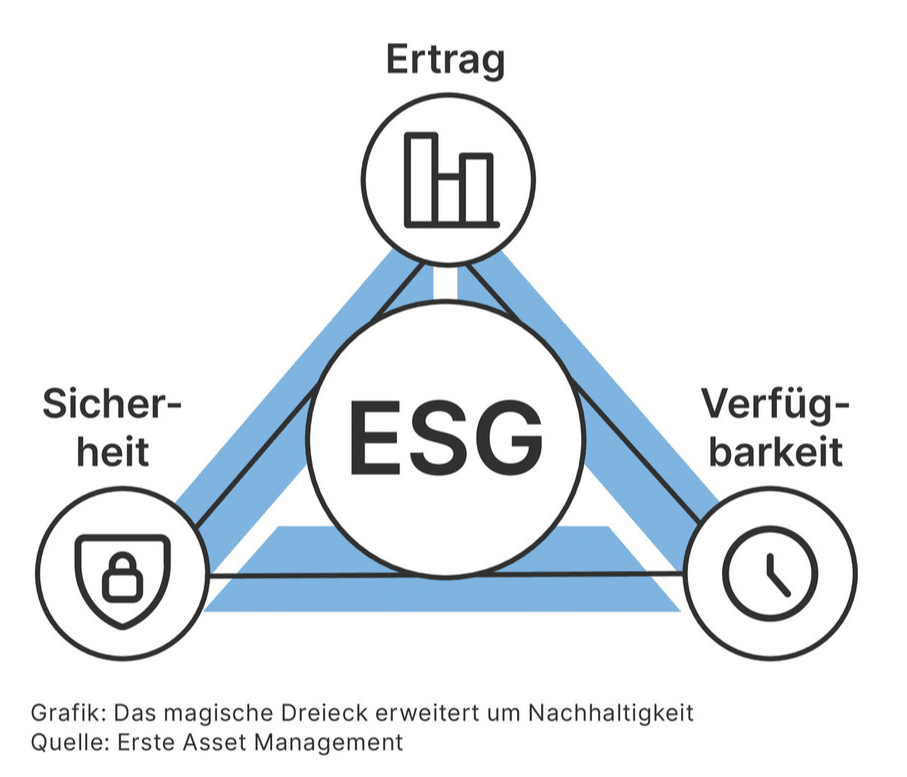

Every form of investment is influenced by three central factors: safety, availability, and return. This is also referred to as the “magic triangle”. All financial investments can be classified between the corner points of this triangle. The principle is: the safer and more available an investment is, the lower its yield.

Conversely, those who invest profitably in equity funds, for example, should invest the money for at least five years in order to be able to ride out possible phases of loss. It is important to start early enough. When you invest money regularly and over the long term in yield-generating securities, you can build up a considerable volume of assets in small steps.

The “Magic Triangle”, complemented by sustainability

Return / Safety / Availability

Advice 3: set your investment amount

A fund savings plan does not have a “too little” or “too much”. For financial provision, you should set an amount that you can handle in addition to the normal costs of living. It should be an amount that can be maintained over a long period of time without having to sell anything prematurely if you need money at short notice. Fund savings plans are available from as little as EUR 50 a month.

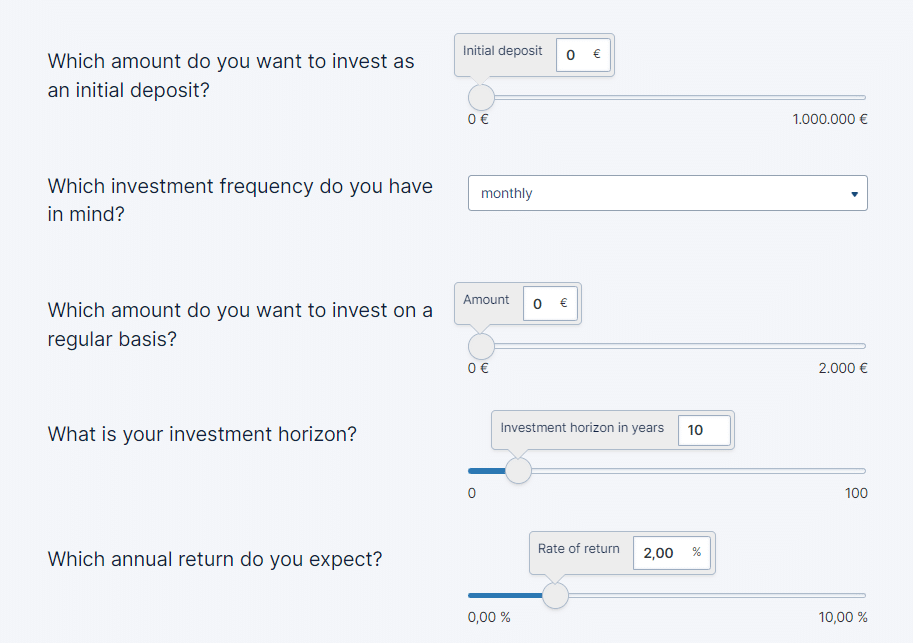

Advice: with the Investment calculator, you can calculate on your own how much money you could get back after your savings period.

Advice 4: assess the risk

There is no point taking high risk in the hope of high profits – this can possibly lead to sleepless nights. It is better to take only the amount of risk that you feel comfortable with. Many investors have recently invested their money in real estate because it is a tangible asset and the risk seems lower. However, what is often forgotten is the fact that shares are also tangible assets because they represent an investment in productive companies.

Investing in a single share can go well or fail painfully. It is better to rely on the experience of professionals and invest your savings monthly in investment funds. With funds, you regularly buy shares in a variety of different companies, thereby reducing the risk of suffering losses. Also, you save yourself the trouble of watching share prices and headlines every day.

Advice 5: it’s not difficult, and it’s not expensive

Investing money through funds in equities, bonds, real estate, or commodities requires experience and advice. Professionals know what to look for and which investment is suitable for you. The customer advisors of Erste Bank and Sparkassen are happy to offer you tailor-made investment advice, regardless of whether the amounts involved are small or large. If you talk to an advisor at your Erste Bank and Sparkasse now, we also throw in a sweetener – for example, no custody account fee for three years with an s Fund Savings Plan!*

For more information on funds and fund savings plans, please click here.

* Only online: you pay no custody account fee with the Investment Plan custody account for three years, no minimum custody account fee, and no minimum securities account fee up to a total market value of EUR 10,000 of the custody account. If you exceed the EUR 10,000 limit, the Investment Plan custody account is switched to a normal custody account. The special conditions listed here only apply to one s Investment Plan custody account per customer. In addition, you receive a 20% discount on the respective transaction fee for each purchase of securities. You find the detailed list of the total costs of the s Investment Plan on the statement in the Investment Plan contract before agreeing to it online.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Please note that an investment in securities also involves risks in addition to the opportunities described.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.