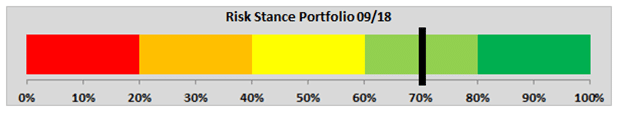

We held our monthly Investment Committee meeting at the beginning of September. Since the previous meeting at the beginning of August, where the assessment of the financial markets had been largely optimistic, equities in particular had had a mixed run. While the USA (in EUR) was up, Europe and the emerging markets (in EUR) had recorded a decline. The optimistic risk stance of the team had therefore only paid off in parts. Against this backdrop, we remain generally optimistic as a group in September although we have become slightly more cautious with our assessment. More specifically, our risk stance decreased from 75% to 70%. This level, however, continues to signal the willingness to assume risk. This means that we still prefer risky asset classes like equities or corporate bonds.

Number or risks picking up at the horizon

The change in the opinions held by the team members that had been noticeable throughout previous months has thus left its first tangible imprint this month. Whereas almost all committee members had been optimistic up until summer, the spectrum of opinions is now much more diverse. While many team members stick to their optimistic basic stance, the number of those who can see risks forming at the horizon and have thus assumed a neutral position has increased in the past months. Interestingly, we now also have a group member who holds a risk-averse stance. Overall, our current aggregate risk stance is therefore cautiously optimistic.

Strong growth with downside risks

Gerhard Winzer, Chief Economist of Erste Asset Management, expects four factors to affect the state of the global financial markets in the coming months:

- Gradual weakening of the still strong global economic growth. Here, the focus is on China and the other emerging economies

- Increase in inflation, especially in the USA

- Interest rate hike in the USA and stimulus package in China

- Deteriorating trade conflict between the USA and China

Overall, global growth is currently strong but comes with numerous downside risks.

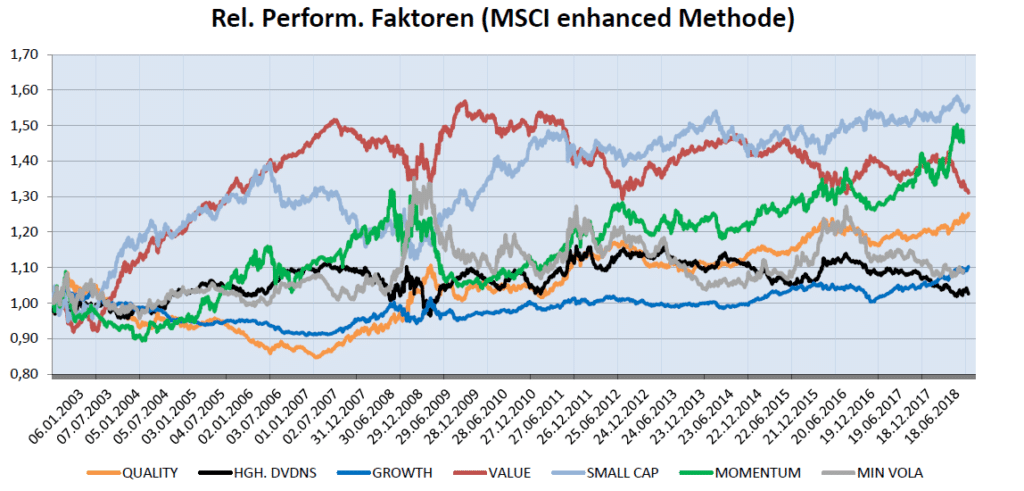

Growth shares with advantage

Our factor analysis models are pretty much in line with the aforementioned scenario. In the past weeks, the growth, quality, and small caps segments have been positive, whereas value, high-dividend, and minimum volatility have been generally under pressure. At the same time, we have seen a first weakening in the dynamics of small caps and momentum equities.

This suggests that investors basically maintain the premise of a robust economic environment, which is why there is little demand for more defensive market segments. At the same time, the existing downside risks (China, emerging markets, trade conflicts) have been priced into the performance of more aggressive investment styles.

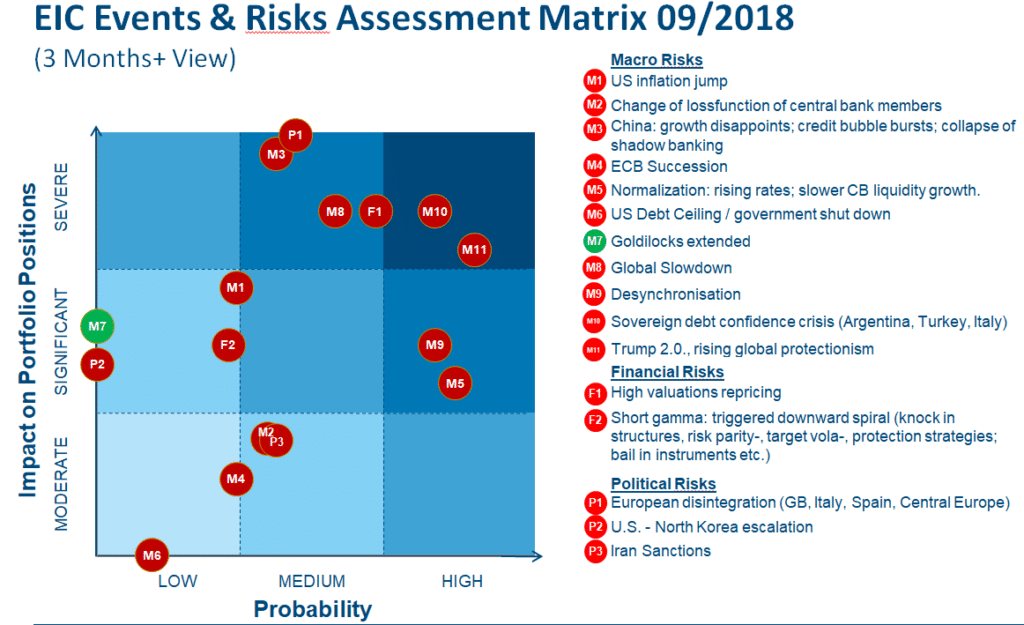

The biggest risk is global protectionism

Like every month, the members of the Investment Committee rated the existing global risks by probability of occurrence and by impact on the financial markets. The resulting risk matrix suggests that the biggest risk (both in terms of probability and of impact) is associated with the increase in global protectionism. A possible government debt crisis in the emerging economies is regarded as equally serious. These two are followed by a possible correction of the equity markets, in some part due to the current valuations, and by a global economic decline.

The US debt ceiling, the succession plan in the ECB, and sanctions against Iran should hold a lower degree of risk.

Conclusion:

From our point of view, the immediate outlook for the global financial markets is basically positive. In particular, the macroeconomic environment in the developed economies is largely sound. There are downside risks such as an excessive decline in Chinese growth or potential crises in the emerging economies. As long as the underlying investor sentiment remains positive and investor confidence does not tilt, we are optimistic about the autumn on the capital markets.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.