The European People’s Party (EPP) successfully defended its position as the strongest faction in the European Parliament in the EU elections held from 6–9 June. However, right-wing populist parties made significant gains in many of the 27 EU states. According to experts, Europe therefore now faces major challenges – not only in important projects such as climate change and asylum politics, but also regarding topics such as Russia’s war against Ukraine. The election results caused some uncertainty on the stock markets at the start of the week: share indices, bonds and the euro all fell on Monday, but stabilised again on Tuesday.

In France, Marine Le Pen’s Rassemblement National (RN) party came out on top, dealing a blow to French President Emmanuel Macron. According to projections, the right-wing nationalist RN won 32 per cent of the vote – more than twice as much as Macron’s party. As a result, the head of state announced a new election for the lower house, with two rounds of voting planned for 30 June and 7 July. There is also some focus on the French presidential election in just under three years. Macron, who beat Le Pen twice in the runoff vote, cannot run again, and it is still unclear who the centre-right forces will send into the race and who would have a chance against Le Pen.

CDU/CSU Strongest Party in Germany, AfD Gains Ground in Eastern Germany

In Germany, the European elections were also an important test of public opinion ahead of the three state elections in Thuringia, Saxony and Brandenburg in September and the federal elections next year. Although, nationwide, the CDU/CSU was ahead with nearly 30 per cent of the vote, in eastern Germany the AfD is in first place by a large margin. According to projections from Monday, the right-wing party received 15.8 to 15.9 per cent of the vote, an increase of almost five points compared to 2019. The AfD thus performed better than any single party in the red-yellow-green coalition: the SPD received 14 per cent, the Greens 11.9 per cent and the FDP 5.1 per cent of the vote.

Pro-Europe Camp Remains Strongest Force, Right-Wing Populists Make Gains at the Expense of Smaller Factions

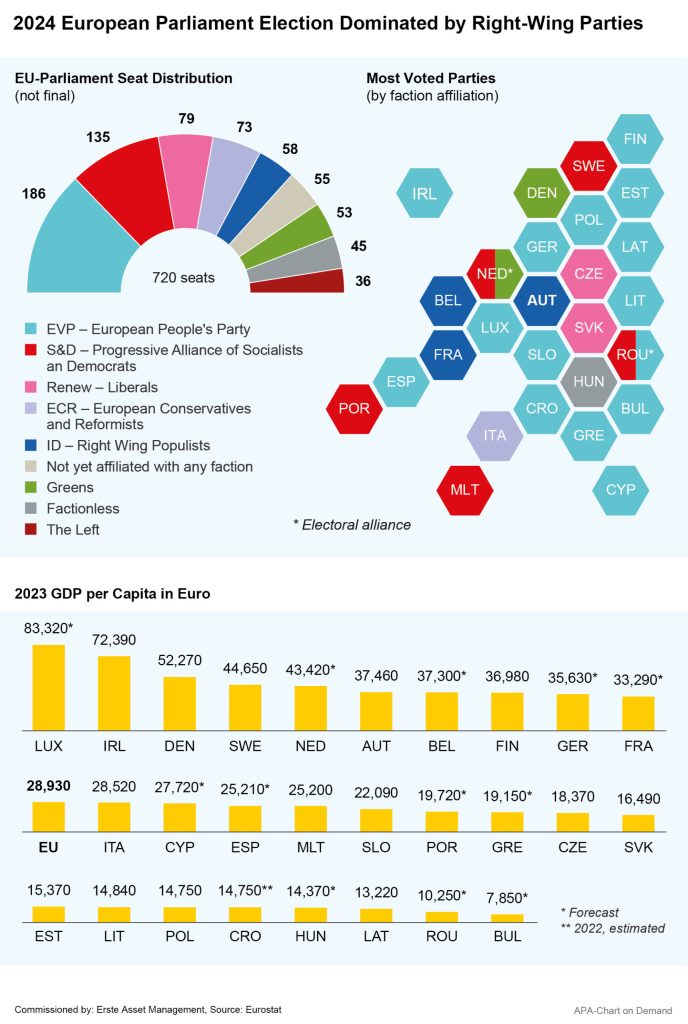

The two existing right-wing populist party alliances, the ECR and the ID, made significant gains across Europe. Overall, however, the clearly pro-European camp remains by far the largest in the European Parliament. Even if all right-wing parties were to join forces, they would probably have fewer than 200 seats and would therefore be a long way from the 361 seats required for a majority.

The shift to the right in the European elections has largely been at the expense of the Liberals and Greens. While the Conservatives and Social Democrats were largely able to maintain their number of seats, the smaller pro-European factions saw their numbers plummet to 80 (-22) and 52 (-20) members of parliament. This is mainly due to poor results in Germany and France.

In some countries, however, smaller parties were able to make surprising gains. In Slovakia, the young party “Progresivne Slovensko” overtook the left-wing populist Smer (Direction) of Prime Minister Robert Fico to become the strongest force. In Hungary, the new opposition star Péter Magyar and his party TISZA achieved almost 30 per cent off the bat, giving Prime Minister Viktor Orbán’s governing party Fidesz its worst result since Hungary joined the EU in 2004.

The clear winner of the European elections is the centre-right alliance of the European People’s Party (EPP) with German top candidate Ursula von der Leyen. The CDU politician can therefore optimistically look forward to a second term as President of the European Commission. However, to secure a further term in office, the EPP’s top candidate will have to rely on the support of “various corners of the European mainstream”, said political scientist Janis Emmanouilidis from the EPC.

The European Commission’s work programme for the next five years will resemble a “Christmas tree” of individual wishes, Emmanouilidis fears. The open discussion about the fact that necessary changes for the future will create both winners and losers will continue to be avoided for fear of strengthening the right. In the medium and long term, however, this will make the problem even worse, according to the political analyst.

Economists Warn Against Weakening Europe in International Competition

In their initial reactions on Monday, economists warned of the possible economic consequences of the shift to the right in the European elections. The results would weaken the EU economically and could mean a further disadvantage for Europe in competition with China and the USA, warned the President of the German Institute for Economic Research (DIW), Marcel Fratzscher.

The chances of completing the single market or achieving a common industrial and defence policy have probably been significantly reduced. Germany will be one of the biggest losers of a divided Europe, as the German economy has a lot to lose in global competition with China and the USA, said the Berlin-based top economist.

The President of the Kiel Institute for the World Economy (IfW), Moritz Schularick, expressed a similar view. “In a turbulent time for the global economy, only a strong EU can represent European interests with vigour,” he said. “Europe needs the completion of the capital market and banking union, as well as bold steps towards the development of a European defence system.”

Europe’s economic and military security and the further development of the single market should be at the centre of the new Commission’s work. The strong result of populist and Eurosceptic parties in particular does not make this any easier, but it does not make it impossible either. Populism is “extremely expensive in economic terms” and has a negative impact on economic growth, as research shows. “These are costs that we cannot afford,” warned Schularick.

Concerns About Growing Government Spending and Debt Pulled Down Government Bonds on Monday

Some economists fear that the election results in many member states will lead to higher government spending or redistribution and thus to higher government debt. These concerns were also reflected in the currency and bond markets on Monday. The euro fell well below the 1.08 USD mark and at times reached its lowest level since early May.

Bond prices of many euro area countries also fell. French government bonds came under significant pressure after the election, while yields rose to a yearly high.

Observers see a risk that the new election will result in a right-wing majority in the National Assembly against Macron’s pro-European centre camp. A government led by the right-wing Rassemblement National is likely to cause great uncertainty. After all, the party is very critical of the EU and has made extensive spending promises.

Some experts fear that the fight against climate change could also become more difficult in some countries following the rise of right-wing populist parties. On the German stock exchange, shares in companies in the renewable energy sector fell temporarily after the poor performance of the Greens. In an interview with the dpa, the President of the German Federal Environment Agency (UBA) said that global cooperation is of fundamental importance in order to mitigate the climate crisis and to ensure a better future.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.