Autor: Tamas Menyhart, Fund Manager Equities, Erste Asset Management

Autor: Tamas Menyhart, Fund Manager Equities, Erste Asset Management

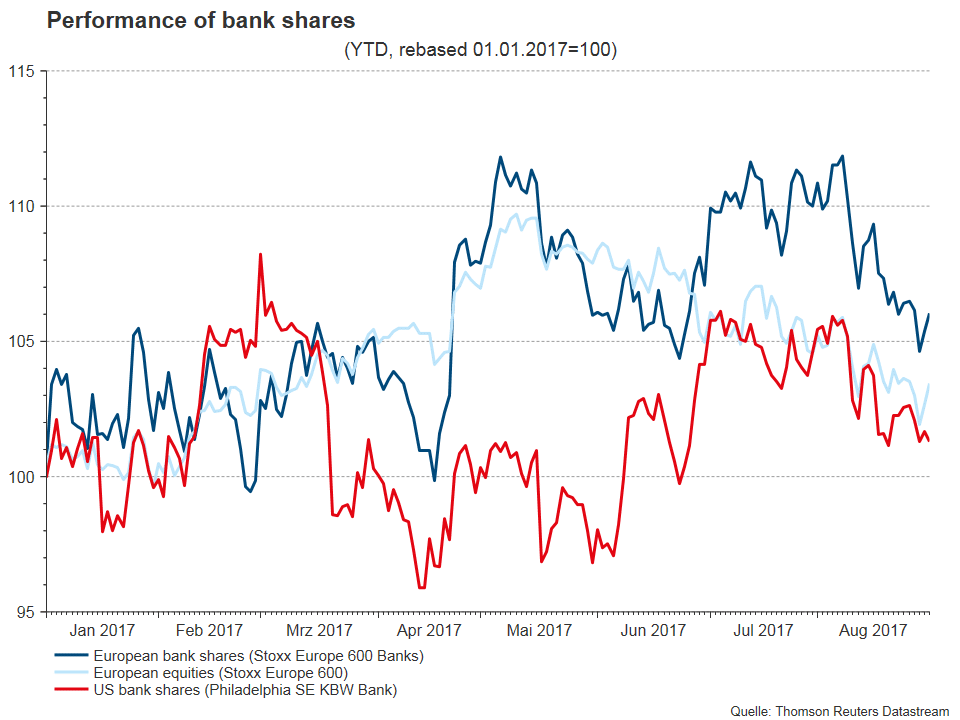

After years of drought, European bank shares have shown a solid performance in the year to date. The Stoxx Europe 600 Banks index, which contains the 45 largest European banks, had gained about 6% by the end of August.* Thus, European bank shares have outperformed European shares overall (by 2.6% in terms of the Stoxx 600 index) as well as US bank shares (by 4.7% in terms of the KBW Bank index*).

* Source: Bloomberg; data as of 31 August 2017

We believe that the European bank index will maintain its relative strength vis-à-vis European shares in general and US bank in the second half.

Past performance is no reliable indicator of future development.

Since the beginning of 2017 european bank shares outperformed US bank shares and european equities.

Past performance is no reliable indicator of future development.

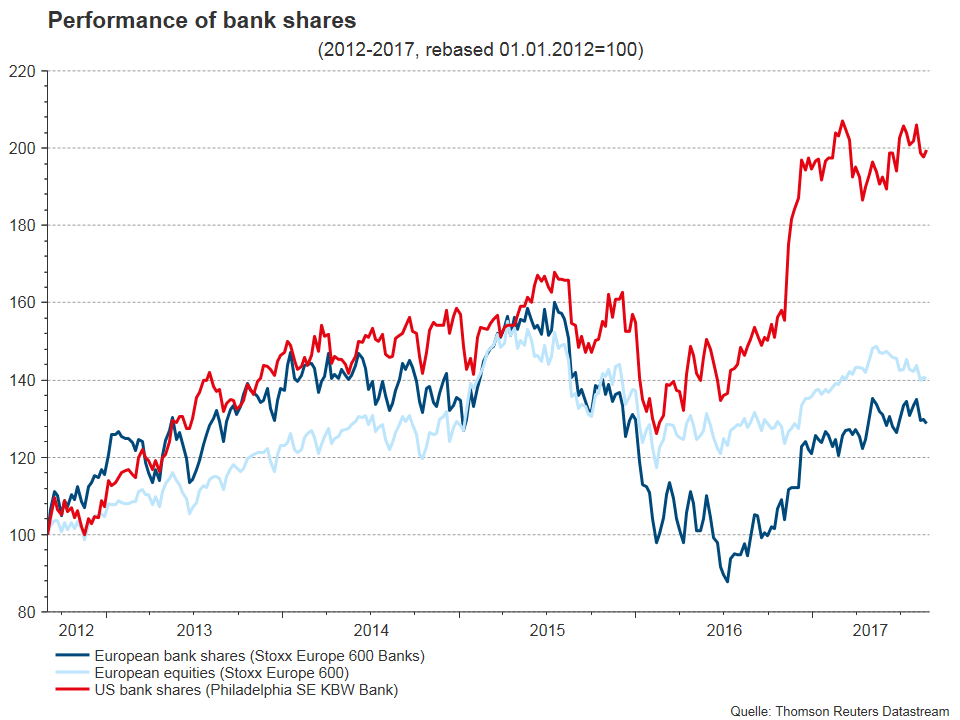

In the long run US banks outperformed european bank shares and european equities.

Reasons for the upswing of European bank shares

The different development of the banking sector on both sides of the Atlantic has several reasons.

The first one is the base effect: the drastic share price increase of European banks in the year to date is due to the fact that they started from low levels. On the basis of the price on the day after the Brexit vote (24 June 2016), US banks were initially performing better. The reason for this discrepancy is the fact that European banks (and their shares) were affected more negatively by Brexit than their US peers. At the same time, US banks benefited from a rise in growth and inflation expectations in the wake of Donald Trump’s victory in November 2016.

The development of bond yields, driven by political events in particular this year, have had a significant impact on the good performance. Higher yields have a positive effect on banks, because the income from the interest margin, i.e. one of the main income sources for banks, increases.

Trust in united Europe

In 2017, the political climate in Europe has developed significantly better than in the USA. The biggest political risk for Europe was the presidential election in France. Macron’s victory relegated fears over a strengthening of populist forces to the backseat. The elections in the Netherlands and progress in the Italian banking sector also helped to improve the political environment.

US market euphoria has petered out

In the USA, the initial euphoria about Trump’s victory has gradually waned. The accusations in connection with the Russia scandal have not been dealt with. Cabinet staff replacements have picked up, and the tensions between the USA and North Korea have been getting more intense. The problems in connection with the increase of the debt ceiling have not been sustainably solved either. The new deadline has been pushed back to 15 December. All of this has caused the investors’ hopes for plans regarding infrastructure, tax reforms, and less regulation to gradually decline.

This loss of trust is reflected in particular in the development of the US yields and the US dollar. 10Y US yields that depend strongly on the long-term growth outlook, have decreased by more than 32bps (100bps = 1%) since the beginning of the year, and even 50bps since their year-high in March (Source: Bloomberg; data as of 31 August 2017).

While in Europe the 10Y yields of the German government bond have not been able to buck the trend of falling yields triggered by the increasing geopolitical risks in the past weeks, they were 10bps above the level of the beginning of the year as of 31 August.

Euro: up up and away

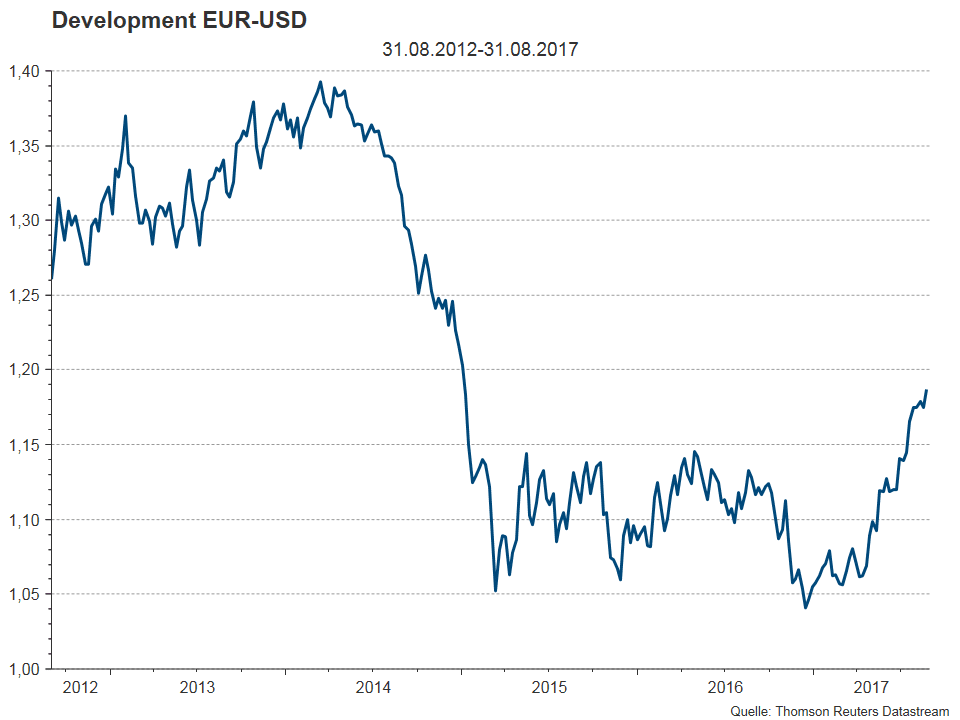

The euro, supported by the relatively comfortable political situation in the Eurozone and by the solid growth and macro data, has appreciated by more than 13% in the year to date (please see the chart below; source: Bloomberg; 31 August 2017). ECB President Draghi has come across as rather unconcerned about the stronger single currency so far and has indicated he will be announcing details on the planned reduction of the bond purchase programme by the ECB in October. This announcement has pushed the euro further up in September.

Past performance is no reliable indicator of future development

Good economic data and hope for increasing yields are driving banks

Solid economic data in the Eurozone and the imminent tapering by the ECB (i.e. the reduction of the bond purchase volume) should come with positive ramifications for European banks in the shape of a higher interest rate outlook. The persistent political tensions expected in the USA, especially in connection with North Korea and the increase of the debt ceiling, should support the euro. The stronger euro is not positive for the European banking sector per se, but banks are less negatively affected by the stronger single currency than export-oriented European sectors, which are suffering under the higher euro.

Given the aforementioned reasons, we are optimistic that European bank shares will be outperforming the overall European market also in the second half. The French presidential elections have undoubtedly effected the biggest push. The upward trend might therefore flatten slightly relative to the first half. European shares might also outperform US banks again, because the political uncertainty should continue to affect US interest rates and the US dollar negatively.

Legal note :

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.